Finance professionals can use two formulas for calculating the degree of financial leverage:

- 1. DFL = (% of change in net income) / (% of change in the EBIT) In this formula, the percent change in a company's earnings before interest and taxes (EBIT) divides into the percent change of the company's net income.

- 2. DFL = (EBIT) / (EBT)

What does degree of financial leverage mean?

The degree of financial leverage is a leverage ratio. It calculates the proportional change in net income that is caused by a change in the capital structure of a business. This concept is used to evaluate the amount of debt that it is obligated to repay.

How do you calculate financial leverage?

- Total Assets = 1,050

- Equity = 650

- Financial Leverage Ratio = Total Assets / Equity = 1,050 / 650 = 1.615x

What is degree of financial leverage (DFL)?

The degree of financial leverage (DFL) is the leverage ratio that sums up the effect of an amount of financial leverage on the earning per share of a company. The degree of financial leverage or DFL makes use of fixed cost to provide finance to the firm and also includes the expenses before interest and taxes.

What are the different measures of financial leverage?

What is Leverage?

- Financial Leverage. When a company uses debt financing, its financial leverage increases. ...

- Financial Leverage Ratio. The financial leverage ratio is an indicator of how much debt a company is using to finance its assets.

- Operating Leverage. ...

- Operating Leverage Formula. ...

- More Resources. ...

How do you calculate degree of financial leverage?

Degree of financial leverage formulasDFL = (% of change in net income) / (% of change in the EBIT) In this formula, the percent change in a company's earnings before interest and taxes (EBIT) divides into the percent change of the company's net income.DFL = (EBIT) / (EBT)

How is the degree of operating leverage measures?

The degree of operating leverage measures how much a company's operating income changes in response to a change in sales. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings.

How do you calculate operating leverage and financial leverage?

Meaning of Financial Leverage:The formula to calculate the degree of financial Leverage is.DFL = % Change in EPS / % Change in EBIT.DFL = EBIT/ EBT.The formula to compute the degree of operating leverage is.DOL = % Change in EBIT / %Change in Sales.DOL = Contribution / EBIT.

How is the degree of operating leverage calculated quizlet?

The degree of operating leverage is computed by dividing contribution margin by net operating income. The excess of budgeted or actual sales over the break even dollar sales. A measure of how sensitive net operating income is to a given percentage change in dollar sales.

What is degree of operating leverage Mcq?

What is a Degree of Operating Leverage (DOL)? Degree of Operating Leverage measures the sensitivity of a company's operating income with changes in sales; a higher DOL implies a higher proportion of fixed cost in the business operations, whereas lower DOL implies lower fixed cost investment in running the business.

Is a higher degree of operating leverage better?

The benefits of high operating leverage can be immense. Companies with high operating leverage can make more money from each additional sale if they don't have to increase costs to produce more sales.

Is degree of operating leverage a percentage?

What is the Degree of Operating Leverage? The degree of operating leverage calculates the proportional change in operating income that is caused by a percentage change in sales. This concept is used to evaluate the cost structure of a business, not including the costs of financing and taxes.

How do you calculate operating leverage and EBIT?

The operating leverage formula is calculated by multiplying the quantity by the difference between the price and the variable cost per unit divided by the product of quantity multiplied by the difference between the price and the variable cost per unit minus fixed operating costs.

What is degree of leverage?

The degree of financial leverage is a financial ratio that measures the sensitivity in fluctuations of a company’s overall profitability to the volatility of its operating income caused by changes in its capital structure.

Why is leverage more volatile?

Also, a high degree of leverage may translate to a more volatile stock price because of the higher volatility of the company’s earnings. Increased stock price volatility means the company is forced to record a higher expense for outstanding stock options, which represents a higher cost of debt. Therefore, companies with extremely volatile operating ...

Why do highly leveraged companies face financial problems during a recession?

. Highly leveraged companies may face significant financial problems during a recession because their operating income will rapidly decline and, thus, so will their overall profitability.

Do taxes affect leverage?

Note that taxes do not affect the degree of financial leverage . A high degree of financial leverage indicates that even a small change in the company’s leverage may result in a significant fluctuation in the company’s profitability. Also, a high degree of leverage may translate to a more volatile stock price because of the higher volatility ...

What is the degree of financial leverage?

Degree of financial leverage formula calculates the change in net income occurring because of change in earnings before interest and taxes of the company; it helps in determining how sensitive the profit of the company is to the changes in the capital structure.

Why is financial leverage important?

It is important to understand the concept of the degree of financial leverage because it indicates the relationship between the capital structure of a company and its operating income. A low ratio is indicative of the low percentage of debt in a company’s capital structure, which again indicates that the sensitivity of the net income to the fluctuation in operating income is low, and as such, these companies are more stable. On the other hand, a high ratio indicates a higher percentage of debt in a company’s capital structure, and these companies are vulnerable because their net income is more responsive to fluctuations in operating income.

How to calculate EBIT for current year?

EBIT current year = Net income current year + Interest expense current year + Taxes current year

How to calculate DFL?

Step 1: Firstly, determine the net income from the income statement and then calculate the EBIT of the company by adding back the interest expense and taxes to the net income. Step 2: Next, calculate the EBT of the company by deducting the interest expense from the EBIT. Step 3: Finally, the DFL formula can be calculated by dividing the EBIT ...

What is DFL in finance?

Degree of financial leverage (DFL) refers to the sensitivity of net income to the fluctuation caused by a change in the capital structure, and it revolves around the concept that is used in the evaluation of the amount of debt that a company is required to repay.

How to calculate percentage change in income?

Firstly, determine the net income of a particular year from the income statement. Then, calculate the percentage change in net income by subtracting the net income of the previous year from that of the current year and then dividing the result by the net income of the previous year.

What is the formula for DFL?

DFL Formula = % change in net income / % change in EBIT

What is the degree of financial leverage?

Businesses use the degree of financial leverage ratio to analyze financial health and long-term success.

How to calculate degree of leverage?

Finance professionals can use two formulas for calculating the degree of financial leverage: In this formula, the percent change in a company's EBIT or "earnings before interest and taxes" divides into the percent change of the company's net income.

How to find percent change in EBIT?

To find percent change in EBIT, you need to know your EBIT for the current and previous periods. For instance, using the previous business example, assume the business calculates its EBIT with the formula (net income) + (interest) + (tax) to get $32,500 + $17,000 + $6,500 = $56,000 as its EBIT.

How to calculate DFL?

To calculate the DFL using percent changes in net income and your company's EBIT, use the formula DFL = (% of change in net income) / (% of change in the EBIT) and the following steps:

What is a DFL?

Finance professionals display the DFL as a percentage that represents a change in a business's net income because of a change in its earnings before interest and taxes (EBIT). The DFL ratio can show the level of financial leverage businesses have, which affects the volatility of earnings.

How to find the DFL of a business?

You can determine this percentage with the formula % of change in net income = [(current net income) - (previous net income)] / (previous net income) x 100. Using the previous example business, assume it continues calculating its DFL and determines its percent change in net income if its net income for the previous period is $29,900:

How to calculate net income?

Calculate the net income for the period you're measuring using the formula ( revenue) - (COGS) - (expenses). For example, if a business that produces and sells cellphone cases earns a revenue of $55,000 and has to cover $15,000 in costs of goods sold (COGS) and $7,500 in expenses, it calculates its net income as ($55,000) - ($15,000) - ($7,500) = $32,500.

What is financial leverage?

Financial leverage is the use of borrowed money (debt) to finance the purchase of assets. Types of Assets Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and.

When lending out money to companies, financial providers assess the firm’s level of financial leverage?

When lending out money to companies, financial providers assess the firm’s level of financial leverage. For companies with a high debt-to-equity ratio, lenders are less likely to advance additional funds since there is a higher risk of default. However, if the lenders agree to advance funds to a highly-leveraged firm, it will lend out at a higher interest rate that is sufficient to compensate for the higher risk of default.

What is debt to equity ratio?

The debt-to-equity ratio#N#Finance CFI's Finance Articles are designed as self-study guides to learn important finance concepts online at your own pace. Browse hundreds of articles!#N#is used to determine the amount of financial leverage of an entity, and it shows the proportion of debt to the company’s equity. It helps the company’s management, lenders, shareholders, and other stakeholders understand the level of risk in the company’s capital structure#N#Capital Structure Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm's capital structure#N#. It shows the likelihood of the borrowing entity facing difficulties in meeting its debt obligations or if its levels of leverage are at healthy levels. The debt-to-equity ratio is calculated as follows:

What happens if an asset depreciates 30%?

If the asset appreciates in value by 30%, the asset’s value will increase to $130,000 and the company will earn a profit of $30,000. Similarly, if the asset depreciates by 30%, the asset will be valued at $70,000 and the company will incur a loss of $30,000.

What is interest rate?

Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. . In most cases, the provider of the debt will put a limit on how much risk it is ready to take and indicate a limit on the extent of the leverage it will allow.

What is equity in a company?

Equity refers to the shareholder’s equity (the amount that shareholders have invested in the company) plus the amount of retained earnings (the amount that the company retained from its profits).

Why is leverage important in manufacturing?

High operating leverage is common in capital-intensive firms such as manufacturing firms since they require a huge number of machines to manufacture their products. Regardless of whether the company makes sales or not, the company needs to pay fixed costs such as depreciation on equipment, overhead on manufacturing plants, and maintenance costs.

What does higher DFL ratio mean?

A higher DFL ratio means a company's EPS is more volatile. For example, assume Company ABC in its first year has EBIT of $50 million, an interest expense of $15 million and 50 million outstanding shares. Company ABC's resulting EPS is 70 cents, or ($50 million – $15 million) ÷ 50 million shares.

How to calculate EPS?

EPS is used to determine a company's profitability. EPS is calculated by subtracting dividends paid out to shareholders from a company's net income. The resulting value is divided by the company's outstanding shares.

What are the measures of financial leverage?

Measures of Financial Leverage 1 Debt Ratio: It is the ratio of debt to total assets of the firm which means what percentage of total assets is financed by debt. 2 Debt Equity Ratio: It is the ratio of debt to equity which signifies how many dollars of debt is taken per dollar of equity. 3 Interest Coverage Ratio: It is the ratio of profits to interest. This ratio is also represented in times. It represents how many times of the interest is the available profit to pay it off. Higher such ratio, higher is the interest paying capacity. The reciprocal of it is income gearing.

What are the three leverages?

There are basically three leverages; operating leverage, financial leverage, combined leverage. The objective of introducing leverage to the capital is to achieve maximization of wealth of the shareholder. Financial leverage deals with the profit magnification in general.

What is debt ratio?

Debt Ratio: It is the ratio of debt to total assets of the firm which means what percentage of total assets is financed by debt. Debt Equity Ratio: It is the ratio of debt to equity which signifies how many dollars of debt is taken per dollar of equity. Interest Coverage Ratio: It is the ratio of profits to interest.

What is interest coverage ratio?

Interest Coverage Ratio: It is the ratio of profits to interest. This ratio is also represented in times. It represents how many times of the interest is the available profit to pay it off. The higher such ratio, the higher is the interest-paying capacity. The reciprocal of it is income gearing.

Is debt a part of financial planning?

Debt is an integral part of the financial planning of anybody whether it is an individual, firm or a company. We will try to understand it from the business point of view. In a business, debt (short or long term) is acquired not only on the grounds of ‘need for capital’ but also taken to enlarge the profits accruing to the shareholders.

Is leverage always profitable?

12%. This is the reason behind the higher EPS as well as ROE in the case of a levered firm. So, leverage would not always be profitable. The following matrix explains the behavior of levering a firm.

What is the degree of operating leverage?

The degree of operating leverage (DOL) is the ratio of the percentage change in operating income to the percentage change in units sold. We can use the following formula to measure the degree of operating leverage:

What is leverage in business?

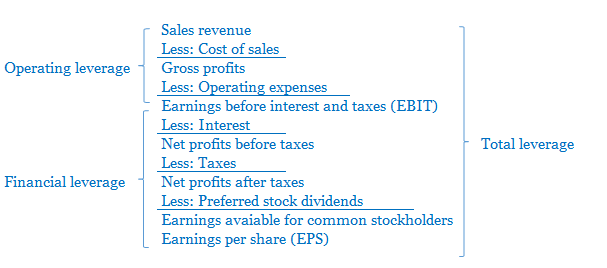

This reading presents elementary topics in leverage. Leverage is the use of fixed costs in a company’s cost structure. Fixed costs that are operating costs (such as depreciation or rent) create operating leverage. Fixed costs that are financial costs (such as interest expense) create financial leverage.

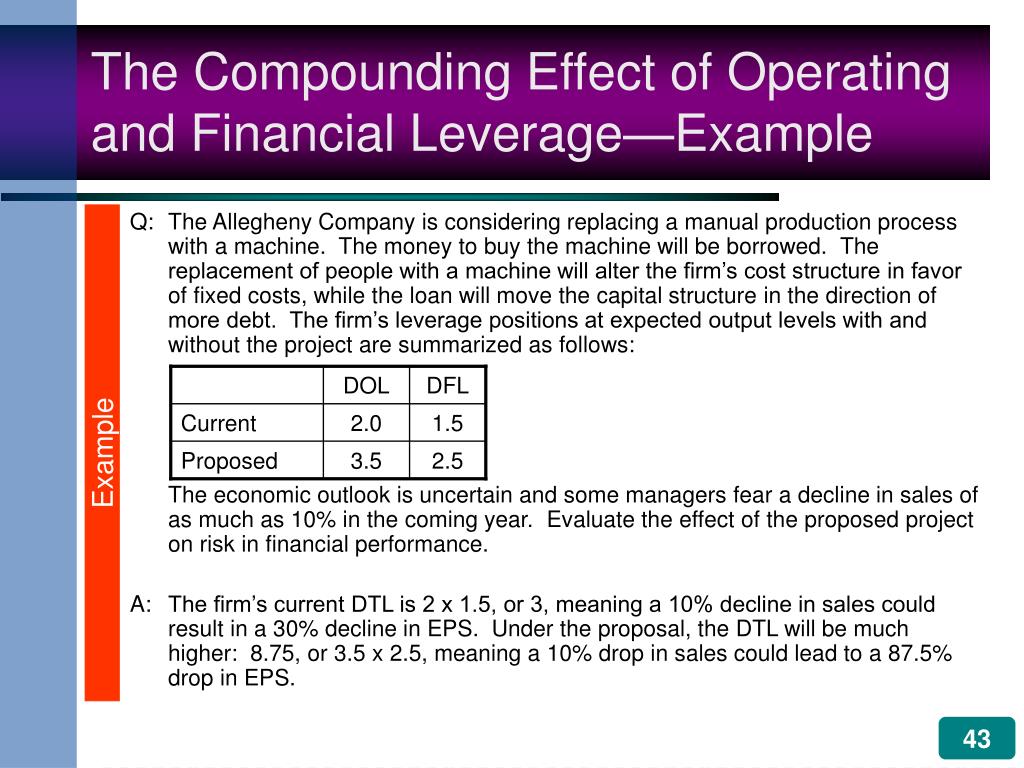

What is DTL in accounting?

The degree of total leverage (DTL) is a measure of the sensitivity of net income to changes in unit sales, which is equivalent to DTL = DOL × DFL.

What is the operating breakeven point?

The operating breakeven point, QOBE, is the number of units produced and sold at which the company’s operating income is zero, which we calculate as

Why is leverage important?

First, the degree of leverage is an important component in assessing a company’s risk and return characteristics. Second, analysts may be able to discern information about a company’s business and future prospects from management’s decisions about the use of operating and financial leverage. Knowing how to interpret these signals also helps ...

Why are fixed costs leveraged?

Analysts refer to the use of fixed costs as leverage because fixed costs act as a fulcrum for the company’s earnings. Leverage can magnify earnings both up and down. The profits of highly leveraged companies might soar with small upturns in revenue.

Does leverage magnify earnings?

Leverage can magnify earnings both up and down. The profits of highly leveraged companies might soar with small upturns in revenue. But the reverse is also true: Small downturns in revenue may lead to losses. Analysts need to understand a company’s use of leverage for three main reasons.

How to Calculate Degree of Financial Leverage?

Thus, DFL is calculated by dividing the percentage change in EPS and the percentage change in EBIT.

Why is degree of financial leverage important?

The degree of financial leverage is an important indicator to measure the relative changes of EPS compare to changes in EBIT.

How does financial leverage affect EBIT?

The effect of financial leverage results from the changes in the firm’s EBIT. An increase in EBIT results in a more than proportional increase in EPS. Whereas, a decrease in EBIT results in a more than proportional decrease in EPS.

What is leverage in financial terms?

Financial leverage is the potential use of fixed financial costs to magnify the effects of changes in earnings before interest and taxes on the firm’s earnings per share. Financial leverage is concerned with the relationship between a company’s earnings before interest and taxes (EBIT) and its earnings per share (EPS) of common stock.

What is a DFL?

DFL is the numerical measure of a corporation’s financial leverage. Similarly to the degree of operating leverage, DFL represents the changes of two variables. These are the percentage change in earnings per share (EPS) and percentage change in earnings before interest and taxes (EBIT).

What are fixed financial costs?

There are two common fixed financial costs that we usually see in the income statement of a company. These are the interest on debt and preferred stock dividends. The interest on debt and preferred stock dividends are generally a must expenses to be reflected in the corporation’s income statement regardless of the amount of EBIT available to pay them. These two costs represent the total fixed financial costs of a corporation.

How much is 40% increase in EBIT?

From the example above, 40% increase in EBIT is at $14,000 ($10,000 × 40%) while the 40% decrease in EBIT is at $6,000 ($10,000 × (100% – 40%)).