The formula for the calculation is expressed mathematically as below: Tax to GDP ratio = Tax Revenue of the Nation During the Period / Gross Domestic Product of the Nation Where, Tax Revenue = Total amount of revenue collected by the government of a country in the form of the taxes during the period of time.

How do you calculate GDP with the expenditure approach?

How do you calculate GDP using the expenditure approach? GDP can be measured using the expenditure approach: Y = C + I + G + (X – M) . GDP can be determined by summing up national income and adjusting for depreciation, taxes, and subsidies.

What countries have the highest GDP?

Which country has highest GDP in 2020?

- United States. GDP – Nominal: $20.81 trillion. …

- China. GDP – Nominal: $14.86 trillion. …

- Japan. GDP – Nominal: $4.91 trillion. …

- Germany. GDP – Nominal: $3.78 trillion. …

- United Kingdom. GDP – Nominal: $2.64 trillion. …

- India. …

- France. …

- Italy.

What is the equation for real GDP?

The formula for real GDP is nominal GDP divided by the deflator: For example, real GDP was $19.073 trillion in 2019. The nominal GDP was $21.427 trillion. The deflator was 1.1234. 2 3 $19.073 trillion = $21.427 trillion/1.1234.

What goes into GDP calculation?

Key Takeaways

- GDP is the sum of all the final expenses or the total economic output by an economy within a specified accounting period.

- It does not include the output of its underground economy.

- The BEA uses four major components to calculate U.S. ...

- Consumer spending comprises 70% of GDP.

- The retail and service industries are critical components of the U.S. ...

What is the GDP of taxes?

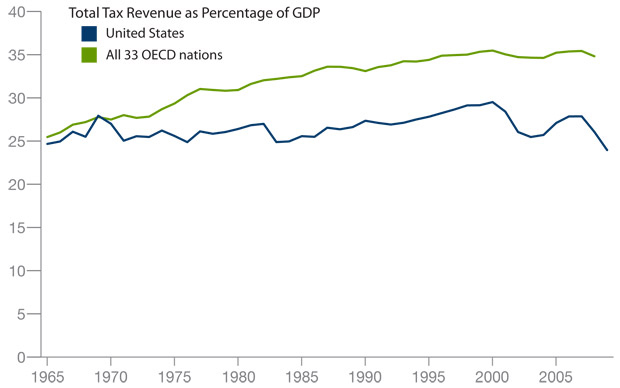

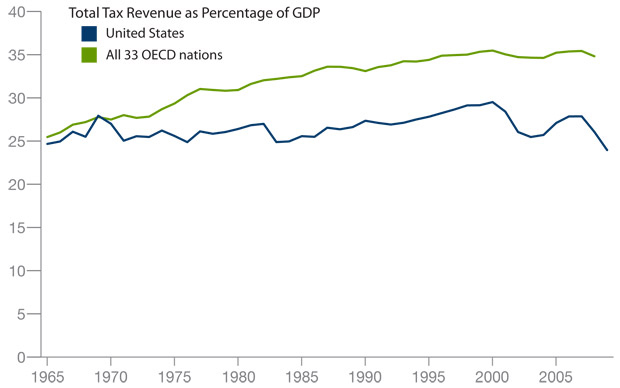

The tax-to-GDP ratio in the United States has decreased from 28.3% in 2000 to 25.5% in 2020. Over the same period, the OECD average in 2020 was slightly above that in 2000 (33.5% compared with 32.9%).

How do you calculate GDP example?

Interest income is i and is $150. PR are business profits and are $200. As you can see, in this case, both approaches to calculating GDP will give the same estimate....Table 1: Income.Transfer Payments$54Indirect Business Taxes$74Rental Income (R)$75Net Exports$18Net Foreign Factor Income$127 more rows

What are the 3 ways to calculate GDP?

GDP can be calculated in three ways, using expenditures, production, or incomes. It can be adjusted for inflation and population to provide deeper insights.

Do you subtract taxes in GDP?

Income taxes are not a component of GDP. Government spending includes spending at the federal level of $80 million and state and local spending of $120 million. Net exports is equal to exports of $45 million minus imports of $50 million. Imported goods are part of another country's GDP.

What is GDP explain with example?

If, for example, Country B produced in one year 5 bananas each worth $1 and 5 backrubs each worth $6, then the GDP would be $35. If in the next year the price of bananas jumps to $2 and the quantities produced remain the same, then the GDP of Country B would be $40.

How is GDP growth calculated?

How Do You Calculate GDP Growth Rate? The GDP growth rate, according to the formula above, takes the difference between the current and prior GDP level and divides that by the prior GDP level.

How do you calculate GDP with price and quantity?

By definition, GDP is the total market value of goods and services produced. Since market value = price * quantity, it means we multiply the price times the quantity for all goods in the economy and add them up for every year we're looking at.

How do you calculate GDP at market price?

GDP at Market Prices is calculated by subtracting the value of intermediate consumption from the total value of output produced by all producers within a country's domestic territory. In other words, it is calculated as the entire gross value added multiplied by the market price.

How to calculate GDP?

There are generally two ways to calculate GDP: the expenditures approach and the income approach. Each of these approaches looks to best approximate the monetary value of all final goods and services produced in an economy over a set period (normally one year).

What is the income approach to calculating gross domestic product?

The income approach to calculating gross domestic product (GDP) states that all economic expenditures should equal the total income generated by the production of all economic goods and services.

What is the alternative method of calculating GDP?

The alternative method for calculating GDP is the expenditure approach, which begins with the money spent on goods and services. GDP provides a broader picture of an economy. The national income and product accounts (NIPA) form the basis for measuring GDP and allows people to analyze the impact of variables, such as monetary and fiscal policies.

What is the income approach to measuring GDP?

The income approach to measuring the gross domestic product (GDP) is based on the accounting reality that all expenditures in an economy should equal the total income generated by the production of all economic goods and services. It also assumes that there are four major factors of production in an economy and that all revenues must go to one ...

Why is GDP important?

Some economists illustrate the importance of GDP by comparing its ability to provide a high-level picture of an economy to that of a satellite in space that can survey the weather across an entire continent.

What is the difference between income and expenditure?

The major distinction between each approach is its starting point. The expenditure approach begins with the money spent on goods and services. Conversely, the income approach starts with the income earned (wages, rents, interest, and profits) from the production of goods and services.

What is the total national income?

Total national income is equal to the sum of all wages plus rents plus interest and profits.

How is GDP calculated?

GDP can be calculated by considering various sector net changed values during a time period. GDP is defined as the market value of all goods and services produced within a country in a given period of time and it can be calculated on an annual or quarterly basis.

What is GDP in terms of GDP?

GDP is defined as the market value of all goods and services produced within a country in a given period of time and it can be calculated on an annual or quarterly basis.

What is GDP at market price?

For quarter 2 of 2017, total GDP at market price Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. read more is calculated in the below-given figure.

What is the reverse of the expenditure approach?

From the name, it is clear that value is added at the time of production. It is also known as the reverse of the expenditure approach. To estimate the gross value-added total cost of economic output is reduced by the cost of intermediate goods that are used for the production of final goods.

What is sales tax?

Sales Taxes = Tax imposed by a government on sales of goods and services. Depreciation = the decrease in the value of an asset. Net Foreign Factor Income = Income earn by a foreign factor like the amount of foreign company or foreign person earn from the country and it is also the difference between a country citizen and country earn.

What is depreciation in accounting?

Depreciation = the decrease in the value of an asset.

What does G mean in government?

G = All of the country’s government spending. It includes the salaries of a government employee, construction, maintenance, etc.

How is GDP calculated?

GDP can be calculated by adding up all of the money spent by consumers, businesses, and government in a given period. It may also be calculated by adding up all of the money received by all the participants in the economy. In either case, the number is an estimate of "nominal GDP.". Once adjusted to remove any effects due to inflation, ...

How to measure real GDP?

Once adjusted to remove any effects due to inflation, "real GDP" is revealed. There are two main ways to measure GDP: by measuring spending or by measuring income. And then there's real GDP, which is an adjustment that removes the effects of inflation so that the economy's growth or contraction can be seen clearly.

What is the unadjusted GDP?

A nation's unadjusted GDP can't tell you whether GDP went up because production and consumption increased or because prices went up. Real GDP is a measure of an economy's output adjusted for inflation. The unadjusted figure is referred to as nominal GDP.

What is depreciation in business?

Depreciation, a measure of the decreasing value of business equipment over time. Net foreign factor income, which is foreign payments made to a country's citizens minus the payments those citizens made to foreigners. In this income approach, the GDP of a country is calculated as its national income plus its indirect business taxes and depreciation, ...

Why do businesses use GDP?

Businesses may use GDP as a factor when deciding whether to expand or contract production or whether to undertake major projects. Investors watch GDP to get a sense of where the economy may be headed in the weeks ahead.

What is the gross domestic product of a nation?

The gross domestic product (GDP) of a nation is an estimate of the total value of all the goods and services it produced during a specific period, usually a quarter or a year.

When to use GDP?

Businesses may use GDP as a factor when deciding whether to expand or contract production or whether to undertake major projects.

How to Calculate Tax to GDP Ratio?

It is calculated by dividing the Tax revenue of a period by the gross domestic product. The formula for the calculation is expressed mathematically as below:

What is the formula for GDP?

Gross Domestic Product Formula GDP or gross domestic product refers to the sum of the total monetary value of all finished goods and services produced within the border limits of any country . GDP determines the economic health of a nation. GDP = C + I + G + NX read more

What is the difference between tax revenue and gross domestic product?

Tax Revenue = Total amount of revenue collected by the government of a country in the form of the taxes during the period of time. Gross domestic product (GDP) = Value of total final goods and the services produced in the nation during the period of time.

What is the gross domestic product?

The Gross domestic product does not include the value of goods and services which are not purchased and sold by the persons in the market and value of goods and services which are in the process i.e., the value of Intermediary goods and the services. Now using these parameters, this ratio will be calculated by dividing tax revenue by Gross domestic ...

Why is tax to GDP important?

Importance. Tax to GDP ratio reflects whether the government of any country has sufficient reserves in order to finance all its expenditures. If the ratio is less, then it shows that the government does not have the reserve to meet its expenditure.

What is excluded when calculating gross domestic product?

Any value of the Intermediary goods and the services and the value of those goods and the services that cannot be purchased and sold in the market are excluded while calculating Gross domestic product. The mathematically Gross domestic Product formula.

What is the tax to GDP ratio?

Tax to GDP ratio reflects whether the government of any country has sufficient reserves in order to finance all its expenditures. If the ratio is less, then it shows that the government does not have the reserve to meet its expenditure. So, this ratio should be sufficient enough for meeting the expenditures of the government of the country. Also, it helps in knowing that the status of the country i.e., whether it is underdeveloped, developing or developed. Typically the lower ratio shows that the nation is the developing nation and the higher ratio shows that the nation is the developed nation.

What is depreciation in GDP?

Depreciation: In terms of GDP, depreciation is also referred to as the capital consumption allowance and measures the amount that a country must spend to maintain, rather than increase its productivity. Net income of foreigners: This refers to the income that domestic citizens earn abroad subtracted from the income a foreigner earns domestically.

What is gross domestic product?

Gross domestic product is defined by the Organisation for Economic Co-operation and Development (OECD) as "an aggregate measure of production equal to the sum of the gross values added of all resident and institutional units engaged in production (plus any taxes, and minus any subsidies, on products not included in the value of their outputs." More simply, it can be defined as a monetary measure of the market value of final goods produced over a period of time, typically quarterly or yearly, that is often used to determine economic performance of a region or country. Generally, growth of more than two percent indicates significant prosperous activity in the economy. On the other hand, two consecutive three-month periods of contraction may indicate that an economy is in recession.

What is the largest component of GDP?

Personal consumption: This is typically the largest GDP component in the economy that is comprised of durable goods, nondurable goods, and services such as food, rent, jewelry, gasoline, and medical expenses (not including the purchase of new housing)

What is gross investment?

Gross investment: This includes business investment in equipment, but not the exchange of existing assets. For example, the construction of a new factory and the purchase of machinery and equipment for said factory would constitute a gross investment. The purchase of financial products is classified as "saving" rather than investment.

What is net income of foreigners?

Net income of foreigners: This refers to the income that domestic citizens earn abroad subtracted from the income a foreigner earns domestically.

How often does the Commerce Department estimate GDP?

In the United States, the Commerce Department undertakes the major project of estimating GDP using all three approaches every three months. Collecting data involves surveying hundreds of thousands of firms and households. Data is also collected from government departments overseeing activities such as agriculture, energy, health, and education, which results in an enormous amount of data. This typically results in an initial estimate being made based on a partial compilation of the data. Once the full data is available and has been analyzed (usually a few months later), a revised estimate is often released.

What is government consumption?

Government consumption: This includes the sum spent by the government on final goods and services such as public servant salaries, weapon purchases, and any investment expenditures, but not including transfer payments like social security or unemployment benefits.

How to find total income?

To get total income we have to know the relationship between GDP and income. Since a relationship is not specified in the question, we can assume that total income is going to be equal to GDP. If this is the case the answer to total income is going to be the same as the answer to real GDP. The reason that total income can be the same as real GDP is because of how GDP is measured. GDP is the value of every final good or service produced within a country during a specified time period. Since all of these goods and services must be purchased, the money has to go somewhere and it generally goes to the owners of the factors of production. This means that the owners of the capital, labor, land, and entrepreneurship get paid (have an income) the same amount as is recorded for GDP.

What is GDP in economics?

GDP is the value of every final good or service produced within a country during a specified time period. Since all of these goods and services must be purchased, the money has to go somewhere and it generally goes to the owners of the factors of production.

What is net tax?

Net taxes is calculated as the difference between taxes paid to the government minus transfers received from the government or (T-TR).

What is tax multiplier?

The term “tax multiplier” refers to the multiple which is the measure of the change witnessed in the Gross Domestic Product (GDP) of an economy due to change in taxes introduced by its government. To put it simply, this metric is mostly used by investors, economists and governments to study the impact of policy changes in taxation on the aggregate income level of a nation.

How many versions of tax multiplier?

The tax multiplier can be expressed in two versions –

Why is the tax multiplier negative?

The reason for the negative sign is that the tax multiplier essentially measure is an increase in national income (ΔY) by a decrease in tax receipts (ΔT). Mathematically, it is represented as,

Why is tax policy important?

It is an important concept from an economic point of view because taxes form an indispensable part of the economic system, both at micro and macro levels. So, it is interesting to understand how a government takes a decision on the changes in tax policy.

Does tax multiplier affect GDP?

Although tax multiplier is not the metric that goes into tax policymaking, it definitely influences the decision as it impacts the GDP of a nation. Inherently, when taxes go up the available disposable income decreases, which eventually negatively impacts consumption and that is what is captured by tax multiplier.

What is the relationship between GDP and tax revenue?

Relationship Between GDP and Tax Revenue. There is a strong relationship between GDP and tax revenue. But before we must know what is GDP (Gross Domestic Product). GDP is an indicator of a countries economic health. GDP figure also show how big is the economy. But why we use GDP.

What does GDP show?

GDP figure also show how big is the economy. But why we use GDP.

How do governments meet their spending targets?

In order to meet the target of government’s spending, government must first collect sufficient Revenues

What is the most important component of GDP?

To calculate GDP, government spending is a very important component.

Why do governments spend money?

Generally government spendings are done to make economy more productive.

What is the term for how the government collects its revenues?

First talks about how government collects its revenues. It is called ‘Total Receipts’ .

Is the GDP of the USA high compared to Pakistan?

In this case GDP of USA is very high compared to Pakistan.

Explanation

How to Calculate Tax to GDP Ratio?

- It is calculated by dividing the period’s tax revenue by the gross domestic product. The formula for the calculation is expressed mathematically as below: Where, 1. Tax Revenue = Total amount of revenue collected by the government of a country in the form of the taxes during the period of time. Gross domestic product (GDP) = Value of total final go...

Tax to GDP Ratio Example

- For a year, the comparison is to be made between the two countries, A and B. The tax revenue of country A for the period is $ 2.50 trillion, and that of country B was $ 4 trillion. The gross domestic product (GDP) of countries A and B for the same period was $ 15 trillion and $ 20 trillion, respectively. Calculate the Tax to GDP ratio of the two countries. Solution: Now, 1. Tax revenue …

Importance

- The tax to GDP ratio reflects whether any country’s government has sufficient reserves to finance all its expenditures. If the ratio is less, it shows that the government does not have the reserve to meet its expenditure. So, this ratio should be sufficient enough to meet the government’s expenditures of the country. Also, it helps in knowing the country’s status, i.e., whether it is under…

Uses

- The following are the uses: 1. The ability of spending by the government of the country of any nation on different activities in the nation depends on the country’s tax to GDP ratio. These activities include spending on the social development programs, economic development programs, spending on the country’s infrastructure, paying the salary and pension of its employe…

Conclusion

- Thus this ratio, along with the other metrics, is used to measure the control of the government of the nation on its economic resources. Generally, with the increase in the country’s Gross domestic product, the tax revenue also increases. So, mostly the Tax to GDP ratio remains constant except in cases of unexceptional circumstances. Typically countries with lower are less developed whe…

Recommended Articles

- This has been a guide to the Tax to GDP Ratio and its meaning. Here we discuss how to calculate the tax to GDP ratio with an example and its uses. You may learn more about financing from the following articles – 1. Top 10 Best Microeconomics Books 2. GDP Per Capita Example 3. Types of Equity in Economy 4. GDP vs GNP 5. Meaning of Nominal GDP