The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.

Is catastrophic health insurance worth it?

High-deductible insurance plans, sometimes known as catastrophic plans, are much lower in cost than other insurance plans, although you'll have to pay a large amount of out-of-pocket money if you need care, so it still makes sense to put money aside each month, even if it's into your own savings account instead of paid as a premium for insurance.

Should I get catastrophic health insurance?

Those who benefit most from catastrophic health plans are healthy individuals under the age of 30. People under 30 are likely to not need as much health care as older people, so a catastrophic health plan can decrease health care costs. A catastrophic plan can serve as a safety net in case of a serious medical issue.

What is the cost of catastrophic health insurance?

The average cost of a catastrophic health plan is $195 per month, but your cost will depend on your location, age, and insurer. 5 That amount is significantly less than what a bronze plan purchased through the Health Insurance Marketplace would cost. As of 2022, the lowest-tier bronze plan costs $328 per month, on average. 6

Should you have catastrophic health insurance?

If you are under 30, you are eligible to purchase catastrophic health coverage. But you should only consider a catastrophic health insurance plan if you rarely get sick, you are not suffering from a chronic medical condition, or your goal is to spend as little as possible on health insurance.

What is Medicare catastrophic coverage?

Catastrophic coverage is a phase of coverage designed to protect you from having to pay very high out-of-pocket costs for prescription drugs. It usually begins after you have spent a pre-determined amount on your health care. For example, Part D prescription drug plans offer catastrophic coverage.

What is the catastrophic cap for Medicare 2022?

$7,050In order to get out of the donut hole and move into the catastrophic coverage level (where your costs will be much lower but not necessarily low, depending on your medications), your out-of-pocket spending will have to reach $7,050 in 2022 (up from $6,550 in 2021, and up considerably from 2019, when it was $5,100).

Does Medicare Part B have a catastrophic limit?

The catastrophic coverage limit for 2021 is $6,550. Once you spend that amount on drugs that are covered by your plan, you'll only pay the low copayment or coinsurance amounts listed above for generic and brand-name drugs through the rest of 2021.

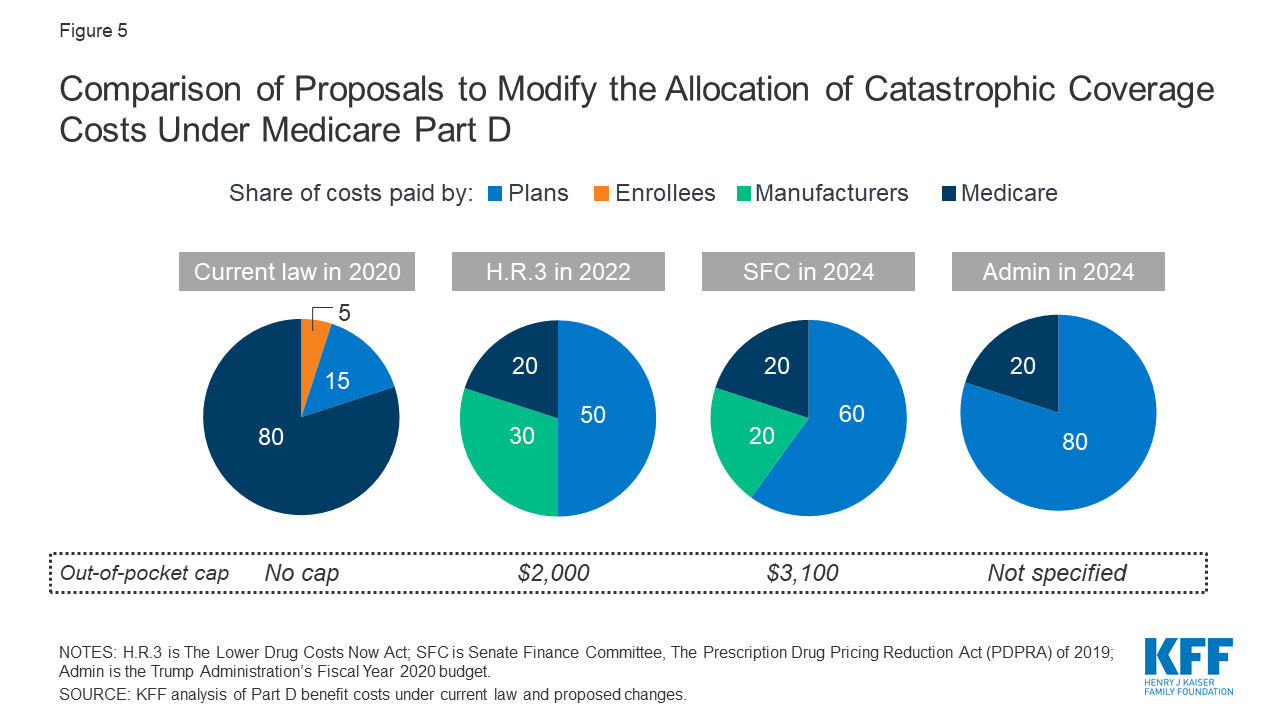

Who pays for Medicare Part D catastrophic coverage?

Once the catastrophic portion of the benefit is reached, the plan pays 15 percent of the cost, Medicare pays 80 percent, and the beneficiary pays the remaining 5 percent.

What is the maximum out-of-pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How does catastrophic coverage work?

Catastrophic insurance coverage helps you pay for unexpected emergency medical costs that could otherwise amount to medical bills you couldn't pay. It also covers essential health benefits, including preventive services like health screenings, most vaccinations, your annual check-up, and certain forms of birth control.

What is the donut hole in Medicare for 2022?

Donut Hole: Who Pays What in Part D Medicare beneficiaries will see a Part D deductible up to $480 in 2022, followed by an Initial Coverage Period in which they will be responsible for 25% of costs up until they reach the threshold of $4,130 spent on prescription medications.

Does Medicare cover 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What is the Medicare lifetime maximum?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($91,000 if you file individually or $182,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Why is Medicare Part D so expensive?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive. Read more about .

What is the donut hole in Medicare for 2022?

Donut Hole: Who Pays What in Part D Medicare beneficiaries will see a Part D deductible up to $480 in 2022, followed by an Initial Coverage Period in which they will be responsible for 25% of costs up until they reach the threshold of $4,130 spent on prescription medications.

What is the monthly Medicare premium for 2022?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

What is Medicare's deductible for 2022?

The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021. Once the Part B deductible has been paid, Medicare generally pays 80% of the approved cost of care for services under Part B.

What is catastrophic cap?

The catastrophic cap is the maximum out-of-pocket amount the beneficiary will pay each calendar year for TRICARE-covered services. The beneficiary is not responsible for any amounts over the catastrophic cap in a given year, except for: Services that are not covered.

What happens to prescriptions once you meet the catastrophic threshold?

Once a person meets the catastrophic threshold in their coverage, the cost of their prescription medications decreases for the rest of the year.

What happens during the catastrophic phase?

Catastrophic: Individuals may reach this phase if they meet the maximum out-of-pocket (OOP) limit. During this phase, a person’s prescription drug costs decrease. The maximum OOP limit changes each year.

What is the OOP limit for Part D 2021?

The catastrophic phase of Part D coverage happens when a person reaches their maximum OOP expenses. For 2021, the OOP limit is $6,550 out of pocket. A person will then be out of the coverage gap for Medicare prescription drug coverage and will automatically get catastrophic coverage.

How many phases are there in Medicare Part D?

Medicare Part D plans have four coverage phases for prescription drugs. These are as follows: Deductible: Individuals with a Part D plan pay a deductible before their plan covers the cost. During the deductible phase, people with a Part D plan pay the full cost of their prescription.

How much will people pay for prescription drugs in 2021?

In 2021, according to the KFF, people will pay whichever is higher of 5% of the retail costs of the medication or $9.20 for a brand-name drug and $3.70 for a generic drug.

How much is the OOP expense for 2021?

OOP expenses: In 2021, the allowed OOP expense is $6,550, which is a $200 increase from 2020.

How often does Medicare Part D change?

The costs for Medicare Part D covered medications usually change every year. For 2021, the costs are as follows:

How much does catastrophic coverage cost?

Once in Catastrophic Coverage, the cost drops to $1,300. (Costs can vary depending on location and drug plan.) Although 5% may sound reasonable — and it often can be — for very expensive drugs that didn’t exist when Medicare Part D was introduced in 2006, it can quickly become unaffordable for many people.

Why Are More People Reaching Catastrophic Coverage?

Medicare Part D, an optional plan introduced in 2006, hasn’t kept up with skyrocketing increases in the cost of pharmaceutical drugs. Specialty drugs, such as non-injectable cancer treatments or medicines used to treat autoimmune diseases and Hepatitis C, are particularly expensive.

What is Medicare Part D?

Medicare Part D, the federal program that covers pharmaceutical drugs for Medicare recipients, has gone a long way to help patients pay for the rising costs of medicines.

What is a formulary in Medicare?

Each drug plan includes a formulary, or in plain English, a list of drugs that are covered under the policy. As you choose between and among Medicare Part D plans or Medicare Advantage plans, it’s important to make sure that the medicines you need will be covered. Otherwise, you pay full price for your medicine.

Can you have dual Medicare and Medicaid?

If you are eligible for dual enrollment in both Medicare and Medicaid – or if you have certain chronic conditions – ask an agent about Medicare Advantage dual eligible special needs plans (D-SNP). Depending on your health issues, you may find you have broader coverage of prescriptions under these plans.

Can you get a generic drug with Medicare Part D?

Let your healthcare provider know you have Medicare Part D and you are wondering about your long-term out-of-pocket drug costs. Your doctor may be able to suggest a generic with a low copayment to help you keep costs under control.

Is there a lifetime limit on 5% co-insurance?

There is no lifetime limit on this 5% co-insurance. Even after you spend $6,350 each year on drugs, you’ll have to pay something for the rest of the calendar year, no matter how expensive the drugs you need may be. One example: Before hitting Catastrophic Coverage, one could pay over $6,500 for Idhifa, a drug to treat leukemia. ...

What is Medicare Part D catastrophic coverage?

In the coverage gap, you will pay no more than 25% of the cost of your drugs, and 25% of the dispensing fee.

When do you leave catastrophic coverage?

You do not leave the catastrophic stage until the start of the next year. For example, if you enter the stage in August 2021, you will not lose that coverage until January 2022. The coverage gap also does not differ, and is the same for all Part D plans.

What are the other phases of Part D coverage?

There are four stages of Medicare Part D coverage, each with different costs associated with them.

What is the purpose of the Medicare coverage gap?

The purpose of the coverage gap is to help protect you from having to pay high out-of-pocket costs for your prescription drugs.

What is MA plan?

With an MA plan, you’ll get Part A, Part B and Part D coverage in one plan. MA plans offer the same coverage for services and supplies that Original Medicare does, as well as additional coverage such as dental, vision, hearing and prescription drug coverage.

What is the catastrophic stage of Part D?

Then, once your total out-of-pocket costs have reached $6,550 (in 2021), you then exit the coverage gap stage and enter the next stage of Part D coverage called the “ catastrophic stage .” This total is the amount that you have paid, not the total amount you and your plan have paid, for your prescription drugs.

How to choose a health insurance plan?

When choosing a plan, make sure to choose from plans available in your service area. Compare costs, including the deductible, premiums, copayments/coinsurance. Also review the plan’s formulary to make sure any drugs you currently take are covered.

What does a catastrophic plan cover?

What Catastrophic plans cover. Catastrophic plans cover the same essential health benefits as other Marketplace plans. Like other plans, Catastrophic plans cover certain preventive services at no cost. They also cover at least 3 primary care visits per year before you’ve met your deductible.

How much does a catastrophic plan cost?

How much Catastrophic plans cost 1 Monthly premiums are usually low, but you can’t use a premium tax credit to reduce your cost. If you qualify for a premium tax credit based on your income, a Bronze or Silver plan is likely to be a better value. Be sure to compare. 2 Deductibles — the amount you have to pay yourself for most services before the plan starts to pay anything — are very high.#N#For 2019, the deductible for all Catastrophic plans is $7,900.#N#For 2020, the deductible for all Catastrophic plans is $8,150. 3 After you spend that much, your insurance company pays for all covered services, with no copayment or coinsurance.

What is the deductible for catastrophic insurance?

For 2019, the deductible for all Catastrophic plans is $7,900. For 2020, the deductible for all Catastrophic plans is $8,150. After you spend that much, your insurance company pays for all covered services, with no copayment or coinsurance.

Is catastrophic insurance good for you?

Use your new coverage. Catastrophic health insurance plans have low monthly premiums and very high deductibles. They may be an affordable way to protect yourself from worst-case scenarios, like getting seriously sick or injured.

What is the catastrophic phase of Medicare?

The catastrophic phase is the last phase of Medicare Part D drug coverage. You reach it when you’ve spent your way through the donut hole phase. When you get to the catastrophic phase, Medicare is supposed to pay the bulk of your drug costs.

How much does Medicare Part D cost?

The government says the average monthly amount is $33.06, or $396.72 annually. In practice, premiums vary a lot from plan to plan.

What can you do to manage your Part D costs?

Check available pharmacies. Sometimes just changing pharmacies to a “preferred” one in your insurer’s network can lower a drug’s price. Use GoodRX to compare prices and look for coupons that could save you money on your medications. Sometimes checking competitors or switching to a mail-order pharmacy can make a big difference.

How many tiers of insurance are there?

Since 2006, insurers have had the ability to make their own tiers. Some insurers have five or six tiers. The placement of drugs is also different among plans. A tier 2 drug in one insurer’s formulary may be a tier 3 in another. What insurers charge for a drug also varies widely.

What is the state health insurance assistance program?

Contact the State Health Insurance Assistance Program. It’s a nonprofit network of trained, unbiased benefits counselors who provide free guidance on Medicare issues. A SHIP counselor can help you with Part D questions.

Is there a cap on Part D prescription drug coverage?

There is no cap on the cost of Part D prescription drug coverage.

Does Medicare Part D have a cap on out of pocket costs?

No. Medicare Part D has never capped out-of-pocket costs. Even when you reach catastrophic coverage, your 5% coinsurance lasts the rest of the year.

What is a catastrophic health plan?

Catastrophic Health Plan. Health plans that meet all of the requirements applicable to other Qualified Health Plans (QHPs) but that don't cover any benefits other than 3 primary care visits per year before the plan's deductible is met.

How old do you have to be to qualify for a catastrophic plan?

To qualify for a Catastrophic plan, you must be under 30 years old OR get a "hardship exemption" because the Marketplace determined that you’re unable to afford health coverage.

What is catastrophic insurance?

Catastrophic Coverage. Insurance designed to protect you from having to pay very high out-of-pocket costs. Catastrophic coverage usually begins after you have spent a pre-determined amount on your health care. Original Medicare Part A and Part B do not offer catastrophic coverage.

Does Medicare Part A and Part B have catastrophic coverage?

Original Medicare Part A and Part B do not offer catastrophic coverage. They always pay the same amount regardless of how much you have spent. The Medicare prescription drug benefit ( Part D) does offer catastrophic coverage.

Does Medicare have a cap on out of pocket costs?

Medicare private plans, like regional PPOs (Prefered Provider Organizations), may also have catastrophic coverage or caps on out-of-pocket costs, but these caps may exclude certain high cost services. Also, Medicare Medical Savings Accounts (MSAs) must pay all or most of your Medicare Part A and B costs after you have met your deductible .