What Do You Need To Buy a House? 7 Requirements for 2022

- 1. Qualifying Credit Credit requirements vary by loan type and lender, but buyers can qualify with a score as low as 580. ...

- 2. Proof of Income and Finances ...

- 3. Cash Needed to Close On Your Home ...

- 4. Home Buying Budget ...

- 5. Mortgage Loan ...

- 6. Mortgage Pre-Approval ...

- 7. Real Estate Agent ...

How much do you really need to buy a house?

The amount of money needed to buy a house varies hugely from person to person. Someone buying a $250,000 house might need less than $10,000 upfront, while someone purchasing a $600,000 home may need to save over $100,000. The amount you need to save depends on your home price, location, and the type of mortgage you plan to use.

How much do you need to make to buy a house?

There's no minimum income required to buy a house. This leaves many first-time home buyers wondering if they can afford a house in today's real estate market. The good news is, home loan programs are flexible. So there's no minimum income requirement to buy a house.

How much cash will I need to buy a house?

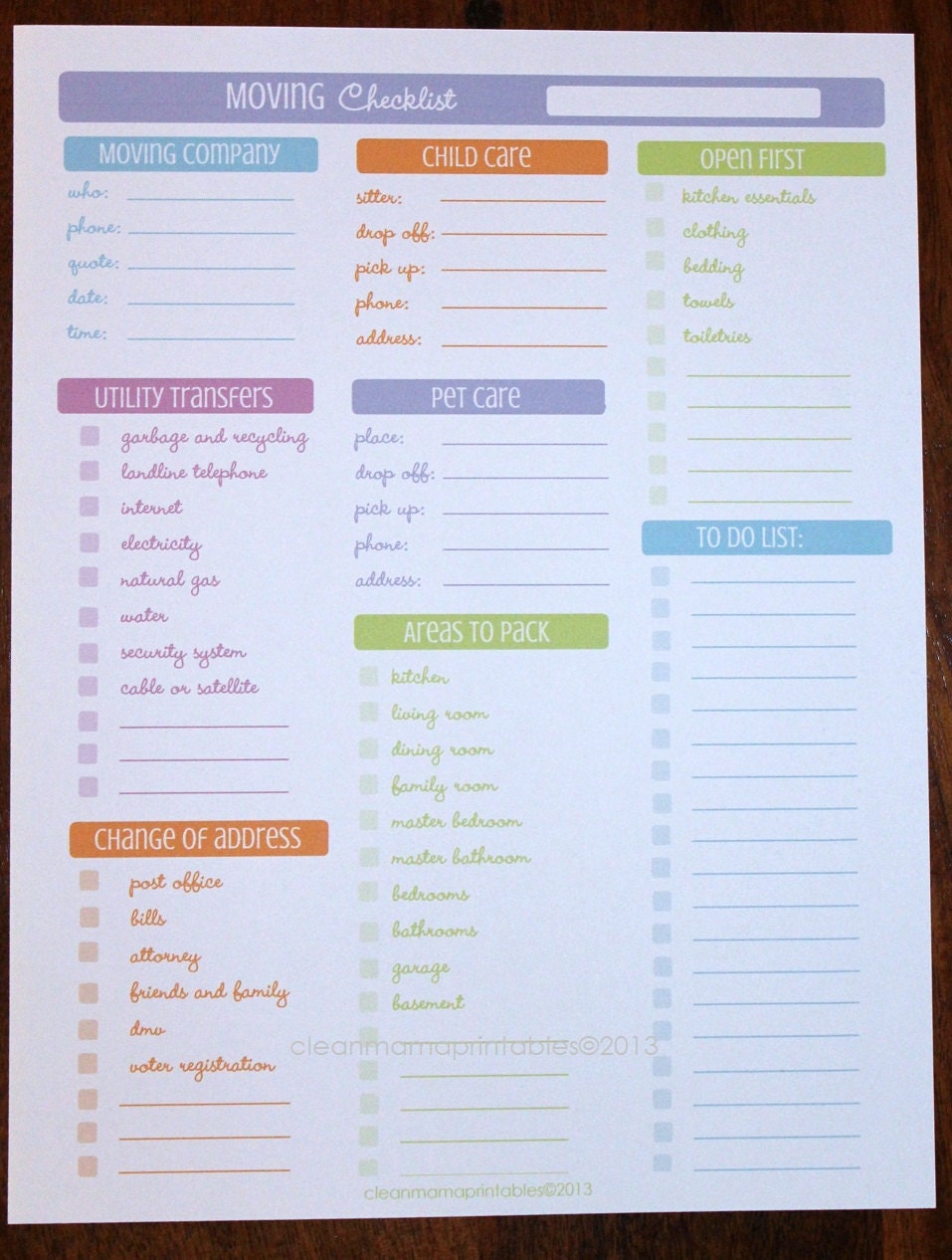

How Much Cash Do I Really Need to Buy a Home? If you’re getting a mortgage, a smart way to buy a house is to save up at least 25% of its sale price in cash to cover a down payment, closing costs and moving fees. So if you buy a home for $250,000, you might pay more than $60,000 to cover all of the different buying expenses.

How long does it really take to buy a house?

The buying a house timeline can be tricky to predict. It typically takes anywhere from four weeks at the low end to six months (or more) to shop for and close on a house. But it can be quicker if you make a strong offer right away in a fast-moving market or slower if you have a hard time finding just the right place or keep getting outbid.

1. Qualifying Credit

Credit requirements vary by loan type and lender, but buyers can qualify with a score as low as 580.

2. Proof of Income and Finances

There are no set income requirements to buy a house, and your monthly income isn’t the only determining factor. To buy a home, you will need to provide lenders the following:

3. Cash Needed to Close On Your Home

There are programs that can help you buy a home with as little as 3 percent or no down payment at all.

4. Home Buying Budget

Home buyer competition can be fierce. The buyers who win are the buyers who prepare. Knowing how much you want to spend on housing each month puts you in a powerful position — you’ll know when to push and when to move on to another home.

5. Mortgage Loan

Almost 9 out of 10 home buyers use a mortgage to purchase their home. You probably will too. That’s why it’s important to understand the different mortgage options available to you.

6. Mortgage Pre-Approval

Mortgage pre-approval is a dress rehearsal for your final approval. Savvy home buyers always get pre-approved before house shopping because pre-approvals:

7. Real Estate Agent

In the United States, a home buyer’s real estate agent is paid for by the seller. It doesn’t cost you to have an agent. Because you aren’t the one footing the bill, you should get the best agent you can find.

What do I need to buy a house?

The process of buying a house will vary according to each person’s situation. However, there are 5 things most everyone will need to make it happen.

Bottom line

While buying a home can be taxing, understanding what you’ll need to qualify for a house can make everything go much more smoothly. Get your credit and debt in order, save up a down payment and collect your paperwork, and you’ll be in your next home before you know it.

What to consider when making a house offer?

There are numerous variables to consider and, hopefully, your knowledgeable real estate agent will help you through this process. Understanding the condition of the US housing market, how houses have been selling in the neighborhoods you’re looking into and at what price (above or below asking), and knowing if there are often other competing offers will help you assess and determine how you’d like to make your offer when the time comes.

How long does it take to find a home?

Depending on the housing market in your area and possibly which season you’re buying in, it can take you a couple of weeks to find a home or more than a year. But after you find your home you can typically expect the entire process from making an offer on a house to walking in its front door, to be as little as a few weeks to a couple of months on average.

What happens if you make an offer on a house that is worth $300,000?

If the home appraisal comes back and states that the house is worth $300,000, but you made an offer of $310,000, the bank will most likely only lend you $300k. You will then either be stuck with paying the additional $10k out of pocket, or you may try to renegotiate the price with the sellers to see if they would be willing to come down. Or you may lose the house altogether.

What does a home inspection look for?

There are several types of home inspections, but in general, a typical home inspection involves a certified inspector that will go in, around, under, and top of your house looking for anything that could be of concern, such as structural or mechanical issues. The inspector would also look for safety issues related to the property. Though they will go into crawl spaces and attics as part of their inspection, they will not open walls. They will inspect the plumbing and electrical systems and should point out any defect in the property that could cost money down the road for the homeowner.

What does a real estate agent tell you?

Your real estate agent will most likely tell you to figure out your list of the things you want in a house versus the extra features that you would like to have, but wouldn’t necessarily deter you from a house if it wasn’t there.

What makes a good agent?

A good agent isn’t trying to get you into a house as quickly as possible so they can earn a commission. Instead, you want an agent that will act as your guide through the home buying process, while having your best interests in mind. A good agent will be able to tell you what you need to buy a house, and if they think a house is a good fit for you, or if you should keep looking. They should also be expert negotiators so that you get the best deal possible.

What is the housing market like in 2021?

Every year the U.S. housing market is different. While the economy expands and contracts, the housing market reacts, producing buyers and seller’s markets. If you’re planning on buying a house in 2021, it’s important to understand what the market is doing now and how it’s expected to perform over the course of the year.