COGS also includes other costs such as:

- Interest

- Rent

- Taxes

- Storage

- Purchasing

- Processing

- Repackaging

- Handling

- Administrative costs

- Other overhead costs for running your warehouse or production facility, like light, heat, insurance, and maintenance

- Raw materials.

- Items purchased for resale.

- Freight-in costs.

- Purchase returns and allowances.

- Trade or cash discounts.

- Factory labor.

- Parts used in production.

- Storage costs.

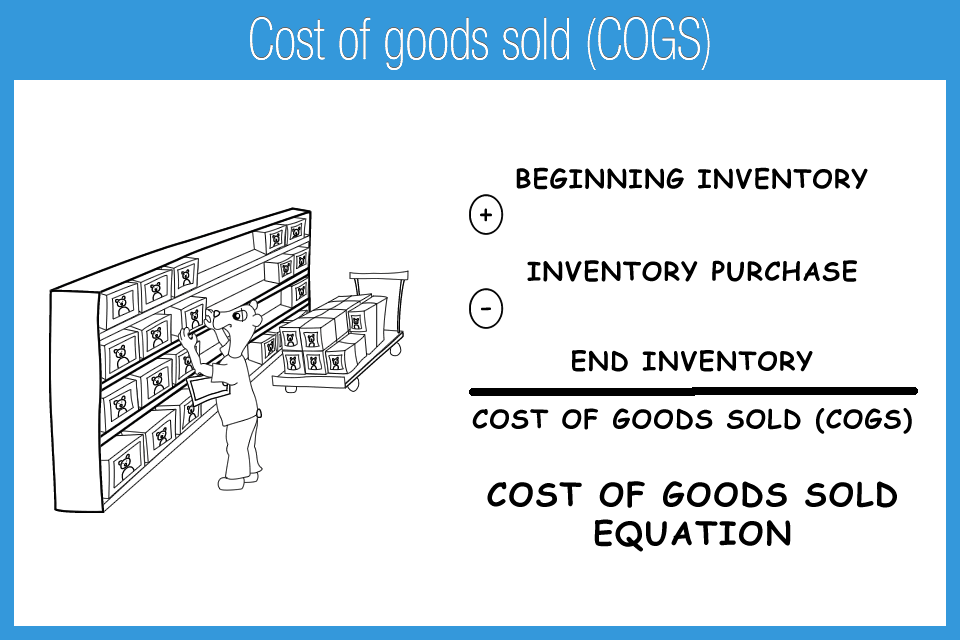

How cost of goods sold or cogs is calculated?

Cost of Goods Sold Formula. Following is the COGS formula on how to calculate cost of goods sold. Cost of Goods Sold = Beginning Inventory + Purchases - Ending Inventory For example, if a business has a beginning inventory worth of $200,000 and ending inventory of $50,000 with new purchases of $300,000, the cost of goods sold can be solve with the above COGS formula.

What are expenses included in cogs?

- Software license fees for embedded third-party apps

- Application hosting and monitoring costs

- Website development and support costs

- Customer support and account management costs

- Data communication expenses

- Costs of subscriptions

- Costs for employees directly involved in production and delivery

- Professional services and training personnel costs

Does cogs include salaries?

Salaries and wages can only be recognized in Cost of Goods Sold (COGS) if these relate to employees who were involved in the creation of the sold product. They are categorized as follows: direct labor - if involvement in production is primary (e.g., wages of tailors in a clothing production company)

Are purchase discounts cogs?

No, the discounts given to your customers (distributors) are not treated in accounting as Cost Of Goods Sold (COGS), but rather as deductions off your gross sales.

What is Cost of Goods Sold (COGS)?

If revenue represents the total sales of a company’s products and services, then COGS is the accumulated cost of creating or acquiring those products.

How to calculate COGS?

Diving a level deeper into the COGS formula requires five steps. Typically, these are tackled by accounting and tax experts, often with the help of powerful software. But these four steps are something all managers should have an appreciation for: 1 Identify the beginning inventory of raw materials, then work in process and finished goods, based on the prior year’s ending inventory amounts. 2 Determine the cost of purchases of raw materials that were made during the period, taking into account freight in, trade and cash discounts. 3 Determine the ending inventory balance. Typically, it’s based on physical cycle counts and is done in accordance with the company’s inventory-valuation method of choice. 4 Ensure that any other direct costs of production are included in the valuation of inventory.

What Does Cost of Goods Sold Tell You, and Why is it Important?

Subtracting COGS from revenue gives gross profit, which reveals the core essence of business viability: What are my costs to make a product, and how much do I sell it for?

What is the meaning of COGS in accounting?

The higher a company’s COGS, the lower its gross profit. So, COGS is an important concept to grasp. COGS, sometimes called “cost of sales,” is reported on a company’s income statement, right beneath the revenue line.

Why is a COGS calculation wrong?

Because a COGS calculation has so many moving parts, it can be prone to errors and subject to manipulation. An incorrect COGS calculation can obscure the true results of a business’ operations. It can also result in misstated net income and tax liability.

How many steps are required to calculate COGS?

Diving a level deeper into the COGS formula requires five steps. Typically, these are tackled by accounting and tax experts, often with the help of powerful software. But these four steps are something all managers should have an appreciation for:

Why is it important to know your COGS?

However you manage it, knowing your COGS is critical to achieving and sustaining profitability, so it’s important to understand its components and calculate it correctly. COGS also reveals the true cost of a company’s products, which is important when setting pricing to yield strong unit margins.

What is the purpose of finding COGS?

The basic purpose of finding COGS is to calculate the “true cost” of merchandise sold in the period. It doesn’t reflect the cost of goods that are purchased in the period and not being sold or just kept in inventory. It helps management and investors monitor the performance of the business.

What is the difference between COGS and LIFO?

Under FIFO, COGS consists of finished inventory units that were produced first and thus consist of costs incurred first, whereas under LIFO, COGS consists of finished inventory units that were produced last and therefore consists of later or most recent costs.

How to find the cost of goods sold?

Under weighted average, the total cost of goods available for sale is divided by units available for sale to find the unit cost of goods available for sale. This is multiplied by the actual number of goods sold to find the cost of goods sold. In the above example, the weighted average per unit is $25 / 4 = $6.25. Thus, for the three units sold, COGS is equal to $18.75.

What is job order costing?

Job Order Costing Guide Job Order Costing is used to allocate costs based on a specific job order. This guide will provide the job order costing formula and how to calculate it. As an example, law firms or accounting firms use job order costing because every client is different and unique. Process-costing, on the other hand can be used

What is activity based costing?

Activity-Based Costing Activity-based costing is a more specific way of allocating overhead costs based on “activities” that actually contribute to overhead costs. An activity is

Can cost be directly attributed?

Costs can be directly attributed and are specifically assigned to the specific unit sold. This type of COGS accounting may apply to car manufacturers, real estate developers, and others. Depending on the COGS classification used, ending inventory costs will obviously differ.

Does COGS include general selling expenses?

COGS does not include general selling expenses, such as management salaries and advertising expenses.

What is the COGS of a company?

The COGS of that company was equal to the value of their purchases plus the value of the inventory they sold.

How to figure out COGS?

To figure out a business’s COGS for a given year, take the value of their beginning inventory, add the cost of purchases made that year, and then subtract their ending inventory.

What does "cogs" mean in business?

COGS Meaning For Business. You’ll notice that the COGS of that company was equal to the value of their purchases plus the value of the inventory they sold. However, this means that their inventory decreased, which is something management will want to pay attention to in order to manage growth and meet demand.

What does it mean when a company's COGS is greater than the value of their purchases?

If a company’s COGS is greater than the value of their purchases, it means that 100% of the money spent on purchases went towards products that were sold, plus the difference in inventory. If the company’s purchases are greater than their COGS, then the difference is equal to the amount that their inventory has increased.

Why is lowering the cost of goods sold a common way for a company to increase their gross profit?

Since COGS are a variable cost, lowering the cost of goods sold is a common way for a company to increase their gross profit.

Why is COGS important?

Because of this relationship, COGS is often used as a measure of how efficiently a company is managing its labor and supplies in production.

What is the key point when thinking about COGS?

A key point when thinking about COGS is that it only applies to funds spent on producing goods that were actually sold for that period.

What is Cost of Goods Sold (COGS)?

Cost of Goods Sold (COGS) simply means the cost of producing the products or services you sell. It includes the cost of all direct materials or direct services used to attain the final product sold to consumers. COGS is the cost of purchasing and converting goods or services to the state of being sold.

Why is it important to know your COGS?

Knowing your COGS helps you determine the right price that gives you a healthy profit margin. You know when the price on a particular product needs to increase and even set competitively lower prices for you to attract more customers.

How to calculate cost of goods sold?

The formula for calculating the cost of goods sold for any product involves adding the cost of beginning inventory to the cost of purchased or manufactured (additional) inventory for an accounting period and then subtracting the cost of ending inventory from the total.

What are the four inventory cost methods?

They are First-in-first-out (FIFO), Last-in-first-out (LIFO), weighted average, and special identification

What is gross profit?

Your gross profit is the amount your business earns from selling your products or services before subtracting taxes and subsequent expenses. Your net profit is the amount your business earns after subtracting all taxes and other expenses.

What are the costs of running a business?

Running a business involves lots of costs such as employee turnover, payroll taxes, maintenance costs, labor costs, production costs, permits and licenses, and more. Understanding your visible and hidden business costs is key to ensuring you can meet your financial goals.

Is the cost of products you do not sell a part of the cost of goods sold?

The cost of products you do not sell is not a part of the Cost Of Goods Sold (COGS), neither are overhead costs. People make the mistake of adding overhead costs to the COGS.

Why do you need to include all of your expenses in your COGS?

Claiming all of your business expenses, including COGS, increases your tax deductions and decreases your business profit. Including all of your costs in the COGS calculation will help you make sure that you don't miss any tax deductions.

What Is Cost of Goods Sold (COGS)?

COGS is sometimes referred to as the cost of sales; it refers to the costs a company has for making products from parts or raw materials or buying products and reselling them. These costs are an expense of the business because you sell these products to make money.

How to value inventory?

Inventory can be valued in one of three ways: 1 FIFO ("First-In, First-Out") assumes that the first goods bought are the first goods sold. S 2 LIFO ("Last-In, First-Out") assumes that the first goods bought are the first goods sold. 3 Specific identification for items that have unique costs (like an inventory of cars)

What is a COGS on a tax return?

It's also an important part of the information the company must report on its tax return. COGS is deducted from your gross receipts to figure the gross profit for your business each year . Gross receipts are the amounts your business received from sales during the year. 1. Claiming all of your business expenses, including COGS, ...

What is beginning inventory?

Beginning inventory : This is the total cost of all the products in your inventory at the beginning of the year. This should be the same as the inventory at the end of last year. If it's not the same, you must include an explanation of the difference in your tax return.

What is labor cost?

Cost of labor : This is your cost for employees who work directly making products from raw materials and parts. It doesn't include payroll costs for administrators or employees in sales, marketing, finance, or other areas.

What are direct costs?

The direct costs include costs for making the product or the wholesale price of goods. These include: Shipping costs. Direct labor costs for paying workers (including contributions to pensions or annuity plans) who produce the products 3.

What Is Included in COGS?

Cost of goods sold includes the costs related to acquiring or producing a physical product to sell or resell. The costs often include:

What Is the Cost of Goods Sold (COGS)?

Cost of goods sold refers to the total costs associated with the production of goods that a company sells. COGS is typically used by manufacturers, retailers, and wholesalers as these businesses sell or resell products to generate revenue.

What items are included in the cost of goods sold?

The five items included in the cost of goods sold are: inventory at the start of a new tax year; purchases not including cost of items used for personal usage; labor costs; material and supplies; and other costs.

How to determine COGS?

Businesses determine COGS by calculating the value of their inventory at the beginning of the tax year, then adding in costs such as purchases , direct labor, materials/supplies, and other costs associated with creating products . The value of the inventory at the end of the tax year is subtracted from that total amount. 1

How to calculate cost of goods sold?

Essentially, to get the cost of goods sold, you add the beginning inventory and the additional inventory costs, then subtract the ending inventory value . The general formula for calculating COGS is:

What is variable cost?

Variable costs are costs that change from one time period to another, often changing in tandem with sales. In contrast, fixed costs are costs that remain the same. The cost of goods sold is a variable cost because it changes. To calculate it, add the beginning inventory value to the additional inventory cost and subtract the ending inventory value.

What is a COGS in business?

In this way, COGS helps businesses to measure their performances, which helps executives make business decisions.

What is success allocation for COGS?

For COGS the success allocation should be for people focused on renewals, personnel (or allocation for personnel) responsible for upsells or cross-sells should be in operating expenses

What is Considered COGS in a SaaS Company?

In terms of cost of services for the core SaaS revenue we recommend the following:

What would happen if the SaaS costs were not paid?

Generally speaking, if these expenses were not paid, the provisioning of the product and service to the installed base of customers would stop or deteriorate quickly.

What is the core gross margin of SaaS?

The core gross margin on SaaS license revenue is an important metric for all SaaS businesses. Gross margins on SaaS license revenue for companies in our portfolio and our annual survey data of private SaaS companies, as defined above, are generally 80% to 85%. Lower gross margin businesses might do very well, but they are fundamentally different in the way they are valued and operated.

How long does it take to get funding from SaaS Capital?

We can make quick decisions. The typical time from first “hello” to funding is just 5 weeks. Learn more about our philosophy.

Does hosting include depreciation?

Hosting costs should also include all core communication costs, and in the rare instance in which a company owns and maintains the servers used to deliver its product, depreciation on those owned assets. Since the vast majority of software companies now utilize off-site hosting, the need to include a depreciation expense in COGS is a practice we rarely encounter.

Is there a GAAP accounting rule for cost of goods sold?

Accounting rules are very specific on some things, and surprisingly unhelpful in other areas. There are no Generally Accepted Accounting Principles (GAAP) rules on the type of costs that are included in Cost of Goods Sold (COGS).

Why is it important to understand COGS versus OpEx?

The proper coding of SaaS COGS versus operating expenses (OpEx) is important for many reasons. First, we must understand our true, overall SaaS gross margin. Second, we must understand our gross margins by revenue stream. Third, without correct expense coding between COGS and OpEx, we cannot create the proper SaaS P&L. Finally, without a correct SaaS P&L, we cannot easily or accurately calculate SaaS metrics.

When I post expenses to a department such as technical support, should the cost center be fully burdened?

Fully burdened means all expenses that arise from that department should be coded back to that department. For example, wages, taxes, benefits, travel, training, internal use software (ticket tracking, for example), pizza parties, and so on.

Is support included in gross margin?

MARGIN: the support department is included in your recurring gross margin.

Cost of Goods Sold (COGS) Example

Cost of Goods Sold (COGS) Formula

- To figure out a business’s COGS for a given year, take the value of their beginning inventory, add the cost of purchasesmade that year, and then subtract their ending inventory. Follow the formula: BI + P – EI = COGS Where : 1. (BI) is the value of the Beginning Inventory 2. (P)is Purchasesrequired to produce goods, such as materials etc. 3. (EI) is the value of the Ending Inv…

Cogs Meaning For Business

- You’ll notice that the COGS of that company was equal to the value of their purchases plus the value of the inventory they sold. However, this means that their inventory decreased, which is something management will want to pay attention to in order to manage growth and meet demand. Often the value of purchases a company makes in a period will exceed the value of thei…

What Businesses Can and Can’T Record as Cogs

- Because COGS is directly tied to the value of a company’s physical assets, only companies that have a physical inventory can record COGS and benefit from a deduction. Usually, companies that can’t record COGS are pure service companies like law firms, accountingfirms, etc. Some companies can both provide services and sell products—airlines that sell food and drinks are a g…