What's the best credit card for MileagePlus?

NerdWallet's favorite credit card for the MileagePlus program is the United℠ Explorer Card. It gives you 2 miles per dollar spent at restaurants, on hotel stays and on purchases from United, and 1 mile per dollar on all other purchases.

What credit score do you need for the United explorer card?

The United℠ Explorer Card: 633+ Credit Score Needed. Fans of United Airlines may be able to obtain The United℠ Explorer Card with a credit score as low as 633, however, the average cardholder credit score is 714. Earn 2 miles per $1 spent at restaurants and hotels. Earn 2 miles per $1 spent on United purchases.

How does the United MileagePlus credit card work?

Credit cards that earn United MileagePlus miles 1 miles per dollar on eligible United Airlines purchases, hotel stays and at restaurants. 2 mile per dollar spent on other purchases. 3 Annual fee: $0 intro for the first year, then $95.

How do I get more miles on United Airlines?

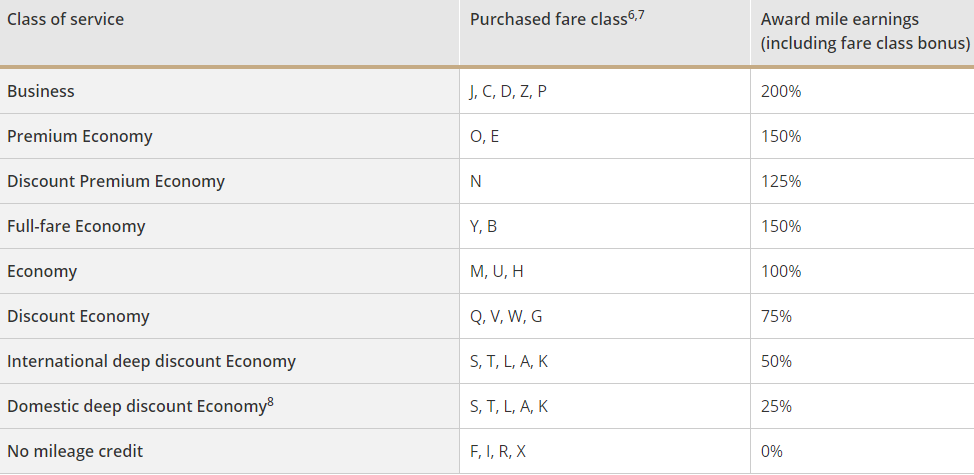

You can earn additional miles by spending money with United’s partners or using a United-branded credit card. The number of miles you'll earn for a flight depends on how much you spent on the ticket and your status level within the MileagePlus program.

Which Chase card is easiest to get?

Chase Freedom® Student credit cardThe easiest Chase credit card to get is the Chase Freedom® Student credit card because applicants can get approved with limited credit. This means the odds of approval are good even for people who are new to credit, making the Chase Freedom® Student credit card much easier to get than other Chase credit cards.

Which credit bureau does United Airlines use?

Editorial and user-generated content is not provided, reviewed or endorsed by any company. The United Explorer Credit Card can use all three major credit bureaus, TransUnion, Experian, and Equifax for approval.

Can I get a credit card with a 650 credit score?

People with a 650 credit score should consider opening a secured credit card account. Secured cards have easy approval and few fees. The best secured card is the Discover it® Secured Credit Card. It offers 1 - 2% cash back on purchases and automatically matches all cash back earned at the end of your first year.

How long does it take to get approved for a United Airlines credit card?

How long will it take to get my United℠ Explorer Card? Because conditional approval is automated on the Chase website, you'll often get a decision immediately. In some cases, you'll need to wait a few days to a few weeks to receive a response. If you're approved, look for your card in the mail within seven to 10 days.

Is it easy to get a United Airlines credit card?

For a solid chance of an approval when you apply for the United℠ Explorer Card, we recommend having a FICO® Score of 670 or above. Your credit score isn't all that matters on your application, but like other top travel cards, the United℠ Explorer Card is targeted at consumers with good credit.

Is your TransUnion or Equifax more important?

Is TransUnion more important than Equifax? The short answer is no. Both TransUnion and Equifax are reliable credit reporting agencies that compile reports and calculate your credit scores using different scoring models.

What credit limit can I get with a 700 credit score?

“In the 700 club, your credit limit will likely be close to the average credit limit for a newly issued card, about $5,000,” says Ted Rossman, senior industry analyst at Bankrate. “That limit can vary based on income and other debt.”

How many points is Credit Karma off?

Credit Karma touts that it will always be free to the consumers who use its website or mobile app. But how accurate is Credit Karma? In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Are credit scores on credit karma accurate?

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

How much is 60000 United miles worth?

Based on TPG's most recent points and miles valuations, 60,000 miles are worth $780, which is a decent haul when it comes to cobranded airline credit cards. And the United Explorer Card packs quite a few valuable benefits for its $95 annual fee (which is also waived for the first year).

What are the benefits of the United MileagePlus card?

What are the United Explorer Card benefits?Up to $100 Global Entry or TSA PreCheck ® fee credit. ... Bonus miles. ... Priority boarding. ... Free first checked bag. ... 25% back on inflight purchase. ... United Club℠ passes. ... Visa Concierge. ... United® MileagePlus Program.

How much is 50000 United miles worth?

about $500How much are 50,000 United miles worth? According to NerdWallet's analysis, 50,000 United miles are worth about $500.

How long does United Airlines credit last?

For most flights, future flight credit must be used within 12 months of the date that your original ticket was issued. Future flight credits for tickets issued between May 1, 2019 – March 31, 2020, are valid for 24 months after the original issue date.

What is the Chase 5 24 rule?

What is the 5/24 rule? Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

Can you use someone else's flight credit?

Normally, a future flight credit is non-transferrable and therefore must be used by the same traveler it was issued to. However, all future flight credits that were issued for tickets purchased on or before August 31, 2021, can now be used to book travel for anyone, including yourself, friends, or family.

Why is United canceling flights?

Experts have blamed overall cancellations on a combination of air traffic control problems and staffing shortages and several airlines have proactively trimmed their summer schedules in an effort to avoid further problems, including JetBlue, Delta Air Lines, and United Airlines.

How long does it take to get the United℠ Explorer Card?

While timelines vary, it could take up to two weeks to get your Chase credit card in the mail after you're approved.

How do you get TSA Precheck with the United℠ Explorer Card?

To get TSA Precheck membership, head to TSA.gov to apply. Pay the membership fee for TSA Precheck with your United℠ Explorer Card, and you’ll see y...

Does the United℠ Explorer Card cover car rental insurance?

The United℠ Explorer Card comes with primary auto rental coverage good for up to the actual cash value of the vehicle for theft and collision damag...

Does the United℠ Explorer Card have foreign transaction fees?

The United℠ Explorer Card doesn't charge foreign transaction fees.

Does the United℠ Explorer Card have travel insurance?

The United℠ Explorer Card comes with quite a few travel insurance benefits: These include primary auto rental coverage, baggage delay insurance, lo...

Does the United℠ Explorer Card pay for Global Entry?

Yes, the United℠ Explorer Card reimburses your Global Entry application fee. To get Global Entry membership with your credit card, head to the U.S....

How do you get United Club passes with the United℠ Explorer Card?

The United℠ Explorer Card automatically comes with two United Club passes each year you have the card.

What credit score do you need for the United℠ Explorer Card?

You'll need 660 - 850 credit to qualify for this airline credit card, which usually entails a FICO Score of 660 or higher.

Can you add an authorized user to the United℠ Explorer Card?

Yes, you can add an authorized user to your United℠ Explorer Card without any additional charge. You may even be able to earn bonus miles for doing...

What credit card gives you miles?

NerdWallet's favorite credit card for the MileagePlus program is the United℠ Explorer Card . It gives you 2 miles per dollar spent at restaurants, on hotel stays and on purchases from United, and 1 mile per dollar on all other purchases. You get a great sign-up bonus to start: Earn 40,000 bonus miles after you spend $2,000 on purchases in the first 3 months your account is open. The annual fee is $0 intro for the first year, then $95 — but the checked bag benefit on this card can make up for it quickly. The first checked bag is free for you and a companion traveling on your reservation.

How many miles can you earn on a United flight?

Government-imposed taxes and fees do not earn miles. Generally, the most you can earn on a ticket is 75,000 miles. Earning on other airlines: When the ticket is issued by United (ticket number starting with 016), you’ll earn miles based on the cost of the fare.

What is United Airlines frequent flyer program?

United Airlines’ frequent-flyer program uses a currency called MileagePlus miles, which NerdWallet values at an average of 1 cent each. You earn miles when you fly on United or one of its partner airlines, and you can redeem them for award flights.

What is United Airlines?

United Airlines is among the largest airlines in the U.S. and the world. It’s the dominant carrier at O'Hare International in Chicago, and it operates domestic hubs in Houston, Newark, Denver, San Francisco, Washington-Dulles, Los Angeles and Guam. The United MileagePlus program is the airline’s loyalty program.

How much is a break even for miles?

For example, break-even would be a flight that costs $400 or 40,000 miles ( 40,000 miles * .01 per mile). If you can book a $400 flight for 25,000 miles, that’s a better use of miles (1.6 cents per mile). United has many opportunities for sweet spot redemptions.

How many miles per dollar on United Airlines?

2 miles per dollar on eligible United Airlines purchases, hotel stays and at restaurants.

What are the elite levels of United?

On United, elite statuses are called Premier levels. From lowest to highest, they are Silver, Gold, Platinum and 1K.

How many miles can you earn on United?

Cardholders can Earn 2 miles per $1 spent on dining, hotel stays and United purchases. 1 mile per $1 spent on all other purchases.

How many miles does United Airlines award?

In our own sampling below, we found Saver economy awards for as little as 8,000 miles and Business class awards for as much as 175,000 miles.

How does the United℠ Explorer Card compare to other cards?

If you're considering the United℠ Explorer Card, you should also take a look at other airline and travel credit cards , including the options below.

How long is the TSA credit good for?

The credit for either program is good every four years.

How many miles do you get with a Welcome Bonus?

Welcome bonus: Enjoy a one-time bonus of 60,000 miles once you spend $3,000 on purchases within 3 months from account opening, equal to $600 in travel ( Worse )

Is the United℠ Explorer Card worth it?

If you fly with United Airlines fairly often or plan to in the future, the United℠ Explorer Card should definitely be on your radar. This airline credit card gives you the chance to earn a generous bonus right away, yet you can also earn 2x miles in popular spending categories like dining, hotel stays booked directly with hotels and, of course, United purchases.

How does United MileagePlus Premier status work?

United doesn’t require you to fly a certain number of miles to qualify for MileagePlus Premier status. Instead of tracking distance flown, United looks at your Premier qualifying flights and Premier qualifying points.

How many levels of MileagePlus Premier?

There are four levels of MileagePlus Premier status.

What is a Premier qualifying flight?

Premier qualifying flights measure how many segments you fly. For example, if you book a one-way flight from New York to Los Angeles that connects in Chicago, you’d get two PQFs because you completed two flight segments. Premier qualifying points measure how much you spend on those flights. You’ll earn one PQP for every $1 you spend on airfare, carrier-imposed surcharges, seat purchases and upgrades.

How many miles do you get for spending $5,000 on a new card?

New cardholders earn 80,000 bonus miles after spending $5,000 on purchases during the first three months from account opening.

Why do I need United Club membership?

But the real reason to get this card is its complimentary United Club membership, which means you can get away from the crowds and do some work while you’re waiting for your flight. And once you’re on board, you can use the 25% in-flight credit to purchase WiFi.

How much back do you get on United Airlines?

On top of that, you’ll get 25% back on your in-flight purchases from United.

How long before departure do you get a seat upgrade on United Premier?

As a United Premier 1K member, you’ll be at the top of the food chain when it comes to seat upgrades. You’ll get first crack at them — four days before departure — if any are available.

What credit cards does United Airlines use?

The two most common United branded credit cards are the United Explorer card and the United Club Infinite card. United co-branded cards earn MileagePlus miles that can be redeemed for flights on United and partner airlines.

How many passengers did United Airlines carry in 2019?

United Airlines transported over 162 million passengers in 2019. If you are reading this, chances are you were one of them. While 2020’s passenger number was significantly lower, many flyers can’t wait to hear the sweet strains of Debussy found when boarding a United Airlines flight. Whether you fly for business or with your family, ...

What is an Amex card?

The Amex EveryDay® Preferred Credit Card is a hidden gem for those who make frequent gas and supermarket purchases every month. Using the card for purchases at least 30 times in a month unlocks a stellar 50% bonus on that month’s points earnings.

How much does a United Business Card cost?

For a modest $99 annual fee, the United Business Card delivers a robust set of travel perks and in-flight benefits, including priority boarding and free checked bags. The rewards program features several spending categories that yield 2x miles, allowing you to accumulate miles quickly. A generous welcome bonus is the cherry on top of an already sweet deal.

What is a United Club Business Card?

The United Club Business card is a brother to the United Club Infinite, with a slightly different earning structure. The high annual fee plus the other United perks would easily outweigh the annual fee if you would normally pay for a United Club membership anyway. If your business is not near a United hub, this card may not be for you.

How to cancel United Airlines credit card?

You can cancel a United Airlines Credit Card by calling the number on the back of your card. Before you cancel your card, you might want to ask for a retention offer.

What cards offer free checked bags?

Cards that offer a free checked bag on United include the United Club Infinite card, the United Business card, the United® Credit Card from First Hawaiian Bank * and the United Explorer card.

What is the minimum credit score for Freedom Unlimited?

Chase Freedom Unlimited® credit card is a cash back card with no annual fee. We found references that pegged the minimum score to be around 680, but one source had a low score of 636.

What is the minimum credit score for Southwest Rapid Rewards?

However, we expect it to have a lower minimum requirement than the 607 found for the middle sibling, the Southwest Rapid Rewards® Premier. That would put this card’s required minimum score at about 600, and perhaps lower.

What is the minimum credit score for Chase Sapphire Reserve?

As such, it’s not surprising to find that its minimum credit score is in the 660 to 670 range.

What to do if your credit score is poor?

If your score is poor, you may want to first obtain another card to help build your credit before applying for this card .

What is the best credit score for Chase Sapphire?

It is geared to consumers having good to excellent credit scores, with an average score of 736 among cardholders. However, scores in the fair range, as low as 646, have been reported.

How many months does Chase have to approve a credit card?

Like all Chase cards, this one observes the 5/24 application rule, which limits approvals (with some exceptions) if you’ve opened 5 or more credit cards from any bank in the past 24 months.

How much back does Southwest credit card earn?

Cardholders also earn 20% back on in-flight Southwest purchases with the Priority card.

What credit card do you use if you don't fly United Airlines?

If you don’t fly with United Airlines on a regular basis, you might want to check out one of these other travel credit cards instead. Chase Sapphire Preferred® Card: This card can be a good option for frequent flyers who don’t want to be locked into one particular airline.

How much are United miles worth in 2020?

According to our point valuations, as of winter 2020, United MileagePlus® miles are worth around 1.71 cents each when redeemed toward flights with United Airlines. That’s among the best valuations for airline programs.

Can you redeem your miles for a hotel?

You can also redeem your miles for hotels, cruises, Broadway shows, gift cards and merchandise like electronics, housewares and jewelry. But you’ll probably get less value than if you use your points toward flights.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

Read our comprehensive guide to United MileagePlus to learn about the best ways to earn, redeem and maximize United miles.

What is United MileagePlus?

United MileagePlus is the loyalty program of United Airlines, rewarding its frequent flyers with airline miles that they can redeem for awards, including free flights on United or one of its Star Alliance partners, gift cards, merchandise and more.

Other news and advice

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.