What is the average household debt in the US?

- Deep subprime (300–500): $562

- Subprime (501–600): $579

- Nonprime (601–660): $591

- Prime (661–780): $574

- Super prime (781–850): $541

- All: $568

What is the average national debt per person?

- In order to pay down our national debt you would have to combine the GDP of China, Japan, and India.

- The United States owes $68,400 per citizen.

- The United States owes $183,000 per taxpayer.

- The United States currently has $125 trillion (yes, trillion) in unfunded liabilities.

What percentage of America is in debt?

The Federal Reserve shares that only 48% of Americans with credit cards pay their bill in full every month. 15 The other 52% are carrying debt and adding to those interest fees and that $787 billion statistic. Student loan debt for Americans age 18–29 is at $333 billion.

Are most Americans in debt?

It's no secret that America is a nation that runs on debt, but it may surprise you to learn that the overwhelming majority of U.S. adults owe money in some way, shape, or form. According to new...

What is the average consumer debt per person in the US?

Even though household net worth is on the rise in America (at $141 trillion in the summer of 2021)—so is debt. The total personal debt in the U.S. is at an all-time high of $14.96 trillion. The average American debt (per U.S. adult) is $58,604 and 77% of American households have at least some type of debt.

How much car debt does the average American have?

Average Auto Loan Balance Surpasses $20,000 Mark After an increase of 1.5% from Q3 2019 through Q3 2020, average auto loan debt balances increased by 6.5% in the 12 months ending in Q3 2021, bringing the average balance above $20,000 for the first time.

How much debt does the average American have without a mortgage?

So how much non-mortgage debt do Americans have? According to Northwestern Mutual's 2021 Planning & Progress Study, U.S. adults aged 18 and over who carry debt hold an average of $23,325 outside of their mortgages.

At what age should you be debt free?

45“Shark Tank” investor Kevin O'Leary has said the ideal age to be debt-free is 45, especially if you want to retire by age 60. Being debt-free — including paying off your mortgage — by your mid-40s puts you on the early path toward success, O'Leary argued.

Is it better to pay off house or keep money in savings?

It's typically smarter to pay down your mortgage as much as possible at the very beginning of the loan to save yourself from paying more interest later. If you're somewhere near the later years of your mortgage, it may be more valuable to put your money into retirement accounts or other investments.

How much credit card debt is normal?

If you have credit card debt, you're not alone. On average, Americans carry $6,194 in credit card debt, according to the 2019 Experian Consumer Credit Review. And Alaskans have the highest credit card balance, on average $8,026.

What is considered a lot of debt?

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

How much debt is healthy?

The 28/36 Rule And households should spend no more than a maximum of 36% on total debt service, i.e. housing expenses plus other debt, such as car loans and credit cards. So, if you earn $50,000 per year and follow the 28/36 rule, your housing expenses should not exceed $14,000 annually or about $1,167 per month.

How much debt does an average person have?

How much money does the average American owe? According to a 2020 Experian study, the average American carries $92,727 in consumer debt. Consumer debt includes a variety of personal credit accounts, such as credit cards, auto loans, mortgages, personal loans, and student loans.

What is considered a high car payment?

A car payment is considered too high if it is more than 30 percent of your total monthly income. According to financial experts, the car payment should not be more than 15 to 20 percent of your total income.

What is an average monthly car payment?

Experian reports that, as of the second quarter of 2020, new vehicle owners paid an average of $568 a month on their vehicles, while used car owners paid $397.

What's the average credit card debt?

On average, Americans carry $6,194 in credit card debt, according to the 2019 Experian Consumer Credit Review.

How much is student loan debt in 2020?

Student loan debt. Student loans help millions of Americans pay for higher education every year. The average balance for this type of debt was $38,792 in 2020, representing a 9 percent increase.

How to pay off debt with the highest interest rate?

Prioritize the debts. Financial experts usually recommend using one of two methods: the snowball method or the avalanche method. With the snowball method, you pay off your smallest balance first, then move one by one to the largest. With the avalanche method, you can focus on paying off the balance with the highest interest rate first to save more money and work down from there.

What should I do if I’m in debt?

The average American debt is at $92,727 — and if you have a balance, the worst thing you can do is ignore it. Interest may accrue on your account, and missed payments could lead to late fees and damage to your credit.

What is the rate of mortgage interest in 2021?

Fueled by a record drop in mortgage interest rates — which reached historic lows in 2020 and continue to hover around 3 percent in 2021 — consumers across the U.S. bought homes despite the coronavirus pandemic and resulting economic fallout.

Is it bad to carry a credit card balance?

Carrying a credit card balance is never a great idea because of accruing interest charges, but credit card balances overall are moving in the right direction. This type of debt saw the largest drop from 2019 to 2020, with the average debt in America for credit cards decreasing by 14 percent. Additionally, the percentage of consumer credit card accounts 30 or more days past due decreased by 29 percent in 2020.

How much debt does the average American have?

While the average American has $90,460 in debt, this includes all types of consumer debt products, from credit cards to personal loans, mortgages and student debt.

Which generation has the lowest debt?

The youngest consumers, Gen Z, have the lowest overall debt balance on average, but they struggle the most to make payments. About 12.24% of Gen Z ’s credit card accounts were 30 days or more past due in 2019. Gen X has the highest average debt balance in all categories, except for personal loans.

What percentage of Gen Z credit cards are past due?

About 12.24% of Gen Z’s credit card accounts were 30 days or more past due in 2019. Gen X has the highest average debt balance in all categories, except for personal loans. Credit cards: Gen X have the highest credit card balance compared to other age groups, at $8,215.

How much debt did millennials have in 2019?

Meanwhile, millennials have seen the largest increase in debt in the last five years: In 2015, the average millennial had about $49,722 in debt, and by 2019 they carried an average of $78,396 in total debt — an increase of 58%.

Is it normal to carry debt?

As you can see, it’s normal to carry debt, but staying on top of it will protect your credit score and ensure that you have access to the right kinds of products at lower interest rates for years to come.

Is debt a normal part of American life?

In our efforts to keep up with the Joneses (or just get by during this period of economic uncertainty), debt has become a normalized part of the American lifestyle.

How Much Credit Card Debt Does the Average American Have?

Median credit card debt is the highest for Americans aged 45-54 at $3,200. Americans younger than 35, on the other hand, have the lowest median credit card debt at $1,900.

How much debt will the US have in 2020?

In the current uncertain economic situation, US consumers continued to borrow in 2020. The total outstanding US consumer debt balance grew $800 billion to a record high of $14.88 trillion, according to Experian data, an increase of 6% —the highest annual rate of growth recorded in over a decade.

What is the average credit card debt for a 45 year old?

Median credit card debt is the highest for Americans aged 45-54 at $3,200. Americans younger than 35, on the other hand, have the lowest median credit card debt at $1,900.

What is the delinquency rate for credit cards in 2020?

In Q3 2020 the average American debt statistics show that the delinquency rate of credit card loans from commercial banks was 1.53%.

How to get out of debt with no money?

First, if you are trying to get out of debt with no money and bad credit, you need to make sure you know how much you owe. You need to adjust your spending and cut costs. The next step would be to consult your bank for better loan terms.

Why did the unemployment rate drop from 9.69% to 8.69%?

The drop from 9.69% to 8.69% could be due to allowances made for coronavirus-related income loss and debt relief programs.

What is the mortgage rate in 2020?

In 2020, the US average mortgage rate hit the lowest of 2.78%.

What is the Federal Reserve Bank of New York's debt and credit report?

Data from the Federal Reserve Bank of New York's Household Debt and Credit report breaks down the average amount of debt Americans have by type, and by borrowers' ages and location. The data was gathered through a random sample of about 5% of Americans with credit report information.

What is the biggest debt in 2021?

Here's a breakdown of the total amount, according to the Federal Reserve Bank of New York's Household Debt and Credit report from the first quarter of 2021. Mortgage debt is most Americans' largest debt, exceeding other types by far. Student loans are the next biggest type of debt among those listed in the data.

What age does debt peak?

Debt peaks between ages 40 and 49, and the average amount varies widely across the country.

What is consumer debt?

Consumer debt is personal debt owed by an individual to another entity, typically a bank or credit union. Consumer debt often involves household purchases and transactions independent of a business or government operation. It does not include debts owed by a business or corporation to another entity.

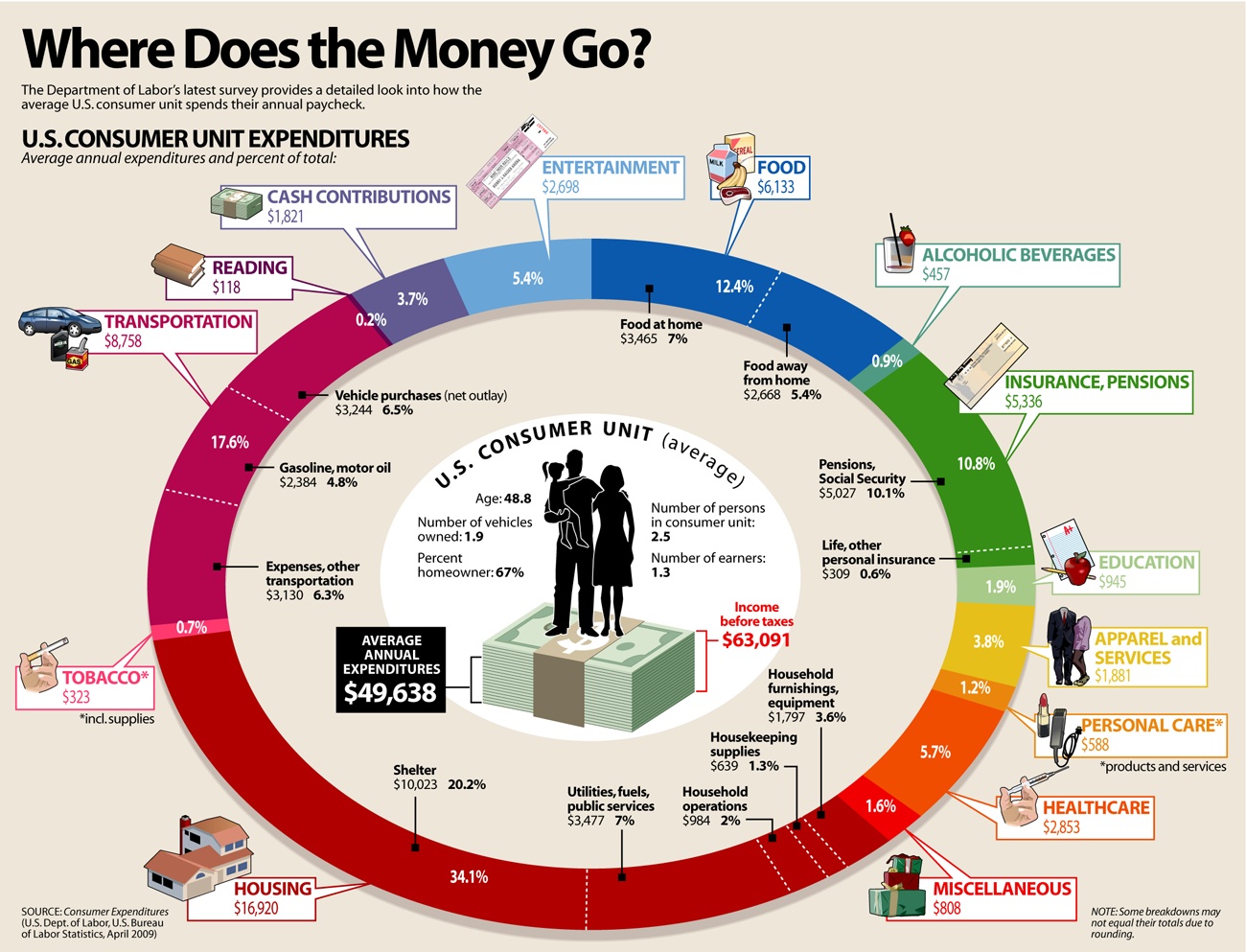

How much is the US consumer debt in 2020?

The following statistics come from the Federal Reserve’s Consumer Credit G.19 release: Total consumer debt totaled $4.161 trillion in September 2020, increasing a total of 4.7%. Average consumer debt per capita is approximately $12,596 (total consumer debt as of September 2020 / total US population as of September 30, 2020).

How much is revolving debt in 2020?

Total revolving consumer debt saw a huge drop of 30.8% in Q2 of 2020. Despite the drop in Q2, total revolving consumer debt rose 4.8% in September 2020. Average revolving debt per capita is approximately $2,992 (total consumer debt as of September 2020 / total US population as of September 30, 2020).

How much debt do Americans owe in 2020?

Total consumer debt amongst Americans rose 4.7 percent and hit just below $4.2 trillion in September 2020, according to the Federal Reserve. Collectively, Americans owe 10 percent of their disposable income to non-mortgage debts like car loans, credit card accounts and student or personal loans.

Why is revolving debt called revolving debt?

This kind of debt is referred to as revolving because it is meant to be paid off frequently, typically within a month. Federal Reserve fluctuates with consumer use and usually comes with a variable interest rate.

What are the two types of consumer debt?

Also referred to as credit debt, there are typically two types of consumer debt: revolving and non-revolving.

How much debt will break in the next decade?

It is possible that total consumer debt may break four trillion dollars within the next decade. If you’re unsure how to begin tackling your personal debt, there are many available resources to help you. Paying your monthly fees on time and maintaining your credit can also help you reduce your loan amounts over time.

What is debt in finance?

Plain and simple, debt is owing any money to anybody for any reason. If you have debt, you’ve most likely agreed on terms of repayment, and those terms mean specific payments at specific time periods until the debt is paid off —typically with interest (the extra cost the lender charges you for borrowing their money).

How much is student loan debt?

The total student loan debt in America is currently at $1.56 trillion, with each borrower owing an average of $35,359. 13,14 The fastest-growing debt in America (increasing in growth at almost 157% since the Great Recession), student loans make up 11% of the country’s debt total. 15 That’s the second largest percent, just after mortgages. 16

What happens when you pay off debt?

3. Pay off your debt with the debt snowball method.

What will happen to the economy in 2021?

The changing economy in 2021 is reflecting a rise in costs, spending and debt in at least three major debt categories.

Why did credit card balances drop in 2020?

In their research, they suggest one cause of the drop in credit card balances during 2020 is simply that consumers were spending less. The Bureau looked for evidence to support another theory—that those with secure employment might be decreasing their credit card debt at a large enough rate to cover up the increase in debt of those in financial distress. The Bureau explains they couldn’t test that idea directly. But in an indirect test, they saw “the decrease in average credit card balance holds for all groups” in their data. 43

What to do when debt is out of the way?

When it’s out of the way, you put all the money you were throwing at it onto the next -smallest debt . Repeat until you’re debt-free. You’ll get quick wins all along the way. And those quick wins will keep you moving.

How does student loan debt affect young adults?

Young adults say the weight of student loans keeps them from basic financial and life decisions. For example, 40% delay investing in retirement, and 47% put off buying a home. And 21% even wait to get married because of their student loan debt. 23

How much is the consumer debt in 2020?

The New York Fed's quarterly Household Debt and Credit Survey (HHDC) shows that total consumer debt stands at $14.35 trillion as of the third quarter of 2020. That's a record high as far as the HHDC goes.

How much credit card debt do Americans have in 2020?

According to the latest Household Debt and Credit survey results from the New York Fed, Americans owe $807 billion in credit card debt as of Q3 2020. That's down from $881 billion in Q3 2019 and $817 billion in the second quarter of 2020.

How much is the average unsecured loan?

According to TransUnion's September Monthly Industry Snapshot, the average unsecured personal loan amount was $5,538, down from $6,096 in September 2019. The average balance per customer, however, is $9,074, indicating that many people who have one unsecured personal loan have at least one more.

What is the average mortgage rate for 2020?

Average mortgage rate in 2020: 2.78%. 2020 was a record year for mortgage rates, with the average 30-year fixed rate at 2.78% on Nov. 5. That's the lowest it's been since the St. Louis Fed started compiling this data in 1971.

What is the average debt payment for 2020?

Average American debt payments in 2020: 8.69% of income. The St. Louis Federal Reserve tracks the nation's household debt payments as a percentage of household income. The most recent number, from the second quarter of 2020, is 8.69%. That means the average American spends less than 9% of their monthly income on debt payments.

What is the average household debt in 2019?

According to the 2019 Survey of Consumer Finances, the average (mean) household debt among those who had any debt was $140,416, while the median was $65,000. That includes a wide range of debt, from mortgages to personal loans, credit cards, and more. Total debt has increased since 2019 -- we estimate the average ...

What is the delinquency rate for credit cards in 2020?

In the second quarter of 2020, the delinquency rate of credit card loans from commercial banks was 2.42%.

The Pandemic Impact on Debt

Debt and Education

- The more educated you are, the more debt you have. That’s because higher education leads to higher income, and higher income leads to higher spending. People with college degrees carry an average of $8,200 in credit card debt. Those who attended college but did not graduate carry $4,700. High school graduates only carry an average of $4,600, according to data from the Feder…

Average Debt to Income Ratios

- Debt to income ratiois a key indicator of financial health. It’s determined by taking you monthly expenditures and dividing that number by your monthly income. For instance, if your bills amount to $5,000 a month and you make $7,500 a month, your DTI is 66%. It also means you are dire need of financial overhaul. The maximum DTI you can have to qualify for a mortgage is usually 43%. …

Debt and Family Type

- Research shows that singles have more friends and certainly more free time than married couples, but being married decreases the chances you’ll stay in debt. The median income for general population households was $90,500 in 2020, according to a C+R Research report. The median income for singles was $72,300. A 2017 study of 2,000 people by TD Ameritrade found t…

Debt and Income

- The wealthier you are, the more likely you will carry debt. Of course, the wealthier you are, the easier it is to erase that debt. Americans in the top 10% by income have a median of $222,200 in debt, whereas those in the bottom 25% have less than $20,900. When it comes to home ownership, smaller income means less chance of even qualifying for loan debt. Credit card quali…

Debt and Minorities

- Minorities in general earn less than whites, though that doesn’t necessarily translate to more debt because they have less to spend and are less likely to qualify for higher-dollar loans. The average credit card balance for white families was $6,940 in 2021, according to the Value Penguin study. For Black families it was $3,940, and for Hispanics it was $5,510. From 2000 to 2019, the media…

Debt and Gender

- Women have made huge economic gains over the decades, but most will have more debt than men. In 2021, women earn 82 cents for every dollar earned by men, according to crowdsourced data compiled by PayScale. The median salary for men was about 18% higher than for women. That’s a 1% improvement from 2020 and an 8% improvement from 2015. Experts cite a variety o…

Student Loan Debt

- Paying for college has turned into a long-term burden for millions of Americans. The total bill as of March 2021 was $1.7 trillion, according to the Federal Reserve. That was more than double what it was a decade earlier. Not surprisingly, the 18-to-29 age group accounted for 34% of that debt, according to the Department of Education. But the highest average belonged to 35-year-olds wh…