Key Takeaways

- Accrual accounting is a method of accounting where accountants record revenue and/or expenses when a transaction occurs or when a payment is made.

- The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and other such things.

Is accrual accounting better than cash accounting?

While the accrual basis of accounting provides a better long-term view of your finances, the cash method gives you a better picture of the funds in your bank account. This is because the accrual method accounts for money that’s yet to come in.

How to calculate accounting on an accrual basis?

How to Calculate Accounting on an Accrual Basis

- Accrual accounting at work. Let's say a company sells $10,000 worth of products on March 1 and receives payment for those products on April 30.

- Advantages of the accrual basis. The accrual basis of accounting provides a more accurate picture of a company's profitability during a specific accounting period.

- Choosing between the accrual and cash basis. ...

Why is accrual accounting better than cash?

Cash vs accrual vs hybrid accounting. Accrual accounting gives a better indication of business performance because it shows when income and expenses occurred. If you want to see if a particular month was profitable, accrual will tell you. Some businesses like to also use cash basis accounting for certain tax purposes, and to keep tabs on their ...

How to choose between cash and accrual accounting?

- It makes it easy to see future revenue and expenses. Unlike cash accounting, accrual basis accounting lets you see a full picture of your business’s finances. ...

- It provides a more accurate picture than cash basis accounting. ...

- It allows tax savings for depreciation. ...

What is accrual explain with example?

Accrual accounting is a method of accounting where accountants record revenue and/or expenses when a transaction occurs or when a payment is made. The most common accrual accounting examples are sales on credit, purchases on credit, rent paid, electricity expense, depreciation, audit fees, and other such things.

Which of these are examples of accrual accounting?

Taxes incurred are an example of a commonly accrued expense. They are taxes that a company has not yet paid to a government entity but has incurred from the income earned. Companies retain these taxes as accrued expenses until they pay for them.

What is accrual accounting in simple terms?

Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The method follows the matching principle, which says that revenues and expenses should be recognized in the same period.

What are the two types of accruals?

They are done at the end of an accounting period so that the reported income statement and balance sheet can be inclusive of these amounts. There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.

What is accrual accounting and why is it important?

Accrual basis accounting is one of two leading accounting methods and the preferred bookkeeping method for providing an accurate financial picture of a company's business operations. Accrual basis accounting recognizes business revenue and matching expenses when they are generated—not when money actually changes hands.

How do you calculate accruals?

You can calculate the daily accrual rate on a financial instrument by dividing the interest rate by the number of days in a year—365 or 360 (some lenders divide the year into 30 day months)—and then multiplying the result by the amount of the outstanding principal balance or face value.

What is difference between cash and accrual accounting?

The difference between cash basis and accrual basis accounting comes down to timing. When do you record revenue or expenses? If you do it when you pay or receive money, it's cash basis accounting. If you do it when you get a bill or raise an invoice, it's accrual basis accounting.

What are the major reasons for accrual accounting?

Accrual accounting matches expenses and revenues to the time periods in which they are incurred. This allows companies to better monitor their cash flow and to identify and remedy potential profitability issues.

Which of the following is an example of an accrual quizlet?

Q 4.12: Which of the following is an example of an accrual? Record Revenues that will be received in cash in a subsequent period.

What are the types of accruals?

There are several different types of accruals. The most common include goodwill, future tax liabilities, future interest expenses, accounts receivable (like the revenue in our example above), and accounts payable. All accounts payable are actually a type of accrual, but not all accruals are accounts payable.

Which of the following is true of accrual basis accounting?

Therefore, the correct option is (B) Accrual accounting records revenue only when it is earned.

Which of the following is not an application of an accrual accounting?

Recording advertising fees earned at the time the cash payment is received . Recording advertising fees earned at the time the cash payment is received is not an application of accrual accounting because the recording of fees should be done as soon as the service has been performed.

What Is An Accrual (In Plain English)?

What exactly is an “accrual”? If companies received cash payments for all revenues at the same time when they were earned, and made cash payments f...

Categories in Accrual Accounting

In accounting, accruals in a broad perspective fall under either revenues (receivables) or expenses (payables).

Prepaid Expenses vs. Accrued Expenses

Prepaid expenses differ from accrued expenses in one significant way – in the case of prepaid expenses, the company pays upfront for services and g...

Impact of Accrual Accounting

Despite accruals adding another layer of accounting information to existing information, it changes the way accountants do their recording. In fact...

The Relationship Between Accrual Accounting and Cash Accounting

Even though both accrual accounting and cash accounting methods serve as a yardstick of performance and the economic position of a company in a giv...

What is accrual accounting?

Accrual Accounting refers to the concept in the accounting where there is the practice of recording expenses in the books of accounts of the business at the time when they are incurred regardless of the time when they are paid off as well as an income is recognized in the books of accounts of the business whenever they are earned and not at the time when the payment against such income is received.

How are revenue and expenses recorded in accounting?

In Accrual Accounting the revenue and expenses of a business enterprise are recorded in the books of accounts in the period when they occur irrespective of the time when the payment against such revenue or expenses is received or paid respectively. For example, the sale is done by a business firm on credit basis then the sale is recorded in accounts books when the ownership of goods is transferred not when the payment against such sale is received and in the case of the expense we can take the example of electricity bill which gets due at the end of each month but is generally paid in the following month but following the accrual concept the electricity expense is recorded in the month to which it relates to.

When a business purchases raw materials on a credit basis from the supplier, the entry in the books of accounts will?

When a business purchases the raw materials on a credit basis from the supplier then the entry in the books of accounts will be made on the invoice issue date or at the date of the receipt of the raw materials as the case may be and not at the time when the owner pay the amount to the supplier. Suppose X ltd. purchased raw material worth $10,000 from its supplier on 01.05.2020 but the payment for the same is made on 15.05.2020. In this case, entry will be made on 01.05.2020 and not on 15.05.2020 as below:

What is an example of revenue accrual?

Let's look at an example of a revenue accrual for an electric utility company. The utility company generated electricity that customers received in December. However, the utility company does not bill the electric customers until the following month when the meters have been read. To have the proper revenue figure for the year on the utility's financial statements, the company needs to complete an adjusting journal entry to report the revenue that was earned in December.

What Are Accruals?

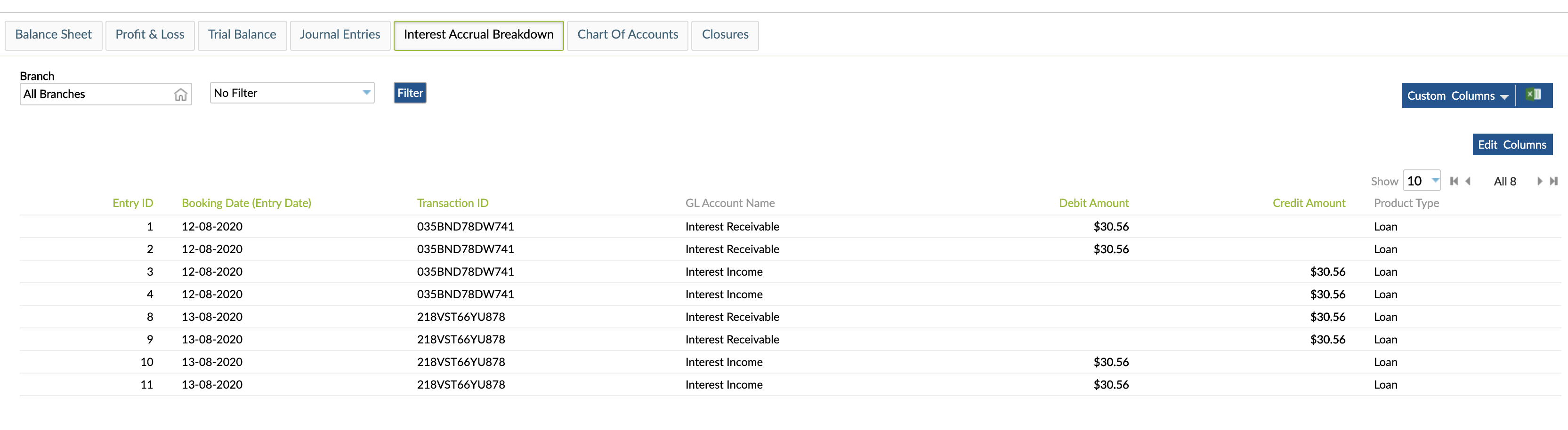

Accruals are revenues earned or expenses incurred which impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities. Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable.

What is offset to accrued expense?

In double-entry bookkeeping, the offset to an accrued expense is an accrued liability account, which appears on the balance sheet. The offset to accrued revenue is an accrued asset account, which also appears on the balance sheet. Therefore, an adjusting journal entry for an accrual will impact both the balance sheet and the income statement.

How are accruals created?

Accruals are created via adjusting journal entries at the end of each accounting period.

How do accruals improve financial statements?

Accruals improve the quality of information on financial statements by adding useful information about short-term credit extended to customers and upcoming liabilities owed to lenders.

What is accrual on a balance sheet?

Accruals are revenues earned or expenses incurred which impact a company's net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities.

Why do we use accrual accounts?

The use of accrual accounts greatly improves the quality of information on financial statements. Before the use of accruals, accountants only recorded cash transactions. Unfortunately, cash transactions don't give information about other important business activities, such as revenue based on credit extended to customers or a company's future liabilities. By recording accruals, a company can measure what it owes in the short-term and also what cash revenue it expects to receive. It also allows a company to record assets that do not have a cash value, such as goodwill .

What is the purpose of accrual accounting?

The purpose of accrual accounting is to match revenues and expenses to the time periods during which they were incurred, as opposed to the timing of the actual cash flows related to them.

Why do we need accruals?

In fact, accruals help in demystifying accounting ambiguity relating to revenues and liabilities. As a result, businesses can often better anticipate revenues while keeping future liabilities in check.

How to record accruals?

To record accruals, the accountant must use an accounting theory known as the accrual method. The accrual method enables the accountant to enter, adjust, and track “as yet unrecorded” earned revenues and incurred expenses. For the records to be usable in the financial statement reports, the accountant must adjust journal entries systematically ...

What is account payable?

Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are. , liabilities and non-cash-based assets, goodwill, future tax liabilities, and future interest expenses, among others.

What is prepaid vs accrued?

Prepaid Expenses vs. Accrued Expenses. Prepaid expenses are the payment opposite of accrued expenses. Rather than delaying payment until some future date, a company pays upfront for services and goods, even if it does not receive the total goods or services all at once at the time of payment.

What is interest expense accrual?

Interest expense accruals – Interest expenses that are owed but unpaid.

What is accrued revenue?

Accrued Revenues. Accrued revenues are either income or assets (including non-cash assets) that are yet to be received. In this case, a company may provide services or deliver goods, but does so on credit.

What Is Accrual Accounting?

Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold or expenses are recorded as incurred before the company has paid for them.

What are the different types of accrual accounts?

There are various types of accrual accounts. The most common include accounts payable, accounts receivable, goodwill, accrued interest earned, and accrued tax liabilities.

When is an accrued expense recorded?

The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet and as an expense in the income statement. On the general ledger, when the bill is paid, the accounts payable account is debited, and the cash account is credited.

Is accrual accounting accurate?

However, accrual accounting says that the cash method is not accurate because it is likely, if not certain, that the company will receive the cash at some point in the future because the services have been provided.

Is revenue earned recognized on the company's accounting books?

In other words, the revenue earned is recognized on the company's accounting books regardless of when cash transactions have occurred. Accrual accounting is one of two accounting methods; the other is cash accounting. Cash accounting only records the revenue when the cash transaction has occurred for the goods and services.

Is accrual method more expensive?

The accrual method does provide a more accurate picture of the company's current condition, but its relative complexity makes it more expensive to implement.

Which principle says that revenues and expenses should be recognized in the same period?

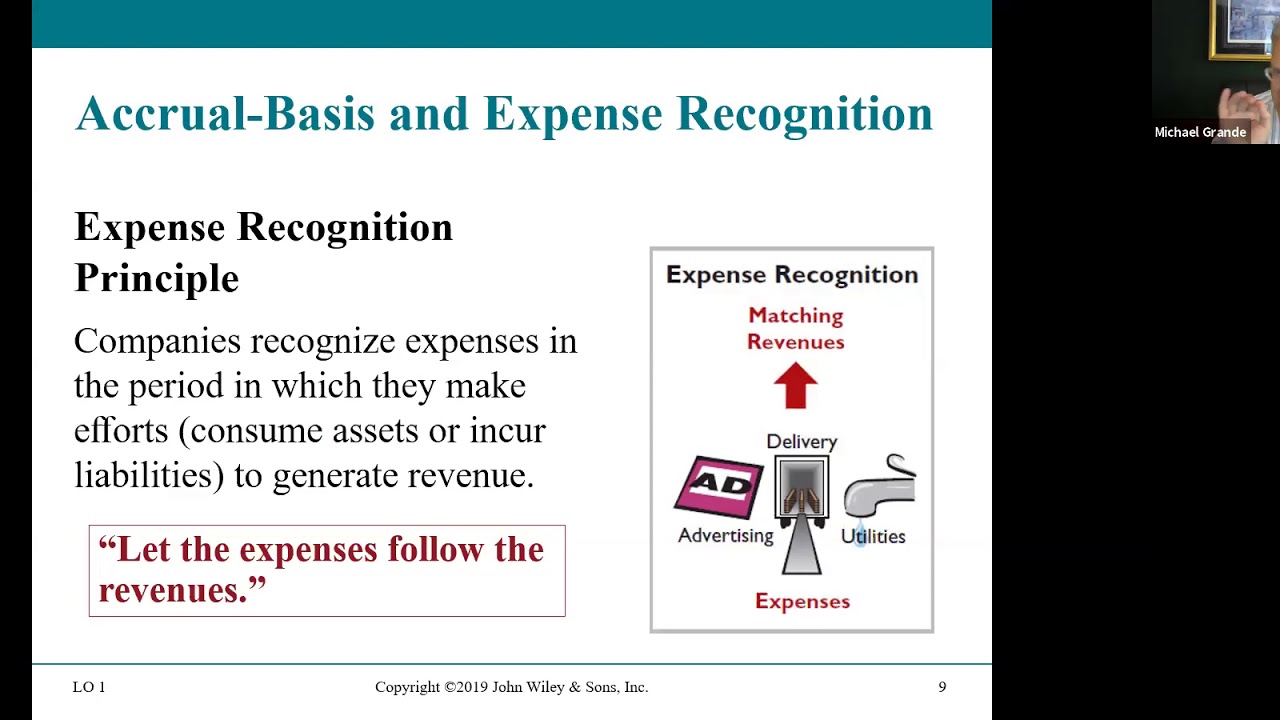

The method follows the matching principle, which says that revenues and expenses should be recognized in the same period.

How does accrual accounting help a company?

Accrual accounting adds another layer to a company’s accounting information, and it changes the way that accountants or small business owners record their financial information. It can lower business volatility by deciphering any ambiguity around revenues and expenses.

What Is Accrual Basis of Accounting?

Accrual basis of accounting is the standard method accountants use to rectify financial events by matching revenues with expenses. With accrual basis, a business’s financial position is more realistic because it combines the current and expected future cash inflows and outflows.

When Should Expenses Be Recognized Under Accrual Accounting?

Accountants recognize expenses under accrual accounting when a business incurs the liability. When a company pays the expense is irrelevant as the expense must be recognized in the period in which it was incurred.

What is the difference between cash basis and accrual basis?

The difference between accrual and cash accounting is how companies account for sales and purchases. Accrual basis accounting matches revenue with expenses when incurred. Cash basis accounting records expenses or income only when a payment is made or cash is received.

Why is accrual basis not computational?

Because the accrual basis method records a transaction before any money changes hands, the time of transactions is not a computational factor. For example, a utility company provides services to its customers and bills them once a month. The utility company records the expenses for providing the monthly service. It records the revenue when it posts the customer bill at the end of the month, even though the customer hasn’t submitted a payment. Therefore, for that month of service, the accountant records the expenses and accrues revenue on the balance sheet even if the customer has not yet submitted payment.

What are the two types of accounting?

The Two Types of Accrual Accounting 1 Matching principle. Using this principle, accountants record all revenue and expenses in the same reporting period, matching them and designating profits and losses for that period. When companies use the matching principle, they must book the expense during the period they incurred it, not necessarily when they happened. 2 The second principle is the revenue recognition principle, which falls under GAAP in standardized accounting. It refers to the period and manner in which a company realizes its income and it provides auditors with an apples-to-apples comparison of a company’s financial picture that is more transparent across industries. This principle is fully documented in the International Financial Reporting Standard (IFRS) 15 and Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606) , (ASC 606).

Why do small businesses not use accrual accounting?

Small businesses do not usually perform accrual accounting because the method can pose a financial risk . When using accrual accounting, companies often end up paying expenses before the associated cash is received (for example, paying the sales tax before they receive their cash for the sale).

What are some examples of accruals?

Accruals Example. Here are several different examples: Utilities – The utility company may only issue a bill once a quarter when they read the meter. It will mean that no transaction will show in the accounts for the period. Therefore the accounts need adjusting.

What is accrual accounting?

Accruals Accounting adjusts the accounts to record when the transaction takes place. The transaction takes place when the goods or services are delivered or received.

How do Accruals Work?

Accruals work by altering the accounts to move the transaction from one period to another. Post a reversing journal when the correct paperwork is on the system. Using Accounting software, you set the journal up to automatically reverse in the next period.

How to create an accrual in a balance sheet?

Accruals in the Balance Sheet. To create an accrual in the balance sheet, use a journal entry form. A journal entry form is available from the website. As with all double entry bookkeeping, there will be two entries to the accounts. One will be a debit to an expense account, and the balancing item is to the accruals under current liabilities.

Why is accrual accounting important?

For cash accounting accruals are not needed. The benefits of accruals accounting are that the business reports show the actual position of the company in a period.

Is sales accrual an asset?

Sales – As a business, you may work on a project for months before the invoice is issued. A sales accrual will post to the accounts. Ensure that you also enter any expenses that relate to the sale as well. It is recorded as an asset in the balance sheet.

What are Accruals?

Accruals describe revenues earned and expenses incurred on the income statement, irrespective of whether cash was actually received or paid by the company.

Accruals in Accrual Accounting

The concept of accruals is the basis of accrual accounting, in which a company’s revenue and expenses are recognized at the delivery of the good or service, rather than from the exchange of cash.

Why is accrual accounting used?

Although it is easier to use the cash method of accounting, the accrual method can reveal a company’s financial health more accurately. It allows companies to record their credit and cash sales or payments in the same reporting period when the transactions occur.

What is the difference between accrual and cash accounting?

The major difference between the two methods is the timing of recording revenues and expenses. In the cash method of accounting, revenues, and expenses are recorded in the reporting period that the cash payment is made. It is a simpler method.

What is accrual method?

The accrual method of accounting required revenues and expenses to be recorded in the period that they are incurred, regardless of the time of payment or receiving cash. Since the accrued expenses or revenues recorded in that period may differ from the actual cash amount paid or received in the later period, ...

What is accrued expense?

What is an Accrued Expense? Accrued expense is a concept in accrual. Accrual Accounting In financial accounting, accruals refer to the recording of revenues that a company has earned but has yet to receive payment for, and the. accounting that refers to expenses that are recognized when incurred but not yet paid.

What is GAAP accounting?

International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) GAAP GAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial. both require companies to implement the accrual method.

Where are accrued expenses recorded?

Accrued expenses or liabilities occur when expenses take place before the cash is paid. The expenses are recorded in a company’s balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting.

When should accrual be recorded?

Under the accrual method of accounting, the entry for the transaction should be recorded in the reporting period of February, as shown below:

What is Cash Accounting Method?

So, what's the difference between cash and accrual accounting methods? Cash and accrual accounting methods are among the most common methods of accounting, according to the IRS.

What is Accrual Accounting Method?

The accrual method, on the other hand, is when a small business reports the income in the tax year earned, regardless of when it is received. Meanwhile, those expenses are deducted in the year they happen, no matter when the actual payment is made.

Why Most Entrepreneurs Choose the Cash Method of Accounting

Jeffrey Levine: Absolutely. And the first thing I talk to people about when they're deciding whether to use the cash basis or the accrual basis is the cash basis method is much easier.

Accrual Accounting Method Example

The accrual basis is a little bit cruel in that it is much, much more complicated. So for instance, let's say that Bob, I have agreed to do some project work for a company and I have done all the work and they just haven't yet paid me, but I finished it.

Cash Accounting Method Example

With the cash basis, maybe I have a supplier that just doesn't pay me. In fact, you know, if you imagine you do all this work, and they just write you a check on December 31st every year for your entire year's worth of work. Well, on December 30th, it looks like you've done nothing. You've got no revenue. You've done absolutely nothing.