The steps for calculating the partnership capital account are as under:

- Step

- 1 – Credit the capital account with the capital contributed by partners, the share of profit, remuneration of...

- Step

- 2 – Debit the capital account Capital Account The capital account refers to the general ledger that records the...

- Step

- 3 – Share of profit is distributed in the...

What is partner's capital on a balance sheet?

What Is Partner's Capital on a Balance Sheet?

- Company Structure. A company that includes partner's capital on the balance sheet has the structure of a partnership. ...

- Equity. A business gets its funds from either liabilities or equity. ...

- Statement of Partner's Capital. A partnership usually prepares a financial document known as the statement of partner's capital. ...

- Partner's Capital on a Balance Sheet. ...

Can partnership capital accounts be negative?

Tax advisors are likely aware that a partner’s basis in the partnership interest can never be negative. However, a partner’s capital account can be negative. This generally happens when the partnership allocates losses or receives a distribution funded by debt incurred by the partnership. These actions can result in a taxable event for partners, so proactive steps need to be taken to avoid a negative balance.

What is a capital account in a partnership?

What is Partnership Capital Account?

- Explanation. A business entity Business Entity A business entity is one that conducts business in accordance with the laws of the country.

- Example. ABC and Co are the partnership firm with the three partners A, B, and C. ...

- Advantages. Transparency in the records is maintained through the capital account of partners. ...

What affects partner capital accounts?

profits or losses by the partnership, which are allocated based on the partnership agreement, increase the capital accounts (for profit) or decrease the capital accounts (for losses) distributions from the partnership to the partners decrease the capital accounts Partners' capital accounts are tracked on an accumulated basis.

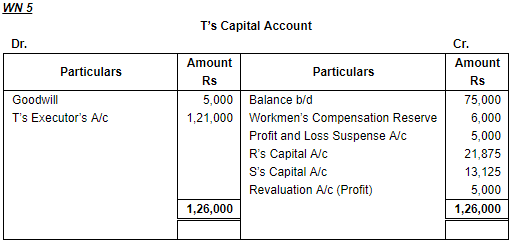

What is a Partnership Capital Account?

The partnership capital account is an equity account in the accounting records of a partnership. It contains the following types of transactions:

Does liquidating payment equate to balance in capital account?

The amount of liquid ating payment that a partner may eventually receive upon the termination of the business does not necessarily equate to the balance in the partnership capital account prior to the liquidation of the business. When assets are sold and liabilities settled, it is likely that their market values will differ from ...

What method do partnerships use to calculate capital accounts?

More specifically, the new tax code requires partnerships to exclusively use the tax basis method to calculate their capital accounts. Previously, taxpayers were allowed to use several different methods—such as GAAP, Section 704 (b), or others—so this change could result in significant accounting adjustments for some businesses.

Why do partnerships have special allocations?

Partnerships also have the ability to make special allocations, which restructure distributions of profits and losses so that they do not correspond to the partners’ actual percentage interests in the business. This enables a partnership to compensate a partner who made a greater initial investment by giving them a greater share of the profits. We often see this discrepancy in medical practices, law firms, engineering firms, financial services firms, and similar businesses.

Is a partnership an ideal entity?

If the members want to base their share in the profits and expenses on factors other than ownership percentage, a partnership is likely the ideal entity choice. Given this motivation for creating a partnership, an important question for tax advisors to ask is: “ How is the partnership going to share the income and losses? ” Since not everyone shares income and expenses of the business according to their ownership percentage, a tax advisor will need to thoroughly review the allocations in order to devise the best plan.

Do partnerships have to report capital accounts?

Beginning in tax year 2020, the IRS has updated its compliance rules for partnerships. Most partnerships will now be required to report their capital accounts. These accounts show the equity owned by each partner and typically include information like the initial contributions made by each partner, business profits and losses assigned to each partner, and distributions made to each partner.

What line do you enter capital on a partnership?

Partners Capital - enter the beginning and ending amounts. If is a difference between the beginning amount entered here and the amount entered on Schedule L, Line 21, an explanation of the differences should be included with the tax return.

What line is net increase in capital account?

Net Increases in Capital Accounts - This is amount is the sum of the preceding lines and is reported on Line 5 of Schedule M-2.

What is "other decreases" in a partnership?

Other Decreases - In this section the user will itemize any item recognized by the partnership that reduced the capital accounts of the partners. An entry in this field is uncommon. Select this line, select New, enter a description of the item, then enter the amount. These "Other Decreases" are itemized and reported on Line 7 of Schedule M-2.

What line does the beginning balance match on 1065?

On Form 1065, the beginning balance amount should normally match the amount entered as the beginning balance on Schedule L, Line 21.

What line is net income on M-1?

Net Income (Loss) per Books (Sch. M-1, Line 1) - This amount is pulled from the reconciled book income (loss) amount from the Schedule M-1. Any adjustments to this amount must be made on the Schedule M-1 menu. This book net income or loss is reported on Line 3 of Schedule M-2.

Where is cash contributed on Schedule M-2?

This cash contributed amount is reported on Line 2a of Schedule M-2.

Do all partnerships have to do this analysis?

Not all partnerships have to do this analysis, and many smaller partnerships do not complete Schedule M‑2.

What method do partnerships use to report their capital accounts?

Partnerships that used a method other than tax basis in 2019 but maintained capital accounts using the tax basis method (for example, for purposes of meeting the requirement to report partner negative tax capital accounts) must report each partner’s 2020 beginning capital account using the tax basis method.

When is a partnership required to report a negative capital account?

In an effort to improve the quality of the information reported by partnerships, the IRS introduced a new requirement in 2018 that mandated partnerships to provide information for partners with a negative tax basis capital account and required all partnerships to switch to tax basis capital account reporting in tax year 2019.

What is the IRS 2020-240?

According to the IRS news release (IR 2020-240), the IRS intends to issue an additional notice providing penalty relief for the transition in tax year 2020, in order to promote compliance. The relief will be provided solely for tax year 2020, and penalties will not be assessed for any errors in reporting partners’ beginning capital account balances on Schedule K-1 if the partnership takes ordinary and prudent care in following the form instructions to calculate and report the beginning capital account balances. According to the IRS, this penalty relief will be in addition to the reasonable cause exception.

What is the requirement for a partner to notify the partner of changes to the partner's outside basis?

A partner must notify the partnership, in writing, of any changes to the partner’s outside basis in its partnership interest during each partnership taxable year. For example, if a person purchases an interest in a partnership that uses the Modified Outside Basis Method, the purchasing partner must notify the partnership of its tax basis in the acquired partnership interest, regardless of whether the partnership has an IRC Sec. 754 – Manner of Electing Optional Adjustment to Basis of Partnership Property election in place or has a substantial built-in loss (IRC Sec. 743 (d)) at the time of the purchase of that interest.

What is modified previously taxed capital?

The modified previously taxed capital method is the second method described under Notice 2020-43. It references “previously taxed capital” in Reg. Sec. 1.743-1 (d) with certain modifications. The partner’s beginning capital account, under this method, is equal to the following:

When will Marcum report capital?

Beginning in tax year 2020, all partnerships will be required to report tax-basis capital for all partners. For specific questions, contact your Marcum professional. Our team can help review records and documentation to determine the tax basis capital for each partner or answer any questions you may have.

Does a partnership have to use GAAP for 2020?

If the partnership reported the partner capital accounts in 2019 using a different method (e.g., GAAP, Section 704 (b), or Other), it must use a tax basis method in 2020 as discussed below. For partnerships that used methods other than tax basis in 2019, the taxpayer should use one of the following methods to satisfy the 2020 tax basis capital ...

How Much Should Members Contribute to Capital Accounts?

The amount each member contributes should cover initial expenses of the LLC until the company's earnings are enough to cover the business's ongoing expenses. In the event more contributions are required, credits to members' capital accounts should reflect those additional contributions. If a company doesn't have adequate capital, the LLC could be disregarded, and members may be held personally liable for the company's debts and obligations. For LLCs with large risks or liabilities, larger capital contributions may be necessary.

Who creates a capital account?

The company's accountant or bookkeeper creates a capital account and maintains a log of each member's financial activities.

How Do Capital Accounts Work?

Individual members in the LLC have capital accounts, and each person should have a full understanding of the account basics . A person's ownership is formed on the basis of the amount he or she contributes at the beginning. "Running totals" are kept on the ownership and investment of members.

What happens if an LLC doesn't have enough capital?

If a company doesn't have adequate capital, the LLC could be disregarded, and members may be held personally liable for the company's debts and obligations.

What is capital account in LLC?

Capital accounts LLC are individual accounts of each person's investment in an LLC. These accounts track the contributions of the initial members to the LLC's capital, and adjustments are made for additional contributions.

What are capital adjustments?

These adjustments reflect business profits or business losses according to the ownership of each member as well as the operating agreement terms.

How to decrease capital account balance?

Ways to decrease the capital account balance include: Share of losses by members. Withdrawals for personal use. When an LLC is dissolved, capital accounts go back to the individual members after any liability payments of the LLC are made. This payment distribution to members is made in order of priority.