Do companies have to expense stock options?

Stock options are not recorded as an expense on companies’ books. But the arguments for this special treatment don’t stand up. Let’s end the charade. The time has come to end the debate on accounting for stock options; the controversy has been going on far too long.

Do you try to sell before options expiration?

Yes, you can buy or sell options with any expiry on or before its expiry date. You are free to close out a long call or put before expiration by selling it at the market value or the current premium.

How to account for expired stock options?

- Depending on when an option is canceled, forfeited or expires, you’ll potentially need to make several updates to your ledgers:

- For unvested, forfeited options; you’ll need to account for any portion of forfeited options that was expensed previously. ...

- See the illustrations below for a better understanding of when to expense and reverse stock options.

Do expired options count as capital losses?

Internal Revenue Service rules treat the expiration of a stock option as equivalent to a sale of the option for zero dollars on the date it expired unexercised. Expiration of unexercised stock options creates a capital loss equal to the purchase price of the options.

What happens if my stock options expire?

Unlike a stock, each option contract has a set expiration date. The expiration date significantly impacts the value of the option contract because it limits the time you can buy, sell, or exercise the option contract. Once an option contract expires, it will stop trading and either be exercised or expire worthless.

How long can you keep stock options?

ten yearsDue to certain tax and securities laws, as well accounting rules, it is very common for stock options issued by private companies to have a term of up to ten years from the date of grant.

What happens if I don't sell my options on expiry?

What happens on the expiry date? In the case of options contracts, you are not bound to fulfil the contract. As such, if the contract is not acted upon within the expiry date, it simply expires. The premium that you paid to buy the option is forfeited by the seller.

Can a stock option be allowed to expire?

The option can be exercised any time it expires regardless of how close it is to the strike price. The relationship between an option's strike price and the market price of the underlying shares is a major determinant of the option's value.

Can I cash out my employee stock options?

Employee stock options are grants from your company that give you the right to buy shares for a guaranteed sum called the exercise price. If your company's stock does well, you can cash in, or exercise, the options, meaning that you use them to buy shares at the exercise price and sell them at a higher market price.

Can a company take away stock options?

Yes, in some instances, a company may take away stock options. This may be disguised in language such as: Company repurchase rights; Redemption; and.

Do you get money back if option expires?

If a put option expires out of the money (OTM), and you are a buyer of the put option, you will simply lose your amount which you have paid (premium) for buying the put option. Again, if you are a seller of the put option, you will get the full amount as a profit which you received for selling the option.

Do all options become 0 on expiry?

Not every call/put option. On the expiry day, the following become zero. All the calls whose strike price is above the closing price in the cash market. All the puts whose strike price is below the closing price in the cash market.

What happens when an option hits the strike price?

When the stock price equals the strike price, the option contract has zero intrinsic value and is at the money. Therefore, there is really no reason to exercise the contract when it can be bought in the market for the same price. The option contract is not exercised and expires worthless.

What happens to stock options after 10 years?

Tick Tock, the 10-year Expiration of Incentive Stock Options (ISOs) Mandated by US tax rules, unexercised employee stock options expire 10 years from date of grant and are absorbed back into the company.

Why are stock options limited to 10 years?

The 10 year exercise window (without an early exercise period) enables employees to wait for a liquidity event (IPO or acquisition) to pay their exercise price and the associated taxes. This extended structure is designed to compensate employees in a way that makes sense for them.

Should you hold option to expiration?

Close Your Trade Before Expiration The reality is that the closer options get to expiration, the faster they lose their value. The odds of making a few more bucks are against you. To protect your trading capital, close out your option trades and take your profit or loss before your options expire.

How long does it take for options to expire?

Summary. The expiration time is when the options contract becomes void and no longer carries any value. Usually, the last day of trading is the third Friday of the month. However, the actual expiration time is the following Saturday at 11:59 a.m. EST.

Why do options expire after 10 years?

Mandated by US tax rules, unexercised employee stock options expire 10 years from date of grant and are absorbed back into the company. Historically, this was never a problem because the incentive stock model familiar to everyone was designed when companies aimed to go public as soon as they viably could.

How long do options take to expire?

The expiration time is the precise date and time at which derivatives contracts cease to trade and any obligations or rights come due or expire. Typically, the last day to trade an option is the third Friday of the expiration month. Derivative contracts will specify the exact expiration date and time.

What time do options expire on expiration date?

The vast majority of options stop trading at the closing bell on expiration day. There are some exceptions to this rule for ETF and index options....

Do options expire at open or close?

Most all options expire at the market close. Some index options, however, expire at the market open. These are called “AM” options.

Do options expire automatically?

Options expire automatically at the close for the option expiration date listed in the contract. In-the-money options will be assigned and exercise...

What is a Stock Option Expiration Date?

A stock options expiration date represents the last day an options contract is valid. On or before the date of the options expiration, investors will have to decide what to do with their options trade, let it expire, or close it out.

When do Options Contract Expire?

When it comes to stock options, there may be a variety of option expiration dates depending on the stock or index you are trading. According to the NASDAQ, options contracts expire at 11:59 AM EST on the expiration date.

Holding an Option Through the Expiration Date

If you are holding a call option with the stock price trading below the current strike price that option has no value at expiration. On the flip side, if you’re holding a put option with the stock price trading above the strike price at expiration, that option has no value. In both of these cases, the stock option ends up expiring worthless.

In-the-Money Expiration (ITM)

If an option is in-the-money it is said to have “intrinsic value”. It means that if the option is exercised right away it will provide profit right immediately. If an option is in the money and approaching expiration you can sell it as most investors do.

Out-of-the Money Expiration (OTM)

Out-of-the-money options hold zero intrinsic value. If an options contract expires out-of-the-money nothing happens. There are no shares that get assigned and the entire options position expires worthless. If you are selling options contracts ( receiving premium ) this is the outcome you want.

Examples of Puts and Calls at Expiration

Below are some examples that can help make sense of call and put options at expiration.

Conclusion

It’s critical for investors to be aware of options positions that are expiring and when they are approaching expiration. You need to make sure you have sufficient capital in place in case your option contract expires in the money and you end up getting assigned shares of stock.

What happens if you let your options expire?

What happens if your options contract expires? Here's the hard truth. If you let your options contract expire, it will likely lose its value. A call option at expiry doesn't have any value if it trades below the strike price. A put option at expiry doesn't have any value if it trades above the strike price.

What is an options contract expiration date?

Investors can hold regular stocks for the rest of their life if they want, but options trading works differently. One of the key factors in any options contract is an expiration date.

What is expiration date?

Article continues below advertisement. An expiration date helps determine your contract's value for an options trade. Whatever type of trade you are enacting, you should usually avoid letting your contract expire out from under you at all costs. Source: Getty Images.

What is time value in options?

Since you pay a premium for each contract, the time value is the portion of the premium remaining based on how long you have until the contract's expiry. Since U.S. options traders can exercise their options anytime between purchase ...

How long does it take for a stock to hit a strike price?

You set a strike price (either a call or put) that you expect the stock to hit by a particular date. The date could be 30 days, 60 days, or longer down the line. Whatever the time frame, the stock in question has until the specified date to hit your positive or negative strike price. Article continues below advertisement.

When can you exercise your contract?

You can exercise your contract at any point prior to expiration, even if you have yet to reach your strike price.

Can you exercise an option contract if it's out of the money?

In short, you can exercise your contract if your option contract is in the money, but you probably won't want to if it's out of the money. Once an out-of-the-money contract expires, you are out of the game. Article continues below advertisement.

What happens when an option expires?

If an option expires in the money, it is assigned, the specified amount of stock is bought or sold, and it is added to the trader’s account.

What is an option expiration date?

When a trader buys an option, they are purchasing the right to buy or sell stock at the predetermined price by the set expiration date.

What happens to the extrinsic value of an option as the expiration date gets closer?

As option expiration dates get closer, the extrinsic value of the option decreases.

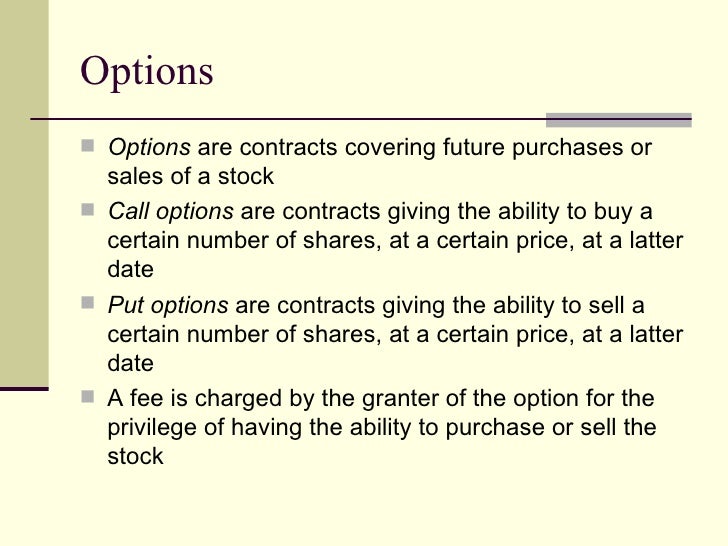

What is option contract?

Options are contracts between two parties that give one party the right to buy or sell shares of an underlying asset at a specified price.

What is part of option premium?

Part of the option premium is attribut ed to the amount of time left before a contract expires. Time value can make it profitable to sell an option and collect the premium.

How long does it take for a stock to expire?

Usually expiration time is on expiration date, and it's usually 1 hour after the market closes on the expiration date.

Can you trade options after they expire?

Once an options contract has expired, it can no longer be traded.

When do stock options expire?

Equity stock option contracts listed on the US exchange will always expire on the Saturday that follows the third Friday of the month.

When is the last day to trade options?

Generally, the last opportunity to trade a monthly options contract is shortly after market close on the third Friday of the expiration month. This can be a little confusing, however, since the actual time that that an option expires is the next day (Saturday).

Can Options be Exercised Automatically?

An options contract will not be exercised automatically if it is “out of the money” at the expiration time.

What About Index Options?

American-style index options contracts, like equity options, can be exercised any time before expiration, up to and including the third Friday of its expiration month.

What does it mean to buy an option contract?

Remember, buying an options contract means you’re buying the right (not the obligation) to buy or sell the assets represented in the contract at a predetermined price and within a set time. Once the contract reaches the end of the set time (its expiration date), unless the buyer of the contract chooses to exercise the right, ...

When do European style options expire?

Similar to American-style index options, some European-style index contracts expire at the end of the day. Some options expire in the morning, however, so it is important to be aware of this and know your expiry times when trading European-style index options.

Do options expire?

Most traders do not hold an options contract until its expiration date; they will move out of the position rather than exercise it or let it expire. Traders should consult their broker regarding expiry, as some brokers will have different notification limits.

What are the Options Expiration Dates?

Technically, expiration occurs on Saturday. That's when settlement actually occurs. But since the market's don't actually trade on Saturday, we treat Friday as the effective expiration date.

When does an option contract expire?

For monthly option contracts, the expiration is the Third Friday of each month.

What if I'm short a call without stock?

If you have a sold call, you will be given a short position if you don't own the stock already. This is known as a "naked" call rather than a "covered" call.

How do options make money?

Option buying strategies attempt to make money if the underlying stock sees a faster move than what the options are pricing in. The profit technically comes from the delta (directional exposure), but since it is a long gamma trade, your directional exposure can change quickly leading to massive profits in the very short term. The main risk here is time decay.

What are the risks of options?

The true risks in the options market come from two things: Theta - the change of an option price over time. Gamma - your sensitivity to price movement. A failure to understand these risks mean that you'll put your portfolio in danger... especially as options expiration approaches.

When are SPX options settled?

Here's where it can get weird. SPX weekly options are settled on Friday at the close. So if you are trading around OpEx with the SPX you need to check if it's a weekly or monthly contract.

What are the two types of options?

There are two kinds of options, a call and a put. And you have two kinds of participants, buyers and sellers. That leaves us with four outcomes: If you're an option buyer, you can use that contract at any time. This is known as exercising the contract. If you're an option seller, you have an obligation to transact stock.

What happens if an option expires?

If an option is out-of-the-money on the expiration date, the option has no value and basically expires worthless and ceases to exist. When an option is in-the-money and expiration is approaching, you can make one of several different moves. For marketable options, the in-the-money value will be reflected in the option's market price.

What happens if you don't exercise an out of the money stock option?

If you don't exercise an out-of-the-money stock option before expiration, it has no value. If it's an in-the-money stock option, it's automatically exercised at expiration.

What is an employee stock option?

Employee stock options and market-traded call options give you the right to buy stocks at the strike price. The options markets also offer put options, which give you the right to sell shares at a preset price. A put option will be in-the-money if the stock is below the strike price and will be automatically exercised by your broker if the option is allowed to reach expiration. If the stock price is above the put option strike price, the option will expire without value.

What is the strike price of an option?

So if you hold an option with a $25 strike price, if you exercise the option, you will pay $25 per share.

What does it mean when an option is in the money?

If the stock price is above the option strike price, the option is "in-the-money." Exercising the option will let you buy shares for less than what you can sell them for on the stock exchange.

Why do you exercise an option?

In this case, there is no financial reason to exercise the option because you can buy the shares cheaper on the open market.

Can you hold a stock option in your brokerage account?

You can hold a market-traded option in your brokerage account or have options from your employer to buy the company's stock. All market-traded options, and often employee options, have expiration dates by which you need to make a decision whether or not to exercise your rights.