A trust created by your will is called an express trust. An express trust can be either an absolute trust or a discretionary trust. If an absolute trust requires only the happening of a conditional event, it is also called an interest-in-possession trust.

What is an express trust?

Put simply an express trust is a trust created 'in express terms, and usually in writing, as distinguished from one inferred by the law from the conduct or dealings of the parties’. All express trusts not otherwise exempt must register with the TRS either as part of 4MLD or 5MLD.

What are the legal requirements for an express will?

An express will trust (being one created intentionally by the testator, rather than an implied trust being created by the operation of law) has several legal requirements to be valid. The legal test, known as 'The Three Certainties Principle' was created in the decision of Lord Langdale MR in Knight v Knight (1840) 49 ER 58.

What is the difference between express trust and implied trust?

Implied Trusts vs. Express Trusts. The opposite of an express trust, in legal terms, is an implied trust. This is a trust that is implied by the circumstances and can be created only with the intervention of a court that is trying to right a wrong or clear up a misunderstanding. There are several kinds of implied trusts,...

What is the difference between an express trust and unsourced material?

Unsourced material may be challenged and removed. An express trust is a trust created "in express terms, and usually in writing, as distinguished from one inferred by the law from the conduct or dealings of the parties." [1]

What are the types of express trusts?

Types of Express Trusts The most common categories of express trusts are living trusts, testamentary trusts, revocable and irrevocable trusts, fixed trusts, and discretionary trusts. Living Trusts. A living trust, or inter vivos trust, is created for the benefit of another during the settlor's life.

Are wills and trusts the same thing?

While a will is a document that expresses the creator's wishes regarding the distribution of their property, a trust is an arrangement that allows a third party to hold and direct the creator's assets in the trust fund.

What is the opposite of an express trust?

The opposite of an express trust, in legal terms, is an implied trust. This is a trust that is implied by the circumstances and can be created only with the intervention of a court that is trying to right a wrong or clear up a misunderstanding.

What is a UK express trust?

An express trust is where the legal owner(s) of the property declare that they hold the property on trust for specified beneficiaries. The declaration will also set out the proportion or ways in which they are to hold beneficial interest (eg as joint tenants or tenants in common).

What are the 3 types of trust?

With that said, revocable trusts, irrevocable trusts, and asset protection trusts are among some of the most common types to consider. Not only that, but these trusts offer long-term benefits that can strengthen your estate plan and successfully protect your assets.

Does a will override a trust?

Does a Will override a Trust? It's possible to create both a Will and a Trust, and in many cases, they'll complement each other. However, if there are any issues or conflicts between the two, the Trust will normally override the Will – not the other way around.

What is required for an express trust?

An express trust requires a settlor, a beneficiary, a trust corpus, words of settlement, certainty of object and certainty of obligation. In order to create an express trust in circumstances such as these, the three requisite certainties must be present.

Is a lifetime trust an express trust?

A trust or improper liferent (or 'liferent trust') is established by a settlor or granter declaring a trust in a trust document or deed, appointing trustees and transferring property to them. Liferent trusts are express trusts.

Does an express trust have to be in writing?

An express trust is usually created by a declaration of trust which is made by the legal owner. This declaration can be written or oral (sometimes called 'parol') except in the case of land where the trust needs to be evidenced in writing under S53(1)(b) Law of Property Act 1925.

Do will trusts have to be registered with HMRC?

You must register your trust with HMRC: to make sure you and the trust comply with anti-money laundering regulations. if you need to get a Unique Taxpayer Reference ( UTR ) — for example, for filling in a Self Assessment tax return for the trust, even if the trust is on the exemption list.

Who are the parties to an express trust?

An express trust is a trust created "in express terms, and usually in writing, as distinguished from one inferred by the law from the conduct or dealings of the parties." Property is transferred by a person (called a trustor, settlor, or grantor) to a transferee (called the trustee), who holds the property for the ...

Is an express trust a discretionary trust?

Normal express trusts are described as "fixed" trusts; the trustees are obliged to distribute property, with no discretion, to the fixed number of beneficiaries.

What are the pros and cons of a will versus a trust?

Pros and Cons of a Will vs. Living TrustWith a WillWith a Living TrustPrivacyAll Estate administration filings are public record. Exposes family to Unscrupulous solicitors and greedy heirs.Privacy preserved. Living trusts are not public record. Everything is kept in the family.8 more rows

How does a trust work after someone dies?

If you put things into a trust, provided certain conditions are met, they no longer belong to you. This means that when you die their value normally won't be counted when your Inheritance Tax bill is worked out. Instead, the cash, investments or property belong to the trust.

What are the disadvantages of a trust?

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate. ... Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust. ... No Protection from Creditors.

What is the main purpose of a trust?

Trusts are established to provide legal protection for the trustor's assets, to make sure those assets are distributed according to the wishes of the trustor, and to save time, reduce paperwork and, in some cases, avoid or reduce inheritance or estate taxes.

What is the HMRC TRS manual?

The recently published HMRC TRS Manual contains information on a number of areas such as registration requirements, information required to register and data retention, and HMRC has promised to add further material on related subjects , including more details on treatment of life insurance policies, deadlines, penalties and third-party information sharing provisions.

What are the two types of implied trusts?

The two types of “implied trust” include constructive trusts and resulting trusts. These are trusts that are implied by the circumstances and can be created only by a court that is trying to right a wrong or clear up a misunderstanding. Such trusts will not need to be registered with HMRC unless they become “taxable trusts”.

What happens if there is no written document for a trust?

Cleary, if there is no written document there may be problems with providing evidence of the existence of the trust. In another part of the Manual, TSEM9550, HMRC states that there must be evidence of: the intention to create a trust, the beneficial interest in the property, and who holds the beneficial interest (i.e. the “three trust certainties” mentioned earlier); as well as the date from which such a trust is said to exist.

What is express trust?

According to the Manual, an express trust is a trust created deliberately by a settlor, usually in the form of a document such as a written deed or declaration of trust. However a written document is not in fact necessary as is confirmed in another part of HMRC’s Manual (TSEM9510) which provides that an express trust is usually created by a declaration of trust which is made by the legal owner, but this declaration can be written or oral except in the case of land.

Can you make a declaration of trust in England?

With the expansion of the TRS, prospective settlors also need to be made aware that it will no longer be possible, in England, to simply make a declaration of trust and put it in a drawer. HMRC will have to be told, although, of course for non-taxable trusts, only the information in relation to the beneficial owners will be necessary.

Is a bare trust taxable?

The Manual also confirms that there is no specific exclusion from registration for bare trusts. A bare trust (also called an absolute trust) is a trust where a beneficiary is absolutely and irrevocably entitled to both the income and capital of the trust. In general, if a bare trust is an express trust it should register on the TRS, unless it falls within the definition of excluded trusts. So, unfortunately, there is no concession for bare trusts, despite the fact that such trusts will never become taxable trusts as the trust income and gains are always taxed on the beneficiary (unless caught by the parental settlor provisions).

What does "implied" mean in law?

The word “implied” is the commonly used antonym for “express”, although the word is used in several ways in legal terminology and indeed in legislation, which may sometimes be confusing and indeed some authors suggest avoiding it altogether.

What is express trust?

An express trust is a trust created "in express terms, and usually in writing, as distinguished from one inferred by the law from the conduct or dealings of the parties.". Property is transferred by a person (called a trustor, settlor, or grantor) to a transferee (called the trustee), who holds the property for the benefit ...

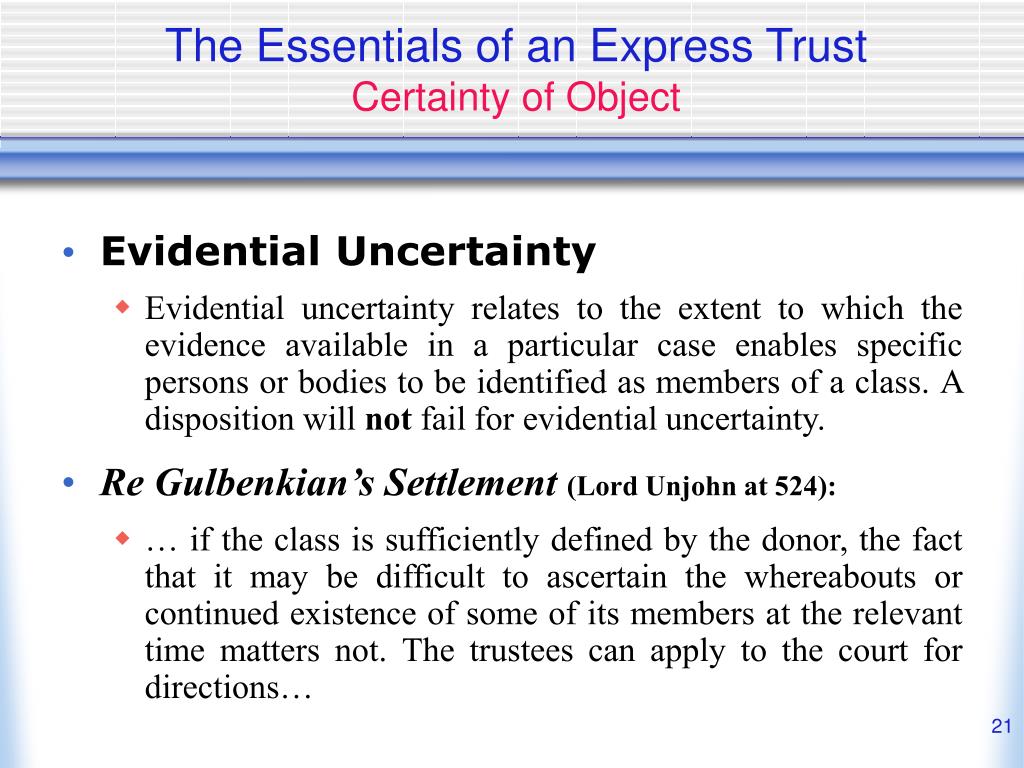

What are the three certainties of express trust?

Three Certainties of Express Trust 1 Certainty of intention: Must be real intention by the settlor to dispose of property and create trust, not just make a gift – a trust also can't be created contrary to the intention of the settlor alleged to have created it: Commissioner of Stamp Duties (Qld) v Jolliffe. 2 Certainty of subject:The property the subject of the trusts must be sufficiently ascertainable at the time the trust was created: Herdegen v Federal Commissioner of Taxation (1988) 3 Certainty of object:Beneficiaries must be ascertainable –

How long can a discretionary trust be indefinite?

Discretionary trusts must not be indefinite and are subject to 'the rule against perpetuities'. In New South Wales, the time prescribed is a statutory period of 80 years from the date the disposition takes effect.

What is an accumulation and maintenance trust?

Accumulation and Maintenance trust. A variation on the discretionary trust, the A&M does not carry the Inheritance tax disadvantages of a discretionary settlement but can only be established for persons under 25 who must be entitled to income at that age. Allows the accumulation of income within the trust until 25.

What is a trust when a life tenant dies?

A trust where, on the death of the life tenant, the property reverts to the person making the gift.

What is the subject of a trust?

Property or rights of a kind which can be the subject of a trust 2. A declaration of trust or disposition on trust by a person legally competent to create a trust 3. Certainty of property and objects (trust must be administratively workable 4. Compliance with requirements regarding evidence 5.

Why do you need more than one trustee?

Often, a trust corporation or more than one trustee is appointed to allow for uninterrupted administration of the trust in the event of a trustee's resignation, death, bankruptcy or incapacity . Additionally a Protector may be appointed who, for example, is authorized to appoint new trustees and to review the trustees' annual accounts.

Will or Trust - Which is Better?

When we’re talking about Wills vs. Trusts, we need to keep in mind that they have very different and specific benefits. It’s not really accurate (or helpful) to assume one is “better” than the other. You should start by assessing your situation, your goals and your needs at the very beginning of the process. Only then can you find the solution that best-suits and protects your family in the most appropriate way.

Do Wills Require Probate?

Just because you take the time to create a Will, it doesn’t mean your estate will avoid probate. Probate is the process your estate goes through after you pass away if you haven’t done proper or comprehensive Estate Planning. It is a court-supervised proceeding, and depending on how solid your Estate Plan is, can be costly and take a long time.

How to make it easier on those you leave behind?

One of the most effective ways to make it easier on those you leave behind is by creating a Trust as part of your Estate Planning. Anything you put inside your Trust can be passed down while avoiding probate. And, a big benefit to having a Trust is distribution of assets remains private, whereas distributing assets through a Will and probate are public.

What does a pour over will mean?

Pour Over Wills essentially act as a backup plan to ensure all of your assets go under your Trust.

What is the difference between a trust and a will?

Trusts provide for the management and distribution of your assets during lifetime and after death. A Will, on the other hand, allows you to do things like name guardians for your children, appoint an executor for your estate, and declare your final wishes.

Why do we need a trust?

Because a Trust instantly takes effect as soon as you sign it , it can simplify the process for those around you. But it’s very different from a Will in that your Trust not only plans for after you die – it’s a document intended to have an impact while you’re still living. A Trust can set provisions for things like what you want to have happen if you become mentally or physically unable to make your own decisions. It protects loved ones from having to make decisions about the unthinkable. Most importantly, a Trust can make sure your wishes are known, during your lifetime and after you pass, so the stress of wondering what you would want can be completely removed from the equation.

What are the benefits of a trust?

A Trust is a bit more complicated, but can provide some great benefits. Trusts: 1 Offer greater control over when and how your assets are distributed 2 Apply to any assets you hold inside the Trust 3 Come in many different forms and types

What is a durable power of attorney?

A General Durable Power of Attorney, which empowers a trustworthy family member or friend to make legal and financial decisions for you when you are incapacitated or unavailable.

Why do you need a will?

If you have minor children, one of the most important reasons for having a will is to specify guardians. Guardians are the people who will actually raise your children. You want to think about who has the same values, who has the same perspective on education, on religion, on medical care, all of those core things that make you and your family who you are. The only way to give direction to the court if you pass away is in a will. So if you prepare a will for no other reason, than to specify who will raise your children. That’s important!

Why is it important to have a will?

Having a will is without a doubt one of the most important things you can do to protect yourself and your family. Done properly, it can spell out how you want things handled after you pass away.

What does "disinherit" mean?

To disinherit those you don’t want to receive part of your money or property.

What is a will?

A will is a legal document by which a person expresses their wishes as to how their property is to be distributed at death, and names a personal representative to manage their estate until its final distribution. If you have minor children, another function of a will is to designate a guardian to raise those children to adulthood.

Can you add videos to your watch history?

Videos you watch may be added to the TV's watch history and influence TV recommendations. To avoid this, cancel and sign in to YouTube on your computer.

Do You Need Both a Trust and a Will?

Nearly everyone should have a will, but not everyone needs a living or irrevocable trust. If you have property and assets to place in a trust and have minor children, having both estate-planning vehicles might make sense.

Does a Will Override a Living Trust?

One doesn't usually trump another, but if the issue arises, a living trust will most likely override a will because a trust is its own entity. 4

How Much Does It Cost to Set Up a Trust?

Setting up a simple trust online with LegalZoom costs less than $300, but an estate-planning attorney will most likely charge more. 5

What is the difference between a will and a trust?

First, a trust is activated when the grantor signs it. A will does not go into effect until the testator. Upon your death, your will goes through probate, and a trust does not.

Why are wills and trusts important?

Wills and trusts are both estate planning tools that can help ensure your assets are protected and bequeathed to your heirs, besides your spouse, which is generally not an issue. This is because the unlimited marital deduction provision within the United States Estate and Gift Tax Law allows the passing of wealth to a surviving spouse without incurring gift or estate tax liabilities. 1

Why is a trust called a living trust?

It is called a living trust because it is created while the property owner, or trustor, is alive. It is revocable, as it may be changed during the life of the trustor. The trustor maintains ownership of the property held by the trust while the trustor is alive. The trust becomes operational at the trustor’s death.

How long does it take to get an executor to sort out an estate?

Your executor would still be responsible for sorting out the estate, which could take six to 18 months, depending on the intricacies. Imagine your eldest child spending the next year and a half traveling back and forth to court hearings when they should be mourning your passing. It doesn’t sound fun, but it’s a possibility if you haven't left a clear and well-drawn will and/or trust documents.

What is a trust?

To understand what a will trust is , first we must understand the concept of a trust. Early examples of trust mechanisms can be found in ancient Roman law, in the form of the fideicommissum. English trust law began developing during the Crusades in the 12 th and 13 th centuries and the underlying principles are long established.

What are the legal requirements of a will trust?

The legal test, known as ' The Three Certainties Principle' was created in the decision of Lord Langdale MR in Knight v Knight (1840) 49 ER 58. He held that in order for a valid trust to be created, there must be three certainties:

What types of will trusts are there?

There are many other uses for will trusts and furthermore, many different types of will trust. Here are just some of them:

Should I use a will trust?

Will trusts are a commonly used tool in succession planning and they bring many advantages that are unique to trusts. A carefully considered and professionally drafted will trust can be a great solution to a person's objectives. Testators must however be mindful that will trusts are governed by laws developed over a number of centuries and accordingly, can be very complex.

What is discretionary trust?

A discretionary trust is a trust where no beneficiary has a right to the income or capital of the trust and any distributions of income or capital are at the discretion of the trustees. A discretionary trust is often used where a testator has a business interest and they want to appoint certain trustees who will be capable of running the business.

What is the three certainties principle?

He held that in order for a valid trust to be created, there must be three certainties: Certainty of intention.

How old do you have to be to be a trustee of a trust?

The trustees can be one or more individuals over the age of 18, corporate entities or public bodies appointed to administer the trusts created by the will. The testator's will shall also stipulate the beneficiaries of the trust. A specified beneficiary can be an individual or corporate body, although some trusts are established to serve a charitable purpose.

Overview

Common forms of express trust

Bare trust property transferred to another to hold e.g. for a third person absolutely. May be of use where property is to be held and invested on behalf of a minor child or mentally incapacitated person.

Life Interest trust the income from property transferred is paid to one person, "the life tenant" (e.g. a widow/er), during their lifetime and thereafter is transferred to another person (who may take a…

Terms

Law generally requires only a simple formality to create an express trust. In certain jurisdictions, an express trust may even be established orally. Typically, a settlor would record the disposition, where real property is to be held in trust or the value of property in trust is large. Where legal title to property is being passed to a trustee, a "deed of settlement" or "Trust Instrument" (for jurisdictions that do not recognise Deeds) may be used. Where property is to continue to be hel…

Three Certainties of Express Trust

• Certainty of intention: Must be real intention by the settlor to dispose of property and create trust, not just make a gift – a trust also can't be created contrary to the intention of the settlor alleged to have created it: Commissioner of Stamp Duties (Qld) v Jolliffe.

• Certainty of subject:The property the subject of the trusts must be sufficiently ascertainable at the time the trust was created: Herdegen v Federal Commissioner of Taxation (1988)

Variation of Trusts in English Law

The Variation of Trusts Act 1958 gave the courts the power to vary trusts in the following circumstances

• s1(1)(a) Any person having, directly or indirectly, an interest, whether vested or contingent, under the trusts who by reason of infancy or other incapacity is incapable of assenting; or

• s1(1)(b) Any person (whether ascertained or not) who may become entitled, directly or indirectly, to an intere…

Forms of trust used by UK taxpayers

Accumulation and Maintenance trust A variation on the discretionary trust, the A&M does not carry the Inheritance tax disadvantages of a discretionary settlement but can only be established for persons under 25 who must be entitled to income at that age. Allows the accumulation of income within the trust until 25.

Disabled Trust Similar to an A&M trust but established for a disabled person.

Forms of trust used by US persons

Certain US jurisdictions and other jurisdictions have developed a radically different interpretation of the trust. Valid trusts can be established by persons who then continue to deal with property as if it were their own during their lifetime, the trust crystallising on death. Trust funds can be taxed as legal entities by election ("checking the box").