§ 25120 - Definition of Business and Nonbusiness Income.

- (1) Rents from real and tangible personal property: Rental income from real and tangible property is business income if the property with respect to which the rental income was received ...

- (2) Gains or losses from sales of assets. ...

- (3) Interest. ...

- (4) Dividends. ...

- (5) Patent and copyright royalties. ...

Is rental income treated like ordinary income?

The short answer is that rental income is taxed as ordinary income. If you're in the 22% marginal tax bracket and have $5,000 in rental income to report, you’ll pay $1,100. However, there’s more to the story. Rental property owners can lower their income tax burdens in several ways. In fact, a profitable rental property might show no income ...

How to calculate rental income the right way?

To calculate the property’s ROI:

- Divide the annual return ($9,600) by the amount of the total investment, or $110,000.

- ROI = $9,600 ÷ $110,000 = 0.087 or 8.7%.

- Your ROI was 8.7%.

How does the IRS know if you have rental income?

Rental income includes:

- Normal rent payments

- Advance rent payments

- Payments for canceling a lease

- Expenses paid by the tenant

Are rentals qualified business income?

Rental income will be considered to be qualified business income if it meets the following criteria under the safe harbor rules contained in Revenue Procedure 2019-38. Under the safe harbor rule, a rental real estate activity falls under the definition of a rental real estate enterprise. A rental real estate enterprise is defined as an interest in real property held for the production of rents and may consist of a single property or interests in multiple properties.

What category of income is rental income?

passive incomeRental income is not earned income because of the source of the money. Instead, rental income is considered passive income with few exceptions.

What is the difference between business income and property income?

Business Income vs Property Income The difference between business income and property income is usually based on the amount of activity needed to generate the income. If it is an active source of income it is typically considered business income whereas a passive source of income would be considered property income.

Is rental income unrelated business income?

According to IRC Section 512(b)(3), rents from real property are excluded from unrelated business taxable income.

Is a rental property considered a business?

When you rent out real estate, your income is treated as property income if you provide only basic services, such as utilities (e.g. light and heating), parking and laundry facilities. If you provide additional services, such as cleaning, security and / or meals, then it may be considered a business.

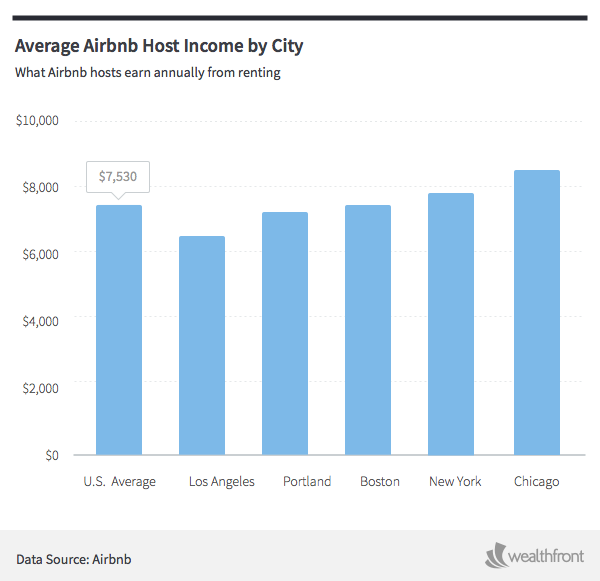

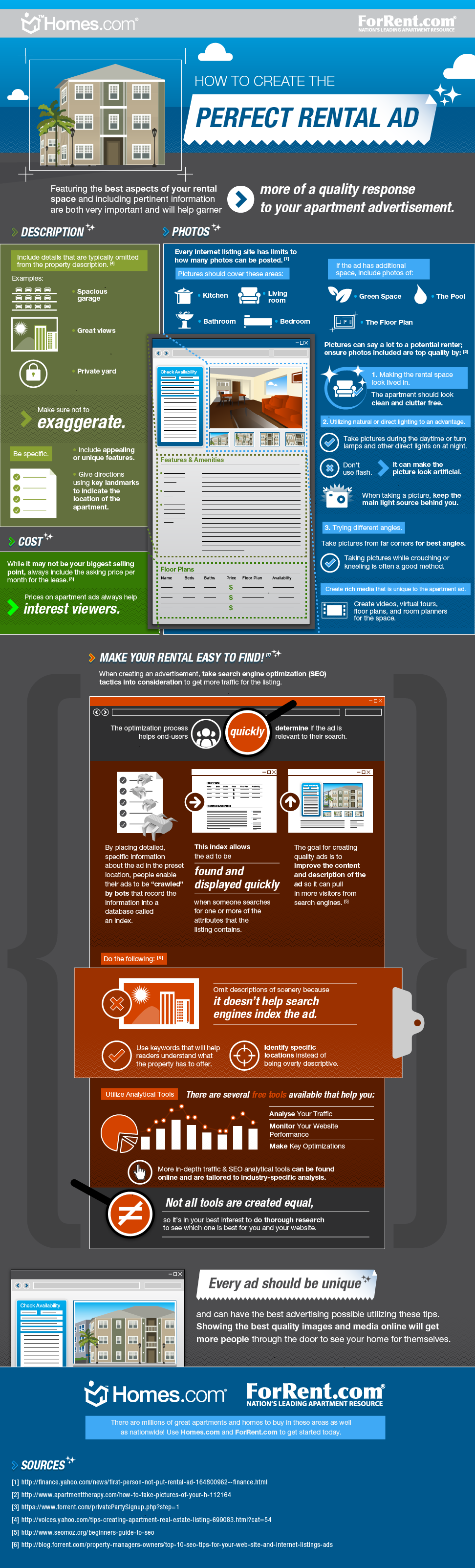

Is Airbnb rental income or business income?

You might list your home when you travel, rent out a private room or even operate a second property as a vacation rental on Airbnb. However, it's important to remember that running an Airbnb is a business venture, so there are also tax responsibilities that come with renting out your home on one of these sites.

Do I have to report rental income from a family member?

Typically, home owners will charge family members below fair market value rent for allowing them to stay in their home. If this is the case, you do not need to claim the income. However, you cannot claim any rental expenses or rental loss on your taxes.

What qualifies as unrelated business income?

For most organizations, unrelated business income is income from a trade or business, regularly carried on, that is not substantially related to the charitable, educational, or other purpose that is the basis of the organization's exemption.

How do you avoid unrelated business taxes?

Conduct Activities Substantially Related to Tax-Exempt Purpose. ... Evaluate Income from Debt-Financed Property. ... Be Cautious of Advertising Income. ... Assess Income from Pass-through Entities.

What are business income examples?

Business income may include income received from the sale of products or services. For example, fees received by a person from the regular practice of a profession are business income. Rents received by a person in the real estate business are business income.

Is my rental property qualified business income?

Qualified business income, or QBI, is the net income generated by any qualified trade or business under Internal Revenue Code (IRC) § 162. Rental properties are usually treated as passive activities, and passive activities are excluded from the definition of a qualified trade or business.

What is the difference between business income and non business income?

Nonbusiness income means all income other than business income or compensation. Business income means all income (other than compensation) that may be apportioned by formula among the states in which you are doing business without violating the Constitution of the United States.

What are the types of income in business?

Business income falls into two categories for profit and loss reporting: sales or 'turnover' other income....Business income: other than salesinterest on business bank accounts.sale of equipment you no longer need.rental income to the business.money you put into a limited company from personal funds.

What line do you declare rental income on?

If you rent out a property, you must declare your Gross Rental Income on Line 12599 of your personal tax return. Then, you may deduct qualifying expenses to arrive at your Net Rental Income on line 12600.

What utilities do you pay for when renting a house?

Utilities – Gas, oil, electricity, water, and cable, if the rental arrangement specifies that the property owner pays for the utilities.

What is travel in rental property?

Travel – Related to collecting rents, supervising repairs, and managing properties are eligible. Including the cost of getting to your rental property, but do not include board and lodging along the way there or back.

What is the difference between capital and current expenses?

Whereas a current expense generally reoccurs after a short period, such as the cost of painting, a capital expense generally provides a lasting benefit or advantage, such as renovations which extend the useful life of the property or improve it beyond its original condition .

Can rental income be deducted?

Any reasonable expenses incurred to earn rental income are able to be deducted, and the two basic types of expenses are categorized as being either current expenses or capital expenses.

Is rental property insurance deductible?

Insurance – Only the premiums for insurance coverage on your rental property for the current year are deductible. Where your policy provides coverage for multiple years, claim that coverage in the applicable year

Is property tax deductible?

Property taxes – Only for the period the rental property was available for rent. Salaries, wages, and benefits, including employer’s contributions – Amounts paid or payable to superintendents, maintenance personnel, and others employed to take care of the property are deductible, such as; CPP, QPP, EI and Workers Compensation.

What is HP in tax?

The Income can broadly fall under the following two heads of income in the Income Tax Act: 1. Income from House Property (HP) 2. Income from Business and Profession (PGBP) Taxability as HP provides (or limits) a standard deduction of 30% of the income along with a deduction on interest paid on borrowed capital for the purposes of acquisition, ...

When taxpayers are able to provide factual material to substantiate that their activities are in the nature of?

Therefore, when taxpayers are able to provide factual material to substantiate that their activities are in the nature of business and in line with their constitution documents, we hope to see reduced litigation on this issue. Needless, judicial precedents also seem to test the substance over form of transactions. Risk of litigation and related cash tax outflows could impact transaction values in the real estate sector.

Is leasing out property part of a business?

The trend of judicial precedents and directions released by the Central Board of Direct Taxes (CBDT) reveal that the authorities are now accepting that ownership of property and leasing it out may also be done as part of a “business,” apart from as a mere owner. Some of these judicial precedents and directions are as follows:

Is rental income a PGBP?

As there are no limits or restrictions on deductions under the head PGBP, taxpayers veer towards classifying rental income received from lease of immovable property as PGBP. Obviously, this requires the support of facts in every case. The tax authorities, on the other hand, argue that rental income should be chargeable to tax as HP Income, perhaps the ease (and limitation) of deductions under HP being the driving force.

What line is real estate rental income on?

from real estate rentals is reported on Form T776, and on line 12600 rental income (line 126 prior to 2019) of the tax return.

Is child care expense included in earned income?

is not included in earned income for purposes of calculating the child care expense deduction.

Is rental income considered business income?

Rental Income Received by a Corporation. When rental income is received by a corporation, the income is usually considered investment (property) income , and is not considered active business for purposes of the small business deduction .

Is rental property business income?

In general, the number and kinds of service provided in relation to the rental of the property will determine whether the income is property or business income. The more services that are provided, the more likely that the income will be considered business income. The number of rental properties being managed will not affect ...

Is CWB included in working income?

is included in working income for purposes of the Canada Workers Benefit (CWB) - prior to 2019 this was the Working Income Tax Benefit (WITB).

Is rental income the same for an individual?

The tax treatment for each type of rental income is the same for an individual or a partnership. If you're not sure if you have a partnership, see Income Tax Folio S4-F16-C1, What is a Partnership?

Earned income vs. rental income

Real estate investors can receive two main types of income: rental income (sometimes known as passive income) and earned income (sometimes known as active income).

How rental income is taxed

Income from rental property is taxed based on an investor’s marginal income tax rate. To illustrate, assume an investor is married filing jointly and reports a total taxable income of $250,000 from all sources. According to the most recent guidance from the IRS for tax year 2022, the marginal tax rate would be 24%.

What happens if rental income is negative?

The example above assumes there is taxable rental income, but in the real world of real estate investing, a rental property may generate a loss for tax purposes. For example, it could take longer than expected to find a qualified tenant and, consequently, the rent collected is less than anticipated.

Tips for reducing taxable rental income

Investors should report all income and expenses. Generally speaking, the tax laws in the U.S. are favorable to real estate investors. Here are some other ways an investor may be able to reduce taxable income from a rental property:

How to automate income and expense tracking

Keeping track of income and expenses from a rental property can be complicated. Free rental property financial management software from Stessa automates income and expense tracking to help investors maximize profits and tax deductions.