The following show two common ways to calculate CFADS:

- 1. Starting with EBITDA Adjust for changes in net working capital Subtract spending on capital expenditures Adjust for equity and debt funding Subtract taxes

- 2. Starting with Receipts from Customers

What does CFADS stand for?

Cash Flow Available for Debt Service (CFADS) = Revenue - Expenses +/- Net Working Capital Adjustments - Capital Expenditures - Cash Tax - Other Items

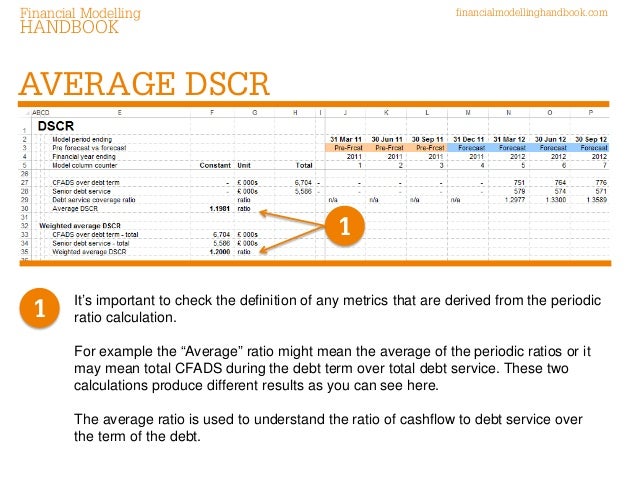

What is the CFADS ratio in the DSCR?

The DSCR uses CFADS in the numerator and debt service (calculated as principal + interest) is in the denominator. A ratio of 1.00x means that the CFADS in a period is equal to the total debt service in that same period. A ratio of greater than 1.00x means that there is sufficient cashflow to meet principal and interest payments.

What is cash flow available for Debt Service (CFADS)?

Cash flow available for debt service (CFADS) is arguably the most important metric in project finance. It determines how much cash is available to all debt and equity investors. Conceptually similar to unlevered free cash flows, CFADS is calculated as follows:

What items are included in the CFADS calculation?

Incorrect and n-n cashflow items are included in the CFADS calculation, such as: depreciation, cash balances, and reserve accounts balances. When modelling subordinated or mezzanine debt, it is important to include cash flow available at the appropriate level of seniority.

What is CFADS in finance?

What happens if a solar project is seasonal?

What is waterfall in project finance?

Is CFADS a cash flow?

Does CFADS cover full debt service?

Who is Kyle from Corality?

See 1 more

How do you calculate NPV for Cfads?

Calculation of NPV of CFADS The next step is to calculate the Net Present Value (NPV) of the qualifying CFADS. To do this start from the last period and calculate the NPV as CFADS/(1+ Discount Rate). For all the preceding years calculate the NPV as (CFADS + NPV of the next Period)/(1+ Discount Rate).

Is Cfads the same as FCF?

CFADS is the essence of Project Finance and if you are starting off in Project Finance – this is where to start. If your background is in Corporate Finance, the closest equivalent you will find when crossing the bridge from Corporate to Project Finance is Free Cash Flow (FCF).

What does Cfads mean?

cash flow available for debt serviceCADS is also known as cash flow available for debt service (CFADS). Cash available for debt service (CADS) is a numerical measure of how much cash is available to service debt obligations, generally short-term ones. CADS is often used in project finance, to determine if an investment or a venture is viable.

Is Cfads after interest?

Tax is a key component of CFADS. However, tax is based on net profit before tax, which is after interest expense. Therefore, if CFADS is used without thought, interest will be a function of CFADS available, but CFADS is calculated after interest.

How does project finance calculate Cfads?

How to Calculate Cash Flow Available for Debt Service?Starting with EBITDA. Adjust for changes in net working capital. Subtract spending on capital expenditures. Adjust for equity and debt funding. ... Starting with Receipts from Customers. Subtract payments to suppliers and employees. Subtract royalties.

What is included in Cfads?

They can include items such as operating revenues, operating expenses, capital expenditures, taxes, and funding. Alternatively, you can start with receipts from customers and net this against any outflows to arrive at CFADS.

Is Ebitda same as Cfads?

CFADS is preferred over EBITDA in determining gearing and lending capacity because this measure does not take taxes and timing of cash flows into consideration. EBITDA is a common metric in corporate finance but in project finance the focus is on actual cash flow.

How do you calculate debt service payments?

It is calculated by dividing the total net income by the total debt service, using the equation DSCR = total net income / total debt service. Creditors look at this information to assess a debtor's ability to pay current or new loans.

Does Cfads include Dsra?

The cash from which deposits are made in the DSRA is called cash flow available for debt services (CFADS). The cash can be withdrawn from the DSRA by both lenders and the project company if the project company fails to make debt principal repayment or interest payment.

What is Dsra interest?

The Debt Service Reserve Account (DSRA), which is a component of a debt service fund, is a reserve account used to pay interest and principal amounts of debt. The DSRA is very important when the cash flow available for debt services (CFADS) is below the necessary amount to make the payments.

What happens if DSCR is not met?

How a lender reviews DSCR could affect whether a loan is in good standing. If the target is not met, a lender may have the right to declare a loan default or have the right to require that borrower make principal reductions to bring the loan into compliance.

Does total debt service include interest?

Total debt service refers to current debt obligations, meaning any interest, principal, sinking fund, and lease payments that are due in the coming year. On a balance sheet, this will include short-term debt and the current portion of long-term debt.

Is Cfads the same as EBITDA?

CFADS is preferred over EBITDA in determining gearing and lending capacity because this measure does not take taxes and timing of cash flows into consideration. EBITDA is a common metric in corporate finance but in project finance the focus is on actual cash flow.

Is DCF and FCF the same?

Discounted Cash Flow (DCF) is an analysis method use to value a business. It estimates the revenues that a company will generate by calculating free cash flow (FCF) and the net present value of this FCF.

Is Dscr same as cash flow?

Key Takeaways. The debt-service coverage ratio (DSCR) is a measure of the cash flow available to pay current debt obligations.

What is the difference between FCF and CFO?

FCFF indicates the value remaining out for all of the firm's investors, including bondholders and shareholders, whereas FCFE denotes the amount left over for the firm's common equity holders only.

CFADS how to calculate it and why it matters... and it does - Pete Wild

CFADS is a measure of a company’s Cash Flow Available for Debt Servicing… and it matters because Bankers like it… so if you’re looking at an MBO or going on an acquisition spree chances are your bankers will look at your CFADS to see if they want to come along…. Calculating your CFADS… and how much they’ll lend you

How is cfads calculated?

How is Cfad calculated in UK? Measuring CFADS. CFADS is quite simple to calculate and is defined as: EBITDA +/- changes in working capital +/- corporation tax +/- capex +/- dividends You should compare this to your debt service obligations (i.e. your business’ bank and asset finance repayments, including interest). How do you calculate cash available for debt service?

CFADS Calculation Application | PDF | Debt | Loans - Scribd

CFADS Calculation Application - Free download as PDF File (.pdf), Text File (.txt) or read online for free. CFAD CALCULATOR

Debt Service Coverage Calculator | CB&S Bank

Get In Touch By phone. 877.332.1710 T 256.277.0677 F. By mail. P.O. Box 910 200 Jackson Avenue South Russellville, AL 35653. By chat. Monday through Friday 8am - 5pm CST

PF BASICS – PART 1: WHY CFADS IS KEY IN PROJECT FINANCE - LinkedIn

In the world of Project Finance, a project’s capacity to generate cash is at its core. Cash Flow Available for Debt Service (CFADS) is a measurement of precisely this.

What is CFADS in finance?

Cash flow available for debt service (CFADS) is arguably the most important metric in project finance. It determines how much cash is available to all debt and equity investors. Conceptually similar to unlevered free cash flows, CFADS is calculated as follows:

What happens if a solar project is seasonal?

If the project is highly seasonal (like a solar farm), expect to see fluctuations in CFADS (and commensurate fluctuations in debt service)

What is waterfall in project finance?

This cash-flow hierarchy is modeled as a “waterfall.” In a typical project finance waterfall, the starting line is CFADS, from which debt service is paid out, with the cash-flows remaining split in the hierarchy to other cash uses, for example:

Is CFADS a cash flow?

Hence, CFADS will form a large proportion of overall revenue cash flow. In projects where there is a feed stock, for example in a gas turbine, the cost of the feed material (e.g. gas) can be a huge component of revenue.

Does CFADS cover full debt service?

Lenders understand the ramp up and allow for a grace period before a full debt service is required as CFADS may not be enough to cover full debt service of interest and principal.

Who is Kyle from Corality?

Kyle was previously head of training EMEA at Mazars Global Infrastructure Finance, and trained professionals and students in project finance financial modeling around the world with project finance consulting firm Corality.

What does it mean when CFADS calculations are back calculated from EBITDA?

CFADS calculations back calculated from EBITDA is a warning sign that the modeller is inexperienced in project finance modelling and should be checked carefully.

What does 1.00x mean?

A ratio of 1.00x means that the CFADS in a period is equal to the total debt service in that same period. A ratio of greater than 1.00x means that there is sufficient cashflow to meet principal and interest payments. DSCR = CFADS / scheduled debt service. Scheduled debt service = interests + principal repayment.

What is CFADS plotted against?

Many projects experience a ramp-up period before they reach steady state production and revenue. In screenshot 2, CFADS is plotted against debt service. CFADS is increasing over time while debt service is decreasing over time.

Why is CFADS preferred over EBITDA?

CFADS is preferred over EBITDA in determining gearing and lending capacity because this measure does not take taxes and timing of cash flows into consideration. EBITDA is a common metric in corporate finance but in project finance the focus is on actual cash flow.

Does Mazars need contact information?

Mazars needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

What is a CFADS?

CFADS is a measure of a company’s Cash Flow Available for Debt Servicing… and it matters because Bankers like it… so if you’re looking at an MBO or going on an acquisition spree chances are your bankers will look at your CFADS to see if they want to come along…

How to calculate CFADS?

1.Caluclate your CFADS. 2.Adjust for their required DSCR (Debts Service Cover Ratio) 3.Deduct any existing Debt repayments you’re making. 4.Multiply the result by 3 or 4. And that tells them what they can afford to lend based on the company’s ability to generate enough cash to pay them back.

What is the waterfall report in project finance?

In Project Finance; however, the report of highest importance is none of the above. Instead, a Cash flow waterfall is often the main focus. A Cash flow waterfall simply lists the cash inflows and outflows as they occur. Importantly, it does this in terms of seniority, meaning that after taking into consideration your Revenue and Operating expenses, cash obligations that have a higher seniority (e.g. senior debt) are found further up in the Cash flow waterfall, whilst cash obligations with a lower seniority (e.g. distributions) are found further down in the Cash flow waterfall.

What is CFADS in finance?

In the world of Project Finance, a project’s capacity to generate cash is at its core. Cash Flow Available for Debt Service (CFADS) is a measurement of precisely this.

What tax should be deducted in the cash flow waterfall?

Put simply, the tax that should be deducted in the cash flow waterfall is the tax that will actually be paid in the period that you are calculating CFADS.

What are the three main reports that are included in an annual report?

The three main ones being an Income statement, a Balance sheet, and a Cash flow statement.

When does debt repayment start in CFADS?

The example calculation below shows the breakdown of a typical CFADS calculation. Debt repayments start after the start of operations when the project starts generating cash (January 2021 in the example).

Is EBITDA an approximation?

Whilst EBITDA is commonly used in the corporate world as an approximation for cash – that is exactly what it is, an approximation. In Project Finance, cash is of the highest importance due to a multitude of reasons (limited recourse being the main one), and an approximation simply will not do.

Is the tax line in your income statement a tax?

It is an over-simplification to assume that the tax line in your Income statement equates to Tax actually paid. In most tax jurisdictions there are many adjustments between the accounting profit and the taxable profit. Furthermore, the timing of tax payments is impacted by many factors (for example accumulated tax losses during the construction period).

What is CFADS in finance?

Cash flow available for debt service (CFADS) is arguably the most important metric in project finance. It determines how much cash is available to all debt and equity investors. Conceptually similar to unlevered free cash flows, CFADS is calculated as follows:

What happens if a solar project is seasonal?

If the project is highly seasonal (like a solar farm), expect to see fluctuations in CFADS (and commensurate fluctuations in debt service)

What is waterfall in project finance?

This cash-flow hierarchy is modeled as a “waterfall.” In a typical project finance waterfall, the starting line is CFADS, from which debt service is paid out, with the cash-flows remaining split in the hierarchy to other cash uses, for example:

Is CFADS a cash flow?

Hence, CFADS will form a large proportion of overall revenue cash flow. In projects where there is a feed stock, for example in a gas turbine, the cost of the feed material (e.g. gas) can be a huge component of revenue.

Does CFADS cover full debt service?

Lenders understand the ramp up and allow for a grace period before a full debt service is required as CFADS may not be enough to cover full debt service of interest and principal.

Who is Kyle from Corality?

Kyle was previously head of training EMEA at Mazars Global Infrastructure Finance, and trained professionals and students in project finance financial modeling around the world with project finance consulting firm Corality.