The IPMT function syntax has the following arguments:

- Rate Required. The interest rate per period.

- Per Required. The period for which you want to find the interest and must be in the range 1 to nper.

- Nper Required. The total number of payment periods in an annuity.

- Pv Required. The present value, or the lump-sum amount that a series of future payments is worth right now.

- Fv Optional. ...

- Type Optional. ...

Full Answer

What are the arguments of IPMT function?

The IPMT function syntax has the following arguments: Rate Required. The interest rate per period. Per Required. The period for which you want to find the interest and must be in the range 1 to nper. Nper Required. The total number of payment periods in an annuity.

How do you calculate the amount of interest in IPMT?

IPMT helps to calculate the amount. The IPMT function uses the following arguments: Rate (required argument) – This is the interest per period. Per ( required argument) – This is the period for which we want to find the interest and must be in the range from 1 to nper.

What is the formula for intpmt?

IntPmt = IPmt (APR / 12, Period, TotPmts, -PVal, FVal, PayType) TotInt = TotInt + IntPmt Next Period Msg = "You'll pay a total of " & Format (TotInt, Fmt) Msg = Msg & " in interest for this loan." MsgBox Msg ' Display results. Have questions or feedback about Office VBA or this documentation?

What is IPMT function?

How to use the IPMT Function in Excel?

What is the formula for IPMT?

What is rate required argument?

What units do you use for nper?

See 2 more

About this website

How many arguments are required in the IPMT function?

The IPMT function uses the following arguments: Rate (required argument) – This is the interest per period. Per (required argument) – This is the period for which we want to find the interest and must be in the range from 1 to nper. Nper (required argument) – The total number of payment periods.

What does Ipmt mean in Excel?

interest payment functionIPMT is Excel's interest payment function. It returns the interest amount of a loan payment in a given period, assuming the interest rate and the total amount of a payment are constant in all periods. To better remember the function's name, notice that "I" stands for "interest" and "PMT" for "payment".

What argument is optional for the fv function?

Pv Optional. The present value, or the lump-sum amount that a series of future payments is worth right now. If pv is omitted, it is assumed to be 0 (zero), and you must include the pmt argument. Type Optional....Syntax.Set type equal toIf payments are due1At the beginning of the period1 more row

How do you calculate interest payments on a mortgage in Excel?

Excel IPMT FunctionSummary. ... Get interest in given period.The interest amount.=IPMT (rate, per, nper, pv, [fv], [type])rate - The interest rate per period. ... The IPMT function can be used to calculate the interest portion of a given loan payment in a given payment period.

How use IPMT function in Excel with example?

The IPMT function syntax has the following arguments:Rate Required. The interest rate per period.Per Required. The period for which you want to find the interest and must be in the range 1 to nper.Nper Required. The total number of payment periods in an annuity.Pv Required. ... Fv Optional. ... Type Optional.

What is the full form of Ipmt?

The Full form of IPMT is Intraductal Papillary Mucinous Tumor, or IPMT stands for Intraductal Papillary Mucinous Tumor, or the full name of given abbreviation is Intraductal Papillary Mucinous Tumor.

What is FV in PMT function?

Fv Optional. The future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

Why is FV function negative?

The Future Value, (FV), of your investment. It is zero if you simply pay off a loan, positive if you save a certain amount of money, and negative if you are planning to pay off or refinance a balloon payment at the end of your payment.

What does the Excel argument type indicate?

What does the Excel argument Nper refer to? Number of periods of time for a loan or investment.

What is the formula for calculating mortgage payments?

For your mortgage calc, you'll use the following equation: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]. Here's a breakdown of each of the variables: M = Total monthly payment.

How do you calculate principal and interest on a mortgage?

Amortizing loansDivide your interest rate by the number of payments you'll make that year. ... Multiply that number by your remaining loan balance to find out how much you'll pay in interest that month. ... Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.More items...

What is the formula to calculate monthly interest?

What Is the Monthly Compound Interest Formula in Math? The monthly compound interest formula is used to find the compound interest per month. The formula of monthly compound interest is: CI = P(1 + (r/12) )12t - P where, P is the principal amount, r is the interest rate in decimal form, and t is the time.

What is PPMT and Ipmt?

Function Explained PPMT function helps to calculate the Principal amount to be paid for a certain period on a loan or other financial instrument, such as bonds. IPMT function is used to find out the Interest portion of a certain payment.

How do I calculate a loan amount in Excel?

We can calculate an original loan amount by using the Present Value Function (PV) if we know the interest rate, periodic payment, and the given loan term....We can input any of the following as the rate:0.0125.The cell containing the interest rate divided by 12.15%/12.

Why do we freeze panes in Excel?

To keep an area of a worksheet visible while you scroll to another area of the worksheet, go to the View tab, where you can Freeze Panes to lock specific rows and columns in place, or you can Split panes to create separate windows of the same worksheet.

How does the pv function work in Excel?

PV, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate. You can use PV with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment goal.

The Excel IPMT Function

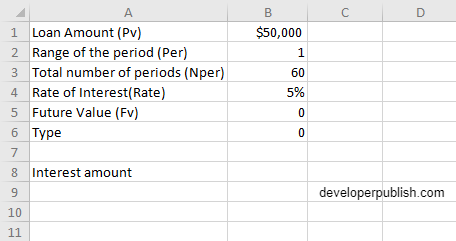

Note that in this example: The payments are made monthly, so it has been necessary to convert the annual interest rate of 5% into the monthly rate (=5%/12), and the number of periods from years to months (=5*12).

How to Calculate Interest on a Loan in Excel (5 Methods)

While working with borrowed loans, we have to calculate the amount of interest or capital that we have to pay for that loan. We can easily calculate interest on a loan in Excel using in-built financial functions named PMT, IPMT, PPMT, and CUMIPMT.In this article, I will show you how to use these functions to calculate the interest for a given period, interest in a given year, and interest rate.

What is IPMT function?

What is the IPMT Function? The IPMT function is categorized under Excel Financial functions. Functions List of the most important Excel functions for financial analysts. This cheat sheet covers 100s of functions that are critical to know as an Excel analyst. .

How to use the IPMT Function in Excel?

As a worksheet function, IPMT can be entered as part of a formula in a cell of a worksheet.

What is the formula for IPMT?

The formula to be used will be =IPMT ( 5%/12, 1, 60, 50000).

What is rate required argument?

Rate (required argument) – This is the interest per period.

What units do you use for nper?

If you make annual payments on the same loan, use 24% for rate and 4 for nper.

Remarks

An annuity is a series of fixed cash payments made over a period of time. An annuity can be a loan (such as a home mortgage) or an investment (such as a monthly savings plan).

Example

This example uses the IPmt function to calculate how much of a payment is interest when all the payments are of equal value.

See also

Have questions or feedback about Office VBA or this documentation? Please see Office VBA support and feedback for guidance about the ways you can receive support and provide feedback.

What is IPMT function?

The IPMT function returns the interest payment for the specified period for an investment or load, based on periodic, constant payments and a fixed interest rate.

What is IPMT in Excel?

The Excel IPMT function to figure out the interest payment of a given period in an investment or loan, based on periodic, constant payments and constant interest rate in Excel.

How many features does Kutools have?

Would you like to complete your daily work quickly and perfectly? Kutools for Excel brings 300 powerful advanced features (Combine workbooks, sum by color, split cell contents, convert date, and so on...) and save 80% time for you.

Syntax

IPMT (Interest rate, Period to examine, Number of periods, Present value [, Future value] [, Payment timing])

Additional information

The Period to examine and Number of periods arguments enable you to specify the number of periods interest accrues over, and the period for which to view the interest.

Examples

In this example, a module has eight line items on rows, and a Loans list on columns. The first four line items contain data for each of the required arguments for the IPMT function. The fifth line item uses the IPMT function to calculate interest payments.

When to Use PMT, PPMT, IPMT Function of Excel

The word PMT stands for “payment” for each period. The PMT function of Excel gives the total payment (principal amount + interest money) which we need to pay when taking a loan or we receive on investment.

Must Remember – Excel PMT, PPMT, IPMT Function

The following points must be kept in mind before actually using these functions.

Examples for PMT, PPMT and IPMT Functions of Excel

In this section of the blog, we will discuss some examples to get practical knowledge of these functions.

What is IPMT function?

What is the IPMT Function? The IPMT function is categorized under Excel Financial functions. Functions List of the most important Excel functions for financial analysts. This cheat sheet covers 100s of functions that are critical to know as an Excel analyst. .

How to use the IPMT Function in Excel?

As a worksheet function, IPMT can be entered as part of a formula in a cell of a worksheet.

What is the formula for IPMT?

The formula to be used will be =IPMT ( 5%/12, 1, 60, 50000).

What is rate required argument?

Rate (required argument) – This is the interest per period.

What units do you use for nper?

If you make annual payments on the same loan, use 24% for rate and 4 for nper.

Formula

How to Use The IPMT Function in Excel?

- Note: Examples that follow demonstrate the use of this function in a Visual Basic for Application…

This example uses the IPmt function to calculate how much of a payment is interest when all the payments are of equal value. Given are the interest percentage rate per period ( APR / 12 ), the payment period for which the interest portion is desired ( Period ), the total number of payments … - FVal = 0 ' Usually 0 for a loan.

Fmt = "###,###,##0.00" ' Define money format.

Things to Remember About The IPMT Function

- =IPMT(rate, per, nper, pv, [fv], [type]) The IPMT function uses the following arguments: 1. Rate (required argument) – This is the interest per period. 2. Per (required argument) – This is the period for which we want to find the interest and must be in the range from 1 to nper. 3. Nper (required argument) – The total number of payment periods. 4. ...

Additional Resources

- As a worksheet function, IPMT can be entered as part of a formula in a cell of a worksheet. To understand the uses of the IPMT function, let us consider a few examples: