Are stock mutual funds a good investment?

They’re a good investment option for the average investor since a single share of a mutual fund gives you exposure to hundreds of stocks or bonds. This diversifies your investment dollars and reduces the risk that any one company will cause your investment to lose value.

Are municipal funds a good investment?

Municipal bonds aren’t bulletproof, but they are one of the safest investment vehicles you will find. They also offer substantial tax advantages and are very liquid when held as ETFs.

Are Qualified Opportunity Funds good investments?

The roughly 8,700 federal qualified opportunity zones represent areas in great need of investor capital, so by intention they carry greater risk than other types of investment. Additionally, not all opportunity zones have the best investment opportunities.

Are fixed deposits a good investment?

Yes, if you wish to earn consistent returns with minimal risks, a fixed deposit is a great investment vehicle. Investment in fixed deposits doesn’t require paying close attention to the market like some equity investments.

Are GNMA bonds safe?

GNMA securities, like U.S. Treasuries, are guaranteed and backed by the full faith and credit of the U.S. government and generally are considered to be of the highest credit quality.

Is Ginnie Mae a safe investment?

Overall, Ginnie Maes are a popular type of mortgage-backed security because they are guaranteed by the U.S. government. 3 They are not necessarily risk free but the government will step in to prevent the collapse of Ginnie Mae and its securities.

Why are GNMA funds down?

Rising Rates, Falling Prices In a rising rate environment, the prices of Ginnie Mae bonds and the share prices of Ginnie Mae funds decline.

Are GNMA loans guaranteed?

The Ginnie Mae guarantee ensures that investors in these mortgage-backed securities (MBS) do not experience any disruption of the timely payment of principal and interest, thus shielding them from losses resulting from borrower defaults.

What is not a risk of investing in a GNMA?

What is NOT a risk of investing in a GNMA? The principal value of a security is fixed - it does not fluctuate.

Does GNMA pay monthly income?

This type of security provides monthly income over a period of time and is generally considered to be safe because it is guaranteed by the government.

Is GNMA tax free?

The interest earned from a GNMA mortgage-backed bond is fully taxable on both your federal and state income tax returns.

Is GNMA backed by the US government?

Ginnie Mae was established as a GSE and remains so today as part of the Department of Housing and Urban development, or HUD. Currently, Ginnie Mae is the only home-loan agency explicitly backed by the full faith and credit of the United States government.

Are GNMA dividends taxable?

Ginnie Mae Dividends Unless you owned shares of the fund for less than a month, you earned dividends from the fund. Any dividends your earned will be reported on an IRS Form 1099, and those dividends count as taxable income for the year.

How do I invest in GNMA?

You can buy shares in a Ginnie Mae mutual fund directly or through your brokerage firm. In addition, through your broker, you can buy shares in a real estate investment trust that buys GNMA bonds.

What are the three types of loans covered by Ginnie Mae?

Unlike Fannie and Freddie, which work with conventional home loans, Ginnie Mae focuses exclusively on government loans like FHA loans, VA loans and USDA loans.

Is Ginnie Mae federally backed?

Ginnie Mae was established as a GSE and remains so today as part of the Department of Housing and Urban development, or HUD. Currently, Ginnie Mae is the only home-loan agency explicitly backed by the full faith and credit of the United States government.

Is Ginnie Mae FDIC insured?

Ginnie Mae (GNMA) securities are backed by the government but not FDIC insured.

What does Ginnie Mae do for a living?

Ginnie Mae, or the Government National Mortgage Association (GNMA), is a government agency that guarantees timely payments on mortgage-backed securities (MBS). In doing this, Ginnie Mae works with other government agencies to make affordable housing widely available through mortgage loans.

Does Ginnie Mae own my loan?

Ginnie Mae does not purchase individual loans or MBS*. Ginnie Mae does not issue or sell MBS*.

What is a GNMA fund?

Mortgage. By Tim Plaehn. GNMA funds are mutual funds that own mortgage-backed securities issued by the Government National Mortgage Association, or Ginnie Mae. The U.S. government guarantees the payment of interest and principal from Ginnie Mae bonds.

How do GNMA bonds work?

The Ginnie Mae bonds held by GNMA funds are marketable securities, and their value is determined by current market interest rates for similar securities. Bond prices, including GNMA bonds, change inversely to changes in interest rates. If rates increase, the market price of the Ginnie Mae bonds in a portfolio will decline. The fund reflects these price declines with a falling share price. In a rising rate environment, the share value of a GNMA fund can decline faster than the interest paid makes up for the decline. This effect is especially damaging to investors who are taking their fund dividends in cash and see their principal value declining.

Does a GNMA fund have an open ended duration?

The open-ended duration of GNMA securities has the opposite effect if rates rise. Homeowners whose mortgages make up the Ginnie Mae pools will be less likely to refinance their low-rate mortgages, and the expected duration of the GNMA bonds will lengthen. This means a Ginnie Mae fund will receive principal payments at a slower rate. Less principal repayments means less money that can be reinvested at the higher current interest rates. In a rising rate environment, GNMA fund holders will see their share values fall, and the funds will take longer to be able to pay the higher rates of the current bond market.

What is the best rating service for a GNMA fund?

Since all GNMA funds are not equal, examine those investment firm offerings for their performance and ratings. Morningstar is often the preferred rating service and offers overall and three-, five- and 10-year performance ratings using one to four stars. This respected rating service rates each Ginnie Mae-focused fund offered by licensed brokers based on risk-adjusted returns. Using state-of-the-art metrics, top rating services also compare the performance of GNMA funds to other safe and secure investments, such as U.S. Treasury options. Examining online ratings is a must before you decide on the investment firm and GNMA fund that is the best fit for your portfolio.

What is GNMA investment?

GNMA funds are secure investments that contain mortgage pools of loans extended through the Federal Housing Administration and Department of Veterans Affairs, but they also offer other options in their Ginnie Mae Platinum Securities program.

What is a GNMA mortgage?

GNMA mortgage-backed investments are the only mortgage-backed securities with a full faith and credit guaranty from the federal government, so you'll get your monthly principal and interest payments on time each month, regardless of individual homeowner mortgage delinquencies that may develop.

How to invest in ginnie mae?

You can open an investment account with a trusted investment brokerage that offers the GNMA mutual funds that interest you. And you can invest in Ginnie Mae Platinum Securities, which combine GNMA mortgage pools with uniform rates and maturity dates into a single Ginnie Mae certificate. GNMA Platinum Securities offer the diversity of a mutual fund with different mortgage pools, while focusing on simplicity, with similar rates and terms to maturity.

Does a GNMA fund have a front end?

Before you choose the Ginnie Mae fund or investment firm you prefer, compare the fees and costs, as they will lower your yield. For example, GNMA funds offered by some licensed investment brokers are no-load mutual funds. This means no front-end charges are assessed when you buy and no back-end fees are charged when you sell. While these options are often preferable, you may find a GNMA fund that performs well and requires only modest costs to administer, offering you higher returns despite associated fees.

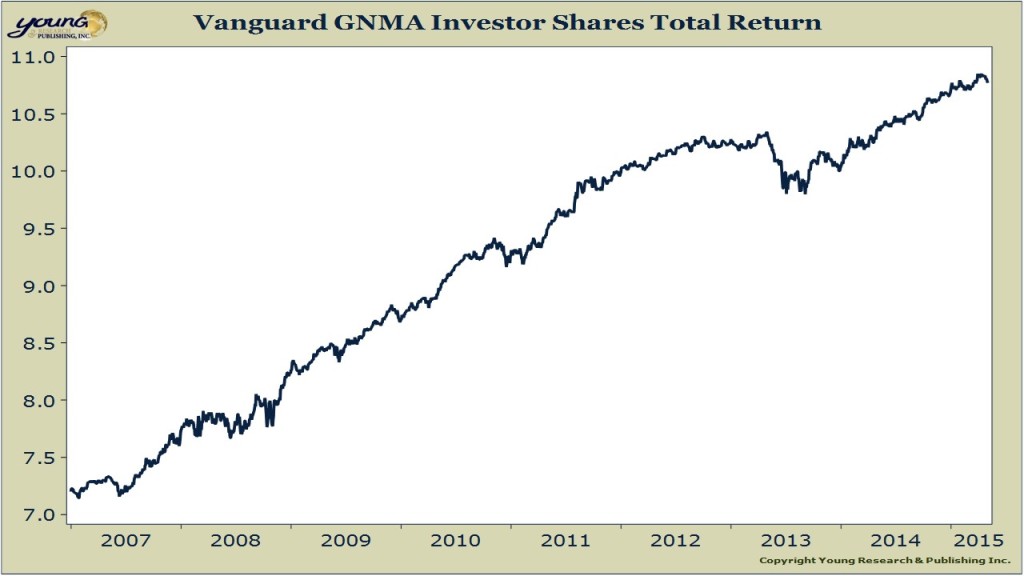

What is Vanguard GNMA?

The Vanguard GNMA Fund falls within Morningstar’s intermediate government category. Funds in this category generally have at least 90 percent of their holdings in U.S. government-backed bonds or in bonds backed by government-linked agencies. This fund focuses primarily on Government National Mortgage Association securities and other pass-through mortgage-backed securities.

How much money does Morningstar have in 2021?

As of April 29, 2021, the fund has assets totaling almost $26.85 billion invested in 15,140 different holdings.

Does Morningstar invest in mortgages?

Morningstar cites the fund’s straightforward approach to investing in mortgage-backed securities, coupled with low fees, that have contributed to solid long-term results.

What is GNMA fund?

Backed by Uncle Sam. GNMA is the Government National Mortgage Association, which is not an association but a federal agency, so its securities have Uncle Sam’s full faith and credit. That satisfies the safety requirement. The question is whether the income is enough to match or exceed any possible erosion of the principal—a concern if mortgages lose value or higher-rate loans are refinanced in such numbers that these funds fill up with lower-rate debt in a sort of accidental bait and switch. (You thought you were getting 4%, but instead it’s 3%, plus some of the principal back.) When GNMA funds register negative returns, refis (known as “prepayments”) are the usual cause. Managers perform graduate-school math to analyze the optimal interest rate and maturity combination in their funds to soften this threat, but sometimes market forces are just too powerful. In a rough quarter, you can lose 2%.

Do mortgages retain their market value?

Logically, yes. But the mortgages as a portfolio should retain their market value better than ordinary bonds if 10-year T-bond yields really do double from 1% to 2%.

Should a portfolio of mortgages retain their value better than ordinary bonds?

A portfolio of mortgages should retain their value better than ordinary bonds if interest rates rise. by: Jeffrey R. Kosnett. February 28, 2021. In these unpredictable times, any combination of high safety and fair income should deliver extra value.

Is GNMA a cash bond?

It is okay to think of GNMA funds as substitutes for cash or ultra-short bonds, but GNMA funds’ historical returns are not totally cash-like. Vanguard GNMA (symbol VFIIX) has a five-year annualized return of 3.0%, compared with 1.9% for Vanguard Ultra-Short-Term Bond ( VUBFX ).

What is a GNMA fund?from homeguides.sfgate.com

Mortgage. By Tim Plaehn. GNMA funds are mutual funds that own mortgage-backed securities issued by the Government National Mortgage Association, or Ginnie Mae. The U.S. government guarantees the payment of interest and principal from Ginnie Mae bonds.

How do GNMA bonds work?from homeguides.sfgate.com

The Ginnie Mae bonds held by GNMA funds are marketable securities, and their value is determined by current market interest rates for similar securities. Bond prices, including GNMA bonds, change inversely to changes in interest rates. If rates increase, the market price of the Ginnie Mae bonds in a portfolio will decline. The fund reflects these price declines with a falling share price. In a rising rate environment, the share value of a GNMA fund can decline faster than the interest paid makes up for the decline. This effect is especially damaging to investors who are taking their fund dividends in cash and see their principal value declining.

Do you lose your bond if you default on a mortgage?from finance.zacks.com

Normally, bond payments are reduced or lost altogether if mortgage borrowers default on their loans. However, with GNMA funds, you are assured of receiving your bond income because the entity honors these payments if the actual borrowers default.

Who guarantees home loans?from finance.zacks.com

The Department of Veterans Affairs and the Federal Housing Administration are among the entities that guarantee home loans. FHA and VA loans are often securitized by firms such as Freddie Mac. If borrowers default on the loans, the VA and FHA cover some of the investors' losses. So GNMA bond funds receive two layers of protection, ...

Does a GNMA fund have an open ended duration?from homeguides.sfgate.com

The open-ended duration of GNMA securities has the opposite effect if rates rise. Homeowners whose mortgages make up the Ginnie Mae pools will be less likely to refinance their low-rate mortgages, and the expected duration of the GNMA bonds will lengthen. This means a Ginnie Mae fund will receive principal payments at a slower rate. Less principal repayments means less money that can be reinvested at the higher current interest rates. In a rising rate environment, GNMA fund holders will see their share values fall, and the funds will take longer to be able to pay the higher rates of the current bond market.

Who is Gary Greenberg?

An undated photo provided by Payden & Rygel shows Gary Greenberg, co-manager of the Payden GNMA mutual fund, which primarily invests in government-backed mortgage bonds known as Ginnie Maes. Greenberg says Ginnie Mae bonds offer the potential for significantly greater investment yields than Treasury bonds with only slightly more risk. (AP Photo/courtesy of Payden & Rygel, Matt Vigil)

Did Chip Ganassi win the IMSA?

After telling the world he was pulling out of NASCAR, Chip Ganassi returned home to Pittsburgh for sushi dinner with drivers Kevin Magnussen and Renger van der Zande, his house guests for a week between sports car races. Magnussen and van der Zande didn't win the IMSA race — “first loser, P2,” Ganassi said — before Ganassi headed to Mid-Ohio Sports Car Course to spend the Fourth of July with his IndyCar team.

What is Vanguard Intermediate-Term Bond ETF?

The Vanguard Intermediate-Term Bond ETF (BIV) holds US government debt and similar types of high-quality fixed income. It’s a big, liquid fund that yields 2.4%, like AGG, and gradually grinds higher over time. In fact, it’s actually beaten AGG over the last ten years.

Why don't I recommend ETFs?

I don’t recommend ETFs too often for buy and hold investors because it’s difficult to find value in the ETF space. But they are sturdier ports in market storms than my beloved closed-end funds (CEFs), which have more yield, more upside, but wider swings than ETFs.

Do volatility markets reward patience?

Volatile markets do tend to reward patience . Daily whipsaws can upset rookies, but they are great for us calculated, methodical buyers who have an opportunity to “dollar cost average” our purchases. After all, we are able to bank more dividend per dollar on dips.

How to build a portfolio of mutual funds?

Such a portfolio can be constructed by purchasing individual funds in proportions that match your desired asset allocation. Alternatively, you can do the entire job with a single fund by purchasing a mutual fund with "growth and income" or "balanced" in its name.

What is municipal bond?

Issued by state and local governments, these investments leverage local taxing authority to provide a high degree of safety and security to investors. They carry a greater risk than funds that invest in securities backed by the federal government but are still considered to be relatively safe.

What is utilities based mutual fund?

Utilities-based mutual funds and funds investing in consumer staples are less aggressive stock fund strategies that tend to focus on investing in companies paying predictable dividends.

Is it smart to invest in fixed income?

Fixed income may be a smart move, but don't try to time the markets by exiting stock funds when you think growth is slowing and then start investing in bond funds.

Is it safe to invest in a lemming?

While bond funds and similarly conservative investments have shown their value as safe havens during tough times, investing like a lemming isn't the right strategy for investors seeking long-term growth. Investors also must understand that the safer an investment seems, the less income they can expect from the holding.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Can you abandon the stock market?

Contrary to popular belief, seeking shelter during tough times doesn't necessarily mean abandoning the stock market altogether. While investors stereotypically think of the stock market as a vehicle for growth, share price appreciation isn't the only game in town when it comes to making money in the stock market. For example, mutual funds focused on dividends can provide strong returns with less volatility than funds that focus strictly on growth.