Types of Liabilities

- 1. Current Liabilities – Obligations which are payable within 12 months or within the operating cycle of a business are known as current liabilities. ...

- 2. Non-current or Fixed Liabilities – Second among types of liabilities is non-current or fixed liabilities; they are long-term obligations of a business and are not payable within a year or an accounting period. ...

What are the three types of liability?

What are the 3 Types of Product Liability?

- Design Defects. Design defect product liability claims are based on the assertion that the product was made according to design, but there was a flaw in the design.

- Manufacturing Defects. ...

- Failure to Warn. ...

- The Team That Has Your Back. ...

What are the types of liability?

Types of Liability

- Criminal Liability (Against the Seller)

- Administrative Liability (Against the Licensee)

- Civil Liability (Against Involved Parties) Civil liability refers to the potential civil legal liability of licensees and their seller for injuries caused by their intoxicated patrons.

What are some examples of short term liabilities?

What are some examples of short term liabilities?

- Trade accounts payable.

- Accrued expenses.

- Taxes payable.

- Dividends payable.

- Customer deposits.

- Short-term debt.

- Current portion of long-term debt.

- Other accounts payable.

What are the examples of inside liabilities?

Example#1. Let’s assume you are the director of a Limited Liability Company. Due to some unseen circumstances, you find yourself breaching a contract. This is an inside liability. But since a company is a separate business entity, you and other stakeholders are protected from this liability as this liability is confined to the business. The ...

What are 4 types of liabilities?

Different types of liabilities in accountingAccounts payable.Income taxes payable.Interest payable.Accrued expenses.Unearned revenue.Mortgage payable.

What are 2 types of liabilities?

Businesses sort their liabilities into two categories: current and long-term. Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period. For example, if a business takes out a mortgage payable over a 15-year period, that is a long-term liability.

What are 5 liabilities?

Some common examples of current liabilities include:Accounts payable, i.e. payments you owe your suppliers.Principal and interest on a bank loan that is due within the next year.Salaries and wages payable in the next year.Notes payable that are due within one year.Income taxes payable.Mortgages payable.Payroll taxes.

What types of accounts are liabilities?

Current liabilitiesType 1: Accounts payable. Accounts payable liability is probably the liability with which you're most familiar. ... Type 2: Principle & interest payable. ... Type 3: Short-term loans. ... Type 4: Taxes payable. ... Type 5: Accrued expenses. ... Type 6. ... Type 1: Notes payable. ... Type 2: Mortgage payable.More items...•

What are the 3 main characteristics of liabilities?

The Boards' existing liability definitions include three criteria: (1) a present obligation; (2) a past transaction or event; and (3) a probable future sacrifice of economic benefits.

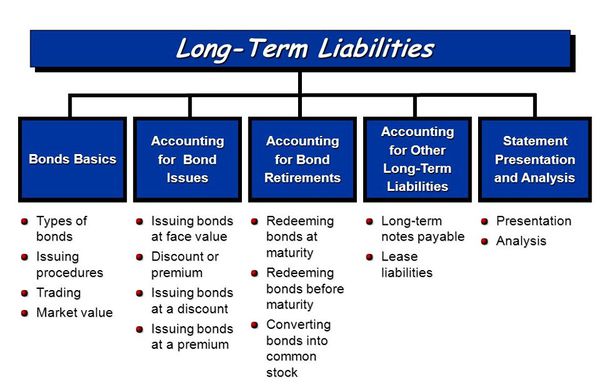

What are 3 types of long-term liabilities?

Long-term loans. Bonds payable. Post-retirement healthcare liabilities. Pension liabilities.

What are 10 examples of assets?

Examples of assets include:Cash and cash equivalents.Accounts Receivable.Inventory.Investments.PPE (Property, Plant, and Equipment)Vehicles.Furniture.Patents (intangible asset)

Is cash a liability or asset?

In short, yes—cash is a current asset and is the first line-item on a company's balance sheet. Cash is the most liquid type of asset and can be used to easily purchase other assets. Liquidity is the ease with which an asset can be converted into cash.

What is a liability or asset?

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

What are current liabilities?

Current liabilities are a company's short-term financial obligations that are due within one year or within a normal operating cycle. Current liabilities are typically settled using current assets, which are assets that are used up within one year.

Are expenses liabilities?

While expenses and liabilities may seem as though they're interchangeable terms, they aren't. Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties.

What are the types of assets and liabilities?

Different Types of Assets and Liabilities?AssetsLiabilitiesCurrent assets and Fixed AssetsCurrent LiabilitiesTangible and Intangible AssetsNon-current LiabilitiesOperating and Non-Operating AssetsContingent Liabilities

What is long-term and short-term liability?

Key Takeaways. Long-term liabilities are due more than one year in the future. They are separately identified on the balance sheet. While short-term liabilities must be paid with current assets, long-term liabilities can be repaid through a variety of current and future business activities.

What are the two classifications for liabilities quizlet?

Two common classifications of liabilities are: current liabilities and long-term liabilities.

What are long-term and current liabilities?

Share. Long-term liabilities, also called long-term debts, are debts a company owes third-party creditors that are payable beyond 12 months. This distinguishes them from current liabilities, which a company must pay within 12 months.

What are current liabilities?

Current liabilities are a company's short-term financial obligations that are due within one year or within a normal operating cycle. Current liabilities are typically settled using current assets, which are assets that are used up within one year.

What is the difference between a current liability and a long-term liability?

While both reflect money owed to an outside source, current liabilities represent money owed that is due within the next 12 months. Long-term liabi...

Why can't I just record all business debts in one category?

If you're a very small business, chances are that the only liability that appears on your balance sheet is your accounts payable balance.

Is principal and interest a current or a long-term liability?

It's actually both. For example, if you have a 30-year mortgage on your office building, the amount due within the next 12 months should be recorde...

What is contingent liability?

Contingent liabilities – contingent liabilities are not used as often but they are the third most common type seen on a balance sheet. Contingent liabilities include any potential lawsuits or product and equipment warranties and are only recorded if they are likely to occur.

Why are contingent liabilities more like potential liabilities?

Contingent liabilities are actually more like potential liabilities because they are recorded depending on the outcome of a future event.

Why is unearned revenue different from short term liabilities?

Unearned revenue is a little different than the types of short term liabilities we’ve discussed so far because it is money that has been received in advance of goods or services.

What type of liabilities do small businesses have?

The only type of liabilities that many small businesses have on their balance sheet in the beginning are accounts payable.

What is short term liability?

Short term liabilities are obligations that need to be paid within a years time, which is why they are called short-term or current liabilities.

What is a liability?

Liabilities can be any type of legal obligation or debt owed to another person or company.

What is the term for accounts payable?

Most accounts payable terms are Net15 or Net30, while some may stretch out to Net45 or even Net60.

What is accounts payable?

Accounts payable: Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. Accounts payables are. These are the unpaid bills to the company’s vendors. Generally, accounts payable are the largest current liability for most businesses.

What is interest payable?

Interest Payable Interest Payable is a liability account shown on a company’s balance sheet that represents the amount of interest expense that has accrued. Interest expenses that have already occurred but have not been paid. Interest payable should not be confused with the interest expenses.

Why are legal expenses considered contingent liabilities?

The legal expenses may be recognized as contingent liabilities because: The expenses are probable.

What is the accounting equation for liabilities?

According to the accounting equation, the total amount of the liabilities must be equal to the difference between the total amount of the assets and the total amount of the equity.

What is a mortgage payable?

Mortgage payable /long-term debt: Long Term Debt Long Term Debt (LTD) is any amount of outstanding debt a company holds that has a maturity of 12 months or longer. It is classified as a non-current liability on the company’s balance sheet.

What is the legal status of a non-human entity that is unable to repay its outstanding debts?

Bankruptcy Bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that is unable to repay its outstanding debts. . In addition, liabilities determine the company’s liquidity and capital structure.

What is a liability in finance?

A liability is a financial obligation of a company that results in the company’s future sacrifices of economic benefits to other entities or businesses. A liability can be an alternative to equity as a source of a company’s financing. Moreover, some liabilities, such as accounts payable.

What Is a Liability?

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

What is liability in business?

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services.

How Do I Know If Something Is a Liability?

A liability is something that is owed to or obligated to someone else. It can be real (e.g. a bill that needs to be paid) or potential (e.g. a possible lawsuit).

What Is a Contingent Liability?

A contingent liability is an obligation that might have to be paid in the future, but there are still unresolved matters that make it only a possibility and not a certainty. Lawsuits and the threat of lawsuits are the most common contingent liabilities, but unused gift cards, product warranties, and recalls also fit into this category.

How Are Current Liabilities Different From Long-Term (Noncurrent) Ones?

Current liabilities are due with a year and are often paid for using current assets. Non-current liabilities are due in more than one year and most often include debt repayments and deferred payments.

How Do Liabilities Relate to Assets and Equity?

The accounting equation states that—assets = liabilities + equity. As a result, we can re-arrange the formula to read liabilities = assets - equity. Thus, the value of a firm's total liabilities will equal the difference between the values of total assets and shareholders' equity. If a firm takes on more liabilities without accumulating additional assets, it must result in a reduction in the value of the firm's equity position.

What is liability in accounting?

A liability can also mean a legal or regulatory risk or obligation. In corporate accounting, companies book liabilities in opposition to assets.

1. Current Liabilities Or Short term Liabilities

Current Liabilities are obligations or debts that are payable within a period of one year.

2. Non-Current Liabilities Or Fixed Liabilities Or Long Term Liabilities

Non-Current Liabilities are those obligations or debts that are payable after a period of one year. Or These are those Liabilities that are not payable within a period of one year. For Examples: 1. Long-term Bank Loan, 2. Debentures, 3. Long-term Loan, 4. Borrowings, 5. Bonds etc.

3. Contingent Liabilities

These are those Liabilities that will become payable of an uncertain future event, otherwise not. Or Contingent Liabilities are those Liabilities that are not certain at the time of preparing the balance sheet. Contingent Liabilities are not shown in the balance sheet. However, they are disclosed by way of a footnote just below the balance sheet.

What is a liability in accounting?

A liability is an obligation of money or service owed to another party. What is a liability to you is an asset to the party you owe. You can think of liabilities as claims that other parties have to your assets. On a company balance sheet, liabilities and assets are listed side by side.

What is liability in business?

A liability is an obligation of money or service owed to another party.

What is the difference between expenses and liabilities?

The key difference between the two is that expenses are listed on a company’s income statement, rather than its balance sheet where liabilities are listed. Expenses are costs associated with a company’s operations, not the debts it owes.

What does it mean to have a liability?

In simple terms, having a liability means that you owe something to somebody else. However, there is a lot more to know about liabilities before you can say you know what the word “liability” means in corporate finance.

Can a company have liabilities?

No! Having liabilities can be great for a company as long as it handles them responsibly. Sometimes borrowing money to fund company growth is the right call, but if your company is routinely taking on liabilities that you can’t repay in time, you might be in need of bookkeeping services. Bookkeepers keep track of both liabilities and expenses, and more.

Is liability the same as personal liability?

This basic concept of liability is the same whether you’re discussing personal or business liabilities, but there’s a lot more to remember when it comes to financial liabilities besides who owes who a beer.

What is the difference between assets and liabilities?

Assets represent a company's resources while liabilities represent a company's obligations. An asset helps business owners and financial professionals find out what the company owns. Liabilities show what a company owes.

What is the accounting equation for assets, liabilities and equity?

The accounting equation for assets, liabilities and equity. Equity, liabilities and assets are all used by accountants to determine the "balance sheet equation," otherwise known as the "accounting formula.". This equation combines a company's equity and liability to determine their total assets, basically reworking the equity formula.

What is equity?

Equity is the remaining amount after a company deducts their total liabilities from the total assets. It's a way to figure out a company's value once all debts are paid and profit is left over.

What are the items that accountants consider when calculating the financial outlook of a company?

These items are called "assets" and "liabilities." It's important to understand these figures because they can help determine the overall financial stability of a company. In this article, we explain the meaning of assets and liabilities, give examples of each and share how companies use these figures on a balance sheet to calculate the total value or equity of a business.

How to determine equity?

Equity is determined by totaling a company's assets and subtracting their total liabilities from that number. The remaining figure represents a company's equity. A quick way to think of equity is assets minus liabilities.

Why use a balance sheet?

Use the balance sheet for analysis. A balance sheet can be used to prepare financial modeling reports that give stakeholders an idea of a company's performance. If the assets far outweigh the liabilities, a company will most likely prove more financially successful in the future.

How to find the equity of a company?

The following steps can help you find the amount of equity in a business: 1. Determine your assets. To find the amount of equity a company possesses, you'll first need to calculate the total assets of a business .

Type I liabilities

The first type of liabilities are known future amounts and payout dates. A simple example of a Type I liability is an option-free fixed-rate bond. These kinds of liabilities are easiest to model.

Type II liabilities

The second type of liabilities are known future amounts but uncertain payout dates, called Type II liabilities. An issuer of a callable bond or a putable bond has this type of liability. Another example is an insurance company selling term life insurance.

Type III liabilities

The third type of liabilities have uncertain future amounts but known payout dates. These are called Type III liabilities. An example of Type III liabilities are floating rate instruments and real rate bonds such as Treasury Inflation Protection Securities (TIPS).

Type IV liabilities

The final type of liabilities have both uncertain future amounts and uncertain payout dates. These are referred to as Type IV liabilities. Good examples are property and casualty insurance as well as some defined benefit plan liabilities.

Summary

We discussed types of liabilities. Depending on the type of liability, it can be easy to model them (e.g. Type I liabilities) or really hard to model them (Type IV liabilities). Simple duration is enough to model Type I, while others require effective duration.

Accounting Reporting of Liabilities

Current Liabilities vs. Long-Term Liabilities

- The primary classification of liabilities is according to their due date. The classification is critical to the company’s management of its financial obligations. Current liabilities are those that are due within a year. These primarily occur as part of regular business operations. Due to the short-term nature of these financial obligations, they should be managed with consideration of the compan…

Long-Term Liabilities

- Long-term (non-current) liabilities are those that are due after more than one year. It is important that the long-term liabilities exclude the amounts that are due in the short-term, such as interest payable. Long-term liabilities can be a source of financing, as well as refer to amounts that arise from business operations. For example, bonds or mortgages can be used to finance the compan…

Contingent Liabilities

- Contingent liabilities are a special category of liabilities. They are probable liabilities that may or may not arise, depending on the outcome of an uncertain future event. A contingent liability is recognized only if both of the following conditions are met: 1. The outcome is probable. 2. The liability amount can be reasonably estimated. If one o...

Related Readings

- Thank you for reading CFI’s explanation of Liability. To keep advancing your career, the additional CFI resources below will be useful: 1. Free Reading Financial Statements Course 2. Accrued Expenses 3. Financial Accounting Theory 4. Notes Payable 5. Projecting Balance Sheet Items