For accounting treatment, the capital leases are treated as the company’s assets and shown in the balance sheet. The funding provided by the lessor is treated as a liability. In the event of an agreement, the lessor will record it as the sale of property, and the lessee will record it as a purchase event.

Can lessor record depreciation?

Under an operating lease, the lessor records rent revenue (credit) and a corresponding debit to either cash/rent receivable. The asset remains on the lessor’s books as an owned asset. The lessor records depreciation expense over the life of the asset.

How to calculate capital lease payments?

Calculate the present value of all lease payments; this will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account. For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 ...

How to record the lease liability and corresponding asset?

The asset is recorded as the sum of the following amounts:

- The lease liability

- Any payments made to the lessor prior to commencement date (prepaid rent) less any incentives received from the lessor

- Any initial direct costs associated with the lease

What are capital lease requirements?

Top 4 Criteria for a Capital Lease

- Ownership. Ownership of a leased asset is transferred to the lessee at the end of the lease agreement. ...

- Bargain Purchase Option (BPO) If the lease agreement contains a bargain purchase option, the lease is called Capital Lease. ...

- Lease Term. ...

- Present Value. ...

How do you account for a capital lease?

For instance, if a company estimated the present value of its obligation under a capital lease to be $100,000, it then records a $100,000 debit entry to the corresponding fixed asset account and a $100,000 credit entry to the capital lease liability account on its balance sheet.

Where do capital leases go on balance sheet?

Capital leases are classified under the "fixed assets" or "plant, property and equipment" heading in the assets section of a small or large company's balance sheet.

Who owns the asset in a capital lease?

the lesseeComparison chartCapital LeaseLease criteria - OwnershipOwnership of the asset might be transferred to the lessee at the end of the lease term.Lease criteria - Bargain Purchase OptionThe lease contains a bargain purchase option to buy the equipment at less than fair market value.5 more rows

When a lessee is accounting for a capital lease?

A capital lease, referred to as a finance lease under ASC 842 and IFRS 16, is a lease that has the characteristics of an owned asset. In accounting, for a capital lease, the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor.

What is the journal entry for a capital lease?

The journal entry for a capital lease is the fair value of all future lease payments, calculated as the present value of future lease payments in the lease contract. Journal entries include the initial recognition of the lease, along with finance lease interest, depreciation, and recording payments.

How do I record a capital lease on my books?

Initial recordation. Calculate the present value of all lease payments; this will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account.

What happens at the end of a capital lease?

Description: In a capital lease, the lessor transfers the ownership rights of the asset to the lessee at the end of the lease term. The lease agreement gives the lessee a bargain option by dint of which the lessee can buy the asset at a discounted price than the fair market value at the end of the lease term.

Are capital leases Current liabilities?

Current Capital Lease Obligation is the amount due within a year of balance sheet date for long-term asset lease agreements that look economically similar to asset purchases. These are listed in the liabilities section of a balance sheet.

How do you record capital lease with residual value?

1:038:07Entries for Capital Leases- Guaranteed Residual ValueYouTubeStart of suggested clipEnd of suggested clipGive the ultimate journal entries necessary to record the payment to satisfy the residual guaranteeMoreGive the ultimate journal entries necessary to record the payment to satisfy the residual guarantee and to ride off the leased equipment accounts. So first the present value of the lease.

How does a capital lease work?

A capital lease (or finance lease) is an agreement where the lessor has agreed that the ownership of the asset will be transferred to the lessee when the lease period is over. It allows the lessee the choice of buying the asset at a bargain price that is lower than the market value at the end of the lease period.

How does a capital lease affect the income statement?

A capital lease also affects the income statement. You report depreciation as well as interest on the lease principal. You also record the right to use and the lease value respectively as an asset and a liability on the balance sheet.

Are capital leases Current liabilities?

Current Capital Lease Obligation is the amount due within a year of balance sheet date for long-term asset lease agreements that look economically similar to asset purchases. These are listed in the liabilities section of a balance sheet.

Do leases go on balance sheet?

Adoption of the IFRS 16 accounting standard for leases is starting to impact balance sheets for companies that choose to lease rather than buy assets. As a result, almost all leases are on the balance sheet.

Are capital leases considered debt?

Capital leases are counted as debt. They depreciate over time and incur interest. The lessor can transfer it to the lessee at the end of the lease term and it may contain a bargain purchase option that enables the lessee to buy it below fair market value.

Are capitalized leases intangible assets?

Since the leasehold serves as a contractually provided interest, not the actual building, it is an intangible asset.

What is capital lease?

A capital lease is a lease in which the lessee records the underlying asset as though it owns the asset. This means that the lessor is treated as a party that happens to be financing an asset that the lessee owns. Note: The lease accounting noted in this article changed with the release of Accounting Standards Update 2016-02, which is now in effect.

Who owns the leased asset?

Ownership of the leased asset shifts to the lessee following the lease expiration; or

What is depreciation in capital lease?

Depreciation. Since an asset recorded through a capital lease is essentially no different from any other fixed asset, it must be depreciated in the normal manner, where periodic depreciation is based on a combination of the recorded asset cost, any salvage value, and its useful life. For example, if an asset has a cost of $100,000, no expected salvage value, and a 10-year useful life, the annual depreciation entry for it will be a debit of $10,000 to the depreciation expense account and a credit to the accumulated depreciation account.

What does it mean when a lease payment is recorded as interest expense?

As the company receives lease invoices from the lessor, record a portion of each invoice as interest expense and use the remainder to reduce the balance in the capital lease liability account. Eventually, this means that the balance in the capital lease liability account should be brought down to zero.

How to record a lease payment?

Initial recordation. Calculate the present value of all lease payments; this will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account. For example, if the present value of all lease payments for a production machine is $100,000, record it as a debit of $100,000 to the production equipment account and a credit of $100,000 to the capital lease liability account.

When an asset is disposed of, is the asset credited?

When the asset is disposed of, the fixed asset account in which it was originally recorded is credited and the accumulated depreciation account is debited, so that the balances in these accounts related to the asset are eliminated.

Do leases have to be recorded as capital leases?

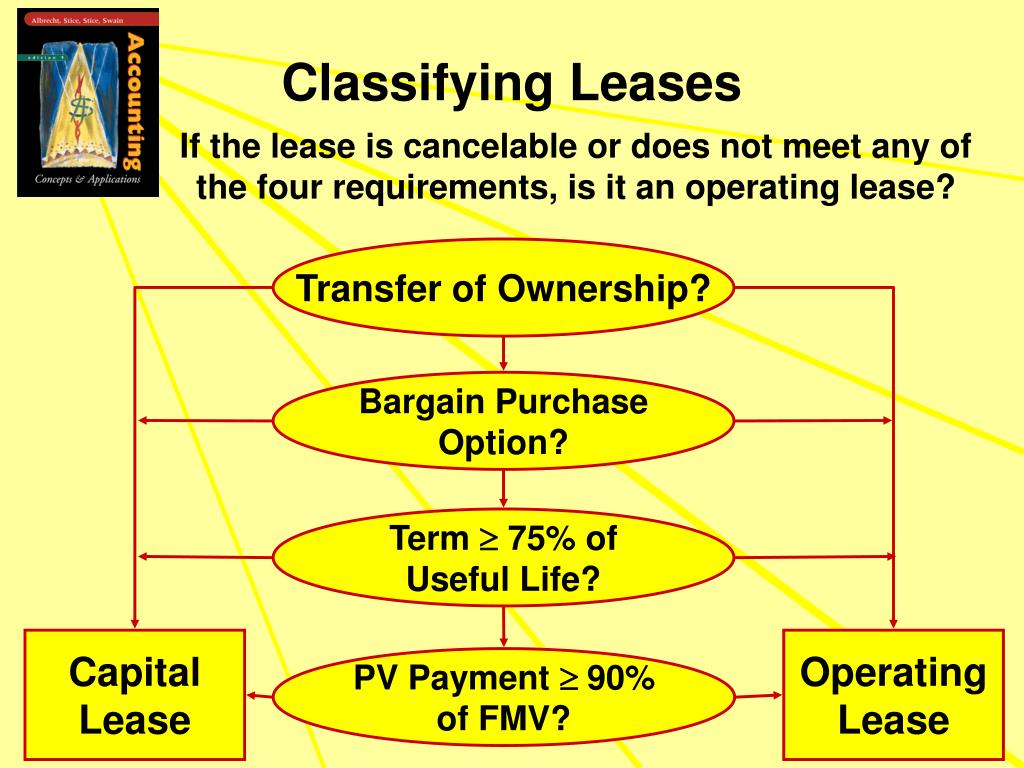

Under the old accounting rules, the lessor should record a lease as a capital lease if any of the following criteria are met:

What is a lessor lease?

There are two types of lessor capital leases: Sales-Type Lease: The lessor firm is typically a dealer or manufacturer who leases its equipment rather than selling the equipment outright.

What is direct financing lease?

Direct Financing Lease: The lessor firm leases to other companies at cost and the income from the lease is interest income. An example of this business model would be a financial institution that owns an aircraft leasing unit which leases aircrafts to other companies at a rate the covers the cost of the airplane plus interest. The income from the lease is recognized as interest income on the lessor’s income statement, representing the lessor’s return on investment in the capital lease.

Is a lease a capital lease?

Classifying a lease as a capital lease or operating lease by a lessor is a materially significant accounting policy, as the balance sheet, the income statement, the statement of cash flows, and key financial ratios will be different under the different methods.

Is a payment received from a lessee a rental?

Payments received from the lessee are treated as rental revenue on the lessor’s income statement and the lessor continues to account for the leased asset as a fixed asset on its balance sheet.

Can a lessor collect a lease payment?

The lessor can reasonably expect to collect the minimum lease payments ; and. The lessor has no material uncertainties regarding the amount of un-reimbursable costs yet to be incurred, as part of the lease agreement. If these conditions are not met, then the lessor normally must classify the lease as an operating lease.

What is a lessee in a lease?

Lessee A Lessee, also called a Tenant, is an individual (or entity) who rents the land or property (generally immovable) from a lessor (property owner) under a legal lease agreement. read more. at the end of the lease period. The lessee can buy an asset at the end of term at a value below market price.

What is depreciation in a lease?

Depreciation is charged on the asset as normal over the term of the agreement. The lease rent payments are divided into principal and interest and charged to the profit and loss account. Capital lease.

What happens after lease payments are made?

After Lease Payments are made – the lease payments are made, cash is reduced on the asset side , and also, the rental property is reduced by the depreciation amount. On the liabilities side, it has two effects, Lease obligation is reduced by the lease payment LESS the interest payments, and the shareholder’s equity is reduced by the interest expense and depreciation expense amount.

What is the present value of a lease payment?

Present value- The present value of the lease payment is 90% of the fair value of the asset at the beginning.

What is interest expense?

Interest Expense – The periodic payments to pay the lease needs to be broken down as per the interest payments at an applicable interest rate. Interest expense is calculated as Discount rate times the Lease liability at the beginning of the period

How long is a lease term?

Neither there is a bargain purchase option. The lease term is 3 years, while the useful life is 8 years. 3 years is less than 75% of 8 years, so the three tests for capital lease accounting are not met.

What is CFO in accounting?

Cash Flow From Operations (CFO) Cash flow from Operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating business in an accounting year. Operating Activities includes cash received from Sales, cash expenses paid for direct costs as well as payment is done for funding working capital. read more

What is lease accounting?

Lease accounting is the process by which entities record the financial impact of agreements to rent or finance the rights to use specific assets. This is commonly known as leasing. Recent accounting pronouncements have changed the way lessees and lessors are required to account for and report their leases.

Lessee vs. lessor

The terms “lessee” and “lessor” are used to identify the different parties involved in a lease agreement. This distinction is important because lease accounting as a lessor is significantly different from lease accounting as a lessee.

Lease accounting under the old standards

The legacy lease accounting standards included ASC 840, IAS 17, and various GASB standards, mainly GASB 13 and GASB 62. Before the announcement of new lease accounting standard requirements, most companies did not find it essential to pay close attention to operating leases within the financial reporting process.

New lease accounting standards, changes, and full examples

The FASB, IASB, and GASB have released new lease accounting standards over the last several years, which are ASC 842, IFRS 16, and GASB 87, respectively.

Why were these changes implemented?

The impetus behind the standard changes was to enhance transparency into financial obligations. Leases have long been a blind spot for financial statement users. Each of the standards requires entities to bring most leases onto the balance sheet.

Lease accounting calculations you need to know

Before you begin preparing your financial reports, you need to get a deeper understanding of what the standards require. There is a complex set of calculations you have to complete to be fully compliant. Below are some calculations that are necessary to account for your leases under the new standards and successfully navigate your transition:

Challenges companies face under the new standards

As companies adopt the new standards, they need to record all leases on the balance sheet, which, for public companies, has resulted in an average liability increase of 1,475%.