What is the formula for dividend discount model?

Formula. Dividend Discount Model = Intrinsic Value = Sum of Present Value of Dividends + Present Value of Stock Sale Price. This Dividend Discount Model or DDM Model price is the intrinsic value of the stock. If the stock pays no dividends, then the expected future cash flow will be the sale price of the stock. Let us take an example.

What is constant growth dividend valuation model?

Constant Growth Dividend Valuation Model. This model is used when a company’s dividend payments are expected to grow at a constant rate for a long period. The formula is: Dt = D0(1+g) ^t. The model assumes that a company’s earnings, stock price, and dividends are expected to grow at a constant rate.

How to calculate dividend growth rate?

- Enter a set of tickers (you could enter one or over fifty)

- Enter a start year and an end year (data will be downloaded from 1 st January of the start year to 31 st December of the end year)

- Optionally, check “Write to CSV”, “Collate Data” or “Dividend Growth Rate”

- Click “Get Bulk Dividends”

What is the formula for common stock dividends?

Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding; Dividend per share = $2,02,500/2,00,000; Dividend per share = $1.01 dividend per share; Example #3. Anand Group of Company has paid annual dividends of $5,000. Outstanding Stock at the beginning was 4000 and Outstanding stock at the end it was 6000.

Are dividend discount models reliable in determining whether a stock may be over or undervalued?

The dividend discount model doesn't require current stock market conditions to be considered when finding the value of a stock. Again, the emphasis is on future dividend growth. For that reason, DDM isn't necessarily a 100% accurate way to measure the value of a company.

Why is the dividend discount model good?

The dividend discount model allows the investor to determine a reasonable price for a stock based on an estimate of the amount of cash it will return in current and future dividends. DDM is one way of estimating the intrinsic value of a stock.

Why is DCF better than DDM?

The dividend discount model (DDM) is used by investors to measure the value of a stock. It is similar to the discounted cash flow (DFC) valuation method; the difference is that DDM focuses on dividends while the DCF focuses on cash flow. For the DCF, an investment is valued based on its future cash flows.

What does the dividend discount model tell you?

The dividend discount model (DDM) is a quantitative method used for predicting the price of a company's stock based on the theory that its present-day price is worth the sum of all of its future dividend payments when discounted back to their present value.

How do you value a company using the dividend discount model?

What Is the DDM Formula?Stock value = Dividend per share / (Required Rate of Return – Dividend Growth Rate)Rate of Return = (Dividend Payment / Stock Price) + Dividend Growth Rate.

Which one is better CAPM or dividend growth model?

Advantages of the CAPM It is generally seen as a much better method of calculating the cost of equity than the dividend growth model (DGM) in that it explicitly considers a company's level of systematic risk relative to the stock market as a whole.

Why is DDM not accurate?

The DDM is built on the flawed assumption that the only value of a stock is the return on investment (ROI) it provides through dividends. Beyond that, it only works when the dividends are expected to rise at a constant rate in the future. This makes the DDM useless when it comes to analyzing a number of companies.

Is DDM or DCF better?

Out of the two tools to calculate the present value of the stock of a company, DCF is more popular among investors as a vast majority of companies do not pay dividends. As such DDM is used on a much smaller scale than DCF.

What are two weaknesses of the DCF model?

The main Cons of a DCF model are: Prone to errors. Prone to overcomplexity. Very sensitive to changes in assumptions. A high level of detail may result in overconfidence.

What are the 3 types of dividend discount model DDM?

The Dividend Discount Model, also known as DDM, is in which stock price is calculated based on the probable dividends that one will pay....Table of contents#1 – Zero-growth Dividend Discount Model. ... #2 – Constant-Growth Rate DDM Model. ... #3 – Variable-Growth Rate DDM Model (Multi-stage Dividend Discount Model)More items...

Is WACC used in dividend discount model?

It assumes that the stock's current price contains all the information necessary to discount and extrapolate its future earnings and dividends. The rate of discount for these future cash flows is known as the Weighted Average Cost of Capital or WACC.

Why is the dividend growth model important?

Dividends provide protection in down markets, giving investors access to cash, either to spend or to buy more stock after prices have fallen. This phenomenon creates more demand for dividend-paying stocks in down markets and can help to further stabilize prices.

Why is the dividend growth model important?

Dividends provide protection in down markets, giving investors access to cash, either to spend or to buy more stock after prices have fallen. This phenomenon creates more demand for dividend-paying stocks in down markets and can help to further stabilize prices.

What are the advantages of the discounted cash flow models?

The main advantages of a discounted cash flow analysis are its use of precise numbers and the fact that it is more objective than other methods in valuing an investment. Learn about alternate methods used to value an investment below.

What are the advantages of dividend policy?

Five of the primary reasons why dividends matter for investors include the fact they substantially increase stock investing profits, provide an extra metric for fundamental analysis, reduce overall portfolio risk, offer tax advantages, and help to preserve the purchasing power of capital.

What are the advantages of dividend investing?

Dividend-paying stocks, on average, tend to be less volatile than non-dividend-paying stocks. And a dividend stream, especially when reinvested to take advantage of the power of compounding, can help build wealth over time. However, dividends do have a cost.

What are the downsides of the dividend discount model?

The downsides of using the dividend discount model (DDM) include the difficulty of accurate projections, the fact that it does not factor in buybacks, and its fundamental assumption of income only from dividends.

What is a DDM in stock?

The DDM assigns a value to a stock by essentially using a type of discounted cash flow (DCF) analysis to determine the current value of future projected dividends. If the value determined is higher than the stock's current share price, then the stock is considered undervalued and worth buying. While the DDM can be helpful in evaluating potential ...

What are the shortcomings of the DDM model?

Another shortcoming of the DDM is the fact that the value calculation it uses requires a number of assumptions regarding things such as growth rate, the required rate of return, and tax rate. This includes the fact that the DDM model assumes dividends and earnings are correlated. One example is the fact that dividend yields change substantially ...

Is the dividend discount model too conservative?

A key limiting factor of the DDM is that it can only be used with companies that pay dividends at a rising rate. The DDM is also considered too conservative by not taking into account stock buybacks.

Is DDM useless?

This makes the DDM useless when it comes to analyzing a number of companies. Only stable, relatively mature companies with a track record of dividend payments can be used with the DDM. This means that investors who only utilize the DDM would miss out on the likes of high-growth companies, such as Google (GOOG).

Is DDM good for dividends?

While the DDM can be helpful in evaluating potential dividend income from a stock, it has several inherent drawbacks.

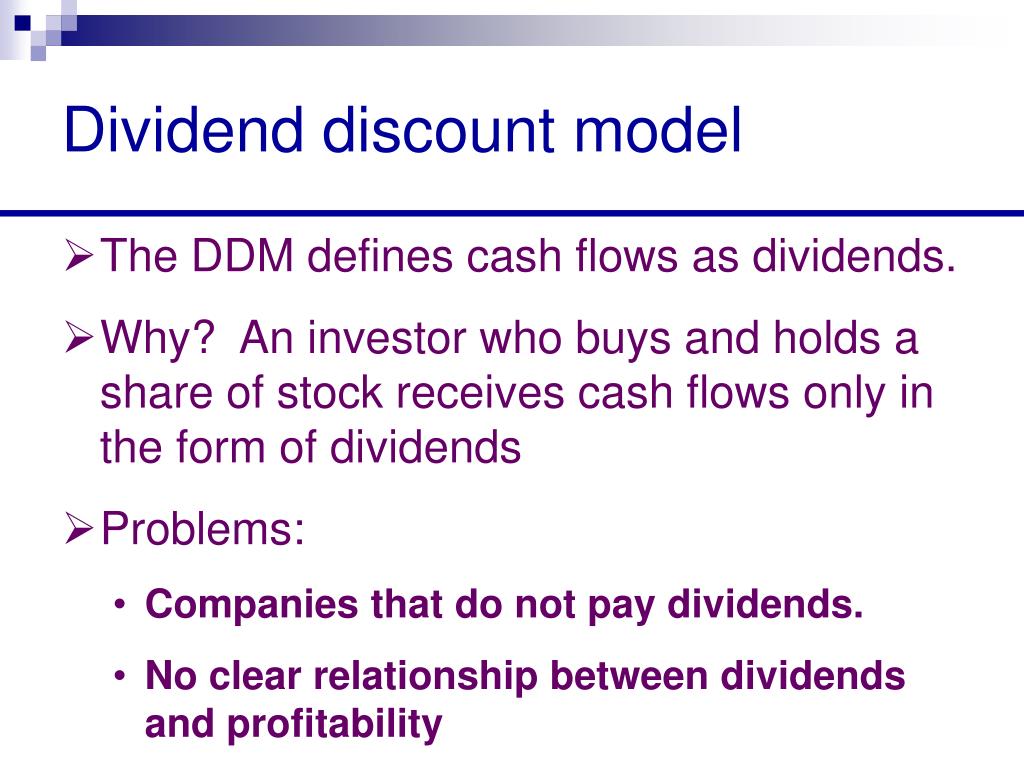

What is the dividend discount model?

You can take that same approach, and tailor it specifically for analyzing a stock that pays dividends. This method is the Dividend Discount Model (DDM). It’s also called the Dividend Growth Model, and the most straightforward form is called the Gordon Growth Model.

What inputs are needed to calculate discount rate?

The inputs you need are the current free cash flow figures, the projected growth rate of those cash flows, and your target rate of return to use as the discount rate.

What Discounted means?

By discounted, what I mean is that due to the time value of money, a payment in the future is worth less than the same payment today. Imagine you can earn a 10% rate of return on your money over time. Therefore a payment of $10,000 one year from now would only be worth $9,091 to you today, because if you had $9,091 today, you could invest it at a 10% rate of return and turn it into $10,000 a year from now ($9,091 multiplied by 1.10 equals $10,000).

What is dividend toolkit?

The one product I offer on this site is the Dividend Toolkit, which is a comprehensive stock guide that also comes with an easy-to-use valuation spreadsheet to calculate the fair price for dividend stocks.

What is the difference between blue and orange dividends?

The orange values are the actual dividends you expect to be paid if the dividend grows by 5% per year. The blue values are the discounted versions of those dividends; the dividends translated into today’s value based on your discount rate of 11%.

What is the DDM in stock?

The DDM is based on the exact same idea, except that the share of stock represents what we’re valuing, and all future dividends represent all future cash flows of that share. The value of the stock is equal to the sum of the net present value of all future dividends.

What do you need to know about valuation?

All valuation methods rely on estimated inputs. The two main things you need are an estimate for the growth rate, and your discount rate. (Your discount rate should be your target rate of return.). But if those inputs are off even slightly, the whole valuation method will be off. With basic freebie valuation calculators, you need to put in more than one set of inputs if you want to see several output options, and you have no way of keeping track of the differences.

Overview

- The downsides of using the dividend discount model (DDM) include the difficulty of accurate pr…

There are a few key downsides to the dividend discount model (DDM), including its lack of accuracy. - A key limiting factor of the DDM is that it can only be used with companies that pay dividends at …

The DDM is also considered too conservative by not taking into account stock buybacks.

Drawback N 1: Must Pay Dividends

- The first drawback of the DDM is that it cannot be used to evaluate stocks that don't pay dividen…

Beyond that, it only works when the dividends are expected to rise at a constant rate in the future. This makes the DDM useless when it comes to analyzing a number of companies. Only stable, relatively mature companies with a track record of dividend payments can be used with the DDM.

Drawback N 2: Many Assumptions Required

- Another shortcoming of the DDM is the fact that the value calculation it uses requires a number …

One example is the fact that dividend yields change substantially over time. If any of the projections or assumptions made in the calculation are even slightly in error, this can result in an analyst determining a value for a stock that is significantly off in terms of being overvalued or un…

Drawback N 3: Ignores Buybacks

- Additional criticism of the DDM is that it ignores the effects of stock buybacks, effects that can make a vast difference in regard to stock value being returned to shareholders. Ignoring stock buybacks illustrates the problem with the DDM of being, overall, too conservative in its estimation of stock value. Meanwhile, tax structures in other countries make it more advantageous to do sh…