The cost approach must be performed “if the subject property is proposed or new construction. If the cost approach is not developed, FHA does not require appraiser to provide an estimate of site value. The cost approach is only required in the appraisal of new construction manufactured homes.

How to prepare for and FHA appraisal?

“As a property seller, the best way to prepare for an FHA appraisal is to visit HUD’s website and review the minimum property standards in order to make sure your home will pass that inspection,” says Linsell. In general, you can expect an FHA appraisal to be completed within a week.

What is a HUD or FHA appraisal?

Within the context of FHA loans, the purpose of the appraisal is to determine the market value of the home that is being purchased. During this process, the appraiser will look at comparable properties that have sold recently, in the same area as the one being purchased.

What determines the cost of an appraisal?

The appraisal value is determined by the compilation of all the comps’ net values. From this value, the price per square is derived. Let’s assume a comp sold for $410,000 and is 175 square feet bigger than the subject property.

What to expect during the home appraisal process?

They typically look at the following:

- Lot size, view, curb appeal, etc.

- Value-adding features, upgrades or additions

- Quality of construction and overall condition of the property

- Structural integrity (but with less scrutiny that a home inspector)

- Whether or not the property conforms to the neighborhood, for resale purposes

Is the cost approach required for appraisals?

Construction lenders require cost approach appraisals because any market value or income value is dependent upon project standards and completion. Projects are reappraised at various stages of construction to enable the release of funds for the next stage of completion.

Which approach or approaches to value is required in all FHA appraisal assignments?

the cost approachFHA requirements re: site value (In USPAP vernacular, they are referred to as assignment conditions.) As an example, some lenders require that an appraiser must complete the cost approach in all appraisal assignments, even those in which the appraiser believes the cost approach will not produce credible results.

When would an appraiser use the cost approach?

The cost approach can be used to appraise all types of improved property. It is the most reliable approach for valuing unique properties. The cost approach provides a value indication that is the sum of the estimated land value, plus the depreciated cost of the building and other improvements.

Does FHA require the cost approach on manufactured homes?

New construction manufactured housing also requires the appraiser to complete the cost approach section of the appraisal. HUDs standard guidelines regarding utilities. The appraiser must address any deficiencies from HUDs minimum property standards for utilities.

What appraisal form is used for FHA?

An FHA appraisal is completed on an FNMA 1004 form.

What appraisal form is used for FHA loans?

D-1 Uniform Residential Appraisal Report This report form is designed to report an appraisal of a one-unit property or a one-unit property with an accessory unit; including a unit in a planned unit development (PUD), based on an interior and exterior inspection of the subject property.

Who uses cost approach in real estate?

Share: In real estate, the cost approach appraisal method is one of the common ways appraisers calculate or estimate the value of a property.

When using the cost approach an appraiser needs all of the following information?

When using the cost approach, an appraiser needs all of the following information, except the: capitalization rate. What is the primary purpose of professional organizations like the Appraisal Institute (AI)? Appraisers report appraisal results using one of two reporting options.

What are the limitations of the cost approach?

Limitations of the Cost Approach If there is no vacant land, the estimated value of the property will be inaccurate. Also, an area can be fully developed, and local authorities can be restrictive on new developments, and so it will be impractical to estimate land values in that area.

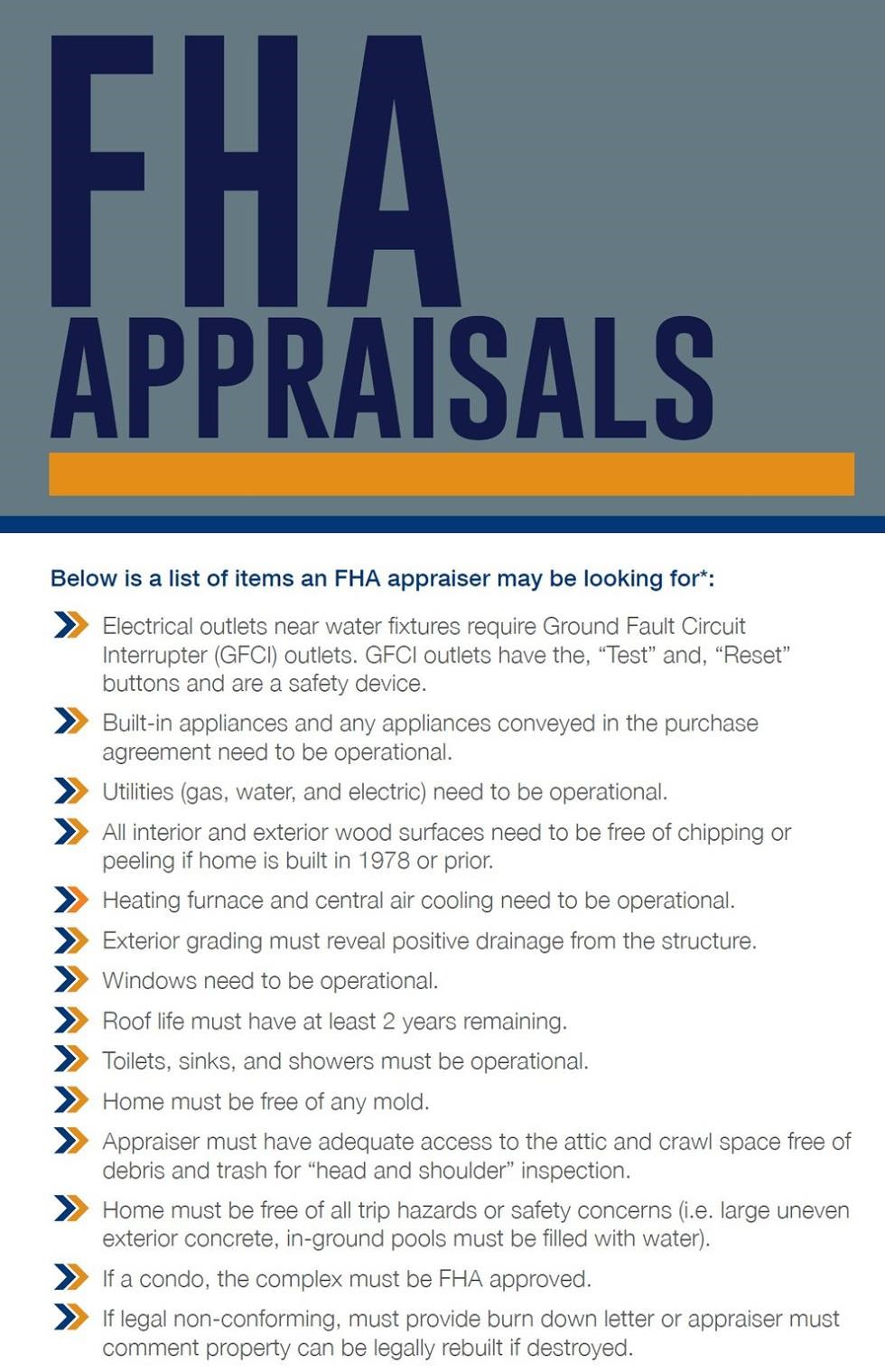

What will not pass an FHA inspection?

The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

How picky are FHA appraisers?

FHA mortgage appraisals are more rigorous than standard home appraisals. Whether you're looking at refinancing an FHA loan, buying a house with an FHA loan or even selling to someone who will be using an FHA loan, you'll want to understand what these appraisals entail.

What will FHA not approve?

If a home is too close to a high-pressure gas pipeline, high voltage electrical wires, mining or drilling operations or other hazards, it may not be possible for your lender to approve the loan.

Does Fannie Mae require the cost approach?

Answer: No! In order to comply with Fannie Mae guidelines, the sales comparison approach must be the primary method used to determine the value. In fact, Fannie Mae will not purchase a mortgage on a property if the cost approach is the primary or only method of valuation used.

What approach to value is based on the return of income to the investor?

The income approach, sometimes referred to as the income capitalization approach, is a type of real estate appraisal method that allows investors to estimate the value of a property based on the income the property generates.

Which approach to value makes use of a rate of investment return?

Which appraisal method uses a rate of investment return? Income approach.

What type of approach would most often be applicable to single unit residential properties?

The sales comparison approach is commonly used in valuing single-family homes and land. Sometimes called the market data approach, it is an estimate of value derived by comparing a property with recently sold properties with similar characteristics.

What is an appraisal for a FHA loan?

An appraisal is an expert assessment of a particular product or asset (in this case a house) to determine its value. Within the context of FHA loans, the purpose of the appraisal is to determine the market value of the home that is being purchased. During this process, the appraiser will look at comparable properties that have sold recently, ...

What is the difference between a FHA appraisal and a regular appraisal?

So the primary difference between FHA and regular appraisals is the level of inspection that is required by HUD. If the HUD-approved appraiser flags certain issues -- such as peeling paint, loose handrails, or other safety issues -- those issues must be corrected before the loan will be funded.

What Does the Appraiser Look for?

So, what does the FHA appraiser look for during this process? The primary areas of inspection are the roof, the foundation, lot grade, ventilation, mechanical systems, heating, electricity, and crawl spaces (when present).

What is the purpose of an FHA appraisal?

The Department of Housing and Urban Development (HUD) requires him to determine the current market value, as with any appraisal. But they also require a property inspection to make sure the home meets HUD's minimum standards for health and safety. This is the "double duty" mentioned earlier. It's what makes the FHA appraisal process unique.

How to do a home appraisal?

At a minimum, the appraiser must complete the following steps: 1 Visually inspect the subject property both inside and out. 2 Take photos of the property to be included within the loan file. The photos must show the sides, front and rear of the home, as well as any value-adding improvements such as a pool or patio. 3 Take a photo of each comparable sale transaction that is being used to support the appraisal. 4 Obtain and provide a copy of a street map that shows the location of the property and each comparable sale, or "comp," used during the valuation. 5 Take photos that show the grade of the lot, if it's a proposed construction.

What is the primary concern of HUD?

HUD's primary concern is the health and safety of the home buyer who will actually live in the house. Thus, most of their appraisal / inspection checkpoints have to do with health and safety aspects of the property. Above all, the home must be habitable and comfortable, without any potential hazards to the occupant.

What is a conventional appraisal?

Conventional: In a typical real estate transaction, where a conventional (non-government-insured) home loan is being used, the appraiser is mostly concerned with the current market value of the property in question. That is his primary objective when visiting the house.

What does an appraiser do for a FHA?

During an FHA Appraisal, an Appraiser (a professional) comes to the house with an aim to assess its value (how much it is worth) so that he can decide the market value of the house being purchased. The appraisers are highly specialized in what they do.

What is the purpose of an appraisal on a house?

During the inspection, not only will the Appraiser will inspect the “Subject” house but may also evaluate others in the vicinity so as to have a comparison between both for the value assessment. A detailed report will be written by this expert and it will include a probable value of the house. Afterward, this report will be handed over to the mortgage lender for final review and further action.

What is a conventional appraisal?

Regular Appraisal (Conventional): When a conventional appraisal takes place and you intend to buy a house on other than an FHA loan, then the appraiser only focuses on the value of the property. So, when he visits the house, his main motive is about how much the property is worth.

What does an appraiser look for in a house?

So, an Appraiser looks for places like crawl spaces, electricity, heating, mechanical system, ventilation, lot grade, foundation, roof, and other related areas.

What should be taken into photos for appraisal?

Each comparable transaction that is being used to support the appraisal should be taken into photos by the appraiser. A copy of the street map and the location of the property, each comparable sale, or “comp” should be obtained during the assessment.

What to do before getting a house appraised?

Before you get the house appraised or inspected by a professional appraiser, we highly suggest you make sure that the house is as valued as it should be.

Does an FHA appraiser make sure the property is safe?

So, not only does an FHA appraiser ensure the market value of the property, ...

What is cost approach appraisal?

The cost approach is another method an appraiser may use to develop an opinion of value. In a nutshell, it’s a breakdown of what it would cost to rebuild the property today if it were destroyed.

Is cost approach reliable?

The cost approach is a valuable approach to use when appraising newer homes that might have little or no depreciation; however for homes older than a few years, it is not very reliable. Some underwriters still want these completed regardless of the age of the home and that’s when start running into confusion from borrowers.

Does FHA require cost approach?

Some lenders still require this, even though Fannie Mae, Freddie Mac and FHA do NOT . If it is a lender/client requirement, the Cost Approach will be completed, regardless of the property’s age.

What is the subject section of a FHA appraisal?

This section provides the factual data to identify the property and the parties to the appraisal process. The FHA case number together with the Borrower and/or property information will be supplied by the mortgagee/client who engages the appraiser. The following table provides instruction for completing the “Subject” section of the form.

What is the purpose of an appraisal of a lease?

If the property is subject to Ground Rent, the appraiser must include an analysis of the terms of the lease, including the term of lease, renewal options, right of redemption, capitalization rate, date of expiration, etc. The mortgagee is responsible for ensuring that the appraiser has a copy of the deed or lease for analysis and that a copy is included in the loan file. The subject’s final value estimate must be adjusted for and reported as its Leasehold value, not the Fee Simple value.

How to do an attic inspection?

The appraiser is required to inspect the attic. Enter the attic and observe the interior for insulation, ventilation ( fan, vent, or window), and the condition of the roof structure. Note any deficient materials, leaks or readily observable evidence of significant water damage, structural problems, previous fire damage, exposed and frayed wiring, or any other health and safety deficiencies. If any deficiencies exist, condition the appraisal on their repair or inspection and prepare the appraisal as “subject to repairs” and/or “subject to inspection.” The following table provides instruction for completing the “Attic” portion of the “Improvements” section of the report form.

What is the purpose of an appraiser's inspection of the mechanical, plumbing, and electrical systems of the subject property?

An appraiser must examine the mechanical, plumbing and electrical systems of the subject property to ensure that they are in proper working order. The following table provides instruction for completing the “Heating and Cooling” portion of the “Improvements” section of the report form.

How to analyze a contract for sale?

Analyze Contract for Sale Mark the appropriate box to identify whether the appraiser did or did not analyze the contract for sale for the subject purchase transaction. Explain the results of the analysis (terms and conditions) of the contract for sale or why the analysis was not performed. The analysis may include a reference to the number of pages contained in the contract for sale provided. Identify the source(s) used, price(s) and date(s) of current or prior listings. If purchaser name in contract does not match borrower name provided by the lender, include a comment. Contract Price $ Enter the final agreed upon contract price. Use whole dollars only. Date of Contract Enter the date of the contract. This is the date when all parties have agreed to the terms of, and signed the contract. The data input format is: yyyy-mm-dd, but PDF will display this format: mm/dd/yyyy. Defined Transaction Types Explain the results of the analysis of the contract for sale or why the analysis was not performed. The allowable values are listed below and are self-explanatory. The abbreviated version is displayed in the sales adjustment grid.

How to determine market trends for one unit homes?

Comparing houses that have been sold and resold in recent years is an effective way to determine market trends. Appraisers who use this method, however, should make sure to factor in any improvements or changes made to the property between sales. Demand/ Supply Mark the appropriate demand/supply trend. To determine the equilibrium status of supply and demand in the neighborhood, compare the number of houses sold to the number of houses listed for sale in a recent time period. The similarity or difference between the number of houses sold and listed, not the absolute numbers, should determine the demand/supply level. Marketing Time Mark the appropriate marketing time –the typical length of time a one-unit property in the subject’s neighborhood would have to stay on the market before being sold at a price near its Market Value. The following table provides instruction for completing the “One-Unit Housing” price and age trends section of the report form.

What is a HUD 92051?

Compliance or Final Inspection for New Construction or Manufactured Housing Form HUD-92051,Compliance Inspection Report, in Portable Document Format (PDF) Compliance or Final Inspection for Existing Property Certificate of Completion Section of Fannie Mae Form 1004D/Freddie Mac Form 442, Appraisal Update and/or Completion Report;MISMO 2.6 Errata 1 format The following sections provide instructions for completion of the forms and providing the data needed by FHA.

What is cost approach in real estate appraisal?

In order to use, the cost approach assumption is to inform the buyers that they shouldn’t pay more than the amount estimated. A good cost approach on appraisal defines a good estimate for the real estate agent or seller as well as the buyer. If a person has to sell his home, the cost appraisal approach will allow him to assess the property value aligned with the market value. Based on the property value, a seller or real estate agent can decide if he is going to sell his property or not. In the same way, a buyer can also assess if the estimated cost is in accordance with his budget.

How many approaches to value in appraisal?

There are three approached to value in an appraisal, these approaches are as followed:

How to determine the value of a property?

The value of a property is strongly dependent on the value of the land. In the appraisal cost approach, we estimate the land value by using different techniques. These techniques are some form of the income approach and the comparison approach. The value of land is deduced by comparing the value given to the land in recent sales or the value of land can also be deduced by evaluating how profitable that land will be. Vacant land will be low value as compared to the land present in the commercial areas.

What is depreciation in real estate?

Moreover, depreciation is the loss in the building value or improvements of the property. These are the improvements that can be made in the property which reduce the property value, resultantly. Physical depreciations refer to the value downfall that occurs as the age of building increases. It also accounts for the remaining life of the improvements while depreciation estimation. Another way, the most comprehensive, is the breakdown method in which all types of the depreciations are estimated and then taken their sum, but this method is very time consuming and lengthy. Another way of calculating the depreciation is known as the market extraction method in which comparable sales are analyzed and estimates the approximate depreciation cost based on data available.

How does a real estate agent determine the cost of a property?

The real estate agents can also use a sales comparison approach in determining the estimated cost of a property. They do sales comparison in which they tell the client about their recently sold properties with more or less similar features to frame a cost. By doing so, they may take advantage of their previous good sale and do not let the depreciation affect the cumulative value of the land and property. Moreover, the income approach is used usually for commercial properties where the property generates some kind of revenue as well, for example, shopping malls, apartments, and etcetera. In this article, the main focus will be the cost approach appraisal.

What is reproduction cost?

In reproduction cost or replacement cost of the structure involves estimating the current cost of building ta new more or less the same structure from scratch and the site improvements – this can be done by either replacement method or reproduction method.

What is income approach?

The income approach is normally used for commercial properties where a property is not just a property but also earns some revenue in some way and there is a good value of the land also. There are two ways of incorporating future income in the value of the property today: The direct capitalization method and the yield capitalization method. By using these methods a good multiplier can be obtained to use with the subjective property.

Why does an appraiser not need to explain the omission of the cost approach in the report?

If a client asks an appraiser not to develop the cost approach in an assignment, the appraiser does not need to explain the omission of the cost approach in the report, because the client is already aware of the omission.

What is the scope of work requirement for an appraiser?

Responsibility. An appraiser is required to complete only the work necessary to produce credible results for the assignment. The SCOPE OF WORK RULE essentially states: If a law or regulation precludes compliance with a part of USPAP, the law or regulation takes precedence.

What is the jurisdictional exception rule for an appraiser?

The JURISDICTIONAL EXCEPTION RULE makes that an easy choice: the appraiser must follow the law and disregard the part of USPAP that has been voided.

Does Fannie Mae require additional disclosure?

The pre-printed disclosure covers all Fannie Mae assignments, and no additional disclosure is necessary. Fannie Mae does not permit additional disclosures in reports . Additional research and analysis are prohibited by Fannie Mae. Fannie Mae does not permit an appraiser to do less than the pre-printed scope of work.

Does USPAP require Fannie and Freddie?

USPAP does not require this, but Fannie and Freddie do.

Which is better, interior or exterior inspection?

Appraisals made with interior inspections are always superior to appraisals made with exterior-only inspections.

Do appraisers have to disclose research?

An appraiser needs to disclose the research and analyses that were performed, but does NOT have to disclose the research and analyses that were NOT performed.