The average millennial makes $47,034 and has a net worth of less than $8,000. 3 What they do have is debt- and lots of it, as the average Millennial has $78,396 in consumer debt. 4 And although their individual net worth might be quite low, collectively, millennials have a net worth of $5.19 trillion. 5

Do you know which benefit millennials value most?

Millennials want benefits they can tailor to their needs. Studies show that 73 percent of younger workers say having flexible benefits increases loyalty to their employer. At the top of the list of benefits that millennials value is medical care, but they also expect to find dental, vision and LASIK options in their benefits packages.

What do millennials really want?

What do millennials really want?

- Affordability of lifestyle is key to millennials%27 choices.

- Somerville is becoming increasing attractive to millennials.

- Millennials are rejecting a car-based life.

- %27It%27s a jigsaw puzzle we%27re trying to do.%27

What do millennials want in a company?

Millennials want to work for a business that embraces opportunities to take risks and either reap the rewards or learn from failures. No one celebrates your failures, which is why failure seems like the enemy. In reality, as long as we don’t fail the same way twice, it’s a natural part of the learning process.

What are the positive traits of millennials?

Traits that make Millennials good employees. 1. Curiosity. Gen Y is a curious generation in general. They are eager to learn and develop new skills and have a broader mindset to understand various things. They are also willing to put in the time and effort to build themselves into better employees as well.

What net worth is considered rich?

What's the Dollar Figure for Being Rich? How much money do you need to be considered rich? Well, according to Schwab's 2021 Modern Wealth Survey (opens in new tab), Americans believe it takes a net worth of $1.9 million to qualify a person as being wealthy.

What is the average 25 year old net worth?

Here are the rest of the stats: Average net worth of a 25 year old: -$23,704. Average net worth of a 30 year old: -$1043. Average net worth of a 35 year old: $25,517.

What is a good net worth by age?

The average net worth for U.S. families is $748,800. The median — a more representative measure — is $121,700....Average net worth by age.Age of head of familyMedian net worthAverage net worth35-44$91,300$436,20045-54$168,600$833,20055-64$212,500$1,175,90065-74$266,400$1,217,7002 more rows•Jul 28, 2022

What is the average savings of a Millennial?

To find out more about the current state of personal savings and debt, I asked five millennials from around the world a series of questions about their work lives and finances. The average amount of savings from these survey responses comes out to $56,000.

Where should I be financially at 35?

So, to answer the question, we believe having one to one-and-a-half times your income saved for retirement by age 35 is a reasonable target. It's an attainable goal for someone who starts saving at age 25. For example, a 35-year-old earning $60,000 would be on track if she's saved about $60,000 to $90,000.

What is upper middle class net worth?

The upper middle class, aka the mass affluent, is loosely defined as individuals with a net worth or investable assets between $500,000 to $2 million. The upper middle class is also sometimes referred to as the aspirational class or HENRYs.

Does net worth include home?

Your net worth is what you own minus what you owe. It's the total value of all your assets—including your house, cars, investments and cash—minus your liabilities (things like credit card debt, student loans, and what you still owe on your mortgage).

What percentage of Americans have a net worth of over $1000000?

9%What percentage of Americans have a net worth of over $1,000,000? About 9% of Americans had a net worth of over $1,000,000 at the end of 2020.

What is middle class net worth?

If your net worth is between $43,760 and $201,800, you are in the middle class.

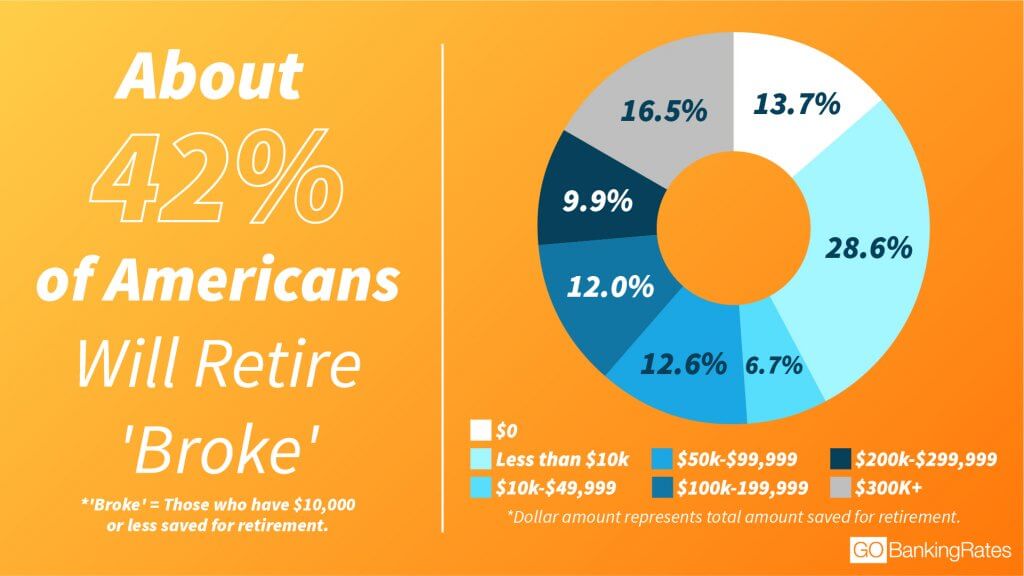

How much do most people retire with?

On average, Americans have around $141,542 saved up for retirement, according to the “How America Saves 2022” report compiled by Vanguard, an investment firm that represents more than 30 million investors.

What does the average person retire with?

Average Retirement Income in 2021. According to U.S. Census Bureau data, the median average retirement income for retirees 65 and older is $47,357. The average mean retirement income is $73,228. These numbers are broken down into median and mean to more fully understand the average retirement income.

What's considered a lot of money in savings?

Most financial experts end up suggesting you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000.

How much should a 25 year old have saved?

By age 25, you should have saved at least 0.5X your annual expenses. The more the better. In other words, if you spend $50,000 a year, you should have about $25,000 in savings. If you spend $100,000 a year, you should have at least $50,000 in savings.

What is a high net worth at 25?

High Achiever Millennial Net Worth By AgeAgeHigh Achiever Net Worth26 (Class of 2016)$142,76725 (Class of 2017)$104,76524 (Class of 2018)$72,70623 (Class of 2019)$41,51814 more rows•Sep 23, 2022

How much should I have saved up by 25?

By the time you're 25, you probably have accrued at least a few years in the workforce, so you may be starting to think seriously about saving money. But saving might still be a challenge if you're earning an entry-level salary or you have significant student loan debt. By age 25, you should have saved about $20,000.

What should my networth be at 27?

According to CNN Money, the average net worth in 2022 for the following ages are: $9,000 for ages 25-34, $52,000 for ages 35-44, $100,000 for ages 45-54, $180,000 for ages 55-64, and $232,000+ for 65+.

What is the average net worth of millennials?

The average net worth of millennials is $18,000. However, this varies quite a bit across the millennial age range.

What is the millennial age range?

Millennials were born between 1982 and 2002, making them roughly 19 to 39 today.

What is the average millennial starting salary?

Millennial starting salaries vary quite a bit by graduation year. Starting salaries have ranged from $40,818 to $52,569.

What is the average millennial student loan debt?

Millennials have graduated with anywhere $18,217 to $31,000 in student loan debt on average, depending on the year they graduated.

Are millennials doing well?

There is a big divergence in millennial success. Many millennials are doing extremely well, but others are struggling. There are plenty of milliona...

Start Saving Now

If you're not doing so already, it is essential that you start saving around 25% of your income while you're young to allow that money to build up over years until you retire. You also should build a safety net for emergencies.

Boost Your Income

Try to increase your earnings. Is there a part-time job you can do in the evenings? Is there extra work at your place of employment? Look around and you might be surprised at the possibilities.

Be Disciplined

This step is key to all you do in your financial life. Being disciplined means, for example, taking the necessary steps to save a set amount each month regardless of what is happening in your life or in your work.

Pay Yourself First

You need to set aside money for long-term savings, the bulk of which will be your retirement savings, before you do anything else with your money. At least 25 percent, or a quarter, of your income should go into savings before you even see it. Have it deducted from your salary or other income. Budget on what is left.

Invest in Retirement Plans

First off you should max out your work retirement plan. Whatever the highest amount is that you can have deducted from your salary, go for it. Chances are, if you do, your employer will match it with a higher amount.

Invest in Assets

Where should you put your money? You should invest in assets that will grow over the long term. For example, stocks have shown an average increase of 7% a year if measured over the long term. The best way to invest in stocks is through mutual funds, which are baskets of stocks set up by investment companies.

Pay Off Your Debts

Set up a program to pay off your student loans and other debts over a set period of time. Have the payments automatically deducted from your bank account so you aren't tempted to use that money in other ways.

What is the average millennial worth?

The average net worth of millennials is $18,000. However, this varies quite a bit across the millennial age range.

How much do millennials make?

Millennial starting salaries vary quite a bit by graduation year. Starting salaries have ranged from $40,818 to $52,569.

Who Are Millennials?

Millennials are technically anyone born between 1982 and 2002 (always subject to change - with more people calling those born after 2000 Xennials). Basically, these people are roughly 19 to 39 today. That's roughly 81 million Americans. We more fully break down the millennial age range here.

What is the average student loan debt for millennials?

When it comes to money, millennials do have some of the highest student loan debt rates of any generation in history. The average millennial has $30,000 in student loans.

How to get rid of student debt as a millennial?

Eliminating that student loan debt is key. Leverage your additional income but also look at student loan repayment strategies to help lower that debt.

How much does a millennial have in student loans?

The average millennial has $30,000 in student loans. See this article on the average student loan debt by graduate class/year. Depending on when the millennial graduated college, they could have entered a terrible or awesome job market.

What makes millennials unique?

What makes them unique as a generation? Well, millennials likely were little kids in a time before computers and cell phones were everywhere. They likely remember getting their first computer and cell phone, and it was a big deal. The likely encountered technology for the first time at school - playing Oregon Trail on a green computer screen. And even today, 64% of millennials are receiving financial support from their parents.

How much money do millennials make in 2020?

2. Pew Research Center, “How Millennials Compare to Prior Generations”, accessed November 12, 2020. The average millennial makes $47,034 and has a net worth of less than $8,000. 3.

How many people are millennials?

Overview of Millennial Income and Debt. Millennials are the largest generation in the U.S, numbering 72.1 million people. Anyone born between 1981 and 1996 is considered a millennial – although there is some debate regarding this.

What Are the Most Common Millennial Expenses?

There are a couple of main suspects, however, there is one that comes up more than others – renting.

How many millennials will be there in 2033?

The total number of Millennials in the United States is projected to peak in 2033 at an estimated 74.9 million people – mostly due to immigration. As of right now, Millennials make up almost a quarter of the US population. 10.

What is the biggest goal of millennials?

The biggest goal is retirement – with 75% of millennials saving towards this goal. This is followed by:

What is a millennial?

This isn’t just some random term that can be used synonymously with young people – Millennials are the generation of people born from 1981 to 1996. Millennials are defined as those born between 1981 – 1996. Millennials saw the widespread adoption of the internet, social media, and mobile devices in their youth.

Why is it important to look at data for millennials?

Millennials entered adulthood in a time of rapid change and found a world that was evolving way too fast for anyone to make sense of. Economic crises, a tough job market, and a wide array of economic issues underpin all the specific “millennial traits”. That’s why it’s important to look at data.

How much should millennials earn in their twenties?

Millennials should strive to accumulate 25% of their overall gross pay during their twenties. This can be a combination of savings, investments, and retirement accounts. This number may be lower if you are paying down staggering student loan debt. Have at least one year of salary saved by the time you turn 30.

How much do millennials have saved for retirement?

According to a survey by Bank of America BAC -1.4%, a surprising 16% of millennials between the ages of 23 and 37 now have at least $100,000 saved for retirement.

How much should a 30-year-old have saved?

How much you should have saved is related to how much you earn. The goal would be to have at least one year of salary saved by the time you reach thirty years old. The median salary for people aged 25 to 34 is around $40,000. It would seem the 16% of millennials with $100,000 saved are ahead of the game. My guess is that many of them also have higher-than-average incomes. The more you make, the easier it can be to save $100,000. This group of people has also likely benefitted from smaller-than-average student loan debt burdens.

Why is there a gap between median and mean savings?

The large gap between the mean and median savings is caused by wealthy individuals (think Jeff Bezos, Warren Buffet, or even Kylie Jenner). It takes quite a few people with zero dollars saved to offset someone with hundreds of millions of dollars, or even billions, of net worth.

How much money do I need to save at 40?

If you start at 40, you’ll need to save $561 per month. That’s still pretty manageable, but that means more than 16 times as much money out-of-pocket, each month, to get to the same end result, becoming a millennial millionaire. I know all of this talk about saving and aging has likely caused many of you to cringe.

Is it easier to invest for retirement?

But I assure you, investing for a happy and secure retirement is easier to accomplish than it sounds. With a little help from employer contribution matches and tax deductions, you will be on your way to financial independence before you know it.

Is Kylie Jenner a millenial?

Both Kylie Jenner and Kendal Jenner are Millenials with impressive amount of money saved.

How Many Millennials Think They Will Never Retire?

According to a recent Harris poll, 61% of older millennials said they planned to work at least part time in retirement. Roughly 14% were unsure about working in retirement, and 25% said they would not work after they retired. 11

Why are millennials not saving?

Millennials won’t be able to save what they need if they don't invest in equities. Millennials face a shortage of jobs due to the effects of automation and the Internet.

How much can millennials contribute to 401(k) in 2021?

With a 401 (k), for example, millennials can contribute up to $19,500 for 2021 as a tax-deferred benefit. If they do not have access to a 401 (k) plan and need to use an individual retirement account (IRA), they are capped at saving $6,000 a year in a tax-deferred account for 2021. 3 . This means that more will have to go to a taxable savings ...

How much do millennials need to sock away?

In addition to the pretax savings listed above, the study suggests that millennials will need to sock away 2% of their income after tax and, if they have an employer-sponsored retirement plan, ...

How many millennials have no retirement plan?

According to a 2019 survey by Milliman.com, more than 25% of millennials have no access to an employer-sponsored retirement plan, while another 30% have jobs at which they haven't met the eligibility requirements to take advantage of one (they may, for example, only be working part-time). 2 That means that less than 45% even have access to these retirement plans. This can have a big impact on how much you can save in a tax-advantaged account. The less you invest in a company retirement account, such as a 401 (k) plan, the more you will have to save overall.

Do millennials need to save more than median income?

Affluent and high-net-worth millennials will need to save much more than median income earners due to higher taxes and the fact that they put less of their total income into Social Security every year. These combined effects mean that they must rely more on their own savings to be able to fund their standard of living in retirement.

Does inflation destroy dollars?

Inflation alone will destroy your dollars' purchase power if your investments lack appreciation potential. So if moving to add more stocks to your portfolio is just too stressful, you will have to find a way to drastically increase your savings.

What is the age of a millennial?

The approximate age to this day of a millennial starts at 18 and ends at around 35.

Which generation has the highest student loan debt?

When talking about money, millennials have the highest student loan debt when comparing to any other generation. On average, according to Time magazine, in 2016 – the average student debt is at $37,100. Compare it to 2003, which was $18,200. Doubled over the past 15 years alone.

How much does an elite school student make?

If you are a student attending top or elite school then that is great for you because you will most likely land a job with on average of $60,000 pay from elite school but for everybody else that is not attending the top school nor have excellent grades, that same average income drastically goes down.

Is time a valuable asset?

Another great thing is you are most likely young which I target most of my readers because I am also still in college and in beginning 20’s and have a lot of time on side. Time is the most valuable asset in life, time is also a road where you choose to build your wealth or not.

Is millennial a complex system?

So, in reality this is a complex system to define millennials as a whole at once finacially.