How to Calculate Cash Flow From Investing Activities

- Identify Cash Outflows. Locate a company’s cash flow statement in its Form 10-Q quarterly report or in its Form 10-K annual report.

- Calculate Total Inflows. Add the outflows to determine the total cash outflows in the section. ...

- Determine Overall Cash Position. ...

- Other Cash Flow Considerations. ...

- Cash inflow from sale of Land = Decrease in Land (BS) + Gain from Sale of Land = $80,000 – $70,000 + $20,000 = $30,000.

- Cash outflow from purchase of property plant and equipment.

What is the formula for cash flow from financing?

- Money from the sale of products and services

- Any cash received

- Cash dividends

- Cash interest accrued

What is cash flow formula and how to calculate it?

What is the Present Value Formula?

- PV = Present Value

- CF = Future Cash Flow

- r = Discount Rate

- t = Number of Years

What is net cash from investing activities?

Investing activities that were cash flow negative are highlighted in red and include: 2

- Purchases of marketable securities for $21.9 billion

- Payments acquiring property, plant, and equipment for $7.7 billion

- Payments for business acquisitions and non-marketable securities

What does cash flow from financing activities include?

Some examples of cash flows from financing activities are listed below:

- Obtaining cash from common stockholders by issuing them the entity’s common stock,

- Obtaining cash from preferred stockholders by issuing them the preferred stock,

- Sale of treasury stock, if available,

- Issuance of bonds long term bonds payable,

- Payment of cash dividend to common stockholders,

- Payment of cash dividend to preferred stockholders,

What Is Cash Flow from Investing Activities?

Cash flow from investing activities (CFI) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets.

Why is cash flow important?

Cash flow from investing activities is important because it shows how a company is allocating cash for the long term. For instance, a company may invest in fixed assets such as property, plant, and equipment to grow the business. While this signals a negative cash flow from investing activities in the short-term, it may help the company generate cash flow in the longer term. A company may also choose to invest cash in short-term marketable securities to help boost profit.

What is the difference between a cash flow statement and a balance sheet?

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

Why is cash flow negative?

Negative cash flow is often indicative of a company's poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development.

What is a cash flow statement?

Overall, the cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing. There are three sections–labeled activities–on the cash flow statement.

Why is it important to analyze cash flow statement?

As with any financial statement analysis, it's best to analyze the cash flow statement in tandem with the balance sheet and income statement to get a complete picture of a company's financial health.

What is the purpose of income statement?

The income statement provides an overview of company revenues and expenses during a period. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

How to calculate cash flow from investments?

Calculate cash flow from investments by adding together the gains and losses from your various investments and entering the total on the cash flow statement.

How to report cash flow from investing?

Calculating the cash flow from investing activities is simple. Add up any money received from the sale of assets, paying back loans or the sale of stocks and bonds. Subtract money paid out to buy assets, make loans or buy stocks and bonds.

What is an Investing Activity?

The cash flow statement reports cash flow from three types of activities, operating, financing and investing. Operating activities are your regular line of business such as retail sales, housekeeping services or building houses. Finance cash flows include buying and selling of your stocks and bonds and paying out dividends. Investing covers several different activities:

What is cash flow in finance?

Finance cash flows include buying and selling of your stocks and bonds and paying out dividends. Investing covers several different activities: Buying or selling fixed assets such as buildings, land or equipment. Buying and selling stocks and bonds. Lending out money and collecting loans.

Why is cash flow from investing activities important?

Cash flow from investing activities is critical because it shows you have resources, even if cash flow from operations is low.

What does operational cash flow mean?

What It All Means. Operational cash flow shows how much money you generate from your company's core purpose. The cash flow statement separates operational and investment income because income from profitable investments could hide that your company doesn't get much revenue the regular way.

Is buying fixed assets an investment?

Standard accounting practice treats buying fixed assets as an investment. If you spend $300,000 this month to purchase updated equipment for your factory, that's a $300,000 negative entry on the cash-flow statement. If you also sell the old equipment for $175,000, that's a positive entry. If those are the month's only investment activities, you'd report -$125,000 in investment cash flow for the month.

How to know what is included in cash flow statement?

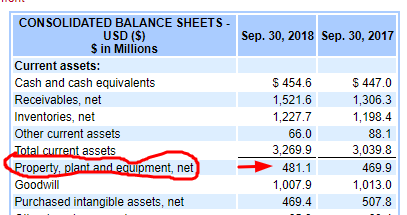

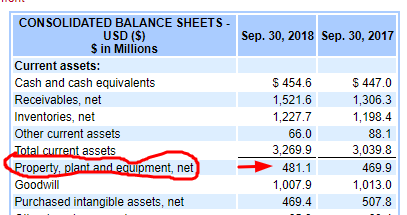

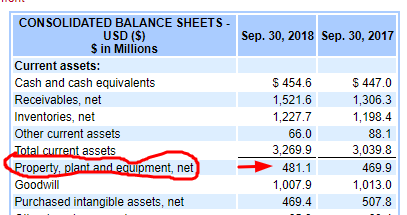

The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement.

What are Investing Activities in Accounting?

In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting.

What are investment activities?

Investing activities can include: 1 Purchase of property plant, and equipment (PP&E), also known as capital expenditures#N#Capital Expenditure A capital expenditure (“CapEx” for short) is the payment with either cash or credit to purchase long term physical or fixed assets used in a 2 Proceeds from the sale of PP&E 3 Acquisitions of other businesses or companies 4 Proceeds from the sale of other businesses (divestitures) 5 Purchases of marketable securities (i.e., stocks, bonds, etc.) 6 Proceeds from the sale of marketable securities

What is Amazon cash used for?

As you can see in Amazon’s numbers, the main uses of cash for investing have been in purchasing property/equipment/software/websites, acquiring other businesses, and buying marketable securities ( stocks and bonds). It’s also important to point out that the purchase of PP&E ( CapEx.

What is a CFI?

CFI is the official global provider of the Financial Modeling & Valuation Analyst (FMVA)®. Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today!

Is depreciation part of investing?

Depreciation of capital assets (even though the purchase of these assets is part of investing)

What is cash flow from investing?

Cash Flow from Investing Activities is a section of a company’s cash flow statement that displays inflows and outflows of cash from various long as well as short term investments. Investing activities include purchases of long-term assets (such as land, machinery,etc.), acquisitions of other businesses and investments in marketable securities (such as stocks, bonds, etc.)

What is cash flow from operating activities?

Cash flow from operating activities are flows from a company’s normal operations. For instance, a bakery would have cash outflows from purchase of flour and salaries, and inflows from sale of bread. Operating activities are what a business is in business for.

Why is cash flow negative?

Negative cash flow is often indicative of a company's poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development.

How to determine if a project is profitable?

So, you need the cash flow that the project generates to gauge whether the investment is profitable or not. You just subtract the money received from the money invested and divide this by the money invested. This is what your return is.

What is accrual accounting?

Under the accrual concept of accounting, bills paid/to be paid will be reflected under the (increase)/decrease of payable.

Can you deposit money in a bank for a long period?

Deposit the amount in Bank for long period - It will give you steady interest on your amount & the amount might be tax free. but its little bit difficult to beat the inflation.

How many formulas are there to calculate cash flow?

In this guide, we’ll explain four formulas that can be used to calculate cash flow, how they work, and how you can use each result to inform your business’s financial decisions.

How to calculate operating cash flow?

Therefore, (and as shown in the chart below) to calculate operating cash flow, you’d start with the net income from the bottom of your income statement. All non-cash items are added to your net income, such as depreciation, stock-based compensation, and deferred taxes. Once you have this number, you’d subtract changes in working capital. This includes changes in inventory, increases in accounts receivable, and increases in accounts payable.

Why do you need a CPA for cash flow?

Due to the complexity of calculating discounted cash flow and its use for business valuation, it’s typically helpful to work with a CPA or appraisal professional to perform this kind of analysis. Generally, this type of cash flow calculation is used to determine the value of a business, which is important if you’re trying to sell your company, gain investors, or establish ownership percentages.

What is DCF in accounting?

DCF is a metric used to determine the value of a business, based on its cash flow. On the whole, DCF is a bit more complex to understand than other cash flow formulas. This being said, however, there are three components to discounted cash flow:

How to determine if a business is able to meet its financial obligations?

This report can help you determine whether your business will be able to meet its financial obligations by taking into account the current cash balance and adding or subtracting expected future cash inflows and outflows. A cash flow forecast is a great financial calculator in that it’s forward-leaning and can help you make decisions for the future, like indicating whether it’s a good time to consider making an investment or to seek funding from business loans, cash flow loans, sales of property, or investors.

Why is cash flow forecast important?

As you can see, a cash flow formula like the one used in a cash flow forecast can be essential in helping you make day-to-day decisions for your business finances. It can help you plan when to spend money and be much more deliberate with where and when your money goes.

What is a cash flow forecast?

A cash flow forecast is a great financial calculator in that it’s forward-leaning and can help you make decisions for the future, like indicating whether it’s a good time to consider making an investment or to seek funding from business loans, cash flow loans, sales of property, or investors.

How to calculate cash flow from operations?

All you have to do is subtract your taxes from the sum of depreciation, change in working capital, and operating income.

Where to find cash flow analysis?

You'll find these financial numbers in your company's balance sheet or income statement. Here's a practical example of how this cash flow analysis works.

Why is free cash flow important?

Free cash flow helps companies to plan their expenses and prioritize investments.

Why is tracking cash from operations important?

Tracking cash from operations gives businesses a clear idea of how much they need to cover operating expenses over a specific period. Companies can also use a cash flow forecast to plan for future cash inflows.

What is cash flow statement?

A cash flow statement is a record of financial transactions over time. In a cash flow statement, you will find information like: Operating Activities: This is the money used for day-to-day business operations, including cash payments and other financial activities. Investing Activities: This refers to cash for business investments.

Why do investors use discounted cash flow?

Investors use discounted cash flow to determine the value of a business and peg their rate of return. It allows for better business decision-making. A positive cash flow shows that your company is healthy.

What is operating cash flow?

Operating cash flow is the money that covers a business's running costs over a fixed period of time.