How to calculate the payback period of an asset?

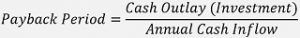

The first step in calculating the payback period is determining the initial capital investment and The next step is calculating/estimating the annual expected after-tax net cash flows over the useful life of the investment. When cash flows are uniform over the useful life of the asset, then the calculation is made through the following formula.

What are the disadvantages of the payback period?

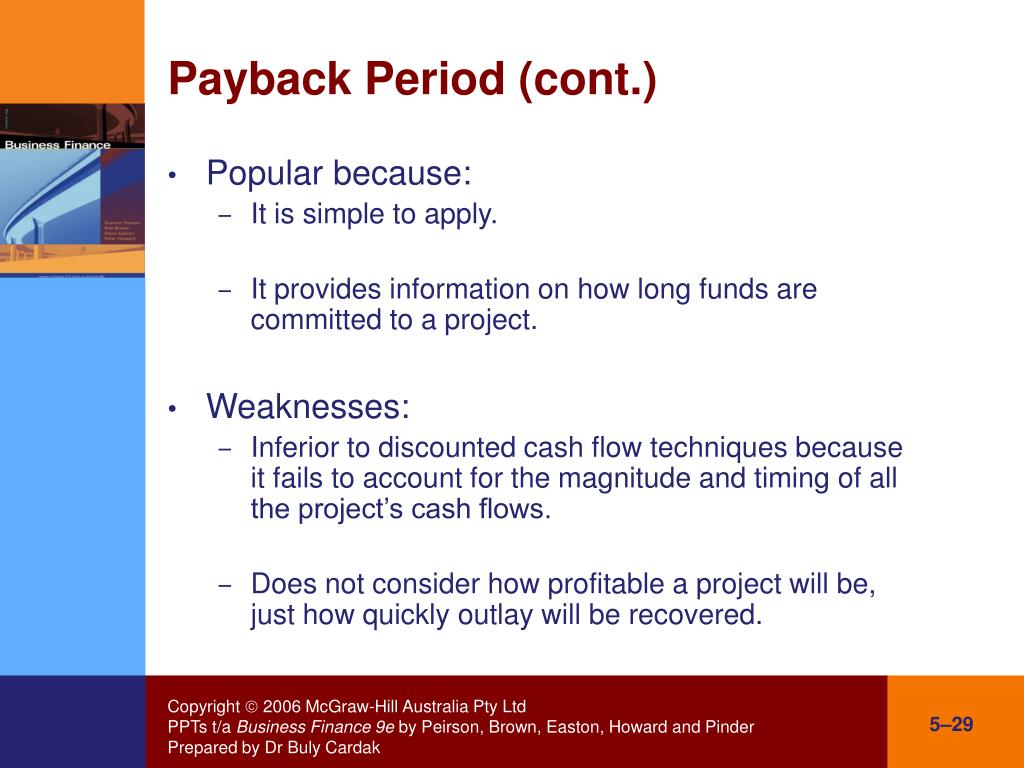

Disadvantages. The following are the disadvantages of the payback period. It ignores the time value of money. It fails to consider the investment total profitability (i.e. it considers cash flows from the initiation of the project until the payback period and fails to consider the cash flows after that period.

What is the payback period of the equipment?

According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years. A D V E R T I S E M E N T Comparison of two or more alternatives – choosing from several alternative projects:

What are the limitations of the payback period method in capital budgeting?

Limitations, or disadvantages, of using the payback period method in capital budgeting include the fact that it fails to take into account the time value of money and does not factor in the value of additional cash flows beyond the payback period.

What does payback period consider?

Payback period is defined as the number of years required to recover the original cash investment. In other words, it is the period of time at the end of which a machine, facility, or other investment has produced sufficient net revenue to recover its investment costs.

Does the payback period consider the time value of money?

The payback period disregards the time value of money and is determined by counting the number of years it takes to recover the funds invested. For example, if it takes five years to recover the cost of an investment, the payback period is five years.

What does the payback period ignore?

Ignores the time value of money: The most serious disadvantage of the payback method is that it does not consider the time value of money. Cash flows received during the early years of a project get a higher weight than cash flows received in later years.

Does payback method consider salvage value?

In accounting, bailout payback method shows the length of time required to repay the total initial investment through investment cash flows combined with salvage value.

Is 3 years a good payback period?

Broadly, the consensus is: For B2C businesses, a payback period of less than 1 month is GREAT, 6 months is GOOD, and 12 months is OK. And the exceptional cases can pay back their acquisition costs on the first transaction.

How do you calculate after payback period?

Payback period Formula = Total initial capital investment /Expected annual after-tax cash inflow.

How does depreciation affect the calculation of a project's payback period?

D) Depreciation does not affect the payback calculation. How does depreciation affect the calculation of a project's accounting rate of return (ARR)? A) Depreciation is added to the annual cash inflows.

Is depreciation expense included in ROI calculation?

We define ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the fiscal year or trailing twelve months divided by average invested capital during that period.

What are the major limitations of payback period method?

Limitations of Payback Period Analysis The first is that it fails to take into account the time value of money (TVM) and adjust the cash inflows accordingly. The TVM is the idea that the value of cash today will be worth more than in the future because of the present day's earning potential.

Does payback period ignore depreciation?

Depreciation is a non-cash expense and has therefore been ignored while calculating the payback period of the project. According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years.

Is salvage value the same as depreciation?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset's estimated salvage value is an important component in the calculation of a depreciation schedule.

What is the difference between salvage value and depreciation?

When valuing a company, there are several useful ways to estimate the worth of its actual assets. Book value refers to a company's net proceeds to shareholders if all of its assets were sold at market value. Salvage value is the value of assets sold after accounting for depreciation over its useful life.

What determines time value of money?

In general, you calculate the time value of money by assessing a discount factor of future value factor to a set of cash flows. The factor is determined by the number of periods the cash flow will impacted as well as the expected rate of interest for the period.

What role does the time value of money play in calculating Arr and payback period?

Time value of money plays no role in ARR or the payback period. Net income is found on the income statement.

What are the two major concept of time value of money?

The two key takeaways are: TVM is a financial concept that states the current value of money is higher than the future value of money. Potential earning capacity decides the current and future value.

What is a payback period?

Payback period can be defined as period of time required to recover its initial cost and expenses and cost of investment done for project to reach at time where there is no loss no profit i.e. breakeven point.

Why is the payback period important?

The length of the project payback period helps in estimating the project risk. The longer the period, the riskier the project is. This is because the long-term predictions are less reliable.

How to calculate payback period?

Steps to Calculate Payback Period 1 The first step in calculating the payback period is determining the initial capital investment and 2 The next step is calculating/estimating the annual expected after-tax net cash flows over the useful life of the investment.

When cash flows are not uniform over the use full life of the asset, then the cumulative cash flow from operations must be?

When cash flows are NOT uniform over the use full life of the asset, then the cumulative cash flow from operations must be calculated for each year. In this case, the payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay.

Does depreciation add up to cash inflow?

While calculating cash inflow, generally, depreciation is added back as it does not result in cash out flow.

What is payback period?

Given its nature, the payback period is often used as an initial analysis that can be understood without much technical knowledge. It is easy to calculate and is often referred to as the “back of the envelope” calculation. Also, it is a simple measure of risk, as it shows how quickly money can be returned from an investment.

Why is the payback period shorter?

In some ways, a shorter payback period suggests lower risk exposure, since the investment is returned at an earlier date.

Does the payback period show the return on investment?

While the payback period shows us how long it takes for the return on investment, it does not show what the return on investment is. Referring to our example, cash flows continue beyond period 3, but they are not relevant in accordance with the decision rule in the payback method.

What is the payback period?

Payback period means the period of time that a project requires to recover the money invested in it. It is mostly expressed in years. Unlike net present value and internal rate of return method, payback method does not take into account the time value of money. According to payback method, the project that promises a quick recovery ...

How to calculate payback period?

Since the annual cash inflow is even in this project, we can simply divide the initial investment by the annual cash inflow to compute the payback period. It is shown below:

How long does Rani beverage equipment last?

The useful life of the equipment is 10 years and the company’s maximum desired payback period is 4 years. The inflow and outflow of cash associated with the new equipment is given below:

What are the disadvantages of the payback method?

Disadvantages: The payback method does not take into account the time value of money. It does not consider the useful life of the assets and inflow of cash after payback period. For example, If two projects, project A and project B require an initial investment of $5,000.

Why is a short payback period important?

A short payback period reduces the risk of loss caused by changing economic conditions and other unavoidable reasons.

Is depreciation a cash expense?

Depreciation is a non-cash expense and has therefore been ignored while calculating the payback period of the project. According to payback method, the equipment should be purchased because the payback period of the equipment is 2.5 years which is shorter than the maximum desired payback period of 4 years.

What Is the Role of Depreciation in the Payback Period?from chisellabs.com

Depreciation is an essential factor to consider while accounting and forecasting for any business.

What is a payback period?from wallstreetmojo.com

Payback period can be defined as period of time required to recover its initial cost and expenses and cost of investment done for project to reach at time where there is no loss no profit i.e. breakeven point.

How To Calculate the Payback Period in Excel?from chisellabs.com

Financial modeling in excel is a good skill that every professional should have. That will enable you to regulate finances efficiently for your business or job.

What Are the Challenges in the Payback Period?from chisellabs.com

Firstly, the payback period considers the cash flow up to the point where the business regains the initial investment, and it doesn’t view the earnings made after that point.

When cash flows are not uniform over the use full life of the asset, then the cumulative cash flow from operations must be?from wallstreetmojo.com

When cash flows are NOT uniform over the use full life of the asset, then the cumulative cash flow from operations must be calculated for each year. In this case, the payback period shall be the corresponding period when cumulative cash flows are equal to the initial cash outlay.

How to determine payback period?

The payback period is determined by dividing the cost of the capital investment by the projected annual cash inflows resulting from the investment. Some companies rely heavily on payback period analysis and only consider investments for which the payback period does not exceed a specified number of years.

Why do corporations use payback period analysis?

Most corporations will use payback period analysis in order to determine whether they should undertake a particular investment. But there are drawbacks to using the payback period in capital budgeting.

What are the drawbacks of the payback period analysis method?

Despite its appeal, the payback period analysis method has some significant drawbacks. The first is that it fails to take into account the time value of money (TVM) and adjust the cash inflows accordingly. The TVM is the idea that the value of cash today will be worth more than in the future because of the present day's earning potential.

Why is a short payback period important?

A quicker payback period also reduces the risk of loss occurring from possible changes in economic or market conditions over a longer period of time.

What is payback period 2021?

Updated May 26, 2021. The payback period refers to the amount of time it takes to recover the cost of an investment. Moreover, it's how long it takes for the cash flow of income from the investment to equal its initial cost. This is usually expressed in years.

Does payback analysis include inflows of cash?

Furthermore, the payback analysis fails to consider inflows of cash that occur beyond the payback period, thus failing to compare the overall profitability of one project as compared to another. For example, two proposed investments may have similar payback periods. But cash inflows from one project might steadily decline following the end of the payback period, while cash inflows from the other project might steadily increase for several years after the end of the payback period. Since many capital investments provide investment returns over a period of many years, this can be an important consideration.