How do you manually calculate a mortgage payment?

- You can calculate a monthly mortgage payment by hand, but it's easier to use an online calculator.

- You'll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

- Click here to compare offers from refinance lenders »

What is the formula for calculating monthly mortgage?

Monthly mortgage payments are calculated using the following formula: P M T = P V i ( 1 + i) n ( 1 + i) n − 1. where n = is the term in number of months, PMT = monthly payment, i = monthly interest rate as a decimal (interest rate per year divided by 100 divided by 12), and PV = mortgage amount ( present value ).

How do you calculate the principal of a loan?

- Input -250 and press the [PMT] key (the 250 payment will be negative cash flow for you)

- Input 48 and press the [N] key

- Input 6 and press the [I/Y] key

- Press the [CPT] key and the [PV] key

How do you calculate paying off mortgage?

Run scenarios for:

- Paying off the debt

- Refinancing

- Spending

- Investing the money

How do you calculate monthly principal and interest payments?

CalculationDivide your interest rate by the number of payments you'll make that year. ... Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month. ... Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.More items...•

How is the principal and interest calculated?

In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is calculated on the outstanding principal balance each month. This means the monthly interest amount declines over time as the outstanding principal declines.

What is the formula for calculating principal?

The formula for calculating Principal amount would be P = I / (RT) where Interest is Interest Amount, R is Rate of Interest and T is Time Period.

How do you calculate principal and interest payments manually?

To figure your mortgage payment, start by converting your annual interest rate to a monthly interest rate by dividing by 12. Next, add 1 to the monthly rate. Third, multiply the number of years in the term of the mortgage by 12 to calculate the number of monthly payments you'll make.

How can I pay off my 30 year mortgage in 15 years?

Options to pay off your mortgage faster include:Pay extra each month.Bi-weekly payments instead of monthly payments.Making one additional monthly payment each year.Refinance with a shorter-term mortgage.Recast your mortgage.Loan modification.Pay off other debts.Downsize.

What happens if I make a large principal payment on my mortgage?

Since your interest is calculated on your remaining loan balance, making additional principal payments every month will significantly reduce your interest payments over the life of the loan. By paying more principal each month, you incrementally lower the principal balance and interest charged on it.

What is principal amount with example?

Understanding Principal In the context of borrowing, principal is the initial size of a loan—it can also be the amount still owed on a loan. If you take out a $50,000 mortgage, for example, the principal is $50,000. If you pay off $30,000, the principal balance now consists of the remaining $20,000.

What principal will amount to 16000?

Expert-verified answer So that the Principal will be "10000".

Which is calculated by multiplying the principal?

It is calculated by multiplying the principal amount by one plus the annual interest rate raised to the number of compound periods, and then minus the reduction in the principal for that year. With compound interest, borrowers must pay interest on the interest as well as the principal.

How do you calculate principal and interest separately?

First, calculate the interest portion of the payment by multiplying the mortgage balance by the annual interest rate. Then divide the result by 12, for the number of months in the year: 0.09375 x $200,000 = $18,750. $18,750 12 = $1,562.50.

Which formula should be used to correctly calculate the monthly mortgage?

If you want to do the monthly mortgage payment calculation by hand, you'll need the monthly interest rate — just divide the annual interest rate by 12 (the number of months in a year). For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% (0.04/12 = 0.0033).

Why is my interest higher than principal?

In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower.

What is the formula for calculating a 30 year mortgage?

Use this mortgage formula and plug in the appropriate numbers: Monthly Payments = L[c(1 + c)^n]/[(1 + c)^n - 1], where L stands for "loan," C stands for "per payment interest," and N is the "payment number."

How is interest calculated?

Here's the simple interest formula: Interest = P x R x N. P = Principal amount (the beginning balance). R = Interest rate (usually per year, expressed as a decimal). N = Number of time periods (generally one-year time periods).

Is it better to pay principal or interest on car loan?

IS IT BETTER TO PAY PRINCIPAL OR INTEREST ON A CAR LOAN? It's better to pay the principal. The principal is the set amount you borrowed to pay for the vehicle, but the interest fees can change based on how much principal you still owe each month.

Why do early payments have interest?

The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge.

What does it mean when you pay extra on a mortgage?

If you pay extra on your loan early into the term it means the associated debt is extinguished forever, which means a greater share of your future payments will apply toward principal. We offer the web's most advanced extra mortgage payment calculator if you would like to track how one-off or recurring extra payments will impact your loan.

How long does a mortgage keep the same interest rate?

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. 1 For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

Do you have to pay down interest only loans?

Interest-only loans are much easier to calculate. Unfortunately, you don’t pay down the loan with each required payment, but you can typically pay extra each month if you want to reduce your debt. 4

Do you have to make additional payments to pay down a loan?

You make additional payments, above and beyond the required minimum payment. Doing so will reduce your loan balance, but your required payment might not change right away. After a certain number of years, you’re required to start making amortizing payments to pay down the debt.

What is principal payment?

A principal payment is a payment toward the original amount of a loan that is owed. In other words, a principal payment is a payment made on a loan. Bullet Loan A bullet loan is a type of loan in which the principal that is borrowed is paid back at the end of the loan term. In some cases, the interest expense is.

Why is principal payment important?

A higher principal payment on a loan reduces the amount of interest owed and , in turn, reduces the total amount paid over the life of the loan. Therefore, principal payments play a significant role in ...

How much is the unpaid balance in 10 years?

In 10 years, the unpaid balance is $0. The principal payment each year goes to reducing the unpaid balance. Since this amount each year is $1,000, the unpaid balance is reduced by $1,000 yearly. The interest payment is calculated on the unpaid balance.

What is prepayment agreement?

Prepayment. Prepayment A Prepayment is any payment that is made before its official due date.

How much interest do banks charge on principal?

A bank may require 5% annual interest on the principal amount – the fee paid to borrow the money. The individual in the situation above would need to make an annual total payment that consists of both principal and interest payments.

What are the components of a loan?

Understanding the components of a loan is very important. Every loan comprises two components – the principal and the interest . Interest Expense Interest expense arises out of a company that finances through debt or capital leases. Interest is found in the income statement, but can also.

Does interest compound with each period?

In many cases, interest compounds with each designated period of a loan, but in the case of simple interest, it does not . The calculation of simple interest is equal to the principal amount multiplied by the interest rate, multiplied by the number of periods.

What is mortgage principal?

What is a mortgage principal? Your mortgage principal is the amount you borrow from a lender to buy your home. If your lender gives you $250,000, your mortgage principal is $250,000. You'll pay this amount off in monthly installments for a predetermined amount of time, maybe 30 or 15 years.

What is mortgage principal vs mortgage interest?

Mortgage principal payment vs. mortgage interest payment. Your mortgage principal isn't the only thing that makes up your monthly mortgage payment. You'll also pay interest, which is what the lender charges you for letting you borrow money. Interest is expressed as a percentage.

What is PMI insurance?

Mortgage insurance: Private mortgage insurance (PMI) is a type of insurance that protects your lender should you stop making payments. Many lenders require PMI if your down payment is less than 20% of the home value. PMI can cost between 0.2% and 2% of your loan principal per year.

How much does PMI cost?

PMI can cost between 0.2% and 2% of your loan principal per year. Keep in mind, PMI only applies to conventional mortgages, or what you probably think of as a regular mortgage. Other types of mortgages usually come with their own types of mortgage insurance and sets of rules.

Do principal payments change with adjustable rate?

So the adjustments balance out to equal the same amount in payments each month. Although your principal payments won't change, there are a few instances when your monthly payments could still change: Adjustable-rate mortgages. There are two main types of mortgages: adjustable-rate and fixed-rate.

Can you change your principal when refinancing?

Depending on your situation , your principal could change when you refinance. Extra principal payments. You do have an option to pay more than the minimum toward your mortgage, either monthly or in a lump sum. Making extra payments reduces your principal, so you'll pay less in interest each month.

Do you have to pay off your mortgage early?

Some lenders charge prepayment penalties, or a fee for paying off your mortgage early. You probably wouldn't be penalized every time you make an extra payment, but you could be charged at the end of your loan term if you pay it off early, or if you pay down a huge chunk of your mortgage all at once.

How to contact the CFPB about a mortgage?

If you have a problem with your mortgage, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). Read full answer.

What is the balloon payment on a mortgage?

Because the monthly payments aren’t high enough to pay off the full loan, the remaining loan balance is due as one large final payment (known as the “balloon” payment) at the end of the loan term. So, for example, if you had a mortgage loan of $100,000 for 30 years at an interest rate of four percent, your monthly principal ...

How to calculate principal on a home loan?

To calculate your principal, simply subtract your down payment from your home’s final selling price. For example, let’s say that you buy a home for $200,000 with a 20% down payment.

What is the difference between interest and principal on a mortgage?

Your monthly mortgage payment has two parts: principal and interest. Your principal is the amount that you borrow from a lender. The interest is extra money that goes to your lender in exchange for giving you a loan. Most lenders calculate interest in terms of annual percentage rate (APR) that you pay per year.

What is escrow in mortgage?

Escrow. Your mortgage lender might take a certain percentage of your monthly payment for an escrow account. An escrow account holds what you owe in property taxes and insurance premiums. Lenders collect this money and pay for it on your behalf to ensure you keep up with your coverage and tax dues.

What is the second part of a mortgage payment?

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate interest in terms of an annual percentage rate (APR). APR is the amount of interest that you pay on your loan per year.

What is APR on a loan?

APR is the amount of interest that you pay on your loan per year. For example, if you borrow $100,000 at an APR of 5%, you’d pay a total of $5,000 per year in interest. At the beginning of your loan (when your principal is high), most of your monthly payment goes toward paying off interest. Just a few percentage points of interest can make ...

How much money can you save by paying principal?

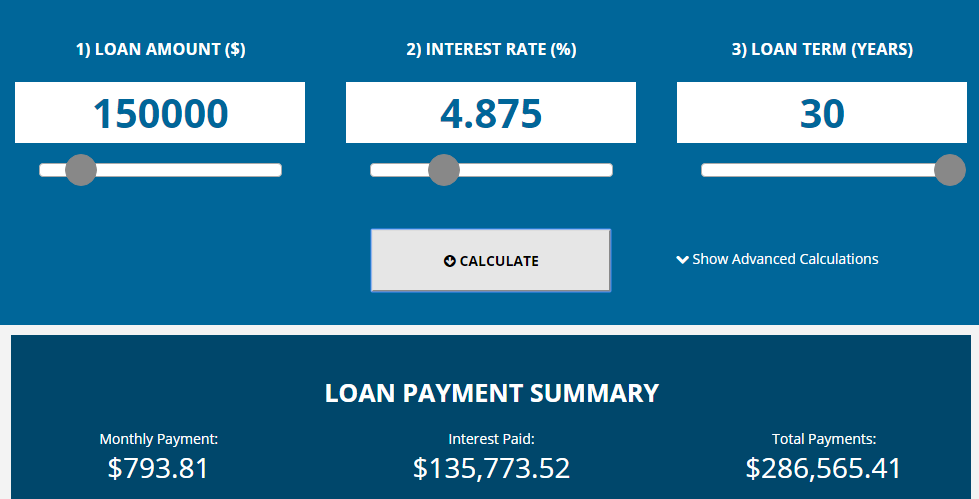

Paying just a little extra money each month on your principal can save you a lot of money over your loan term, or the number of years until you have to pay it off. For example, let’s say you have a $150,000 loan with a 4% interest rate and a 30-year term. Your monthly mortgage payment would be $716.12.

How much interest does a 30-year loan have?

One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate. If you choose the first lender, you’ll pay a total of $107,804.26 in interest by the time you make your last payment.

What are the factors that determine the monthly payment of a mortgage?

Mortgage Payments. The main factors determining your monthly mortgage payments are the size and term of the loan. Size is the amount of money you borrow and the term is the length of time you have to pay it back. Generally, the longer your term, the lower your monthly payment.

Why is it good to make extra principal payments?

This is why it can be good to make extra principal payments if the mortgage permits you to do so without a prepayment penalty. 8 They reduce your principal which, in turn, reduces the interest due on each future payment, moving you toward your ultimate goal: paying off the mortgage.

What is the monthly payment for a mortgage closing on January 25?

If the mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, which is the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment. You should have all this information in advance.

What happens if you make a 20% down payment?

If you make a down payment of less than 20%, you will be required to take out private mortgage insurance, which increases your monthly payment. Some payments also include real estate or property taxes.

How are property taxes calculated?

Taxes are calculated by the government on a per-year basis, but you can pay these taxes as part of your monthly payments. The amount due is divided by the total number of monthly mortgage payments in a given year. The lender collects the payments and holds them in escrow until the taxes have to be paid. 6

What is a mortgage loan?

A mortgage is a long-term loan designed to help you buy a house. In addition to repaying the principal, you also have to make interest payments to the l ender. The home and land around it serve as collateral. But if you are looking to own a home, you need to know more than these generalities.

What type of insurance is included in a mortgage payment?

There are two types of insurance coverage that may be included in a mortgage payment. One is property insurance , which protects the home and its contents from fire, theft, and other disasters.

How Amortizing Payments Work

If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin.

Example Amortization Table

As an example, consider a 10 year loan for $250,000 at 8% APR with monthly payments. The monthly payment would be $3,033.19 throughout the duration of the loan. In the first payment $1,666.67 would go toward interest while $1,366.52 goes toward principal. In the final payment only $20.09 is spent on interest while $3,013.12 goes toward principal.

Boydton Homeowners May Want to Refinance at Today's Low Rates & Save

Lower Interest Expenses: Pay off higher interest rate credit cards & pay for college tuition.

How Amortization Works

- You may be wondering why your mortgage payment—if you have a fixed-rate loan—stays the same from one month to the next. In theory, that interest rate is being multiplied by a shrinking principal balance. So shouldn’t your monthly bill get smaller over time? The reason that’s not the …

Adjustable-Rate Mortgages

- If you take out a fixed-rate mortgage and only pay the amount due, your total monthly payment will stay the same over the course of your loan. The portion of your payment attributed to interest will gradually go down, as more of your payment gets allocated to the principal. But the total amount you owe won’t change. However, it doesn’t work that way for borrowers who take out an …

Interest Rate vs. Apr

- When receiving a loan offer, you may come across a term called the annual percentage rate(APR). The APR and the actual interest rate that the lender is charging you are two separate things, so it’s important to understand the distinction. Unlike the interest rate, the APR factors in the total annual cost of taking out the loan, including fees such as mortgage insurance, discount points, loan ori…