How do you review accounts receivable?

- Trace receivable report to general ledger.

- Calculate the receivable report total.

- Investigate reconciling items.

- Test invoices listed in receivable report.

- Match invoices to shipping log.

- Confirm accounts receivable.

- Review cash receipts.

What is the best way to understand accounts receivable?

The best way to understand accounts receivable is to view a transaction and how it ends up on the balance sheet. Imagine that Wal-Mart wants to order a new special-edition boxed set of Harry Potter books from the publisher. It negotiates a 50,000-unit run that won't be available anywhere else.

What are the reviews of accountsreceivable?

Overview. AccountsReceivable has a consumer rating of 3.4 stars from 64 reviews indicating that most customers are generally satisfied with their purchases. AccountsReceivable ranks 63rd among Business Services Other sites. Service 4. Value 2. Returns 1. Quality 2. Positive reviews (last 12 months): 55.6%.

What are the audit procedures for accounts receivable?

Accounts receivable is frequently the largest asset that a company has, so auditors tend to spend a considerable amount of time gaining assurance that the amount of the stated asset is reasonable. Here are some of the accounts receivable audit procedures that they may follow: Trace receivable report to general ledger.

Do you have an effective account receivable management strategy?

Establishing an effective account receivable (AR) management strategy is a crucial part of running a successful business. Despite this, many business owners fail to take a methodical approach to the situation, and they are the worse for it.

How do you evaluate accounts receivable?

One simple method of measuring the quality of accounts receivables is with the accounts receivable-to-sales ratio. The ratio is calculated as accounts receivable at a given point in time divided by its sales over a period of time. It indicates the percentage of a company's sales that are still unpaid.

How do you effectively manage accounts receivable?

Best Practices for Accounts Receivable ManagementUse Electronic Billing & Payment. ... Outline Clear Billing Procedures. ... Set Credit & Collection Policies — and Stick to Them. ... Be Proactive. ... Set up Automations. ... Make It Easy for Customers. ... Use the Right KPIs. ... Involve All Teams in the Process.

How do you review aging accounts receivable?

The aging of accounts receivable is the process of listing your unpaid invoices and other receivables by their due dates. This is done to estimate which invoices are overdue for payments. The report is broken up by intervals of 0-30 Days, 31-60 Days, 61-90 Days, and 90+ Days.

How often should accounts receivable be reviewed?

She has taught at business and professional schools for over 35 years and written for The Balance SMB on U.S. business law and taxes since 2008. Reviewing your accounts receivable aging report at least monthly—and ideally more often—can help to ensure that your customers and clients are paying you.

What are the most important goals of AR?

Maintaining a high standard of data hygiene is one of the most important accounts receivable goals.

What are accounts receivable procedures?

A traditional accounts receivable process begins when a customer makes a purchase for a product and/or service (think of accounts receivable as an “IOU”) and ends once the outstanding payment has been collected. An accounts receivable workflow is the step-by-step process taken to record and collect the debt.

How do you prepare accounts receivable report?

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.

What is an AR aging summary?

Accounts receivable aging (tabulated via an aged receivables report) is a periodic report that categorizes a company's accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the financial health of a company's customers.

What kind of reports are important for accounts receivable?

Accounts Receivable Reports.Activity Reports.Arrivals Reports.Blocks and Groups Reports.Catering Configuration Reports.Commissions Reports.Configuration Reports.Departures Reports.More items...

What is a good accounts receivable goal?

Sending Invoices Promptly Invoicing your clients as soon as possible can significantly impact your accounts receivable, and it's one of the goals you should strive to achieve in that area. There are many reasons to send invoices promptly, but one of the most significant for your business is getting paid faster.

What is a good AR ratio?

Average turnover ratios for the company's industry. An AR turnover ratio of 7.8 has more analytical value if you can compare it to the average for your industry. An industry average of 10 means Company X is lagging behind its peers, while an average ratio of 5.7 would indicate they're ahead of the pack.

What is importance of AR aging?

An AR collections aging report provides important data on customer payment behaviors and the effectiveness of crediting/collection functions. Running an AR collections report regularly (usually weekly or monthly) helps you understand what to expect from customers in terms of payments.

What is Accounts Receivable?

Accounts receivable are an asset account, representing money that your customers owe you . Accounts payable on the other hand are a liability account, representing money that you owe another business.

Why does Keith record an invoice as an account receivable?

When Keith gets your invoice, he’ll record it as an accounts payable in his books, because it’s money he has to pay someone else. You’ll record it as an account receivable on your end, because it represents money you will receive from someone else.

How to calculate average sales credit period?

To calculate the average sales credit period —the average time that it takes for your customers to pay you—we divide 52 (the number of weeks in one year) by the accounts receivable turnover ratio (30): 52 weeks / 30 = 1.73 weeks.

Do businesses sell on credit?

Most businesses sell to their customers on credit. That is, they deliver the goods and services immediately, send an invoice, then get paid a few weeks later. Businesses keep track of all the money their customers owe them using an account in their books called accounts receivable.

Does receivable count as revenue?

Does accounts receivable count as revenue? Accounts receivable is an asset account, not a revenue account. However, under accrual accounting, you record revenue at the same time that you record an account receivable.

Overview

AccountsReceivable has a consumer rating of 3.34 stars from 67 reviews indicating that most customers are generally satisfied with their purchases. AccountsReceivable ranks 20th among Business Services Other sites.

About the business

As a Collection Agency, we exceed the highest standards in our professionally trained staff, data security, and provide our clients with the latest technology and excellence in customer service and communications, ensuring consumers are treated with re...

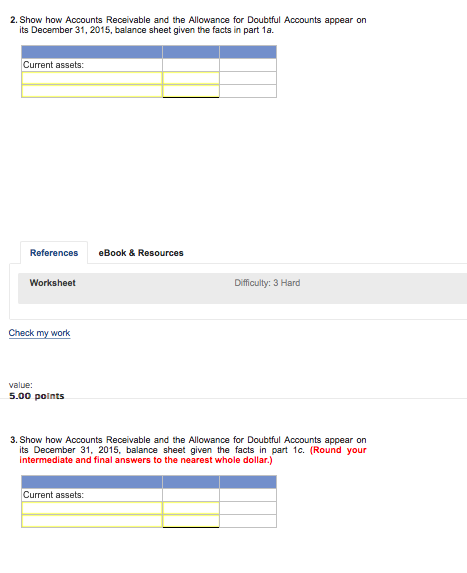

What is the name of the method used to account for bad debt?

These uncollectible accounts are also called bad debts. Companies use two methods to account for bad debts: the direct write‐off method and the allowance method.

What is direct write off method?

For tax purposes, companies must use the direct write‐off method, under which bad debts are recognized only after the company is certain the debt will not be paid. Before determining that an account balance is uncollectible, a company generally makes several attempts to collect the debt from the customer.

Does adjusting entry reduce accounts receivable?

The adjusting entry to estimate the expected value of bad debts does not reduce accounts receivable directly. Accounts receivable is a control account that must have the same balance as the combined balance of every individual account in the accounts receivable subsidiary ledger.

Does a write off affect accounts receivable?

Under the allowance method, a write‐off does not change the net realizable value of accounts receivable. It simply reduces accounts receivable and allowance for bad debts by equivalent amounts. Customers whose accounts have already been written off as uncollectible will sometimes pay their debts.

Why is it important to analyze accounts receivable?

Analyzing a company's accounts receivable will help investors gain a better sense of a company's overall financial health and liquidity. The accounts receivable-to-sales ratio helps investors analyze the degree to which a business's sales have not yet been paid for. Businesses whose accounts receivable are owed by a highly diversified customer base ...

Is account receivable a critical component of due diligence?

Although individual investors will disagree over the best method, few would debate that the analysis of accounts receivable is a critical component of investment due diligence .

Is accounts receivable owed by a highly diversified customer base less vulnerable than accounts receiv

Businesses whose accounts receivable are owed by a highly diversified customer base may be less vulnerable than those whose accounts receivable are owed by customers concentrated within a particular sector.

How to understand accounts receivable?

The best way to understand accounts receivable is to view a transaction and how it ends up on the balance sheet. Imagine that Walmart , the buyer, wants to order a new boxed set of books from the publisher, who is the seller. Walmart agrees to buy 50,000 units that people can only buy at Walmart.

What is account receivable?

Accounts receivable, sometimes shortened to "receivables" or A/R, is money owed to a company by its customers. If a company has delivered products or services but not yet received payment, it's an account receivable. 1 2.

What is the balance sheet of accounts receivable?

The nature of a firm's accounts receivable balance depends on the sector in which it does business, as well as the credit policies the corporate management has in place. A company keeps track of its A/R as a current asset on what's called a balance sheet, which shows how much money a company has (the assets) and how much it owes (the liabilities).

Does a business record an account receivable?

Some companies have a different business model and insist on being paid upfront. In this case, the business doesn't record an account receivable, but instead enters a liability on its balance sheet to an account known as unearned revenue or prepaid revenue. 6

Is a large A/R balance good?

Having a large A/R amount due on the balance sheet seems like it would be good. You would think every company wants a flood of future cash coming their way. This is not the case, though. Money in A/R is money that's not in the bank. This can expose the company to a degree of risk. If Walmart went bankrupt or simply didn't pay, the seller would be forced to write off the A/R balance on its balance sheet by $1.5 million.

How often should you assess accounts receivable?

Ideally, it should be done at least once a week. The sooner you find errors, the sooner you can correct them, and the less likely they are to cause major problems for your business.

Why is optimizing accounts receivable important?

As mentioned above, doing so can drastically improve many aspects of your business. It prevents existing capital from going to waste, which increases liquidity.

How to avoid dumping cash into suspense accounts?

Whenever possible, avoiding dumping cash into suspense accounts until you have the time to figure out where it's actually supposed to go. Optimize the Collection Process: Properly optimizing accounts receivable makes it much easier to collect payment in a timely and effective manner.

Why should customer accounts be audited?

Customer accounts should be audited on a consistent basis to check for anomalies like unusual or inappropriate payment terms, credit limits, discounts, and the like.

How to improve billing and invoicing?

One way to improve billing and invoicing is by automating as much of it as possible, so don't be afraid to rely on technology here. Use exception reports to pinpoint problematic accounts.

Why should collection efforts be consistent and methodical?

A clearly defined process for negotiating payment plans should be established to ensure that it dovetails with the company's overall objectives. Processes should be automated as much as possible to reduce the risk of errors from manual entry.