How do you calculate enterprise value?

May 31, 2021 · Enterprise value and market capitalization are both measures of a company's market value. The two calculations are not identical, and the terms are certainly not interchangeable. Each offers a...

How to determine enterprise value?

Feb 21, 2020 · Enterprise value and market capitalization (also known as market cap) each measure a company's market value. The two calculations are not identical, and the terms are certainly not interchangeable. However, each offers a peek at a company's overall value and a way to compare similar companies.

How does enterprise value differ from market cap?

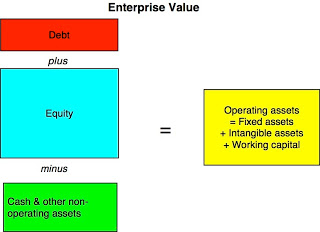

Nov 18, 2016 · Enterprise Value = market value of common stock or market cap + market value of preferred shares + total debt (including long and short-term debt) + minority interest – total cash and cash equivalents.

How to use enterprise value to compare companies?

Aug 09, 2010 · Everything that’s left over is for equity.Enterprise value measures the total capital employed (debt + equity) in a business*. Whereas market value only measures the equity.So, in simple terms, the EV of your house is the price you would sell it for. And both sources of funding have a claim on the proceeds.

Is enterprise value always greater than market value?

A company with more cash than debt will have an enterprise value less than its market capitalization. A company with more debt than cash will have an enterprise value greater than its market capitalization. Companies with identical market capitalizations can have radically different enterprise values.

Is EV the same as market cap?

As its name implies, enterprise value (EV) is the total value of a company, defined in terms of its financing. It includes both the current share price (market capitalization) and the cost to pay off debt (net debt, or debt minus cash).Jan 28, 2021

What if enterprise value is less than market cap?

Enterprise value less than the market cap may look like a bargain. But the devil is in the detail. To put this simply, you won't pay just the market cap but also the debt owed by the company. This outgo would be adjusted against the cash held by the company.Mar 4, 2020

What does it mean when enterprise value is more than market cap?

A higher EV to Market Capitalization ratio is generally not preferred. It means that the firm has an Enterprise value greater than the Market capitalization, or in other words, that the company high levels of debt and preference shares. Such firms are deemed risky.Dec 11, 2021

How do you compare enterprise value?

Simply put, EV is the sum of a company's market cap and its net debt. To compute the EV, total debt—both short- and long-term—is added to a company's market cap, then cash and cash equivalents are subtracted. This number tells you what you would have to pay to buy every share of the company.

Is market cap equity or enterprise value?

When equity analysts and investors discuss the value of companies, two of the most frequently used terms are “equity value” and “enterprise value”, which are briefly explained below: Equity Value (Market Capitalization): The value of the company to the owners of its common equity (i.e. the common shareholders)

Is higher enterprise value better?

The enterprise multiple is a better indicator of value. It considers the company's debt as well as its earning power. A high EV/EBITDA ratio could signal that the company is overleveraged or overvalued in the market. Such companies might be too expensive to acquire relative to the revenue they generate.Sep 22, 2020

What is a good enterprise value?

The enterprise-value-to-EBITDA ratio is calculated by dividing EV by EBITDA or earnings before interest, taxes, depreciation, and amortization. Typically, EV/EBITDA values below 10 are seen as healthy.

Why do you add debt to enterprise value?

Debt holders have a higher priority than equity holders on the claims of the company's assets and value, so they get paid first. In order to get to EV, we must add Debt to the Market Value of the company's Equity.

What is the difference between market capitalization and enterprise value?

Market capitalization is one side that helps the investors to find information regarding the company’s size, value, and growth; the enterprise value enables investors to measure the overall market value of a company at the other.

Why is enterprise value important?

Why Enterprise Value is Important? 1 A company with less or no debt remains an attractive buy option for investors due to the lower risk attached to it. 2 A company with high debt and less cash carries a higher risk because the debt raises the costs, and therefore it remains less attractive to investors.

What is market cap?

Market cap enables investors to make a potential investment in a company based on the market cap size, such as large-cap, medium-cap, and small-cap. It facilitates investors in identifying peers within the same sector or industry. Also, read comparable comps.

How to find market cap of a company?

Therefore, to find the market cap of a company, one can multiply the number of shares outstanding by the current share price of the stock. The market capitalization formula is as follows;

Why is it important to know the value of a company?

A key reason is that it helps the investors to not only make better investment decisions but provide them with a comprehensive view for acquisition assessments and budgeting purposes.

What is the thumb rule for XYZ?

The thumb rule says that lower enterprise multiple and higher earnings yields reflect better value for your money. Thus, in this case, if the investors will be willing to put their money into the company XYZ as it has a lower enterprise multiple and higher earnings yield.