Does JP Morgan Chase offer personal loans?

JPMorgan Chase does not currently offer unsecured personal loans. If you're looking for a loan, you can find options from other lenders, including other banks, credit unions and online lenders. Citibank and Wells Fargo are two banks that offer personal loans.

How can I get a personal loan with Chase?

You can’t get a personal loan from Chase. But you might find rates, terms and loan amounts close to what Chase might have offered with lenders like LightStream, Upgrade or Wells Fargo. Wells Fargo gets you the large national bank experience, while LightStream and Upgrade have more streamlined applications and flexible credit requirements.

Does Chase Bank give out personal loans?

Chase is one of the largest banks in the country, with branches across the U.S. But the bank doesn’t currently offer personal loans. If you have a bank account, auto loan, credit card or home loan with Chase, it makes sense that you’d consider the bank for a personal loan.

How to get Chase Bank personal loans?

How to Get a Chase Loan

- Choose a lender. Determine which lender and loan program best fits your needs. ...

- Lock in your loan rate. When you lock in your rate, you’re guaranteed to get that rate at closing. ...

- Complete your loan application. Once Chase has your complete application, you can get an estimated closing date for your loan.

See more

Does Chase let you take out personal loans?

Chase Bank does not currently offer personal loans. However, if you're looking for a loan, you may be eligible for financing through other online lenders and banks.

What kind of loans does Chase bank offer?

Chase offers home, business and auto loans ranging from $5,000 to $5 million to cover your financial needs.

Which bank provides personal loan easily?

HDFC Bank customers can get Personal Loans with minimal or no documentation. In fact, if they are pre- approved for a Personal Loan, they can easily apply for it. Lower interest rates: Interest rates on Personal Loans are lower than other sources.

What credit score do you need for a Chase personal loan?

For a personal loan or installment loan, you'll need a 580 credit score. Income requirements vary by lender and typically range between $2,000 and $3,000 per month. Your lender will need to verify your income, which can come from a job, Social Security, or disability payments.

How can I get a personal loan from my bank?

How to get a personal loan in 8 stepsRun the numbers. ... Check your credit score. ... Consider your options. ... Choose your loan type. ... Shop around for the best personal loan rates. ... Pick a lender and apply. ... Provide necessary documentation. ... Accept the loan and start making payments.

How can I get the best personal loan?

6 Tips to Choose the Best Personal Loan Check your personal loan eligibility before filing a loan application. Enquire regarding fees and hidden charges from the lender. Check and ensure all the documents required along with the loan application. Consider the loan approval and disbursal tenure.

Which bank is best for personal loan?

Bajaj Finserv provides a range of loan sizes and payback schedules ranging from 12 to 60 months for upto 25,00,000 within 48 hours.10 Best Personal Loan Banks List In India. ... HDFC Bank Personal Loan. ... Bajaj Finserv Personal Loan. ... SBI Personal Loan. ... Tata Capital Personal Loan. ... Axis Bank Personal Loan. ... Canara Bank Personal Loan.More items...•

What is the easiest loan to get approved for?

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

How much loan can I get on 50000 salary?

5,40,000. On the other hand, if you are wondering - how much personal loan can I get on a 40,000 salary, the loan sanction amount will be close to Rs. 10.80 lakhs....Multiplier Method.SalaryExpected Personal Loan AmountRs. 40,000Rs. 10.80 lakhsRs. 50,000Rs. 13.50 lakhsRs. 60,000Rs. 16.20 lakhs2 more rows

Is it hard to get a personal loan from a credit union?

As member-owned institutions, credit unions don't need to turn a profit for investors. This means credit union personal loan rates can be more competitive than those found at big banks. However, credit unions require you to be a member to apply, and requirements can be hard to meet.

What FICO score does Chase?

ExperianWhich Credit Bureau Does Chase Use Most? Chase primarily uses Experian as its credit bureau, but also uses TransUnion and Equifax for certain cards in certain states.

How can I raise my credit score to 800?

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time. ... Keep Your Credit Card Balances Low. ... Be Mindful of Your Credit History. ... Improve Your Credit Mix. ... Review Your Credit Reports.

Can you get a loan with no credit?

Yes, it is possible to get a loan with no credit score. But you're likely to be hit with a high interest rate and less-than-favorable terms. Your lack of credit scares lenders.

Which bank is best for a car loan?

Best Car Loan Rates of October 2022Best Overall: PenFed Credit Union.Best Online Auto Loan: LightStream.Best Bank for Auto Loans: Bank of America.Best Credit Union for Auto Loans: Consumers Credit Union.Best for Used Cars: Chase Auto.Best for Bad Credit: myAutoloan.Best for Refinance: AUTOPAY.More items...

Is Chase good for auto loans?

Chase Auto Loan review: 8.5 Stars We rate Chase 8.5 out of 10.0 for its new and used car loan options, low starting APR and long term lengths. Borrowers can feel confident in the company's ability to finance car loans since it's the nation's largest bank.

How do you qualify for an SBA loan?

SBA 7(a) Eligibility Requirements You must be officially registered as a for-profit business, and you must be operating legally. As the business owner, you can't be on parole. Your business must have fewer than 500 employees, and less than $7.5 million revenue on average each year for the past three years.

How to Get A Chase Mortgage Loan

Although Chase Bank personal loans — including personal loans for bad credit — don’t exist, the bank does offer one of the most important types of...

Types of Chase Mortgage Loans

Although Chase personal loans aren’t available, a number of other Chase Bank loans are offered to consumers. You can get a loan estimate by using t...

How to Get A Chase Auto Loan

Applying for a Chase Auto Direct loan is a bit different from applying for a Chase mortgage. Here’s how to apply for a Chase auto loan: 1. Explore...

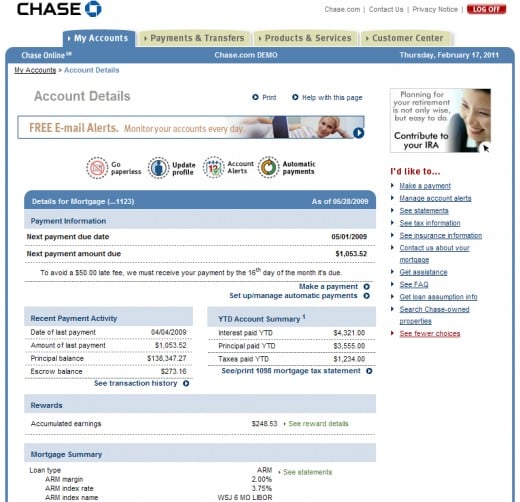

What is My Chase Loan?

My Chase Loan is a feature that allows you to borrow money from your existing card’s available credit. You’ll pay it back over a set period of time between 6 and 24 months with a fixed Annual Percentage Rate (APR) that’s lower than your standard purchase APR.

What is the minimum and maximum amount of money I can request for My Chase Loan?

The minimum amount you can request for My Chase Loan is $500. The maximum amount you can request can vary based on your monthly spending, creditworthiness and other factors. Each time you set up a new My Chase Loan, we’ll tell you the maximum amount you can request.

How to get a loan from a bank?

1. Choose your loan amount ($500 minimum). Illustrative example only. 2. Choose your payment duration — up to 24 months — depending on the loan amount. Illustrative example only. 3. Receive the funds directly into your bank account in 1-2 business days. Illustrative example only.

Do you need a credit check for Chase?

Unlike traditional loans, with My Chase Loan there’s no need for an application, credit check or a separate account to manage. My Chase Loan allows you to borrow money from your existing card’s available credit. We’ll show you a single statement, and you’ll have one monthly payment due on your credit card account.

Can I continue to use my Chase credit card after requesting a My Chase Loan?

You can continue to make purchases using your Chase credit card as long as you have available credit to do so.

What kind of Chase loan can you get?

They offer auto loans, mortgages, and private student loans. If you need a loan in one of these areas, then Chase is a great option to explore.

What type of mortgages does Chase offer?

Here are the types of mortgages offered by Chase: Conventional, FHA, VA, and jumbo loans are all available. You can also choose between fixed and adjustable rate mortgages, as well as a 15-year versus 30-year loan. This is a broad range of loan types that suit just about anyone’s needs.

Where can you get a bad credit personal loan?

Online loan marketplaces let you receive multiple loan offers by completing a single application. Not only does this cut back on time involved with applying for more than one loan, but it also helps you compare offers easily.

How long does Chase loan last?

Chase does have a car loan limit: You can only finance up to $100,000. Loan terms last between four and six years. Even if you don’t know exactly what kind of car you want, you can fill out what information you do have or call a customer service representative to get a quote.

How much does Chase save on new cars?

Using Chase’s car-buying platform, customers who bought new cars averaged a savings of $3,086 off the MSRP. You can also find used cars at great prices. Once you’re ready to finance, you can get a personalized rate quote.

Which is the best bank to buy credit cards?

As one of the largest and most popular banks in the world, Chase is an obvious go-to choice for any financial product. Their credit cards come with competitive rewards programs and the bank’s customer service department is among the best.

Does Chase finance a car?

Chase actually offers a variety of services when it comes to financing your vehicle. In addition to getting a new auto loan, you can also refinance an existing loan. Plus, Chase has partnered with TrueCar to provide a car buying service directly through their website. So essentially, you get help with the process from start to finish.

How to apply for a Chase loan?

Here’s how to apply for a Chase home loan: 1 Give Chase permission to review your credit history. 2 Gather your financial information, including your household income, debts, personal loans and assets. You’ll also need property information such as the property type, purchase price and down payment amount, and name and number of your real estate agent. 3 Chase will create a full mortgage application package for you with a loan estimate included. Read this carefully because it includes information on loan fees and settlement costs as well as your interest rate, loan terms and monthly payment amount. 4 Review all of the documents in your package and sign and return any necessary forms.

How much is a Chase Jumbo mortgage?

Chase Jumbo Mortgage. A jumbo mortgage is typically available for a property worth more than $417,000 — up to $3 million. Choose a Chase jumbo fixed mortgage with a 15-, 20- or 30-year term or an adjustable-rate mortgage with a five-, seven-, 10- or 30-year term.

How much down payment is required for Chase Dreamaker?

Meet the required income limits and take advantage of a Chase DreaMaker mortgage, which requires only a 5 percent down payment and can come from a gift or grant. The DreaMaker mortgage also features flexible funding options for closing costs, reduced private mortgage insurance requirements and lower monthly payments.

How long does a Chase VA loan last?

With 100 percent financing available, you can get a fixed rate loan with a term of 10, 15, 20, 25 or 30 years.

How long does an adjustable rate mortgage last?

The adjustable-rate mortgage from Chase fixes your interest rate for a loan term of five, seven or 10 years, after which it becomes variable for the remaining loan term. For example, a 5/1 ARM would have a fixed interest rate for the first five years and then convert to an adjustable rate after that.

How long before closing can you lock in your Chase loan?

When you lock in your rate, you’re guaranteed to get that rate at closing. You lock your rate in at any time from the day you choose your loan up to five days before closing. Complete your loan application. Once Chase has your complete application, you can get an estimated closing date for your loan.

Does Chase offer a fixed rate mortgage?

Chase offers fixed-rate mortgages for 10-, 15-, 20-, 25- and 30-year terms. With a fixed-rate mortgage, you’ll always know how much your monthly payments will be, including principal and interest. You might qualify for one of Chase’s low down payment options if you apply for a loan.

What is Chase Bank?

About Chase. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more, visit the Banking Education Center.

How many branches does Chase Total Checking have?

Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches.

Does Chase Auto finance cars?

Chase Auto is here to help you get the right car. Apply for auto financing for a new or used car with Chase. Use the payment calculator to estimate monthly payments.

Does Chase offer cash back?

Choose from our Chase credit cards to help you buy what you need. Many offer rewards that can be redeemed for cash back, or for rewards at companies like Disney, Marriott, Hyatt, United or Southwest Airlines. We can help you find the credit card that matches your lifestyle. Plus, get your free credit score!

Is there a guarantee that investment objectives will be achieved?

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

Is JPMorgan Chase a FDIC member?

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

What are the benefits of personal loans?

They are a great financing option with much lower interest rates than other avenues. But, since they are a more risky investment, some of the larger financial institutions like Chase don’t offer personal loans.

What are some alternatives to Chase Bank?

If applying for personal is still is your best option, here are nine great alternatives to Chase Bank for you to consider. 1. SoFi. SoFi is a well-established direct lender that offers personal loans ranging from $5,000 to $100,000. While you must be employed to get approved, SoFi looks at more than just your score and debt-to-income ratio.

What is prosper lending?

Prosper is another online lending marketplace that connects borrowers and investors. It has facilitated more than $12 billion in loans to more than 770,000 people. Choose from either a three- or five-year term and borrow up to $35,000.

What are the benefits of a lender?

Benefits like career coaching, discounted interest rates, unemployment protection, and more.

Can a lender approve a loan that the other won't?

While the rates and terms won’t be as favorable as other lenders on the list, the company will approve borrowers that the others won’t and get money in your pocket.

Does Wells Fargo offer personal loans?

Check out what the best personal loans are to ensure that you choose the best option for you. Even though large banks like Chase, or even Wells Fargo, don’t offer them, it doesn’t mean a personal loan isn’t for you.

Is it hard to get a loan from a bank?

However, it may be more difficult to get a loan from an offline, brick-and-mortar lender. Your local credit union, Wells Fargo, and JPMorgan Chase bank think these loans are too risky for them.

What bank offers credit cards?

Like Wells Fargo and Goldman Sachs, Citibank is one of the biggest banks in the U.S. It also offers credit cards, mortgages and checking and savings accounts, among other offerings. Keep in mind that you’ll need an eligible Citi deposit account open for at least three months before applying.

How long does Citi loan last?

Loan terms — Citi offers loan terms from 12 months to 60 months, which can help give you the flexibility to find a monthly payment that fits your budget. Discounts with auto payments — If you set up automatic payments, you may be eligible for interest rate discounts on a personal loan.

What is LightStream lending?

Why you may want to consider LightStream: LightStream is the online lending division of Truist Bank, another large lender. If you’re able to do some legwork, LightStream can be attractive because of its “rate beat” program, which promises to beat a competitor’s offer by 0.1 percentage points if you meet certain conditions.

How many credit cards does Marcus pay?

If you want to consider some of the best debt consolidation loans, Marcus might be a good option since it will pay up to 10 credit card accounts directly from your loan funds for you if requested.

Is Marcus a Goldman Sachs bank?

Why you may want to consider Marcus by Goldman Sachs: Marcus — an online lender operated by Goldman Sachs — is part of another large national bank. In addition to personal loans, Marcus offers a high-yield savings account and CDs.

Is Citibank good for small loans?

Why you may want to consider Citibank: If you only need a small loan, Citibank’s personal loans start at just $2,000 and go up to $30,000 if you apply online. Having a range of loan amounts may help you avoid borrowing more than you need.

Does Wells Fargo offer a relationship discount?

Interest rate discount — Wells Fargo offers a relationship discount if you have a qualifying checking account and make automatic payments from a Wells Fargo deposit account.