What determines the incidence of tax?

Tax incidence can also be related to the price elasticity of supply and demand. When supply is more elastic than demand, the tax burden falls on the buyers. If demand is more elastic than supply, producers will bear the cost of the tax.

What is the tax incidence on consumers and sellers?

The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. The tax incidence on the sellers is given by the difference between the initial equilibrium price Pe and the price they receive after the tax is introduced Pp.

How are taxes passed on to the consumer?

An increase in excise duties leads to nearly all the tax being passed onto the consumer. For example, the UK has increased tax on tobacco, and this is reflected in a higher price of cigarettes. In the case of a tax on labour, the incidence of the tax could be borne by the employer and employee.

Who bears the cost of a tax?

If demand is more elastic than supply, producers will bear the cost of the tax. Tax incidence describes a case when buyers and sellers divide a tax burden. Tax incidence will also lay out who bears the burden of a new tax, for instance among producers and consumers, or among various class segments of a population.

What is the tax incidence on buyers?

Tax incidence is the manner in which the tax burden is divided between buyers and sellers. The tax incidence depends on the relative price elasticity of supply and demand. When supply is more elastic than demand, buyers bear most of the tax burden.

What is an example of tax incidence?

Imagine a $1 tax on every barrel of apples a farmer produces. If the farmer is able to pass the entire tax on to consumers by raising the price by $1, the product (apples) is price inelastic to the consumer. In this example, consumers bear the entire burden of the tax—the tax incidence falls on consumers.

How do you find the tax incidence of a supplier?

To calculate tax incidence, we first have to find out whether the tax shifts the supply or the demand curve. Next, we can determine in which direction and by how much the curve shifts, which finally allows us to find the new equilibrium and measure the tax incidence.

What is the consumers tax incidence and what is the producer tax incidence?

Tax incidence is the effect a particular tax has on the two parties of a transaction; the producer that makes the good and the consumer that buys it.

What do you mean by tax incidence?

tax incidence, the distribution of a particular tax's economic burden among the affected parties. It measures the true cost of a tax levied by the government in terms of lost utility or welfare.

What are the types of tax incidence?

There are two types of tax incidence, they are economic incidence and statutory incidence. Economic incidence of tax is also known as the final incidence. The economic incidence of a tax is the final burden of that particular tax on the distribution of economic welfare in society.

How do you calculate consumer and producer tax burden?

2:166:24How to calculate Excise Tax and determine Who Bears the Burden of ...YouTubeStart of suggested clipEnd of suggested clipTimes 1 which is 1 times 4. So they bear our 4 dollars of the tax the producer pays $2 of the tax.MoreTimes 1 which is 1 times 4. So they bear our 4 dollars of the tax the producer pays $2 of the tax. And their total tax bill is 2 times quantity which is 4. So the total tax is 8.

How do you calculate tax incidence with elasticity?

0:119:38Tax Incidence Using Price Elasticities of Demand and Supply - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe key formula is going to be given by this the fraction of tax paid by buyers will equal the priceMoreThe key formula is going to be given by this the fraction of tax paid by buyers will equal the price elasticity of supply divided by the price elasticity of supply.

How do you calculate unit burden of tax on buyers?

1:242:22The per-unit burden of the tax is - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo if we look right here we have 16 minus 14 so that's a $2. Per unit tax burden on the buyers as weMoreSo if we look right here we have 16 minus 14 so that's a $2. Per unit tax burden on the buyers as we can see right here for the sellers it will be 14 minus 8 which is a $6 per unit tax burden.

How a tax burden is divided between consumers and producers is called tax incidence consumers bear most of the tax burden when?

How a tax burden is divided between consumers and producers is called tax incidence. Consumers bear most of the tax burden when: Group of answer choices Demand is more elastic than supply The firm decides to pass none of the tax on to the consumer via a higher price.

What is the incidence of tax in economics?

The incidence of a tax refers to the extent to which an individual or organisation suffers from the imposition of a tax – it may fall on the consumer, the producer, or both. The incidence is also called the 'burden' of taxation. How the incidence falls depends upon the price elasticity of demand.

What is consumer tax burden?

The total consumer burden is the total amount of tax paid for by consumers.

What is the incidence of tax in economics?

The incidence of a tax refers to the extent to which an individual or organisation suffers from the imposition of a tax – it may fall on the consumer, the producer, or both. The incidence is also called the 'burden' of taxation. How the incidence falls depends upon the price elasticity of demand.

What is meant by tax incidence quizlet?

Tax incidence is the manner in which the burden of a tax is shared among participants in a market.

What does tax incidence describe quizlet?

Tax incidence. Refers to how the burden of taxation is distributed across various agents in the economy. Deadweight loss of taxation. The loss in total surplus.

What is the importance of tax incidence?

The study of tax incidence is important because, as a result of the different elasticities of demand and supply, the buyer and seller may not necessarily bear an equal share of the tax burden. This can impact the economic decisions of both the buyer and seller, which in turn can have an effect on the overall economy.

Understanding Tax Incidence

Tax incidence is typically studied using supply and demand analysis. French Physiocrats like François Quesnay first gave light to the idea in the context of the tax burden on landowners.

Calculate Tax Incidence

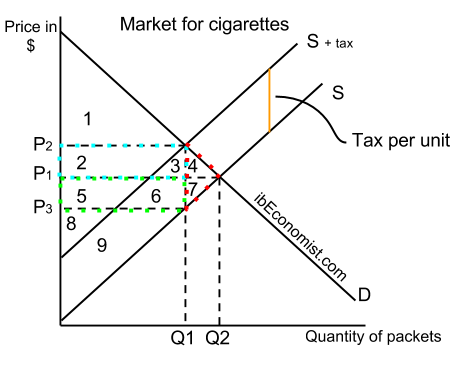

Normally, one can calculate the tax burden or tax incidence by using simple subtraction. For example, in the above graph, the consumer tax incidence would have been P2-P1. The difference would have given the tax borne by the consumer on that particular good. The producer tax incidence would have been P2 – P3.

Example

In this instance, let’s assume the government decides to impose a new luxury tax Luxury Tax The luxury tax is a tax obtained from people purchasing expensive goods or services that offer luxury and are typically not perceived as essential goods. read more on yachts priced above $100,000.

Recommended Articles

This has been a guide to Tax Incidence & its definition. We discuss the formula, calculation, & examples of tax incidence, & how it changes with elasticity. You may learn more about financing from the following articles –

How to calculate tax revenue?

The tax revenue is given by the shaded area, which we obtain by multiplying the tax per unit by the total quantity sold Qt. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. The tax incidence on the sellers is given by the difference between the initial equilibrium price Pe and the price they receive after the tax is introduced Pp. In Figure 1 (a), the tax burden falls disproportionately on the sellers, and a larger proportion of the tax revenue (the shaded area) is due to the resulting lower price received by the sellers than by the resulting higher prices paid by the buyers. Figure 1 (b) describes the example of the tobacco excise tax where the supply is more elastic than demand. The tax incidence now falls disproportionately on consumers, as shown by the large difference between the price they pay, Pc, and the initial equilibrium price, Pe. Sellers receive a lower price than before the tax, but this difference is much smaller than the change in consumers’ price. From this analysis one can also predict whether a tax is likely to create a large revenue or not. The more elastic the demand curve, the more likely that consumers will reduce quantity instead of paying higher prices. The more elastic the supply curve, the more likely that sellers will reduce the quantity sold, instead of taking lower prices. In a market where both the demand and supply are very elastic, the imposition of an excise tax generates low revenue.

How does tax incidence depend on supply and demand?

Tax incidence depends on the price elasticities of supply and demand. The example of cigarette taxes introduced previously demonstrated that because demand is inelastic, taxes are not effective at reducing the equilibrium quantity of smoking, and they mainly pass along to consumers in the form of higher prices.

Why are excise taxes bad?

Some believe that excise taxes hurt mainly the specific industries they target. For example, the medical device excise tax, in effect since 2013, has been controversial for it can delay industry profitability and therefore hamper start-ups and medical innovation. However, whether the tax burden falls mostly on the medical device industry or on the patients depends simply on the elasticity of demand and supply.

What is the analysis of how a tax burden is divided between consumers and producers?

The analysis, or manner, of how a tax burden is divided between consumers and producers is called tax incidence. Tax incidence depends on the price elasticities of supply and demand.

What happens if the government taxes milk?

If the government taxes something like milk, and the quantity that society actually wants-- the socially optimal quantity-- is 100, and they tax it, it's going to decrease efficiency. It's going to cause a decrease in total surplus. So taxes on some products will lead to inefficiency.

Do taxes affect equilibrium quantity?

Similarly, when a government introduces a tax in a market with an inelastic supply, such as, for example, beachfront hotels, and sellers have no alternative than to accept lower prices for their business, taxes do not greatly affect the equilibrium quantity. The tax burden now passes on to the sellers.

What Is Tax Incidence?

Karen is addicted to cigarettes. She smokes a pack a day and has no plans to quit. The state where Karen lives just added a $1 tax to every pack of cigarettes sold. Due to her addiction, she is willing to pay the extra cost in lieu of reducing her consumption of cigarettes. Karen is also in her second year of graduate school. She has just started her fall semester and needs to purchase an expensive textbook for her Advanced Corporate Finance course. The cost of the textbook at the campus bookstore is $200 plus 7% sales tax, for a total cost of $214. Karen decides to purchase the textbook from an online retailer that is based out of state and therefore doesn't charge the state sales tax. She gets the textbook for $200.

Why does Karen buy the same number of cigarettes every day?

Karen will pretty much buy the same number of cigarettes each day regardless of their cost because of her addiction. This is an example of inelastic demand. With inelastic demand, a consumer's demand is unaffected by changes in price. When inelastic demand occurs, it's the consumer who is paying the tax.

What is tax incidence?

Tax incidence refers to how the burden of a tax is distributed between firms and consumers (or between employer and employee). The tax incidence depends upon the relative elasticity of demand and supply. The consumer burden of a tax increase reflects the amount by which the market price rises.

What is the consumer burden of a tax increase?

The consumer burden of a tax increase reflects the amount by which the market price rises.

What is the consumer burden?

The consumer burden is the extra amount the consumers pay. This is an extra £1. The total consumer burden is the total amount of tax paid for by consumers.

What is the producer burden of tax?

The producer burden of the tax is the lost revenue to the firm. Before the tax, they used to get £20. After the tax is paid to the government, they are left with £14. They are £6 worse off.

Who pays the tax on a product?

However, the tax incidence is mostly borne by the producer. The consumer only pays a small percentage.

Is the demand for cigarettes inelastic?

Demand for cigarettes is very price inelastic. An increase in excise duties leads to nearly all the tax being passed onto the consumer. For example, the UK has increased tax on tobacco, and this is reflected in a higher price of cigarettes. See: Cigarette tax and smoking rates.

What Is a Tax Incidence?

Tax incidence (or incidence of tax) is an economic term for understanding the division of a tax burden between stakeholders, such as buyers and sellers or producers and consumers. Tax incidence can also be related to the price elasticity of supply and demand. When supply is more elastic than demand, the tax burden falls on the buyers. If demand is more elastic than supply, producers will bear the cost of the tax.

What is the demand for cigarettes?

Another example is that the demand for cigarettes is mostly inelastic. When governments impose a cigarette tax, producers increase the sale price by the full amount of the tax, transferring the tax burden to consumers. Through analysis, it is found the demand for cigarettes is unaffected by price. Of course, there are limits to this theory. If a pack of cigarettes suddenly increased from $5 to $1,000, consumer demand would fall.