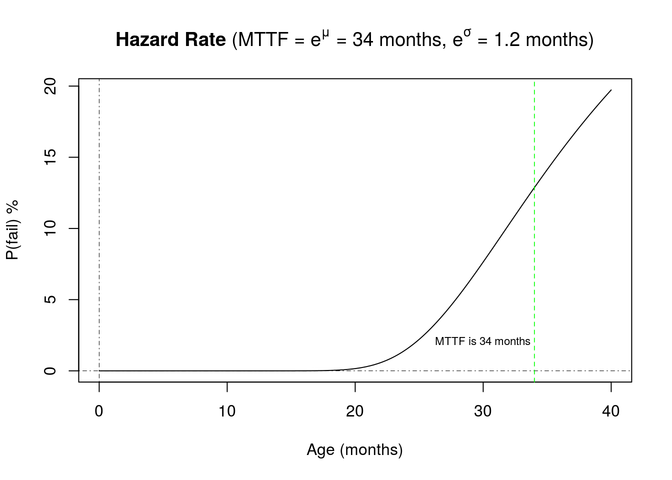

Following steps were used to calculate Hazard Rate and Survival Probability:

- Finding Survival Probability (S (t)) for different time by bootstrapping on CDS Spread Dataset.

- Finding Hazard Rate (h (t)) using Survival Probability. h (t) = -log (S (t)).

Full Answer

Is the hazard rate constant between subsequent CDs maturities?

The hazard rate is assumed constant between subsequent CDS maturities. In order to link survival probabilities to market spreads, we use the JP Morgan model, a common market practice. We also derive approximate closed formulas for "cumulative" or "average" hazard rates and illustrate the procedure with examples from observed credit curves.

How to construct credit curves from observed CDS spreads?

We present a simple procedure to construct credit curves by bootstrapping a hazard rate curve from observed CDS spreads. The hazard rate is assumed constant between subsequent CDS maturities. In order to link survival probabilities to market spreads, we use the JP Morgan model, a common market practice.

How to calculate default probability from CDS spread?

Given country's CDS spread draw implied probability of default. Given probability of default calculate CDS spread. If possible, refer to any papers. Show activity on this post. Risk-neutral default probability implied from CDS is approximately P = 1 − e − S ∗ t 1 − R, where S is the flat CDS spread and R is the recovery rate.

Can CDS spread be used to determine the probability of credit risk?

ISUE: Ascertaining hazard rate from CDS spread. In practice, the most reliable way of determining a probability of credit risk is by using the Credit rating agencies' outcome. However, CDS spread could be used to verify the reliability of such credit rating outcome.

How is hazard rate calculated for CDS?

In the below example, the hazard rate between time 0 and 1Y is h0,1=1% and the hazard rate between between 1Y and 3Y is h1,3=2.5%....Hazard rate and Survival Probability.tenorhazardratesurvprob11.00%99.00%32.50%91.85%53.00%79.06%74.00%59.75%May 10, 2020

How are hazard rates calculated?

The failure rate (or hazard rate) is denoted by h(t) and is calculated from h(t) = \frac{f(t)}{1 - F(t)} = \frac{f(t)}{R(t)} = \mbox{the instantaneous (conditional) failure rate.}

How do you calculate CDS spread?

The percentage of the notional principal paid per year–even if the premiums are paid quarterly or semiannually — as a premium is the CDS spread. So if a CDS buyer is paying 50 basis points quarterly, then the CDS spread is 200 basis points, or 2%, of the notional principal.

How is default rate calculated on CDS?

When two parties enter a CDS trade, S is set so that the value of the swap transaction is zero, i.e. Example: If the recovery rate is 40%, a spread of 200 bp would translate into an implied probability of default of 3.3%.

How do you manually calculate hazard ratio?

2:055:08Calculate Hazard Ratios [Survival Analysis] - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe hazard ratio is always just going to be equal to the parameter. Value of lambda. So for theMoreThe hazard ratio is always just going to be equal to the parameter. Value of lambda. So for the hazard ratio in Group on lambda is equal to one.

What is meant by hazard rate?

The hazard rate refers to the rate of death for an item of a given age (x). It is part of a larger equation called the hazard function, which analyzes the likelihood that an item will survive to a certain point in time based on its survival to an earlier time (t).

What is the spread of a CDS?

The "spread" of a CDS is the annual amount the protection buyer must pay the protection seller over the length of the contract, expressed as a percentage of the notional amount.

How is CD value calculated?

A = P(1+r/n) A is the total that your CD will be worth at the end of the term, including the amount you put in. P is the principal, or the amount you deposited when you bought the CD. R is the rate, or annual interest rate, expressed as a decimal.

What is a CDX spread?

A high spread for the CDX index means that the market is assigning a higher average likelihood of default to high yield bonds today as a result of the forward economic fallout from lower expected corporate earnings due to the coronavirus as well as the difficulties energy companies will have to endure due to the low ...

What does a high CDS spread mean?

The increase in CDS rates indicates that the risk of the debt or the economy has increased. Thus, beyond the insurance function against the default risk, CDS provides insight into the countries' risks.

How do you calculate implied default rate?

Implied Default Rate = Credit Spread / (100% – 40%).

What happens when CDS defaults?

The term credit default swap (CDS) refers to a financial derivative that allows an investor to swap or offset their credit risk with that of another investor. To swap the risk of default, the lender buys a CDS from another investor who agrees to reimburse the lender in the case the borrower defaults.

What does a hazard ratio of 1.5 mean?

Any ratio above 1 generally means that the treatment group healed faster or had a slower time to an event. A hazard ratio of 1 means that both groups (treatment and control) are experiencing an equal number of events at any point in time.

What does a hazard ratio of 0.5 mean?

A hazard ratio of 0.5 means that half as many patients in the active group have an event at any point in time compared with placebo, again proportionately.

What is the difference between failure rate and hazard rate?

h(t) = f(t) / R(t). Thus hazard rate is a value from 0 to 1. Failure rate is broken down a couple of ways, instantaneous failure rate is the probability of failure at some specific point in time (or limit with continuos functions. It is the chance of failure calculated by h(t) for a specific t.

What is hazard rate in credit risk?

q(t) is the density of default probability at any point in time (t): As the hazard rate rises, the credit spread widens, and vice versa. The hazard rate is also referred to as a default intensity, an instantaneous failure rate, or an instantaneous forward rate of default.

How to rank CDS data?

STEP 1. Rank you CDS data in ascending order, i.e. low to high. Call this data ser X (i): (x 1, x 2, ..., x n) where x 1 < x 2 < ... <x n. The subscript (i) in X (i) means raked data.

How to determine probability of credit risk?

In practice, the most reliable way of determining a probability of credit risk is by using the Credit rating agencies' outcome.

How many lags are reasonable?

I have read that with monthly data, including 12 lags is reasonable.

Does the other link give correct hazard rates?

The other link does not give correct hazard rates as the results does not match with the Bloomberg data.

Is CDS static or dynamic?

Another problem that needs to be considered is that CDS tends to be static and represents a cross section of default risk at a given moment in time, whereas credit rating outcomes are reviewd periodically, which make credit rating outcomes more reliable in predicting default risk.

Giuseppe Castellacci

We present a simple procedure to construct credit curves by bootstrapping a hazard rate curve from observed CDS spreads. The hazard rate is assumed constant between subsequent CDS maturities. In order to link survival probabilities to market spreads, we use the JP Morgan model, a common market practice.

Abstract

We present a simple procedure to construct credit curves by bootstrapping a hazard rate curve from observed CDS spreads. The hazard rate is assumed constant between subsequent CDS maturities. In order to link survival probabilities to market spreads, we use the JP Morgan model, a common market practice.

What is CDS in contract?

A credit default swap ( CDS) is a contract that gives the buyer of the contract a right to receive compensation from the seller of the contract in the event of default of a third party.

What is upfront premium on CDS?

Because the periodic premium rates are standardized, the buyer may also be required to pay an amount at the time 0 of the CDS seller. This amount is called upfront premium. The seller of the CDS pays the buyer an amount equal to the loss incurred by the buyer on occurrence of a credit event.