- Loans that amortize, such as your home mortgage or car loan, require a monthly payment. ...

- Convert the interest rate to a monthly rate. That amount is: (6% divided by 12 = 0.005 monthly rate).

- Multiply the principal amount by the monthly interest rate: ($100,000 principal multiplied by 0.005 = $500 month’s interest).

- You can use the equation: I=P*r*t, where I=Interest, P=principal, r=rate, and t=time.

How do I use an amortization mortgage calculator?

The following are intangible assets that are often amortized:

- Goodwill, which is the reputation of a business regarded as a quantifiable asset

- Going-concern value, which is the value of a business as an ongoing entity

- Workforce in place (current employees, including their experience, education, and training)

How do you calculate interest rates on a mortgage loan?

The average interest rate for a standard 30-year fixed mortgage is 4.23%, which is a growth of 25 basis points compared to one week ago. (A basis point is equivalent to 0.01%.) The most frequently used loan term is a 30-year fixed mortgage. A 30-year fixed ...

What is the formula for calculating monthly mortgage?

Monthly mortgage payments are calculated using the following formula: P M T = P V i ( 1 + i) n ( 1 + i) n − 1. where n = is the term in number of months, PMT = monthly payment, i = monthly interest rate as a decimal (interest rate per year divided by 100 divided by 12), and PV = mortgage amount ( present value ).

How do banks calculate mortgage interest?

- Shop around for a lower interest rate. Different lenders offer varying interest rates. ...

- Lengthen the term of your loan. Choose a longer time period to pay off your mortgage, like 30 years rather than 15. ...

- Buy points. ...

- Increase your down payment. ...

- Don’t pay PMI. ...

- Buy a less expensive house. ...

What is the formula for calculating amortization?

Amortization refers to paying off debt amount on periodically over time till loan principle reduces to zero. Amount paid monthly is known as EMI which is equated monthly installment....Amortization is Calculated Using Below formula:ƥ = rP / n * [1-(1+r/n)-nt]ƥ = 0.1 * 100,000 / 12 * [1-(1+0.1/12)-12*20]ƥ = 965.0216.

How do you calculate 30-year amortization?

The monthly mortgage payment formula number of payments over the loan's lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360).

What is the best amortization calculator?

Best Online Amortization CalculatorsThese calculators will get the job done right. Canva.com.Amortization schedule calculator. Amortization schedule calculator.Free mortgage amortization calculator. Mortgage Amortization.Simple Mortgage Calculator. Simple Mortgage Calculator.

What is the formula to calculate monthly mortgage?

For your mortgage calc, you'll use the following equation: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]. Here's a breakdown of each of the variables: M = Total monthly payment.

How do I manually calculate a mortgage payment?

Calculating Your Mortgage Payment To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12. Next, add 1 to the monthly rate. Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments you'll make.

What is an example of amortization?

Amortizing a loan You have a $5,000 loan outstanding. If you pay $1,000 of the principal every year, $1,000 of the loan has amortized each year. You should record $1,000 each year in your books as an amortization expense.

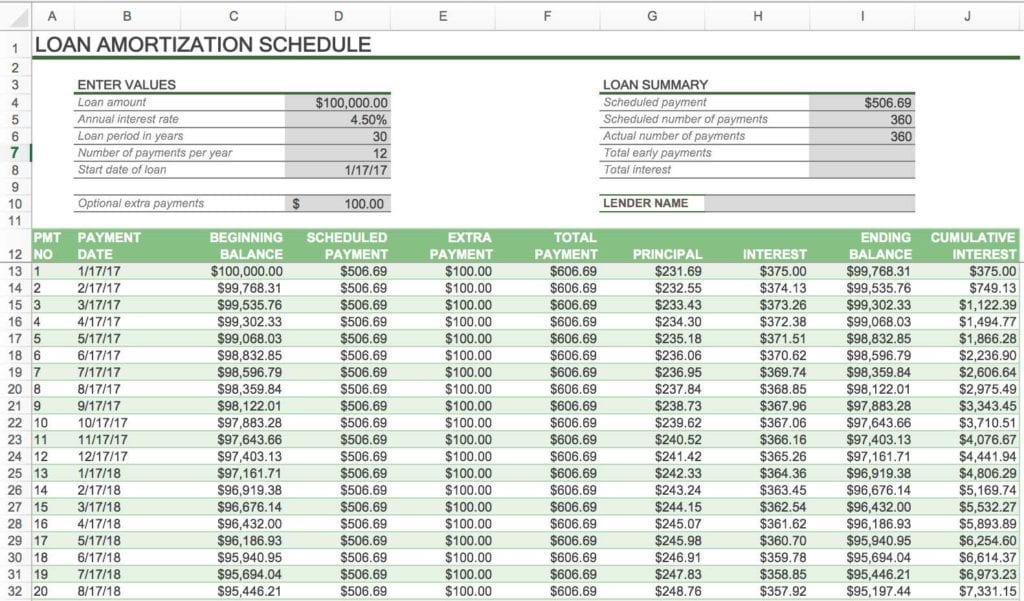

What happens if I pay 2 extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Is it wise to pay off mortgage early?

Paying off your mortgage early is a good way to free up monthly cashflow and pay less in interest. But you'll lose your mortgage interest tax deduction, and you'd probably earn more by investing instead. Before making your decision, consider how you would use the extra money each month.

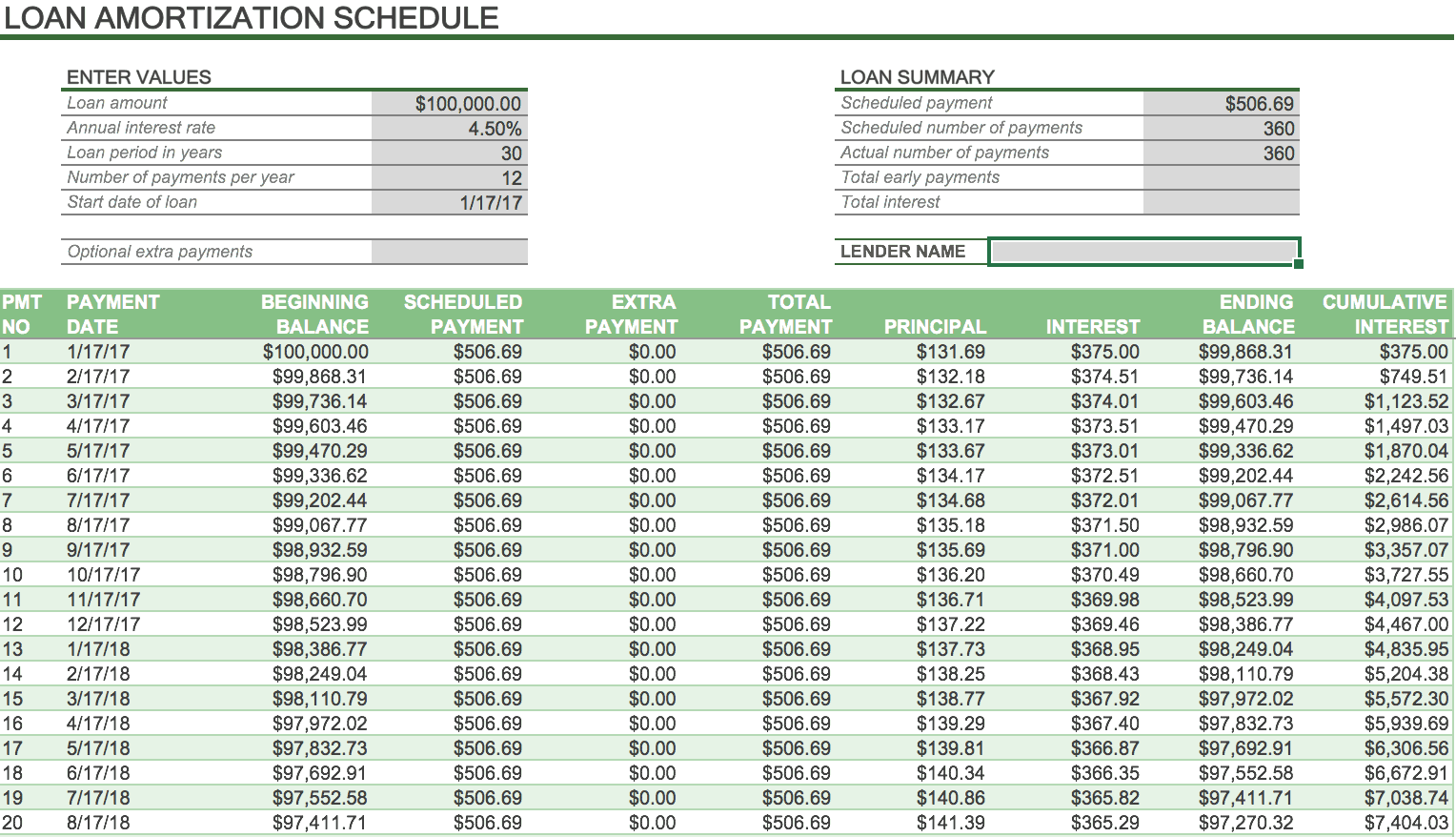

How do you make an amortization table?

Creating an amortization table is a 3 step process:Use the =PMT function to calculate the monthly payment.Create the first two lines of your table using formulas with the correct relative and absolute references.Use the Fill Down feature of Excel to create the rest of the table.

How do I calculate interest on a 30 year mortgage?

To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C. At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years....C = N * MC = N * M.C = 360 payments * $1,073.64.C = $368,510.40.

How can I pay off my 30 year mortgage in 15 years?

Options to pay off your mortgage faster include:Pay extra each month.Bi-weekly payments instead of monthly payments.Making one additional monthly payment each year.Refinance with a shorter-term mortgage.Recast your mortgage.Loan modification.Pay off other debts.Downsize.

Mortgage Calculator

Mortgage Amortization Calculator - Calculate Your Payments

Amortization Calculator - Free Amortization Schedule | Zillow

Loan Amortization Table Calculator

How to calculate amortization?

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount.

What is amortization in finance?

Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. With amortization, the payment amount consists of both principal repayment and interest on the debt. Principal is the loan balance that is still outstanding.

What is amortization on a mortgage?

What is mortgage loan amortization? “Mortgage loan amortization” is the process of paying a home loan down to $0. A mortgage — or any other type of loan — is “amortized” if it’s paid in regular installments and will be fully paid off after a set period of time. Your mortgage amortization schedule determines when your home will be paid off ...

How does amortization work?

How mortgage amortization works. If the amount you borrow for a mortgage loan is scheduled to be repaid in installments, your loan is amortized. “Loan amortization is the process of calculating the loan payments that amortize — meaning pay off — the loan amount,” explains Robert Johnson, professor of finance at Heider College of Business, ...

Why does amortization schedule matter?

“Amortization matters because the quicker you can amortize your loan, the faster you will build equity and the more money you can save over the life of your loan ,” says real estate investor and flipper Luke Smith.

Why do most lenders not offer amortized loans?

Most lenders don’t offer these — and most home buyers don’t want them — because these loans are riskier and don’t help the borrower build equity as quickly. With an amortized loan, your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the full life of the loan.

What are regular home insurance payments?

Regular payments include other homeownership costs, too; like homeowners insurance, property taxes, and if necessary, private mortgage insurance and/or homeowners association (HOA) dues. Payments for these other expenses will not be affected by your amortization schedule.

How long is a mortgage loan?

The most common mortgage term is 30 years. But most lenders also offer 15-year home loans, and some even offer 10 or 20 years. So how do you know if a 10-, 15-, or 20-year amortization schedule is right ...

How long does it take to pay off half of a mortgage?

For example, you can’t assume that completing half the loan term means you’ll own half the home. Consider the example above. Although the full loan term is 30 years, it will take the homeowner 19 years — nearly two thirds of the term — to pay off half their loan principal.

What is amortization schedule?

An amortization schedule is a fixed table that lays out exactly how much of your monthly mortgage payment goes toward interest and how much goes toward your principal each month, for the full term of the loan.

Why do lenders use an amortization schedule?

Lenders use an amortization schedule to show you in detail how each periodic payment on your amortizing loan will ultimately end with your complete loan repayment.

What is the process of paying off a mortgage?

As soon as you start making payments on your mortgage, your loan will start to mature using a process called amortization. Amortization is a way to pay off debt in equal installments that includes varying amounts of interest and principal payments over the life of the loan.

Why is amortization calculator important?

An amortization calculator is useful for understanding the long-term cost of a fixed-rate mortgage because it shows the total principal you'll pay over the life of the loan. It's also helpful for understanding how your mortgage payments are structured. If you've ever wondered how much of your monthly payment will go toward interest ...

How often do you pay off a fully amortized loan?

When you have a fully amortizing loan like a mortgage or car loan, you will pay the same amount every month. The lender will apply a gradually smaller part of your payment toward interest and a gradually larger part of your payment toward principal until the loan is paid off.

How often should you amortize a 5/1 ARM?

You can create an amortization schedule for an adjustable-rate mortgage, but it involves guesswork. If you have a 5/1 ARM, the amortization schedule for the first five years is easy to calculate because the rate is fixed for the first five years. After that, the rate will adjust once per year.

Is mortgage amortization the only type of loan?

Mortgage Amortization Isn 't the Only Kind. We've talked a lot about mortgage amortization so far, because that's what people usually think about when they hear the word "amortization.". But a mortgage is not the only type of loan that can amortize.

What is amortization table?

An amortization table can show you —month-by-month—exactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan.

How long does a mortgage keep the same interest rate?

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. 1 For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

Why do you need to know your LTV ratio?

Your loan-to-value (LTV) ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

Do you have to pay down interest only loans?

Interest-only loans are much easier to calculate. Unfortunately, you don’t pay down the loan with each required payment, but you can typically pay extra each month if you want to reduce your debt. 4

Do you have to make additional payments to pay down a loan?

You make additional payments, above and beyond the required minimum payment. Doing so will reduce your loan balance, but your required payment might not change right away. After a certain number of years, you’re required to start making amortizing payments to pay down the debt.