The constant growth model, or Gordon Growth Model

Dividend discount model

The dividend discount model (DDM) is a method of valuing a company's stock price based on the theory that its stock is worth the sum of all of its future dividend payments, discounted back to their present value. In other words, it is used to value stocks based on the net present value of the future dividends. The equation most widely used is called the Gordon growth model.

What is a constant growth stock?

The constant growth stock, often known as the Gordon Growth Model, is a method of stock valuation. It is presumptively assumed that a company's dividends will continue to climb at a steady pace indefinitely. Based on those future dividend payments, you can use that assumption to determine what a fair price to pay for the stock now.

What is the constant dividend growth model?

The constant dividend growth model, or the Gordon growth model, is one of several techniques you can use to value a stock that pays dividends. Because a company can potentially exist without end, this model assumes that a stock will continue to grow its dividends at a constant rate forever.

What is the required rate of return in constant growth model?

The required rate of return is represented by rs. This is the minimum percentage of gain or return that the investor wants to receive out of the stock. Lastly, the g is the rate of growth. Since we are talking about constant growth model here, we assume that the growth of the stock is the same all throughout the years.

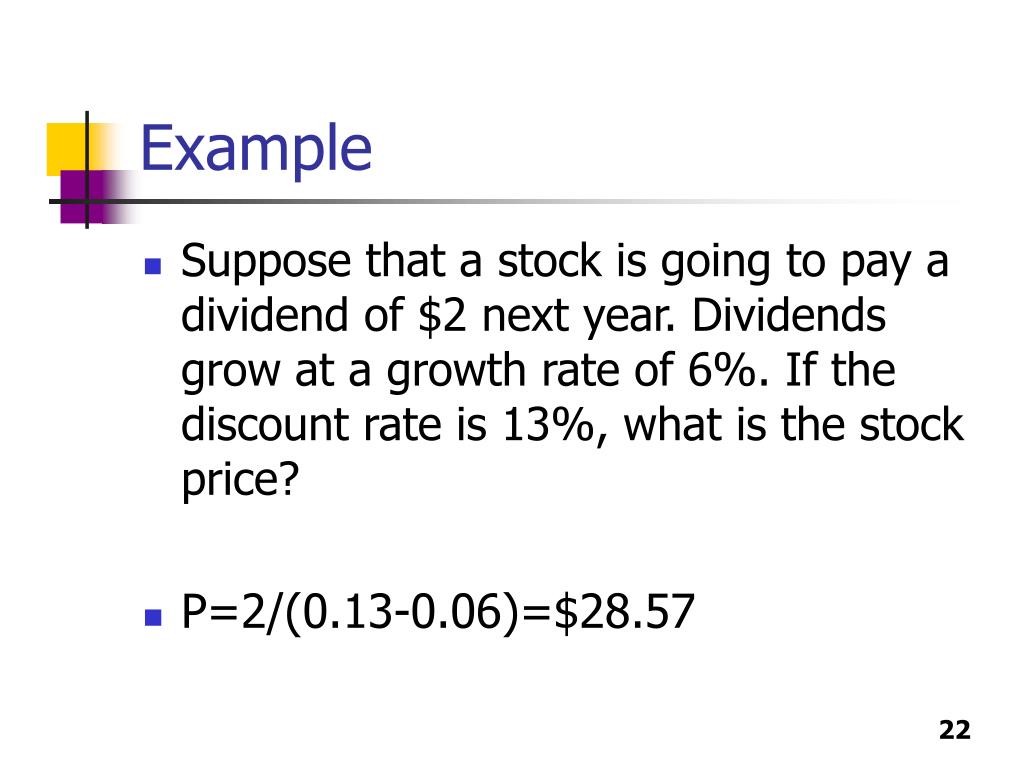

What is the formula of the constant growth model?

The formula of the constant growth model is: Value of Stock (P0) = D1 / (rs - g) Before we go further, first you have to understand that D1 stands for the dividend expected to be paid at the end of the year.

What are constant growth stocks?

A constant growth stock is a share whose earnings and dividends are assumed to increase at a stable rate in perpetuity.

What is a constant growth stock How are constant growth stocks valued quizlet?

The constant growth model is an approach to dividend valuation that assumes a constant future dividend. 3. Assuming that economic conditions remain stable, any management action that would cause current and prospective stockholders to raise their dividend expectations should decrease a firm's value.

How do you find the intrinsic value of a constant growth model?

What is the Gordon Growth Model formula?Intrinsic Value = D1 / (k – g)Intrinsic Value = 2 / (0.1 – 0.04)Intrinsic Value = $33.33.

What is the constant dividend growth valuation formula?

In the simplest assumption where growth is constant forever, the Constant Dividend Growth Model formula is expressed as P = D1 / (k-g). The premise is that the firm will pay future dividends that will grow at a constant rate.

Which of the following statements will always hold true the constant growth valuation formula is not appropriate to use for zero growth stocks?

We then conclude that the only true statement is the second statement. Answer: The constant growth valuation formula is not appropriate to use unless the company's growth rate is expected to remain constant in the formula.

Which of the following statements is true about the constant growth model the constant growth model implies that dividend growth remains constant from now to infinity?

The answer is B) The constant growth model implies that dividend growth remains constant from now to infinity.

When valuing a stock using the constant growth model D1 represents the?

When valuing a stock using the constant-growth model, D1 represents the: the next expected annual dividend. Jensen Shipping has four open seats on its board of directors.

What does constant growth mean?

constant growth. Definition English: Variation of the dividend discount model that is used as a method of valuing a company or stocks. This variation assumes two things; a fixed growth rate and a single discount rate.

What is constant growth rate?

A constant growth rate is defined as the average rate of return of an investment over a time period required to hit a total growth percentage that an investor is looking for.

What is the stock price according to the constant growth dividend model?

The formula for the present value of a stock with constant growth is the estimated dividends to be paid divided by the difference between the required rate of return and the growth rate.

What is the value of a stock that is expected to pay a constant dividend?

The value of the stock is the present value of all expected dividends in perpetuity.

How do Gordon growth models value a company?

Gordon Growth Model Share Price Calculation The formula consists of taking the DPS in the period by (Required Rate of Return – Expected Dividend Growth Rate). For example, the value per share in Year is calculated using the following equation: Value Per Share ($) = $5.15 DPS ÷ (8.0% Ke – 3.0% g) = $103.00.

What does constant growth mean?

constant growth. Definition English: Variation of the dividend discount model that is used as a method of valuing a company or stocks. This variation assumes two things; a fixed growth rate and a single discount rate.

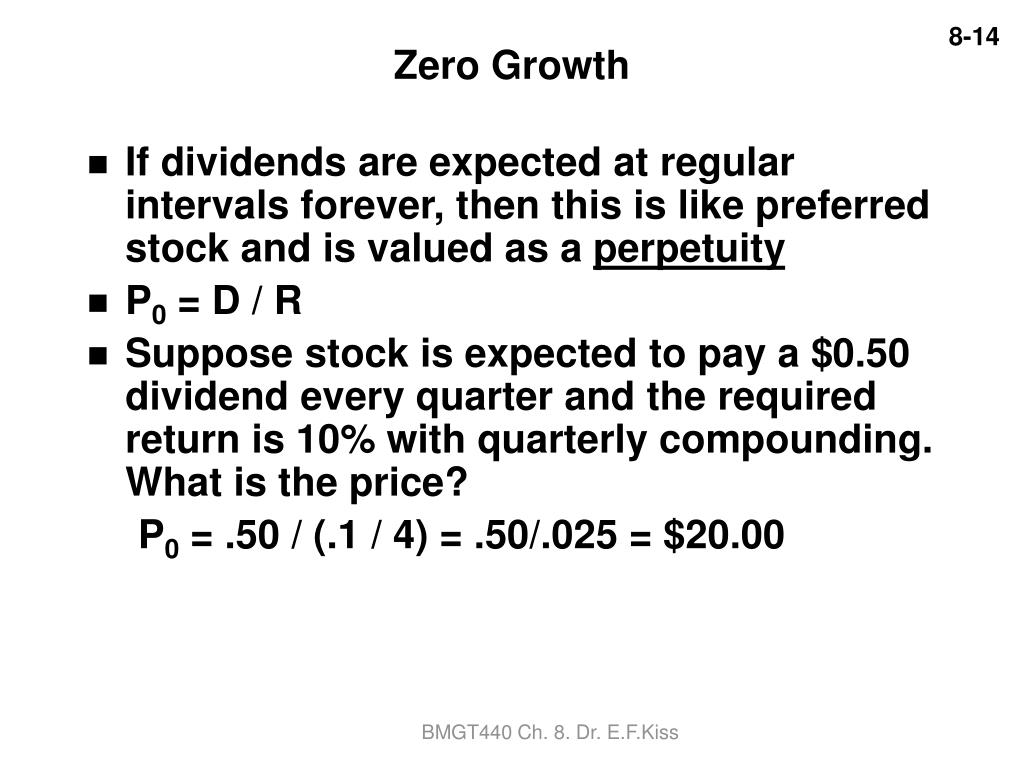

Which of the following is the equation for valuing a stock with a dividend growth rate of zero?

The formula for the present value of a stock with zero growth is dividends per period divided by the required return per period.

What are the three basic patterns of dividend growth?

What are the three basic patterns of dividend growth? Constant growth, zero growth, and differential growth.

Which of the following firms would most appropriately be valued using an asset based model?

The energy exploration firm would be most appropriately valued using an asset-based model.

Why do people buy stocks?

Some people buy stocks because they have a very positive outlook of the company. They may think that the company is worthy enough for them to own. Basically, they hope that the price of owning the company today will increase in the future.

Why do companies issue stocks?

The first thing Sunny has to know is the concept of stocks. Stock issuance has long been done by companies primarily to raise money or capital. Basically, they raise money by selling shares or ownership in their own company. So, in contrast to raising funds by borrowing or loaning, selling your ownership in the company does not require paying off a debt.

Why is Sunny better off buying Thunder Stocks?

In this case, Sunny is better off buying the Thunder Stocks because the market price is lower than the intrinsic value. She may potentially make money out of the stock in the future. Lesson Summary. Stock issuance is important for companies to raise capital.

What is required rate of return?

The required rate of return is represented by rs. This is the minimum percentage of gain or return that the investor wants to receive out of the stock.

Is the intrinsic value of a stock the same as the market value?

Market value is the current price of the stock in the market while intrinsic value is deemed to be the ''real price'' of the stock. They should ideally be equal, but most of the time, the market value and the intrinsic value are not equal. Logically, investors like Sunny should prefer a stock with a low market value but high intrinsic value. This is because they are buying it at a lower price yet they may potentially sell it in the future for a higher value.

What is constant growth?

The Constant Growth Model is a way of share evaluation. Also known as Gordon Growth Model, it assumes that the dividends paid by the company will continue to go up at a constant growth rate indefinitely. It helps investors determine the fair price to pay for a stock today based on future dividend payments.

When is Gordon growth missed?

If Gordon Growth Models is applied to a share that is overestimated, the slowing growth rates are missed after a certain period when the growth rate matures and takes a constant shape.

How is the Present Value of Stock with Constant Growth Derived?

As previously stated, the present value of a stock with constant growth is based on the dividend discount model, which sums the discount of each cash flow to its present value. The formula shown at the top of the page for stocks with constant growth uses the present value of a growing perpetuity formula, based on the underlying theoretical assumption that a stock will continue indefinitely, or in perpetuity. This assumption is not without scrutiny, however the present value of a growing perpetuity can be used as a comparable measure along with other stock valuation methods for companies that are stable and tend to have a calculable outcome of steady growth.

What is capital asset pricing model?

The capital asset pricing model method looks at the risk of a stock relative to the risk of the market to determine the required rate of return based on the return on the market.

Can growth be infinitely negative?

It is important to note that in practice, growth can not be infinitely negative nor can it exceed the required rate of return. A fair amount of stock valuation requires non-mathematical inference to determine the appropriate method used.

Dividends and Stock Price

The Constant Growth Model

- For a company that pays out a steadily rising dividend, you can estimate the value of the stock with a formula that assumes that constantly growing payout is what's responsible for the stock's value. You can use a mathematical formula called the constant growth model, or Gordon Growth Model, to make this calculation or find a stock valuation calcul...

Using The Growth Model Data

- If you have an estimate of the required rate of return and the growth rate on the dividend, which you can usually calculate based on recent past dividends, you can estimate a fair price to pay for the stock. In theory, you'd want to buy the stock if the price is below that level and sell it if you own it and it's well above that price. In practice, you will also want to consider other factors, such as t…