6 Creative Ways to Give Money as a Gift Online

- 1. Send a Prepaid Visa Gift Card If you don't know what exactly a person wants as a gift, you can never go wrong with a prepaid credit card. ...

- 2. Give the Gift of an Amazon eGift Card ...

- 3. Buy a Gift Card for Local Restaurants ...

- 4. Send Money Through PayPal ...

- 5. Buy Gift Cards on GiftCards.com ...

- 6. Gift Home-Cooked Meals With Blue Apron ...

- Gift card. ...

- CDs or savings account transfer. ...

- Stocks. ...

- 529 contribution. ...

- Cash. ...

- Charitable contribution. ...

- 6 ways to save more money in 2022.

- 7 places to save your extra money.

What are some unique ways to give money as gifts?

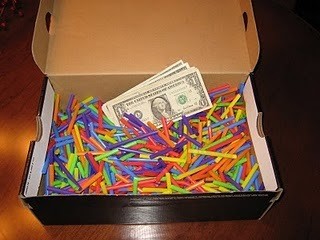

Ways to Hide Money in a Gift

- Money Cake Kit Money Dispenser For Cake Surprise | Etsy. ...

- Box of Chocolates Money Gift. ...

- Rainbow Bath Bomb with Money inside Birthday Gift Idea All | Etsy. ...

- Funny Christmas Money Gift Idea: Cash in a Can. ...

- Easy Peasy Birthday Money Box. ...

- Snowman Money Mini Money Cake | Etsy. ...

- Elf Snot | Christmas Gift Idea for Kids! ...

How to politely ask for money as a gift?

Tips for asking for money as a graduation gift

- Watch your wording. “While your presence at my graduation party is the only gift I need, I’m entering into the real world with a ton of student debt so a ...

- Have your parents do your dirty work. Another approach you can take is to have your parents share the word. ...

- Show your appreciation. ...

How to make 529 plan contributions as a gift?

You can dress up your contribution by:

- Choosing 529 plan printable gift certificates. Some vendors offer the gift-giver the ability to create downloadable or electronic gift certificates to acknowledge the contribution. ...

- Buying physical gift cards. GiftOfCollege.com offers physical gift cards that can be ordered online or bought in person at over 3,000 retail locations.

- Adding a toy. ...

What are some fun ways to give money?

- Money Tie – Gifting money to someone for a new job? ...

- Money Fortune Cookie – What a cute little package! ...

- Money Chain Gift For Graduate – Your new graduate is going to love this money chain! ...

- Money Balloons – Fill some balloons with money and confetti and let your gift recipient have fun popping them!

How can I legally give money as a gift?

Gifting Cash You can write a check, wire money, transfer between bank accounts, or even give actual cash. You know exactly how much you are giving, making it easy to stay under the $16,000 annual gift tax exclusion. Or, if you give more, it's easy to track and report on the gift tax return.

How much money can be legally given to a family member as a gift?

$16,000Annual Gift Tax Limits The annual gift tax exclusion of $16,000 for 2022 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

How much money can be legally given to a family member as a gift UK?

How much money can you gift? Cash gifts can be a huge financial help for your loved ones, both while you're living and after you've passed away. Everyone is permitted by HMRC to gift £3,000 (tax-free) each tax year, this is known as an annual exemption.

How much cash I can give to a person?

However, there is a catch! As per the tax laws, any person cannot receive more than Rs 2 lakh or above in cash from a person in a day in a single transaction. Therefore tax experts say it would be advisable to restrict your cash gift to Rs 2 lakh. “Section 269ST prohibits any person from receiving any amount of Rs.

How does the IRS know if I give a gift?

Filing Form 709: First, the IRS primarily finds out about gifts if you report them using Form 709. As a requirement, gifts exceeding $15,000 must be reported on this form.

How do you give a large sum of money to family?

Choose a Method of GiftingLump sum of cash, which may or may not be earmarked for a particular expense.Cash paid in installments.Transferred investments.Contributions to a child's retirement account.Contributions to a 529 plan whether for an adult child's education or a grandchild's education.More items...•

How does HMRC know about gifts?

HMRC will not be aware per se that a gift has been made. However, the Executor of your will has to complete a form for HMRC, before probate is granted, which outlines the value of the estate for inheritance tax purposes.

Can my parents give me 100k UK?

You're allowed to gift smaller sums of money, up to £250 a year, to as many people as you want. However, you can't combine this with your annual tax-free gift allowance. This means you can't gift your child £3,000 plus an additional £250, as you may be taxed on anything over £3,000.

Can I give money away to my family?

The basics of gifting money to family members You can gift money to family members if: The gift is given at least 7 years before you die.

Can you gift someone a large sum of money?

In 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. In 2022, this threshold is $16,000. If you give more than $15,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you need to file a gift tax return.

Do you have to pay tax if you give someone money?

You do not pay tax on a cash gift, but you may pay tax on any income that arises from the gift – for example bank interest. You are entitled to receive income in your own right no matter what age you are.

What is the maximum amount of cash you can keep at home?

Failure to reveal the source of the money kept in the house can lead to a fine of up to 137 percent. Transactions exceeding Rs 20 lakh in cash in a financial year can attract a penalty. According to the CBDT, it is necessary to provide PAN number for depositing or withdrawing cash more than Rs 50,000 at a time.

How much money can be legally given to a family member as a gift in 2022?

$16,000In 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. In 2022, this threshold is $16,000. If you give more than $15,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you need to file a gift tax return.

What's the maximum gift amount for 2022?

$16,000Included in this area are the instructions to Forms 706 and 709....Annual Exclusion per Donee (One Spouse/Two Spouses)Year of GiftAnnual Exclusion per DoneeAnnual Exclusion Total per Donee (from 2 spouses)2013 through 2017$14,000$28,0002018 through 2021$15,000$30,0002022$16,000$32,0002023$17,000$34,0001 more row

Can my parents give me $100 000?

Current tax law permits anyone to give up to $15,000 per year to an individual without causing any federal income tax issues or reporting requirements. Let's say a parent gives a child $100,000. The parent would have no tax to pay on that gift nor would the child have any tax to pay upon receipt.

How much money can you gift to a family member tax-Free NZ 2022?

Impact of gifting by Single person In the five years before the financial means assessment, you are permitted to make $6,000 worth of gifts per year. Gifts made prior to the five years before making the application may be to the value of $27,000 per year.

How much can you give as a gift?

This exclusion currently sits at $15,000 per person, but is subject to change year over year. That means you can give up to $15,000 in monetary gifts to as many people as you want without needing to file a returnor pay taxes on it.

How much can you give to a 529 plan?

Currently, tax laws allow you to spread out a contribution to a 529 planover five years. This means that you can make a gift of $75,000 ($150,000 as a couple) in one year, as long as that gift goes directly into a 529 plan. Then it’ll be treated as a gift that’s spread over the next five years at $15,000 per year. You can give this type of monetary gift all at once, but note that it cuts into your exclusion each year for five years.

Can you give money as a gift?

Giving monetary gifts under the gift tax exclusion is pretty straightforward. You can give money any way you like, whether that’s by cash, check, gift card or any other medium.

Is it a good idea to give a monetary gift?

Ultimately, giving a monetary gift is fairly simple and hands-off. Even still, it’s typically a good idea to stay below the annual exclusion at the end of each year. But even if you eclipse the limit, you won’t own additional taxes until you go over the lifetime gift tax exclusion, which is quite high.

Can you keep a gift under the lifetime exclusion?

While it’s a bit easier to keep track of monetary gifts and keep them under the annual exclusion, remember that other types of gifts factor into the lifetime exclusion. Don’t lose track of the lifetime gift tax exemption by ignoring gifts of real estate and other non-monetary assets. If you do, this can affect your estate plans after your pass away.

Is a donation to a charity tax deductible?

Not only will you not need to worry about gift tax exclusions when making charitable donations, but your donation may also be tax deductible.

Is it easy to file taxes on your own?

Managing and filing your taxes on your own isn’t always easy. If you’re going at it yourself, you’ll want to prepare. SmartAsset has you covered with a number of free online tax resources. Check out our tax return calculatortoday.

How many US dollars can you put in a caking kit?

Fantastic hit each and every time! This kit from CakingAtHome lets you add 50 US dollar bills. Who doesn't love to see money coming out of a cake?

How many pockets are in a cash dispenser?

This complete cash dispenser set includes the special box, cake topper, 1 plastic roll with 50 connected pockets, and printed instructions. You have all you need for a surprise that your best friend will never forget!

Is giving money a good gift?

Please read the full disclosure here. Giving money as a gift can be one of the best gifts that you can give today. A lot of times though people don’t feel like giving money as personal or creative or thoughtful enough, which is a complete joke because honestly, cash is king. More often than not, the receiver of the gift actually loves to get money.

Can you hide a roll of cash in canned goods?

This is such a clever idea! Giving money was so much fun this year. You can hide a roll of cash inside any canned goods - preferably what the recipient hates the most. Since it is wrapped like a normal Christmas present, no one will expect it to have anything inside but what is on the label!

Do you have to be super creative to give money?

Now, don’t think that you have to be super, super creative, and hone all your crafty skills just to give the best money gift ever.

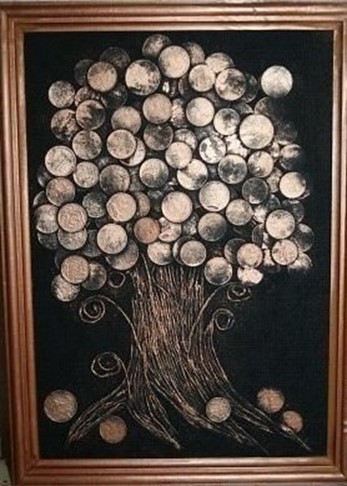

Does money grow on trees?

It is proven that money does grow on trees. This DIY tutorial will teach you exactly how to make your own money tree. This beautiful money tree topiary is ready for one very lucky gift recipient!

What does it mean when you gift money?

Any money you gift must carry “present interest,” which means that the recipient has immediate access to the funds. This is opposed to a monetary gift that carries “future interest,” which means that the recipient must wait until a certain date before the funds are available. You cannot bind the hands of your recipients by placing any restrictions on when your gift money can be used.

How much can you gift a year?

You may gift an individual up to $15,000 per year before you must report it. However, unless you exceed your lifetime gift limit of $11.58 million, you most likely will not have to pay taxes on it.

How much can you give to a person annually?

And this amount is above the tax-free $15,000 you can give each person annually. The IRS includes all yearly cash gift amounts that exceed $15,000 per person toward your lifetime limit of $11.58 million, and it’s these overages that have to be reported with your tax return even though these cash disbursements are also tax-exempt.

What is considered a gift from the IRS?

In fact, the IRS defines a gift as a transfer to someone of any type of real or personal property, which is not reimbursed or compensated in-kind . Real property is considered immovable, such as land, easements and buildings; personal property is considered portable, such as cars, personal belongings and money.

How much can you give to family for tax free?

Limits for Tax-Free Money Gifts to Family. During your lifetime, you can gift up to $11.58 million tax-free to those who are the fortunate recipients of your generosity, family or otherwise. Individuals can give up to $11.58 million, as of 2020, and married couples can give double that, or up to $23.16 million.

Can you gift money to your spouse?

The IRS allows some exceptions to the tax-free annual and lifetime limits on monetary gifts. Notable exceptions for which you can make unlimited tax-free gifts include: Your spouse, if a U.S. citizen. If your spouse is not a U.S. citizen, for tax year 2018 (to be filed in 2019) you may gift up to $ 152,000 as long as $137,000 ...

Can you gift money to family members?

Your gift of money to family members can surprise them on their birthdays or make their holidays brighter. In lean financial times, money can help your family members make ends meet. But are you required to report these gifts on your tax return, or are monetary gifts to family members tax-free?

How much can you gift a year?

The annual gift exclusion limit applies on a per-recipient basis. This gift tax limit isn’t a cap on the total sum of all your gifts for the year. You can make individual $15,000 gifts to as many people as you want. You just cannot gift any one recipient more than $15,000 within one year. If you’re married, you and your spouse can each gift up to $15,000 to any one recipient.

How much can you gift without paying tax?

Most taxpayers won’t ever pay gift tax because the IRS allows you to gift up to $11.58 million over your lifetime without having to pay gift tax. This is the lifetime gift tax exemption, and it’s roughly $180,000 higher than it was in 2019. So let’s say that in 2020 you gift $215,000 to your friend.

What Is the Gift Tax?

The IRS defines a gift as “any transfer to an individual, either directly or indirectly, where full consideration is not received in return.” In other words, if you write a big check, gift some investments or give a car to someone other than your spouse or dependent, you have made a gift. The IRS has a gift tax limit, both for the amount you can give each year and for what you can give over the course of your life. If you go over those limits, you will have to pay a tax on the amount of gifts that are over the limit. This tax is the gift tax.

What happens if you go over the gift limit?

If you go over those limits, you will have to pay a tax on the amount of gifts that are over the limit. This tax is the gift tax. In almost every case, the donor is responsible for paying gift tax, not the recipient.

What are the two numbers to keep in mind when thinking about gift tax?

There are two numbers to keep in mind as you think about gift tax: the annual gift tax exclusion and the lifetime gift tax exemption.

How much is the lifetime exclusion for a gift?

There is also a lifetime exclusion of $11.58 million. For help with the gift tax or any other personal finance issues you may have, consider working with a financial advisor.

How much can you give to someone in 2021?

For 2021, the annual gift tax exemption will stay at $15,000 per recipient. This means you can give up to $15,000 to as many people as you want during the coming year without any of it being subject to a gift tax. The gift tax is imposed by the IRS if you transfer money or property to another person without receiving at least equal value in return.

How much is taxed on gifts in 2020?

For 2020, IRS rules exclude $15,000 per year per person from the gift tax. Gifts made to pay tuition or medical bills are also excluded, but to be eligible for this exclusion the gifts must be paid directly to the school or health care provider.

How much can you give a year without paying taxes?

Cash Gifts Up to $15,000 a Year Don't Have to Be Reported. Cash gifts can be subject to tax rates that range from 18% to 40% depending on the size of the gift. The tax is to be paid by the person making the gift, but thanks to annual and lifetime exclusions, most people will never pay a gift tax. "Anyone can give up to $15,000 per year free ...

How much money can a husband and wife give to their child?

For instance, a husband and wife could each give $15,000 to their child, but they would need to report the $30,000 to the IRS on Form 709 to properly split the gift between them. "While it's not a taxable event, you have to file," Ryan says.

How much capital gains do you pay when you sell stock?

This amount is known as the basis. If you sell the stock for $10,000, you'll pay capital gains on $9,000, which is the sale price minus the basis.

Is cash a tax tracable thing?

Cash may seem like an untraceable way to give and receive money, but IRS regulations still apply. Whether you are giving a gift or paying a worker, make sure you understand these crucial tax rules.

Do you have to report cash gifts?

Cash gifts up to $15,000 per year don't have to be reported. Excess gifts require a tax form but not necessarily a tax payment. Noncash gifts that have appreciated in value may be subject to capital gains tax. Cash payments between individuals typically don't have to be reported. You must report payments of $2,200 or more made to any household ...

Who needs a 1099?

In that case, if your business is paying the person, a 1099-MISC form must be issued to anyone who's been paid more than $600 during the year. A copy of the form must also be provided to the IRS.