Method 1.

- Your Loan Amount value is the total amount you owe.

- Your Annual Interest Rate value is the percentage of interest that accrues each year.

- Your Life Loan value is the amount of time you have in years to pay off the loan.

- Your Number of Payments per Year value is how many times you make a payment in one year.

- Your Total Number of Payments value is the Life Loan value multiplied by the Payments Per Year value.

- Your Payment per Period value is the amount you pay per payment.

- Your Sum of Payments value covers the total cost of the loan.

How to calculate your mortgage payment with Excel?

Use the "Fill" function to automatically enter the rest of your Payment and Date values.

- Select the first entry in your Payment (Number) column.

- Drag your cursor down until you've highlighted to the number that applies to the number of payments you'll make (for example, 360). ...

- Click Fill in the top right corner of the Excel page.

- Select Series.

How do you calculate your mortgage loan payoff?

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

How do you calculate a loan payment in Excel?

- The outstanding balance due will be entered in cell B1.

- The annual interest rate, divided by the number of accrual periods in a year, will be entered in cell B2. ...

- The number of periods for your loan will be entered in cell B3. ...

What is the formula for calculating a mortgage payment?

- M is your monthly payment.

- P is your principal.

- r is your monthly interest rate, calculated by dividing your annual interest rate by 12.

- n is your number of payments (the number of months you will be paying the loan)

How do I calculate a loan payoff in Excel?

0:351:52Calculating Loan Payoff in Excel | Knowledgecity.com - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo negative monthly payment amount that's L 9. And now the next piece of information we need to knowMoreSo negative monthly payment amount that's L 9. And now the next piece of information we need to know is the present value or the loan amount. And that's going to be L 4.

How do I calculate my mortgage payoff amount?

You can calculate a mortgage payoff amount using a formula Work out the daily interest rate by multiplying the loan balance by the interest rate, then multiplying that by 365. This figure, multiplied by the days until payoff, plus the loan balance, gives you your mortgage payoff amount.

Does Excel have a mortgage function?

PMT, one of the financial functions, calculates the payment for a loan based on constant payments and a constant interest rate. Use the Excel Formula Coach to figure out a monthly loan payment.

Is it better to payoff mortgage early?

Save money on interest. Each month that you make a mortgage payment, some money is going toward interest — so the fewer payments you have, the less you will pay in interest. Paying off your mortgage early could save you tens of thousands of dollars.

Is principal balance the same as payoff?

The current principal balance is the amount still owed on the original amount financed without any interest or finance charges that are due. A payoff quote is the total amount owed to pay off the loan including any and all interest and/or finance charges.

How do you calculate mortgage principal in Excel?

1:155:10How to find Interest & Principal payments on a Loan in ExcelYouTubeStart of suggested clipEnd of suggested clipAll we're gonna do is equal PP MT open parentheses the next we're gonna run want the rate. And theMoreAll we're gonna do is equal PP MT open parentheses the next we're gonna run want the rate. And the rate is going to be the monthly. Rate the period is going to be the month that we are currently.

What is the PMT formula in Excel?

What is the PMT function in Excel? The Excel PMT function is a financial function that calculates the payment for a loan based on a constant interest rate, the number of periods and the loan amount. "PMT" stands for "payment", hence the function's name.

How do I make a mortgage spreadsheet?

3:597:23How to make a Fixed Rate Loan/Mortgage Calculator in ExcelYouTubeStart of suggested clipEnd of suggested clipWe want to do equals. PMT open parenthesis the rate and what you want for the rate is the monthly.MoreWe want to do equals. PMT open parenthesis the rate and what you want for the rate is the monthly. Rate. So right there comma. The number of periods. And for the number of periods.

What is a mortgage payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Will a bank negotiate a mortgage payoff?

You can always try and negotiate a lower payoff amount with the bank but it is very unlikely they will reduce the amount owed. By law the bank has to accept a full payoff (called Redemption) on or before the period of redemption expires as set...

Is it better to pay lump sum off mortgage or extra monthly?

Making a lump-sum payment always saves you money on interest. And depending on how you handle it, the payment will either shorten the time it takes to pay off your mortgage or reduce your monthly payment amount.

At what age should you have your mortgage paid off?

You should aim to have everything paid off, from student loans to credit card debt, by age 45, O'Leary says. “The reason I say 45 is the turning point, or in your 40s, is because think about a career: Most careers start in early 20s and end in the mid-60s,” O'Leary says.

How to Calculate Monthly Payments for a Loan in Excel?

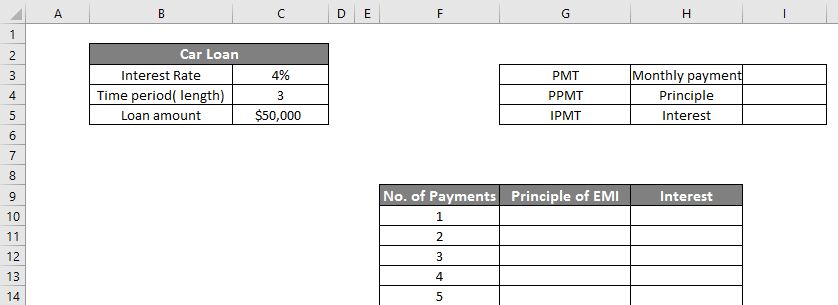

We can calculate the monthly payments for the loan/mortgage using built-in functions like PMT and other functions like IPMT and PPMT.

Why is my mortgage payment negative in Excel?

The Excel shows the monthly payment for the mortgage as a negative figure. This is because this is the money being spent. However, if you want, you can make it positive also by adding – sign before the loan amount.

How many monthly payments are there in a cell I3?

So we have two tables; the smaller one will show the monthly payment PMT (Cell I3). The bigger table shows the total of 36 payments for the loan amount that represents both the principal and interest portions.

What are the three elements of a monthly payment?

These three key elements are –. Principle (Amount of loan) Interest rate.

What does 0 mean in a check?

TYPE – “0” or “1” is used to ascertain whether the payment is to be made at the beginning or end of the month.

What happens to the interest rate as the number of payments increases?

As the number of payment increases, the portion of the principle is increasing, and that of interest is decreasing.

How many elements are needed to calculate PMT?

The PMT function requires 3 elements to calculate the monthly payments:

How Much Extra Should You Pay to Pay off your Mortgage Early?

Blake had taken a home loan of amount 250,000 on Jan 10, 2018. He has made already 5 payments. His original loan term was 20 years. Annual Percentage Rate is 6%.

What is the APR of a home loan?

Annual Interest Rate (APR): Annual Interest Rate you will pay for your loan. Say, your home loan APR is 6% , then the interest rate for a month will be 6%/12 = 0.5%. Extra Payment: Extra payment you want to pay every month. After paying your monthly amount, whatever you pay is considered as extra payment.

How long can you carry a loan?

Carrying a loan for 20-30 years, it is about one-fourth or one-third of your total lifespan. So, when you are in a situation to prepay your loan, get rid of the loan in the shortest possible time. In my workbook, you will find a worksheet (named Prepayment Checklist) where you can check out the factors.

Is mortgage interest tax deductible?

This is referred to as Interest Savings. Tax Deduction: Mortgage interest is tax deductible.

How to figure out how much you have to pay on a mortgage?

Calculate the monthly payment. To figure out how much you must pay on the mortgage each month, use the following formula: "= -PMT (Interest Rate/Payments per Year ,Total Number of Payments,Loan Amount,0)".

How to calculate total cost of loan?

Calculate the total cost of the loan. To do this, simply multiply your "payment per period" value by your "total number of payments" value.

What is payment number?

Payment (number) - The payment number out of your total number of payments (e.g., "1", "6", etc.).

How to calculate payment per period?

The formula for calculating your Payment per Period value relies on the following information in the following format: "Payment per Period<Total Loan+ (Total Loan* (Annual Interest Rate/Number of Payments per Year) ),Payment per Period,Total Loan+ (Total Loan* (Annual Interest Rate/Number of Payments per Year)))".

How to calculate interest value?

The formula for calculating your Interest value relies on the following information in the following format: "Total Loan*Annual Interest Rate/Number of Payments per Year".

Why is the interest rate divided by the number of payments?

Also, the reason the interest rate is divided by the number of payments is because the interest rate is for the year, not month.

What is loan amount value?

Your Loan Amount value is the total amount you owe.

1. The Formula for Monthly Mortgage Payment in Excel

Consider that, we want to start a business. For that, we need to take a loan. Now we would like to calculate the monthly mortgage payment. For example, we received a $150,000 term loan in cell C7 to start the business.

2. Excel Mortgage Formula to Fixed Periodic Payment

Likewise, the previous methods dataset, loan amount $150,000 is in cell C7, rate of interest is in cell C8 which is 6%, the 2-year loan duration in cell C9, the number of payments per year in cell C10, and the total number of payments month is in cell C11. Now we want to calculate the fixed periodic payment in cell C12.

3. Find Out Excel Outstanding Loan Balance

To find out the outstanding loan balance we are using a similar dataset as used before with some modifications. Like, the loan amount is decreased here and the duration of the loan is increased. Now, we need to calculate the outstanding loan amount with just one intermediate period. The procedure is given below.

4. Mortgage Formula to Calculate the Monthly Payments for a Credit Card Debt

To calculate the monthly payments for a credit card debt, we will be using the PMT function again. For calculating this, we need the due balance and the annual interest rate which is sequentially in cells C7 and C8. Let’s have a look at the approaches to calculating the monthly credit card debt.

5. Excel Mortgage Formula for Principal Amount Repayment in 24th Month

The principal to be repaid in the 24th month can be computed, by deducting the outstanding balance after two years from the outstanding balance after 23 months. We will use the dataset as similar as example 3 with the 2nd intermediate period of time. Now, let’s take a look at the strategies below.

How often do mortgages compound?

US mortgages compound every month, Canadian mortgages, compound twice a year and UK mortgages compound once per year.

Can you experiment with different payment frequencies, amortization periods and mortgage rates?

Now – that wasn’t so difficult. You can now experiment with different payment frequencies, amortization periods and mortgage rates. Download the complete spreadsheet from the link at the bottom of this post.

What is mortgage payoff?

Mortgage payoff is the remaining amount you need to pay on your mortgage, including interest. To calculate your mortgage payoff, you’ll need to know the total amount you borrowed, your annual interest rate, the total number of payments for the whole duration of the loan, and the total number of payments remaining.

How to calculate mid month mortgage?

To calculate mid month, multiply the monthly payment for the insurance premiums, interest, taxes, homeowner insurance, and anything else that is lumped into the monthly mortgage payments by the number of days until the close divided by the number of days in the month. Thanks!

How to get payoff amount from a bank?

Contact your lender by phone or online; lenders with online account management likely have a page that allows you to make the request. You will likely receive your payoff amount after a week.

How to calculate annual interest rate?

The annual interest rate (for example, 3%, or 0.03). To do the calculations yourself, you will need to divide this number by twelve (0.03 / 12 = 0.0025) , because mortgage interest compounds monthly.

How to make a formula appear more manageable?

Subtract from the inside. Once you accomplish this step, the formula will appear much more manageable and will be that much closer to completion.

How to make final payment on a mortgage?

If you want to make the final payment, you will need to complete some version of payment form (online or by mail) with the precise amount due and the time frame in which this amount is valid as a final payoff.

Do you have to get a mortgage quote before selling a house?

You must get a quote for the mortgage payoff before you sell a property. The money you make on the sale will first go to covering the payoff, then towards all of the other associated fees and closing costs that the seller is responsible for. After these costs, you will then receive anything leftover.

How long does it take to pay off a 500.00 loan?

By paying extra $500.00 per month, the loan will be paid off in 15 years and 8 months. It is 9 years and 4 months earlier. This results in savings of $108,886.04 in interest.

Where to find unpaid principal balance?

The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement.

What is extra payment?

Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually. Extra payments can possibly lower overall interest costs dramatically.

What is financial opportunity cost?

Financial opportunity costs exist for every dollar spent for a specific purpose. The home mortgage is a type of loan with a relatively low interest rate, and many see mortgage prepayments as the equivalent of low-risk, low-reward investment.

What is the difference between interest and principal on a mortgage?

Principal and Interest of a Mortgage. A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender's charge to borrow the money. This interest charge is typically a percentage of the outstanding principal.

Does each payment cover the interest first?

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

Do you pay a prepayment penalty on a mortgage?

Some lenders may charge a prepayment penalty if the borrower pays the loan off early. From a lender's perspective, mortgages are profitable investments that bring years of income, and the last thing they want to see is their money-making machines compromised.