What is the maximum conventional loan limit?

The current maximum is $647,200 in most U.S. counties, $970,800 in high-cost areas and even more in some cities in California and Hawaii. Nonconforming conventional loan: Lenders are free to set their own limits for nonconforming conventional loans, which include jumbo loans.

What are conventional loan limits?

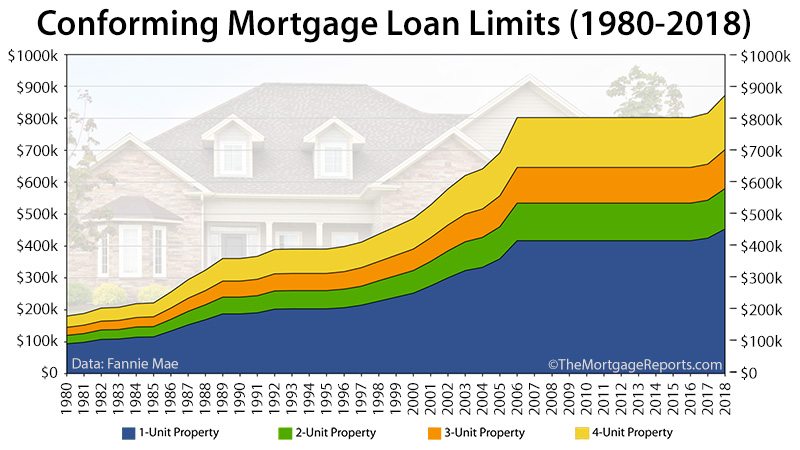

What are conventional loan limits? Most conventional mortgages come with caps on the possible loan amount. These are called “conventional loan limits” or sometimes “conforming loan limits.” In most parts of the country, conventional loan limits top out at over $500,000. So most home buyers will be well under the limit.

Are new loan limits for Fannie and Freddie too high?

In areas with a high cost of living, the loan limits are higher—as much as $970,800 for single-unit homes in places including Alaska, Hawaii, Washington, D.C., and certain counties in California, Maryland, New Jersey, New York and Virginia.

What is conventional lending limit?

Current Conforming Loan Limits. On November 30, 2021 the Federal Housing Finance Agency (FHFA) raised the 2022 conforming loan limit on single family homes from $548,250 to $647,200 - an increase of $98,950 or 18.05%. That rate is the baseline limit for areas of the country where homes are fairly affordable.

What is considered a jumbo loan in 2019?

For 2019, in most of the continental U.S., the conforming loan limit is $484,350. In Alaska, Hawaii, certain U.S. territories, and specific counties in the lower 48 states where home prices are exceptionally high, the limit can be as much as $726,525, or 150% of the national median.

Will conforming loan limits change in 2022?

The Federal Housing Finance Agency (FHFA) recently announced the 2022 conforming loan limits and, to no one's surprise, loan limits have increased significantly to $647,200 in most areas of the country. The 18% increase is the largest year-over-year jump in loan limits in recent history.

What is the Fannie Mae conforming loan limit for 2021?

The Federal Housing Finance Agency (FHFA) announced the conforming loan limits (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac in 2022. In most of the U.S., the 2022 CLL for one-unit properties will be $647,200, an increase of $98,950 from $548,250 in 2021.

What will conforming loan limits be in 2022?

2022 Conforming Loan Limits California is $647,200 and goes up to $970,800 for high-cost counties for one-unit properties.

What is a jumbo mortgage 2021?

In 2021, the conforming loan limit is $548,250 in most counties in the U.S., and $822,375 in higher-cost areas. Any mortgage over these amounts is considered a jumbo loan.

What is a jumbo loan 2020?

A jumbo loan (or jumbo mortgage) is a type of financing where the loan amount is higher than the conforming loan limits set by the Federal Housing Finance Agency (FHFA). The 2022 loan limit on conforming loans for 1-unit properties is $647,200 in most areas and $970,800 in high-cost areas.

What is a jumbo loan in 2022?

In 2022, a jumbo loan is a mortgage bigger than $647,200 in most areas (though loan limits are higher in more expensive counties). Buyers looking to purchase a luxury home or a house in a high-cost real estate market may need a jumbo loan to finance their property.

Will conforming loan limits increase in 2023?

The maximum limit for one-unit properties in approximately 70 high-cost counties has been raised to $970,800, up from $822,375 in 2021. Keep in mind, the Federal Housing Finance Agency may increase conforming loan limits again for 2023.

What is considered jumbo loan?

About jumbo loans A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac — currently $647,200 for a single-family home in all states (except Hawaii and Alaska and a few federally designated high-cost markets, where the limit is $970,800).

What is the most I can borrow with conventional loan?

The baseline conforming loan limit for 2022 is $647,200 – up from $548,250 in 2021. The limit is higher in areas where the median house cost exceeds this number, so borrowers in high-cost areas can get conforming loans of up to $970,800 depending on the limit in their individual county.

How much can I borrow with a conventional loan?

Conventional loans fall into two categories each with their own borrowing limits. Conforming (conventional) loans are subject to Fannie Mae and Freddie conforming loan limits. These limits enable qualified borrowers in most areas to get a mortgage of up to $647,200 for a single-family home.

Are jumbo loan rates higher than conventional?

Taking out a jumbo mortgage doesn't immediately mean higher interest rates. In fact, jumbo mortgage rates are often competitive and may be lower than conforming mortgage rates. It ultimately depends on the lender and the market conditions.

When will conforming loan limits be increased?

Conforming Loan Limits Increased for 2021. On November 24, 2020, the Federal Housing Finance Agency (FHFA) announced that it would raise the baseline conforming loan limit for 2021, for nearly all counties across the country. They are also increasing the limits for certain “higher-cost areas” that fall above the baseline.

What is the maximum conforming loan amount for a single family home in 2021?

In most counties across the country, the 2021 maximum conforming loan limit for a single-family home will be $548,250. That’s an increase of $37,850 from the 2020 baseline limit of $510,400. This marks the fifth year in a row that federal housing officials have raised the baseline, in order to keep up with rising home values.

What is conforming home loan?

A conforming home loan is one that meets, or “conforms” to, certain guidelines set forth by Freddie Mac and Fannie Mae . Freddie and Fannie are the two government-sponsored enterprises (GSEs) that purchase mortgages, bundle and securitize them, and then sell them to investors through Wall Street and other channels.

What is the FHA loan limit for 2021?

In 2021, the baseline loan limit for most counties across the U.S. will be $548,250, an increase from the 2020 cap of $510,400. More expensive markets, such as New York City and San Francisco, have conforming loan limits as high as $822,375.

How often do home values change?

Home values can change over time. When they rise significantly from one year to the next, housing officials usually increase the conforming loan limits to “keep up” with home-price appreciation. But such changes only occur once per year, starting on January 1st.

What is conventional mortgage?

A “conventional” mortgage loan is one that does not receive any kind of government insurance, guarantee or backing. This distinguishes them from the government-backed home loan programs like FHA, VA and USDA.

Does Freddie Mac have a conforming mortgage?

But the size of the loan is one of the most important criteria, from a borrower’s perspective. Freddie Mac and Fannie Mae will only purchase loans up to a certain amount. These maximum amounts, or limits, vary by county and are updated every year.