How can you tell if a candle is engulfing? It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day's candlestick. What are engulfing candles?

How to identify engulfing candlestick patterns?

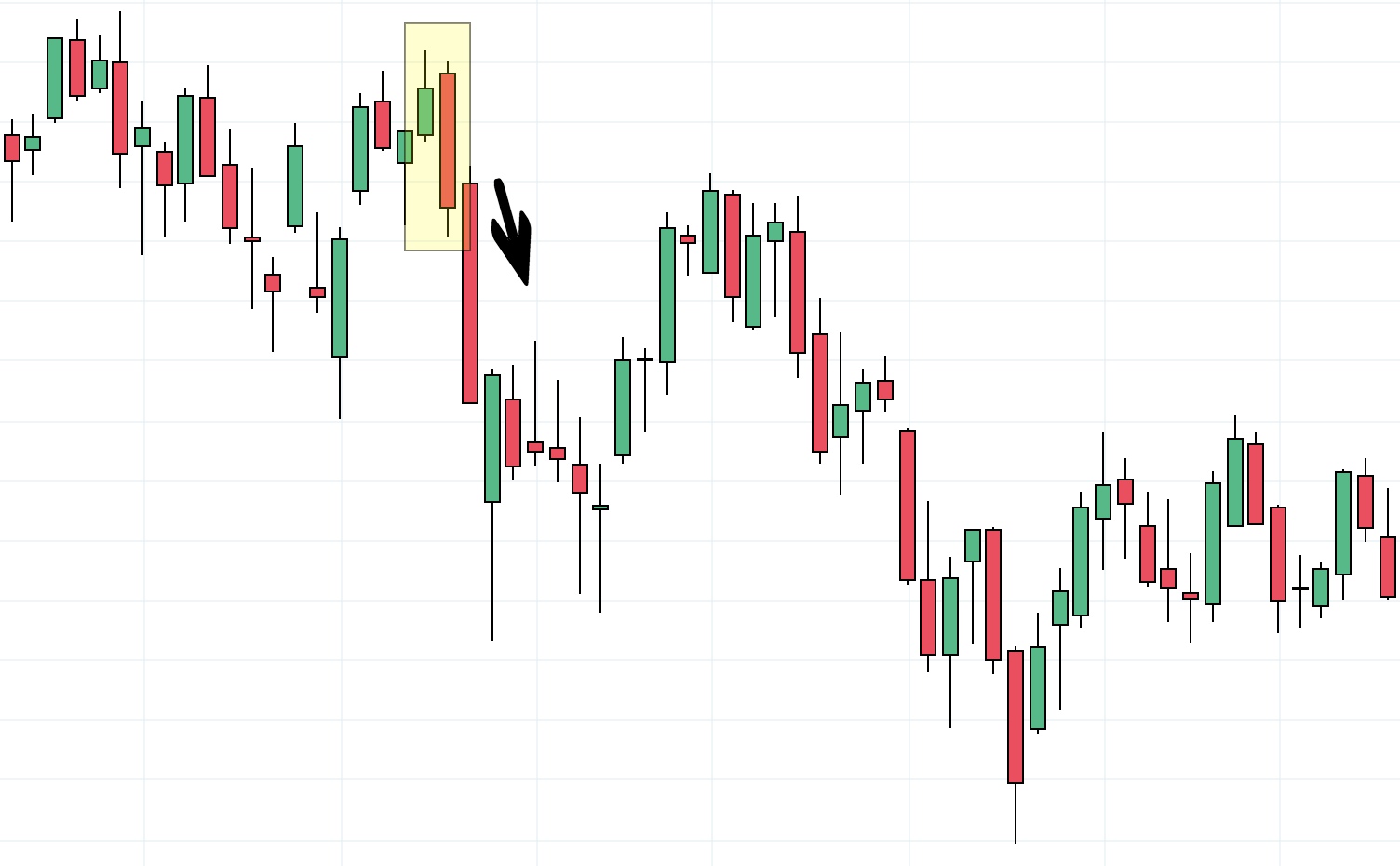

Engulfing candlestick patterns takes two candlesticks to be identified. A bullish engulfing pattern is characterized by a bullish candle whose body, the open and close engulfs the previous candle’s body. Conversely, a bearish engulfing pattern is characterized by a bearish candle whose body engulfs the previous candle’s body.

What is an engulfing pattern?

To get a valid engulfing pattern, the first candle has to fit inside the body of the next candle. The engulfing candle can either be bearish or bullish, depending on its location in the current trend. The opposite scenario is possible too. Since it is formed by two candles, it is categorized as a double candlestick pattern .

Is the engulfing candle bullish or bearish?

The engulfing candle can either be bearish or bullish, depending on its location in the current trend. The opposite scenario is possible too. Since it is formed by two candles, it is categorized as a double candlestick pattern .

How many candles are there in an engulfing bar?

It comprises two candles. the body of the second one must engulf the body of the first one. There are two type of engulfing bars The bullish engulfing bar that cosists of two candles. the bosy of the second candle is greater in size than the previous candle.

How do you know if bearish engulfing?

What Does the Bearish Engulfing Pattern Tell You? A bearish engulfing pattern is seen at the end of some upward price moves. It is marked by the first candle of upward momentum being overtaken, or engulfed, by a larger second candle indicating a shift toward lower prices.

How do you mark engulfing?

For an engulfing candle strategy signal during an uptrend, wait until an up candle engulfs a down candle. Enter a long trade as soon as the up candle moves above the opening price (the top of the real body) of the down candle in real-time.

How can you tell bullish and bearish engulfing?

The bullish engulfing candle signals reversal of a downtrend and indicates a rise in buying pressure when it appears at the bottom of a downtrend. The bearish engulfing signals reversal of the uptrend and indicates a fall in prices by the sellers who exert the selling pressure when it appears at the top of an uptrend.

How accurate are engulfing candles?

The bullish engulfing candlestick, at first glance, appears to perform quite well. It has a reversal rate of 63%. That means price closes above the top of the candlestick pattern 63% of the time.

Which time frame is best for engulfing candle?

You might not want to trade the Weekly timeframe because it requires a large stop loss. The solution? Go down to a lower timeframe and time your entry there with a bullish engulfing candle. Go down to the Daily or 8-hour timeframe and look for bullish chart patterns (like Bull Flag, Ascending Triangle, etc.)

What happens after an engulfing candle?

Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle 'engulfing' the entire body of the candle before it. The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend.

Which candlestick pattern is most reliable?

Which candlestick pattern is most reliable? Many patterns are preferred and deemed the most reliable by different traders. Some of the most popular are: bullish/bearish engulfing lines; bullish/bearish long-legged doji; and bullish/bearish abandoned baby top and bottom.

How many types of engulfing candlesticks are there?

two typesThere are two types of Engulfing candles: Bullish Engulfing and Bearish Engulfing. The Bullish Engulfing pattern is a two candlestick reversal pattern that signals a strong up move may occur. It happens when a bearish candle is immediately followed by a larger bullish candle.

Does engulfing candle include Wicks?

A bullish engulfing candlestick pattern occurs at the end of a downtrend. It consists of two candles, with the first candle having a relatively small body and short shadows, also known as wicks.

Is bullish engulfing reliable?

When is the Bullish Engulfing Pattern a Reliable Buy Signal? It's not enough to trade on a single candlestick just because it happens to be an engulfing pattern. Back testing on various markets shows this simple kind of strategy doesn't work.

Can a bullish engulfing candle be red?

Engulfing pattern examples GBP/USD is in a long downtrend, culminating in a short red candle that opens at 1.3560 and closes at 1.3550. The next session then opens at 1.3548, but shoots up to 1.3580 by the close. This is a bullish engulfing, because: The first candlestick is red, but doesn't see much movement.

How do you find the bullish engulfing pattern of a stock?

The Bullish Engulfing pattern is a two day bullish pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or "engulfs" the previous day's candlestick. This trend suggests the bulls have taken control of a security's price movement from the bears.

What is engulfing candle pattern?

What is an engulfing candlestick pattern? Engulfing candlestick patterns are comprised of two bars on a price chart. They are used to indicate a market reversal. The second candlestick will be much larger than the first, so that it completely covers or 'engulfs' the length of the previous bar.

What is an inside bar pattern?

An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar's high, and the low is higher than the previous bar's low.

What is a doji candlestick?

A Doji is a candlestick pattern that looks like a cross as the opening price and the closing prices are equal or almost the same. When looked at in isolation, a Doji indicates that neither the buyers nor sellers are gaining – it's a sign of indecision.

What is inside bar candle?

What is Inside Bar Pattern? As the name suggests, an inside bar chart pattern engulfs the inside of a large candle, some call it a mother bar. It's a pattern that forms after a large move in the market and represents a period of consolidation.

What is a bullish engulfing candle?

A bullish engulfing pattern indicates the price action may reverse its downward trend and start a new uptrend. “Engulfing” refers to the fact that the body of the candle goes both higher and lower than the previous candle. This is what an engulfing candle looks like. The price dropped at first, then buyers stepped in and drove the price up.

What is a bearish engulfing candle?

A bearish engulfing candle suggests the price action will reverse into a downtrend. The upward trend tops out at a candle that shows the trend tried to continue upward, but sellers took over and the price closed lower.

A bullish engulfing candle trading strategy

So how to get into (and out of) a trade when you see a bullish engulfing candle? Let’s break it down.

A bearish engulfing candle trading strategy

When an upward trend starts to reverse, look for the bearish engulfing candle, make sure you have a strategy in place. Do not improvise.

Which trading platform is best for beginners?

While many trading platforms are good, some are better for beginners. Go here to find some good suggestions for those just starting out.

8 Pro tips for successfully trading the engulfing candle pattern

Success with candlesticks is as much an art as a science. You use them to gauge the psychology of traders, and that interpretation can be subjective. Make up stories with them: “This candle shows that buyers were eager at first but something spooked them and they started selling.”

What are the risks of the engulfing candle pattern?

Engulfing candles are a one-day event. Though many use them to get into the trade the next day, the market can be finicky. Always set stop-loss orders.

How to identify the Engulfing candlestick pattern?

This entails that the low and high of the second candle entirely covers the first. But the major emphasis is on the body of the candle.

What is the first candle in a bullish engulfing pattern?

The first candle is contained with the 2nd candle. A bullish engulfing pattern has a red candle engulfed within a green candle. A bearish engulfing pattern has a green candle engulfed within a red candle.

What is the Engulfing pattern?

Traders make use of the engulfing pattern to enter the market while hoping for a possible trend reversal. Candles in this pattern signal a reversal in the current trend. It involves two candlesticks with one candle entirely “engulfing” the body of the other. To get a valid engulfing pattern, the first candle has to fit inside the body of the next candle.

What is bullish candle?

The bullish candle gives the best signal when it appears below a downtrend and shows a rise in buying pressure. The pattern mostly causes a reversal of a current trend. It’s due to more buyers entering the market and driving prices further up. The pattern involves two candles, with the second green candle completely engulfing the previous red candle with no regard to the length of the tail shadows.

Why do you use the second candle in a bullish engulfing?

Even though the wicks of engulfing candles are not as necessary as the bodies, the second candle in a bullish engulfing can give a perfect indication of the location to place a stop-loss for a long position. This is because it shows the lowest price a trader is willing to accept in exchange for an asset at that point.

What does a bullish candlestick mean?

The bullish candlestick tells traders that buyers are in total control of the market, following a previous bearish run. It is often seen as a signal to buy and take advantage of the market reversal. The bullish pattern is also a sign for traders having a short position to think about closing that trade.

Why is candlestick trading important?

Candlesticks are important in analyzing the price action in any market. They can provide accurate signals about the potential direction of a price chart.

What does it mean when a candlestick pattern is engulfing?

To conclude, the engulfing candlestick patterns are two candlestick patterns and when formed near the tops or bottoms can indicate a short term change in sentiment. Depending on the price action, price could either start a new trend in the opposite direction or merely head towards making a correction to the previous trend.

What are engulfing candlestick patterns?

A bullish engulfing pattern is characterized by a bullish candle whose body, the open and close engulfs the previous candle’s body. Conversely, a bearish engulfing pattern is characterized by a bearish candle whose body engulfs the previous candle’s body.

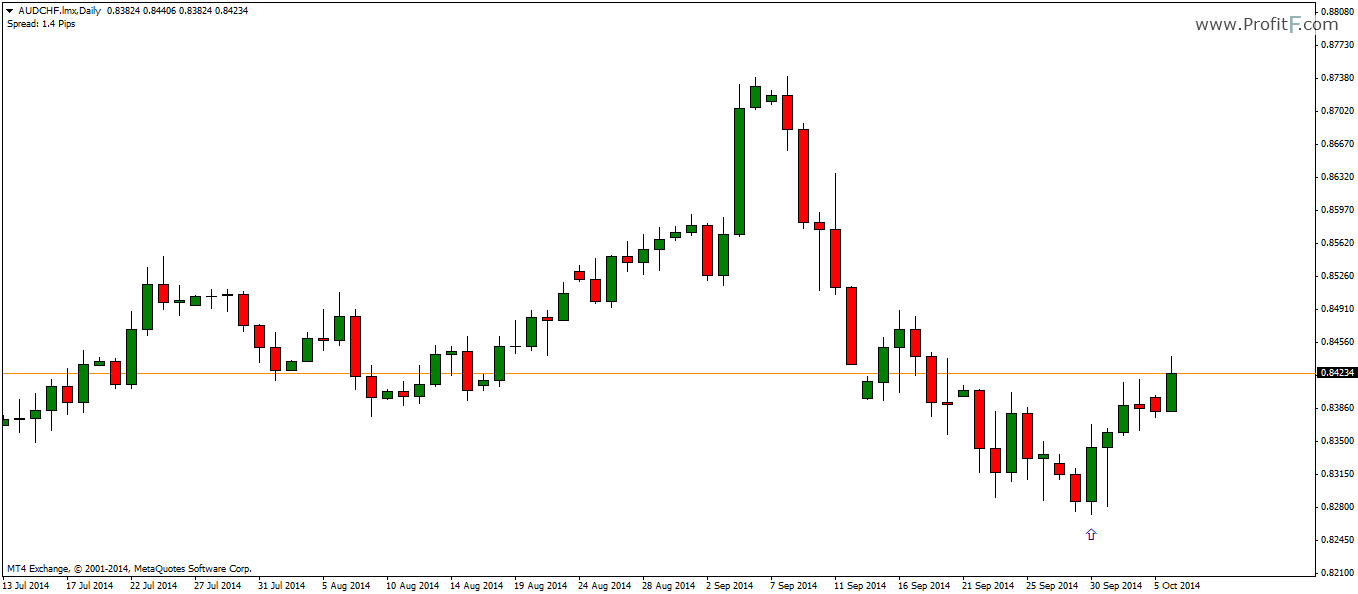

How to trade engulfing patterns?

Another great way to trade the engulfing patterns is to scroll down to a lower time frame to fine tune the entry. For example, if you spot a bullish engulfing pattern on a daily chart, then scale into a H4 or H1 charts to pick out entries with lower risk and high probability.

When to trade engulfing candlesticks?

Engulfing candlestick patterns can be traded as a reversal candlestick pattern when found at the tops or bottom of a short term trend and validated by support or resistance levels. When an engulfing candle is formed within a trend, they are to be traded as a continuation pattern.

Why do traders place stops above the high of the candle?

Because it is well known that traders would attempt to place their stops just above the high of the engulfing candle, price can very easily push higher to stop out the traders before moving in the original direction.

Is a candlestick a reversal pattern?

Because these candlestick patterns are two-candlestick patterns, they are more valid and are often looked upon as reversal patterns. As with any candlestick pattern, the bullish or bearish engulfing pattern takes more priority depending on the time frame that they are formed on. Therefore, when looking to trade with the engulfing candlestick ...

What is an engulfing pattern?

An engulfing pattern is a two candlestick pattern that occurs when the most recent candlestick closes higher (or lower if bearish) than the previous candlestick’s close.

How to identify an engulfing pattern

To identify an engulfing pattern you have to make sure that several things match up.

What is a bullish engulfing pattern?

A bullish engulfing pattern is when the pattern forms towards the end of a downward trend.

What is a bearish engulfing pattern?

A bearish engulfing pattern is when the pattern forms towards the end of an uptrend.

Best Places To Trade Engulfing Patterns

For me personally, I’ve had the best success with engulfing patterns at swing highs and swing lows.

Conclusion: Engulfing Pattern, should you trade it?

This guide has gone over a large portion of what engulfing patterns are about. I think that finding these engulfing patterns around swing areas could help you trade the markets and gain confidence in trading the markets.

What is the pattern of a candle?

The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up ...

What happens if you trade a second candle?

The engulfing or second candle may also be huge. This can leave a trader with a very large stop loss if they opt to trade the pattern. The potential reward from the trade may not justify the risk.

What is a Bearish Engulfing Pattern?

A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

Why is engulfing important?

If the price action is choppy, even if the price is rising overall, the significance of the engulfing pattern is diminished since it is a fairly common signal.

Can candlesticks be used as a price target?

Establishing the potential reward can also be difficult with engulfing patterns, as candlesticks don't provide a price target. Instead, traders will need to use other methods, such as indicators or trend analysis, for selecting a price target or determining when to get out of a profitable trade.

Do two small bars engulf candlesticks?

Two very small bars may create an engulfing pattern, but it is far less significant than if both candles are large. The real body—the difference between the open and close price —of the candlesticks is what matters. The real body of the down candle must engulf the up candle. The pattern has far less significance in choppy markets.

What is an engulfing pattern?

the engulfing bar: an engulfing pattern signals a reversal, and can be bullish or bearish. It comprises two candles. the body of the second one must engulf the body of the first one. There are two type of engulfing bars The bullish engulfing bar that cosists of two candles. the bosy of the second candle is greater in size than the previous candle. This...

What is bullish candlestick?

Bullish Hammer Candlestick These candles are easy to spot and they generally have taller wicks than their bodies, resembling a hammer's handle and head. They tend to close without (or with very little) upper wicks. Here's what a bullish hammer candlestick is telling us: Price opened near the highs of the candle and although sellers initially succeeded at...