French people had problems relating to taxes and unsystematic governance. The French society was structured with kings and nobles, known as the Ancien Regime. Rich people like nobles avoided taxes, which led to the financial crisis, thus causes the french revolution.

Who did not pay taxes in the French Revolution?

The First Estate (the clergy) were about 100,000 in number but owned roughly ten percent of all the land. They did not pay tax, but did contribute a "voluntary gift" to the government.

Why did the French government increased the taxes?

Why did the French Revolution increase the taxes? The reason behind French government to increase the taxes was to acquire the fund from the citizens of the country. When Louis took the charge of the state he found that the government has not sufficient fund to meet the expenses of army, court, government, machinery and etc.

Did the estates exist after the French Revolution?

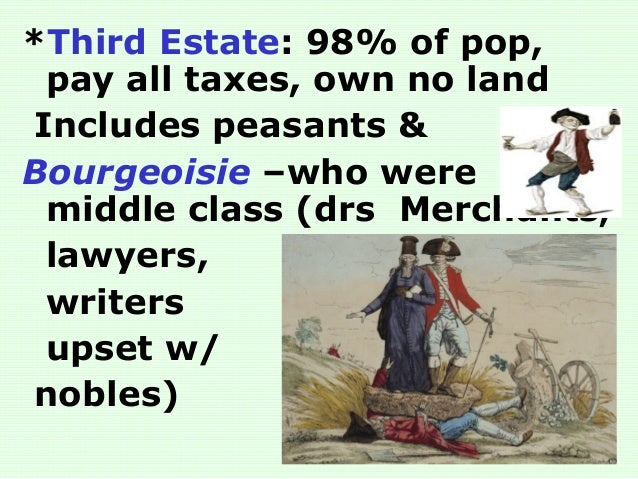

The estates of the realm, or three estates, were the broad orders of social hierarchy used in Christendom from the Middle Ages to early modern Europe. Different systems for dividing society members into estates developed and evolved over time. The best known system is the French Ancien Régime, a three-estate system used until the French Revolution. The monarchy included the king and the queen, while the system was made up of clergy, nobles, peasants and bourgeoisie. In some regions, notably ...

What taxes did French peasants pay?

“Pays d’imposition” were recently conquered lands that had their own local historical institutions, although taxation was overseen by the royal administrator. In the decades leading to the French Revolution, peasants paid a land tax to the state (the taille) and a 5% property tax (the vingtième; see below).

Did taxes start the French Revolution?

With all the exemptions and reductions won by the privileged classes, however, the burden of the new tax once again fell on the poorest. Historians consider the unjust taxation system continued under Louis XVI to be one of the causes of the French Revolution.

Why did the French Revolution increase the taxes?

Why did the French government increase the taxes? The French treasury was nearly empty when Louis XVI ascended the throne therefore in order to meet expenses like maintaining an army, court, running of government machinery etc. the he was forced to increase taxes.

What were the main causes of French Revolution?

What are the main cause of French Revolution? Despotic rule of Louis XVI,division of French society,rising prices,inspiration of the philosophers,role of middle class.

Why did King Louis XVI raise taxes?

Louis XVI concluded to increase taxes because, the economy level in France was deteriorating. The France had to pay loans to those who helped France by giving money. The demand for bread has increased.

How did taxes lead to the French Revolution quizlet?

The French Revolution was caused by heavy taxation against the Third Estate. The First and Second Estates had not paid taxes. The Third Estate was also being mistreated. This included starvation, murder, and torture of the Third Estate.

Why did Louis XVI increase taxes in class 9?

Solution: Maintenance of and extravagant Court: France under various kings had an extravagant court at the Palace of Versailles. Wars and Economic Crisis: Long drawn wars already put a lot of pressure on the royal coffers. Which was followed by helping the thirteen American colonies to gain independence.

What was the process to increase the tax in France at the time of French Revolution?

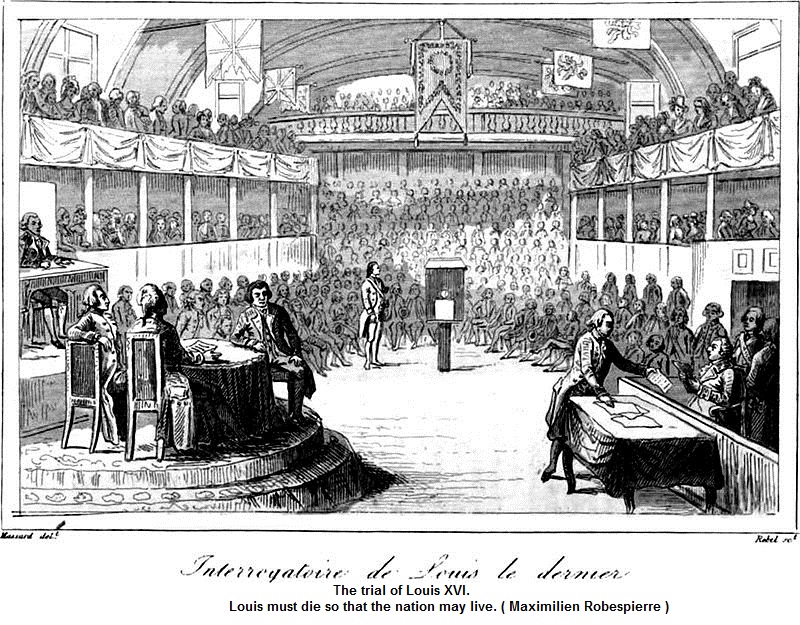

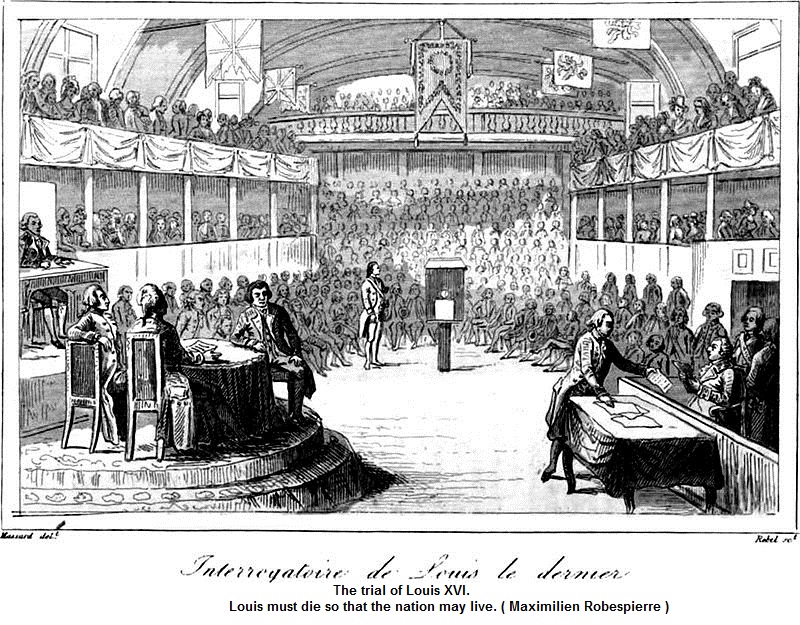

In order to pass proposals for increasing taxes, the French monarch Louis XVI called together an assembly of the Estates General on 5 May, 1789. Each estate was allowed one vote in this assembly. The third estate protested against the unfairness of the proposal.

How did Napoleon change taxation?

The French taxation system had collapsed in the 1780s, one of the key factors leading to the Revolution. Napoleon instituted a modern, efficient tax system that guaranteed a steady flow of revenues and made long-term financing possible.

Who argued that the French monarchy stood in this particular instance for administrative rationalization and progress?

Some observers, partisans of enlightened despotism —such as Voltaire, who defended it indirectly in his play of 1773 titled Les Lois de Minos ( The Laws of Minos )—argued that the French monarchy stood in this particular instance for administrative rationalization and progress.

What were the taxes that were collected by the state?

There were direct taxes, some of which were collected directly by the state: the taille (a personal tax), the capitation, and the vingtième (a form of income tax from which the nobles and officials were usually exempt). There were also indirect taxes that everyone paid: the salt tax, or gabelle, which represented nearly one-tenth of royal revenue;

Who defended despotism in the French monarchy?

Some observers, partisans of enlightened despotism—such as Voltaire, who defended it indirectly in his play of 1773 titled Les Lois de Minos ( The Laws of Minos )—argued that the French monarchy stood in this particular instance for administrative rationalization and progress. But the current of opinion was already moving against the crown. Many writers saw in Terray a tool of royal despotism, plain and simple, and his ministerial colleague René-Nicolas-Charles-Augustin de Maupeou (1714–92) was even more detested for his destruction of the parlements, which had become the bastion of conservative opposition to royal reform.

What was the main goal of Jean-Baptiste de Machault d'Arnouville?

Tax reform. In 1749–51 Jean-Baptiste de Machault d’Arnouville, then comptroller general of finances, tried to deal with the debts resulting from the just-concluded War of the Austrian Succession by proposing a partial reform of the tax system, his particular concern being to restrict the financial immunities of the church.

What were the effects of the French Revolution?

French Revolution had some significant effects on the world. 10 major effects of the French Revolution are: 10. Abolition of Feudalism.

How did the French Revolution affect the land reform movement?

The reform ended the bias feudal tenures, freed people from serfdom, cancelled payments which were not based on real property and abolished feudal courts.

What were the two major events that took place as a result of liberalism?

Two major events took place as a result of liberalism which were: abolishment of feudalism (August 4, 1789) and Declaration of the Rights of Man and Citizen ( August 1789) after the fall of the Bastille, absolute monarchy, and state religion.

How did the abolishment of feudalism affect property rights?

The abolishment of Feudalism did not directly affect the ownership of land or rents , but it was crucial to the property rights. Many other rights, like hunting rights, labour services, and property rights, were also maintained.

What were the major movements that came up following the French Revolution?

The Haitian Revolution, First Italian War of Independence, Irish Rebellion of 1798, Sicilian Revolution of 1848, Italian Revolution in 1848, and the independence movements of Portuguese colonies in America are the major revolutionary movements which came up following the French Revolution. They ushered in which was known to be the Age of Revolution.

What was the role of the censiers and serfs in the French Revolution?

It was able to reinforce individual and private ownership.

Why was France a rich country in the 18th century?

France was a rich and populous country in the 18th Century. French people had problems relating to taxes and unsystematic governance. The French society was structured with kings and nobles, known as the Ancien Regime. Rich people like nobles avoided taxes, which led to the financial crisis, thus causes the french revolution.

Excessive, Inefficient, Unfair

Louis XIV and Colbert

- France’s issues with taxation date back to the reign of Louis XIV (1643-1715). National expenditure increased markedly during the reign of the ‘Sun King’, driven by military spending, participation in several wars, the expansion of the state bureaucracy and extravagant spending on Versailles and the royal court. Funding for these policies was left to Jean-Baptise Colbert, Louis …

The Ferme Générale

- In 1680, Colbert created the Ferme Générale(‘General Farm’), an attempt to streamline tax collection by reducing the number of ‘tax farmers’. When Colbert died in 1683, the government was receiving almost 93.5 million livres in net revenue – more than triple the 32 million livresit had received when Colbert became controller-general in 1661. After Colbert’s death, control of the na…

Types of Tax

- There were two categories of tax in pre-revolutionary France: direct taxes and indirect taxes. Direct taxes were levied on individuals and collected by royal officials. Indirect taxes took the form of duties and excises on goods and were collected by ‘tax farmers’. By the 1780s, indirect taxes made up almost half the government’s taxation revenue w...

The Taille

- The taille was the oldest of France’s state taxes. It was also the royal government‘s most lucrative impost, bringing in about 20 million livresa year. The taillewas first levied in the 15th century to meet the costs of the Hundred Years’ War. It was intended as a payment for military service, so the Second Estate (who fought) and the First Estate (who could not fight) were exempted from p…

Capitation

- The capitationwas a poll tax or ‘head tax’, levied on every adult citizen. It was first introduced in 1695 as a wartime measure. At first, the capitation was levied progressively, each individual paying an amount determined by their profession. There were 22 different payments levels, ranging from one livre to 2,000 livres. The clergy was exempted from the capitation. Members o…

Vingtième

- French citizens in the 18th century were also subject to income taxes. Like the capitation, these taxes were raised to offset the costs of France’s imperial wars. The first of these income taxes was the dixième, levied by Louis XIV in 1710 at the rate of one-tenth of annual income. It was replaced by the vingtième (one-twentieth of annual income) in 1749. The vingtième was renewe…

Gabelle

- The gabelle was unevenly applied, however, and varied wildly from place to place. The amount of gabelle payable in and around Paris could be as much as ten sous (half a livre) per pound, while provinces in France’s south and east paid much smaller amounts or were entirely exempted. By the 1780s, the gabelle raised more than 55 million livres per annum, or more than 10 percent of t…

Duties and Excises

- The importing or trading of food, drink and consumer goods was also taxed indirectly. These imposts took the form of excises, customs duties and tariffs. Wine, the most popular alcoholic drink in 18th century France, was subject to a heavy excise called the aide. A similar excise called tabacapplied to the sale of tobacco. The traites were a series of customs duties, payable by mer…

‘Tax Farmers’

- Most indirect taxes were gathered by 40 fermiers-généraux or ‘tax-farmers’: wealthy individuals who acquired the right to collect taxes on behalf of the government. This was such a profitable enterprise that each fermier-généraux paid the royal government up to 80 million livres for a six-year lease. In good economic times, when production and trading were up, some tax-farmers ma…