How many times may a debt collector call you?

The only time it is legal for a debt collector to call you more than one time per day is if you have previously agreed to speak at a specific time. For instance, if they call you in the morning and you ask them to call back in the afternoon, they may do so.

What to do when Debt Collector calls?

When a debt collector calls, take the time to speak with the collector. If the time of day that the collector has called is inconvenient, you can request a call back at a preferred time . Having advanced notice and an opportunity to prepare may help consumers avoid a sense of unexpected pressure .

How to get debt out of collections in 9 steps?

- Make a list of all your sources of income. Include every way you earn money, whether it's from your job, investments, interest income, etc. ...

- Make another list of your monthly expenses. ...

- Subtract your monthly expenses from your monthly income. ...

- Every month, be sure to stay within your budget. ...

What happens if you don't pay a collection agency?

If you don't pay a collection agency, the agency will send the matter back to the original creditor unless the collection agency owns the debt. If the collection agency owns the debt, they may send the matter to another collection agency. Often, the collection agency or the original creditor will sue you.

How Many Times Can A Debt Collector Call You In One Day?

How to stop debt collectors from calling you?

What is Considered Debt Collection Harassment?

What happens if a debt collector violates the FDCPA?

What is the Fair Debt Collection Practices Act?

Can you sue a debt collector for harassment?

Can a third party debt collector harass you?

See 2 more

Is there a limit to how many times a debt collector can call me?

You do have a right to tell the debt collector to stop calling you. The CFPB has prepared sample letters that you can use to respond to a debt collector who is trying to collect a debt along with tips on how to use these letters. The sample letters may help you to get information, set limits or stop any further communication, or protect some of your rights.

How Many Times a Day Can a Debt Collector Call? - DoNotPay

How Many Calls From a Debt Collector Is Considered Harassment? Besides the time restrictions provided above, debt collectors can't call you repeatedly or continuously to abuse, harass, or annoy you? As such, while the FDCPA doesn't exactly dictate or limit the number of calls it can make to you, it certainly hinders them from calling you several times just to harass you (15 U.S. Code § 1692d).

How Many Times Can a Debt Collector Call You? - Lemberg Law

Under the law, it’s not only the number of times a debt collector calls that matters. It is also how often they call. Multiple calls without leaving a message isn’t considered harassment, but attempting to speak with you within 7 days of a telephone conversation is.

How many times can a debt collector call you?

A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

What happens if you tell a debt collector to stop contacting you?

If you tell a debt collector in writing to stop contacting you, it may not contact you again except: To say there will be no further contact. To notify you that the debt collector or the creditor may take some specific action it is legally allowed to take, such as filing a lawsuit against you.

How to file a complaint with the CFPB?

If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

How many times can a debt collector call before it’s harassment?

The FDCPA prohibits debt collector from engaging in conduct that has the natural consequence of harassing, oppressing, or abusing you. The Act recognizes that making your phone ring repeatedly or continuously in order to annoy, harass, or abuse you to be a violation of this prohibition. This conduct is also prohibited by the debt collection statutes of many states. But the law does not put a number on “repeatedly or continuously.”

How to determine if a debt collector has violated the prohibition against repeated or continuous calls?

In determining whether a debt collector’s frequent calls rise to the level of “repeated,” “continuous,” “annoying,” or “harassing,” courts will look at all of the surrounding circumstances including both the volume and pattern of the calls.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA) protect you from an unreasonable number of debt collection calls, but neither law specifies how many calls are too many calls.

What does "continuously" mean in the FDCPA?

In the FTC regulations, “repeatedly” is defined as “calling with excessive frequency under the circumstances,” and “continuously” means “a series of collection calls, ...

What time does a caller have to be made?

Are made between the hours of 8:00 a.m. and 9:00 p.m. Do not provide the name of the caller and identify the business. Do not provide a contact phone number or address. Do not provide an automatic opt-out mechanism.

Is it harassment to call a debt collector?

Under the law, it’s not the number of times a debt collector calls that matters; rather, it’s how often they call. Multiple calls without leaving a message isn’t considered harassment, but speaking with you in the morning and then calling again that day likely is.

Is there a limit to how many times a creditor can call?

No bright line exists between a permissible and impermissible number of calls. However, the FDCPA does provide you with a way to draw that line. However, the Federal Trade Commission (FTC), the governmental agency responsible for enforcing the FDCPA, defines the terms “continuously” and “repeatedly” in its regulations. In the FTC regulations, “repeatedly” is defined as “calling with excessive frequency under the circumstances,” and “continuously” means “a series of collection calls, one right after another.”

How many times can a debt collector call me?

First, one of the most important things you need to know when a debt collector calls you is that you have legal rights. Debt collecting agents must not use improper methods or any form of harassment when contacting you. This means debt collectors agents are not allowed to use abusive language or intimidate you with physical violence.

When was the Fair Debt Collection Practices Act passed?

The FDCPA (Fair Debt Collection Practices Act) was approved in 1977 with the aim of eliminating abusive debt collection practices. Are you getting harassing calls from a debt collector at home or at work ? Are you receiving many calls per day from the same collector? Are debt collectors filling your voicemail box and calling at all hours of the day? You don’t have to put up with harassing calls. Some of these calls are illegal!

Can a debt collector call you?

Federal law doesn’t give a specific limit on the number of calls a debt collector can place to you. However, a debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you. A debt collector can’t call you about your consumer debt at an unusual or inconvenient time. If a debt collector calls you before 8 a.m. in the morning or after 9 p.m. at night, it’s presumed to be inconvenient. You do have a right to tell the debt collector to stop calling you.

How many times can a debt collector call?

The collector calls more than seven times within ...

When Can a Debt Collector Call You?

A debt collector can't call you at an unusual or inconvenient time. If a debt collector calls you before 8 a.m. in the morning or after 9 p.m. at night , it's presumed to be inconvenient. But if the debt collector knows that you have special circumstances—such as an irregular work schedule that requires you to work nights—a call made between 8 a.m. and 9 p.m. might also be considered inconvenient. ( 15 U.S. Code § 1692c).

Why was the FDCPA enacted?

The FDCPA was enacted to protect debtors from unfair and abusive debt collection practices. The FDCPA doesn't have a specific cap on the number of times a debt collector can call you. But it does provide several restrictions on how a debt collector may communicate with you.

What is the FDCPA?

FDCPA Regulates Debt Collectors. The FDCPA was enacted to protect debtors from unfair and abusive debt collection practices. The FDCPA doesn't have a specific cap on the number of times a debt collector can call you. But it does provide several restrictions on how a debt collector may communicate with you.

What to do if you don't want to receive more calls from a debt collector?

If you don't want to receive any more calls, you can notify the debt collector in writing to stop contacting you . If you notify a debt collector in writing to stop contacting you, the debt collector can't communicate with you further except to:

Can a debt collector harass you?

Debt Collectors Can't Call You Repeatedly to Harass You. In addition to the time restrictions listed above, a debt collector can't call you repeatedly or continuously to harass, abuse, or annoy you. This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you ...

Can a debt collector stop contacting you?

If you notify a debt collector in writing to stop contacting you, the debt collector can't communicate with you further except to: notify you that it may (or will) pursue other remedies under the law, such as filing a lawsuit to collect the debt. ( 15 U.S. Code § 1692c).

How Many Times Can A Debt Collector Call You In One Day?

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

How to stop debt collectors from calling you?

The best way to stop debt collectors from calling you is to send them a letter by certified mail requesting that they no longer contact you this way.

What is Considered Debt Collection Harassment?

According to the Fair Debt Collection Practices Act , the following actions are considered to be harassment:

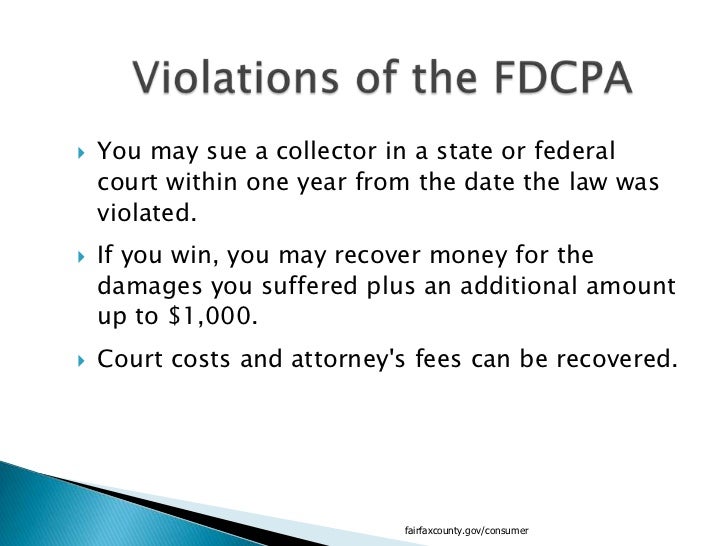

What happens if a debt collector violates the FDCPA?

If a debt collector violates the FDCPA, the debtor has the right to sue the debt collection company and the individual debt collector for harassment. According to the FDCPA, debt collectors who harass debtors are liable for monetary damages, attorney fees, and court fees.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act (FDCPA) is a federal law that limits the types and amounts of actions that third-party debt collectors can use while attempting to receive payments. The law restricts how debt collectors may contact debtors, the time of day they are allowed to contact them, and how many times they may call them each day.

Can you sue a debt collector for harassment?

If the debt collector you are working with has done any of the actions listed above, you have the right to sue them for harassment. Debt collectors who harass their debtors can be sued in court and may be required to pay up to $1000 in damages to the debtor and any attorney fees.

Can a third party debt collector harass you?

If you’ve fallen on hard times and can no longer make payments on your debts, it is common for financial institutions to turn your account over to third-party debt collectors. While these third-party debt collectors have the legal right to contact you regarding repayment options, they are not allowed to mistreat or harass you.