Key Takeaways

- A perpetuity, in finance, refers to a security that pays a never-ending cash stream.

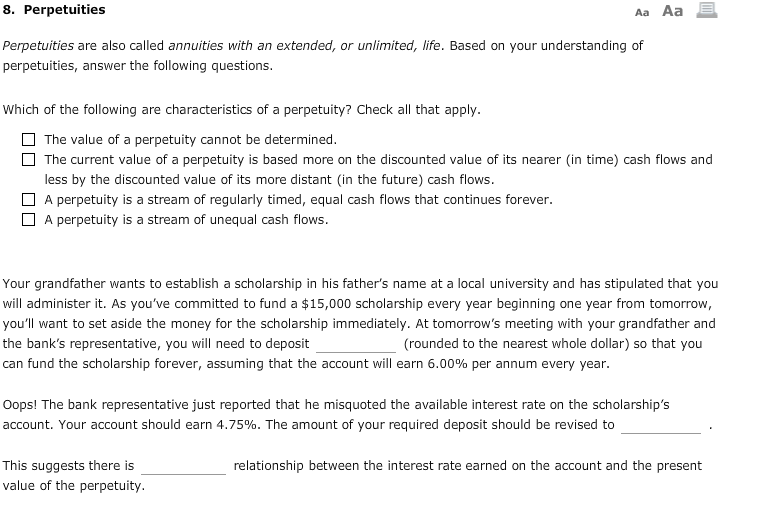

- The present value of a perpetuity is determined using a formula that divides cash flows by some discount rate.

- An example of a perpetuity is the British consol, which were discontinued in 2015. 1

What does'perpetuity'mean?

What does 'Perpetuity' mean. Perpetuity refers to an infinite amount of time. In finance, perpetuity is a constant stream of identical cash flows with no end. The present value of a security with perpetual cash flows can be determined as:

What is perpetuity in financial system?

Perpetuity in the financial system is a situation where a stream of cash flow payments continues indefinitely or is an annuity that has no end.

How does perpetuity annuity work?

It works by finding the present value of an infinite series of ordinary annuity payments. Perpetuity then discounts that figure back to today’s dollars using a discount rate, which should be the appropriate risk-free rate for the period.

How do you calculate perpetuity in real life?

Another real-life example is preferred stock, where the perpetuity calculation assumes the company will continue to exist indefinitely in the market and keep paying dividends. Present Value of Perpetuity Formula. Here is the formula: PV = C / R . Where: PV = Present value; C = Amount of continuous cash payment; r = Interest rate or yield

What is an example of a perpetuity?

A perpetuity is a type of annuity where there is no end to the payments. It may have fixed or growing payments depending on its nature. For example, a rental property will give you a fixed amount every month. Meanwhile, a government bond will result in an increasing amount after each period as time goes on.

How are perpetuity payments calculated?

PV = C / (r – g)PV = Present value.C = Amount of continuous cash payment.r = Interest rate or yield.g = Growth Rate.

What is the point of a perpetuity?

There are just two models to choose from - a growing perpetuity, where the cash stream grows over time, and perpetuity, which delivers cash flow that goes on forever, but with a fixed payment. The cash flow amount. The amount of money generated by a specific investment (an annuity is a good example).

How do you do a perpetuity?

Perpetuity is one sort of annuity that pays forever....First of all, we know that the coupon payment every year is $100 for an infinite amount of time.And the discount rate is 8%.Using the formula, we get PV of Perpetuity = D / r = $100 / 0.08 = $1250.

What is the present value of a perpetuity of $100 given a discount rate of 5%?

$2,000. The present value of a perpetuity is computed as follows: present value = periodic payment / periodic discount rate.

What's the difference between annuity and perpetuity?

An annuity is a set payment received for a set period of time. Perpetuities are set payments received forever—or into perpetuity. Valuing an annuity requires compounding the stated interest rate. Perpetuities are valued using the actual interest rate.

Can a perpetuity run out of money?

A perpetuity is like an annuity except for one important difference. With an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. With a perpetuity, the payments continue on the same schedule infinitely.

How long does a perpetuity last?

A perpetuity is a type of annuity that lasts forever, into perpetuity. The stream of cash flows continues for an infinite amount of time.

Do perpetuities actually exist?

A perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. There are few actual perpetuities in existence. For example, the United Kingdom (UK) government issued them in the past; these were known as consols and were all finally redeemed in 2015.

What is the present value of $10000 per year in perpetuity at an interest rate of 10%?

$1,000PV = (10,000/0.10) = 100,000.

How much do perpetuities cost?

It typically divides cash flow by a discount rate, which is the interest rate banks pay to borrow money from the Federal Reserve. So, if you were to receive $10,000 every year forever, and the discount rate was 5%, the present value of your perpetuity would be 10,000 / 0.05 = $200,000.

What does continuing in perpetuity mean?

One of the most common is the phrase “in perpetuity.” According to Black's Law Dictionary, the definition of “in perpetuity” is “… that a thing is forever or for all time.” In practice, the phrase “in perpetuity” usually applies to a transfer of rights or clauses that survive contract termination.

How do you calculate perpetuity in Excel?

1:105:10Finance Basics 12 - Perpetuity Calculation in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo anyway the basic perpetuity formula is right here annual return divided by discount rate theMoreSo anyway the basic perpetuity formula is right here annual return divided by discount rate the discount rate simply basically the could just be the interest rate.

Can the value of a perpetuity be determined?

Preferred stocks in most circumstances receive their dividends prior to any dividends paid to common stocks and the dividends tend to be fixed, and in turn, their value can be calculated using the perpetuity formula. The value of a perpetuity can change over time even though the payment remains the same.

How is perpetuity growth rate calculated?

Growing Perpetuity Formula: g = the long-term growth in cash flows. The terminal value in year n (for example, year 5) equals the free cash flow from year 5 times 1 plus the growth rate (this is really the free cash flow in year 6) divided by the WACC (w) – growth rate (g).

What is a perpetuity in finance?

A perpetuity is a security that pays for an infinite amount of time. In finance, perpetuity is a constant stream of identical cash flows with no end. The formula to calculate the present value of a perpetuity, or security with perpetual cash flows, is as follows: The concept of a perpetuity is also used in a number of financial theories, ...

What is the difference between annuities and perpetuities?

However, the key difference between them is that annuities have a predetermined end date, known as the “maturity date”, whereas perpetuities are intended to last forever.

What are some examples of perpetual cash flows?

An example of a financial instrument with perpetual cash flows is the British-issued bonds known as consols, which the Bank of England phased out in 2015. By purchasing a consol from the British government, the bondholder was entitled to receive annual interest payments forever. 1 Although it may seem a bit illogical, ...

Why is each payment a fraction of the last?

Because of the time value of money, each payment is only a fraction of the last. Specifically, the perpetuity formula determines the amount of cash flows in the terminal year of operation. In valuation, a company is said to be a going concern, meaning that it goes on forever.

Usage of Perpetuity

Perpetuity is generally used to value assets like real estate. It is also used in infrastructure projects, where it’s easy to derive future cash flows.

Types of Perpetuity & Perpetuity Formula

There are two different annual perpetual valuations: perpetuity with flat or constant annuity and perpetuity with a growing annuity.

Growth Perpetuity

Growth Perpetuity is a Perpetuity that grows by a certain percentage every year. The growth rate can be expressed as a simple growth rate or as a compound rate.

Growth Perpetuity Formula

The general equation for Perpetuity with Growth Rate is: Perpetuity with growing annuity formula is the same as Perpetuity equation except that it includes growth rate in PV formula.

Difference of Perpetuity from Annuity

Perpetuity is the same as an annuity, but with one major difference: Perpetuity has no specified maturity date. This means that Perpetuity does not have a time value.

The Bottom Line

Perpetuity is one of the most common and simple financial terms, but it can be tricky to understand because there are multiple types and formulas.

What is a perpetuity?

A perpetuity is the sum of a regular series of fixed payments that will never end. It is today’s value of all those payments in the future. Some people define a perpetuity as an annuity in the general sense (as opposed to the specific insurance contract). According to Merriam-Webster’s, an annuity is: “a sum of money payable yearly ...

Why is perpetuity important?

The existence of the perpetuity formula makes it possible for financial experts to assign value to stocks, estates, land and an array of additional investments. Growing Perpetuity. The value of money depreciates over time.

Why do perpetuity payments diminish in value over time?

Or why the payments of a perpetuity diminish in value over time, even as they remain constant. In order to ensure that a perpetuity will retain its value in the years to come, the payouts from the perpetuity must do more than continue arriving. They also must grow at a certain rate that matches or exceeds inflation.

What is perpetuity in finance?

Simply put, a perpetuity in the financial world is the present value of a stream of cash that goes on into the future, forever. Though cash payments are infinite, it’s possible to calculate their present total value because the value of each payment incrementally decreases with each year to the point that it approximates zero.

What is an annuity contract?

An insurance company’s annuityis a contract that provides for a stream of income in exchange for a lump-sum premium or series of premiums. Often, the payouts are for the contract owner’s life. In the most standard of arrangements, these payments stop on the contract owner’s death, and the insurance company keeps any balance.

Is rent a perpetuity?

In other words, the rent from your apartment is a perpetuity. In practice, of course, you probably won’t own that apartment for all of eternity – and the rent wouldn’t stay fixed. But if you wanted to calculate the apartment’s value based on its income, you could use the perpetuity formula.

Is regular cash flow for infinity nice?

The idea of regular cash flow for infinity is awfully nice. Pensions had the same idea, though they were only for a worker’s lifetime. Now the closest thing you can buy is an annuity from an insurance company. If you’re interested in one, there are many kinds to choose from.

Definition of perpetuity

Synonyms Did you know? More Example Sentences Phrases Containing perpetuity Learn More About perpetuity

Did you know?

Continual existence—that elusive philosophical concept is reflected in perpetuity, which traces to Latin perpetuus, an adjective meaning "continual" or "uninterrupted." The word has specific legal use.

Examples of perpetuity in a Sentence

Recent Examples on the Web Undoubtedly, many of them would have advocated a U.S. presence in Afghanistan in perpetuity. — David Harsanyi, National Review, 8 Feb. 2022 During this journey, Shemaroo went through one of the largest IPR consolidation exercises in India, buying the rights in perpetuity for 1,600 films across languages.

What is a Perpetuity?

In finance, perpetuity refers to a system of cash flows for an infinite time. It is a stream of cash flows with no end.

How Does a Perpetuity Work?

The total theoretical value of a perpetuity is infinite. However, the present value of a perpetuity is finite. The PV of future cash flows arising annually (annuity) is calculated by adding all discounted annuities and decreasing the discounted annuity period until it reaches close to zero.

What is a Deferred Perpetuity?

A deferred or delayed perpetuity is a constant stream of cash flows starting at a predetermined future date with infinite life.

Formula

The formula for perpetuity calculates the present value of cash flows starting in one year. The formula for deferred perpetuity starting after a specific period “n” can be calculated as:

How Does a Deferred Perpetuity Work?

Deferred perpetuity is perpetuity starting with a delayed stream of cash flows rather than immediately. A normal perpetuity cash flow is discounted for one year.

Working Example of a Perpetuity

Suppose a company ABC pays a $ 5 dividend to its shareholders infinitely. We assume that the current rate of return used by ABC company is 6%.

Perpetuity Vs. Deferred Perpetuity – Key Differences

Both types represent an infinite stream of cash flows. The basic difference is when the cash flow starts at a constant rate.

Why is perpetuity important?

This is due to the difference in how a perpetuity is calculated compared to an annuity. Because a perpetuity goes on indefinitely it is difficult to calculate its face value. Its present value can be calculated, however.

What is a perpetuity annuity?

A perpetuity is a type of annuity that is set up so that the payments will never end. There is no set maturity date. As long as an investor owns a perpetuity, they will keep receiving payments. When the investor dies, the perpetuity will pass on to their heirs and keep making payments as normal. If the investor sells the perpetuity, ...

What is an annuity?

An annuity is an investment that makes regular payments throughout the year. It can be set up as a fixed or variable payment. Fixed annuities pay out a set minimum, while variable annuities are linked to an investment portfolio. A perpetuity is a type of annuity that is set up so that the payments will never end. There is no set maturity date.

Is a perpetuity a rare investment?

Because of their extremely long, potentially infinite time frame, perpetuities are relatively rare investments. Annuities are sold by insurance companies, and most of them don't sell perpetuities. The closest example of a true perpetuity is a type of bond from the British government known as a "Consol.".

Do all annuities stop making payments?

Most annuities eventually stop making payments. They might stop making payments after a set number of years or after the contract owner dies. However, if an annuity is set up so that it never stops making payments, then it is a perpetuity. In other words, all perpetuities are annuities, but not all annuities are perpetuities.

Do perpetuities decrease over time?

The value of a perpetuity tends to decrease over time. Perpetuities pass on to beneficiaries at the time of the holder's death and continue to make payments as before. Certain preferred stocks act as perpetuities in that they are sold without an expiration date and payout a fixed dividend.

Do perpetuity bonds have a maturity date?

These bonds have no maturity date and keep making interest payments forever—or at least as long as the British government is in existence. Although perpetuities pay out forever, they do not maintain their value as time goes on. The real benefit of a perpetuity is realized in the near future as opposed to later in time.