Employee NI / EE NI - The amount being deducted for your National Insurance contribution. Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date".

What does EE ni mean on a payslip?

Employee NI / EE NI - The amount being deducted for your National Insurance contribution. Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip. TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date".

What are the amounts on my payslip?

Amounts and deductions on your payslip Employee NI / EE NI - The amount being deducted for your National Insurance contribution. Employers NI / ERS NI - Employers also pay Employer's National Insurance contributions on their employees' earnings and benefits, which is summarised for reference on your payslip.

Why is there a line for ERS pension on payslip?

So if there is a line for ers pension it will be the total employer's contributions to your pension, which is usually included on the payslip for information only (it does not form part of your salary which is going through your payslip with a gross to net analysis each month).

Why do I need a National Insurance number on my payslip?

You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip. Your National Insurance Number (NI) is your personal, unique identifier used by HMRC to track your tax and national insurance contributions. It will often appear on your payslips.

What does ers stand for on payslip?

Tell HMRC about your employment related securities (ERS) schemes.

What does ER NI stand for?

Employers pay National Insurance contributions on their employees' earnings and benefits. They are also responsible for collecting employees' Class 1 National Insurance contributions and income tax deductions through the PAYE system.

What does EES NI mean on a payslip?

NI: The total amount of National Insurance contributions made by you in this tax year. Employers NI: The amount of National Insurance your employer has paid on your earnings in this tax year. EE Pension to Date: The workplace pension payments you have contributed from your wages in this tax year.

What is the employer's NI?

National Insurance (NI) is a tax on earnings paid by employers and employees to fund various benefits including the state pension, statutory sick pay and maternity leave.

Can I claim back employers National Insurance?

The good news is that you can reclaim any overpayment with a National Insurance Refund. This NIC's guide sets out some of the basic elements of National Insurance including; who does and does not have to pay, circumstances in which you might be due a NI refund and how to make a NI refund claim.

Why is NI deducted from pay?

National Insurance contributions are a tax on earnings and self-employed profits paid by employees, employers and the self-employed. They can help to build your entitlement to certain benefits depending whether you are employed or self-employed, such as the State Pension and Maternity Allowance.

What does EE and ER stand for?

The suffix -er is used to describe a person or thing that does or provides an action. The suffix -ee describes the person or thing that receives the action. Here's an example: employer.

What is EE NI contribution?

EMPLOYEE NI / EE NI The amount being deducted for your National Insurance contribution.

Is 1257L an emergency tax code?

Tax code 1257L 1257L is an emergency tax code only if followed by 'W1', 'M1' or 'X'. Emergency codes can be used if a new employee does not have a P45.

Do I have to pay employer NI?

By law, all employers must pay Employers' National Insurance Contributions on the salaries paid to their employees. In addition, they must also pay a 0.5% Apprenticeship Levy.

What percentage is employer NI?

The employer National Insurance rate is currently 13.8%. From April 2022, the rate of NICs employers pay will also increase by 1.25% making it 15.05%.

What is employer NI and employee NI?

An employee's Class 1 National Insurance is made up of contributions: deducted from their pay (employee's National Insurance) paid by their employer (employer's National Insurance)

What does ni mean in a report?

Net Income (NI)

What is the significance of the numbers in the tax code?

The numbers in an employee's tax code show how much tax-free income they get in that tax year. You usually multiply the number in the tax code by 10 to get the total amount of income they can earn before being taxed.

What does NI stand for in tax?

This stands for Pay As You Earn, it is the system by which you pay both your income tax and national insurance (NI). Every time you’re paid, your employer takes your tax and NI from your wages and sends it on to HMRC.

What does "payslip" mean?

This means “To Date” or “Year To Date”. As well as showing earnings and deductions for that specific pay period, your payslip should also show you a combined total for that tax year to date.

What is an ERN number?

An ERN is given to every business that registers with HM Revenue and Customs as an employer. You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip.

Do you keep payroll number if you move company?

When you have a payroll query, you may need to quote this number. You won’t keep this number if you move company, and it’s worth noting that not all employers will issue one.

Do employers pay national insurance?

Employers also pay Employer’s National Insurance contributions on their employees’ earnings and benefits, which is summarised for reference on your payslip.

What is NI earnings?

Earnings for Tax / Earnings for NI - This is the amount of your earnings that are subject to tax or national insurance deductions. Often, these will be displayed for the pay period and for the year to date.

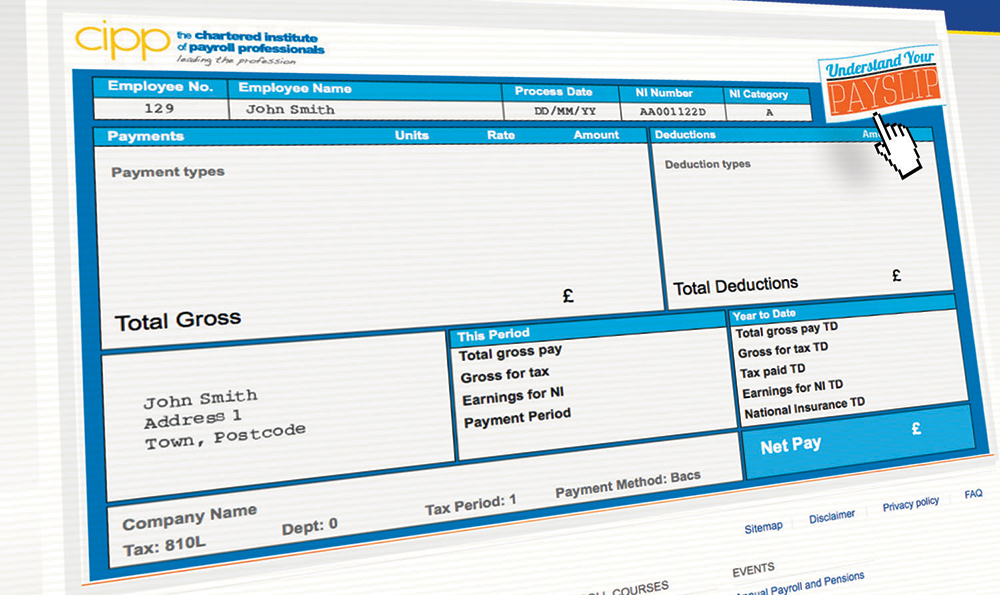

What is the best interactive tool to help you understand more about your payslip?

For a great interactive tool to help you understand more about your payslip we recommend you check out the CIPP payslip template

What is an ERN number?

Employers PAYE Reference / ERN - An ERN is given to every business that registers with HM Revenue and Customs as an employer. You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip.

What does TD mean on a payslip?

TD or YTD (i.e. Tax TD) - This means "To Date" or "Year To Date". As well as showing earnings and deductions for that specific pay period, your payslip should also show you a combined total for that tax year to date.

What is a national insurance number?

National Insurance number / NI number / Nat Ins No, etc - This is your personal, unique identifier used by HMRC to track your tax and national insurance contributions. It will often appear on your payslips.

What is an employee number?

Employee number - This is given to you by your employer and serves as a unique identifier for you while you work there. When you have a payroll query, you may need to quote this number. You won't keep this number if you move company, and it’s worth noting that not all employers will issue one.

What is net pay?

Net Pay - The term for the amount of salary actually paid after the deduction of tax, national insurance and any other deductions.

What is included in a payslip?

Your payslip will contain your payroll number, national insurance number, rate of pay, tax code, the tax period (also known as the financial year) and additional payments (e.g. overtime, bonuses and commission).

How often do you get a payslip?

For employed people, you usually get a payslip each month outlining your gross pay (before tax and deductions) and net pay (after tax & deductions).

What About National Insurance?

Both you and your employer pay National Insurance contributions as a tax based on your weekly earnings. In 2018-2019 you start paying it once you earn over £162 per week.

What is the tax band for a person who earns between £11,851 and £46,350?

If you earn between £11,851 and £46,350 then your earnings over £11,850 will be taxed by 20%. This is called the Basic Rate tax band .

What is the main tax that concerns you as an employee?

The main tax that concerns you as an employee will be Income Tax . This is the tax that is applied to employee wages and salaries, and it is used largely to pay for public services (e.g. NHS, housing and the welfare system).

Do freelancers have a right to a payslip?

Freelancers and contractors do not have a right to a payslip, but casual staff and employees do.

Do gym memberships have to be listed on a payslip?

If you claim any workplace benefits, such as a gym membership or company car, then these should be listed as distinct items on your payslip. Please note that this can affect your tax code.

What is a payslip?

A payslip is a summary of your earnings and deductions issued by your employer on a weekly, bi-weekly, or monthly basis – depending on how often you get paid. Your payslip can be provided to you in a paper format or in digital form – known as electronic payslips or ePayslips.

Do I need to keep my payslips?

The simple is, ‘Yes’ , it’s advisable to hold on to your payslips as you may need them in case you have a query about your pay or if you need to claim state benefits.

What is the NI contribution for £162?

Nothing is taken for the first £162. NI contribution = £0

Why do employees defer national insurance?

Employees in this category defer national insurance because they are already paying contributions in another job (Employees whom have more than one job).

What is a Category Z employee?

Category Z is for employees whom are under the age of 21 and defer national insurance because they are already paying contribution in another job (under 21 and have more than one job).

Who is entitled to reduced national insurance?

Employees who fall under this category are married women and widows entitled to pay reduced national insurance.

What is national insurance contribution?

National insurance contributions are a tax on earnings. Your contributions will be taken off along with your income Tax before your employer pays your wages. Contributions are taken to help build your entitlement to certain state benefits such as state pension and maternity allowance. All of the below category’s are for class 1 National Insurance ...

What Does Ni EE and Ni Er on Your Payslip Mean?

Pay Terms

- GROSS PAY

This is the total amount that you have earned, before deductions have been applied. It may include earnings for overtime, bonuses, shift work, and holiday pay, etc. - BASIC PAY

This is the rate agreed between you and your employer as your set pay, without any bonuses or overtime. For monthly paid staff, it is usually 1/12th of your annual salary.

Reference Numbers

- EMPLOYEE NUMBER

This is given to you by your employer and serves as a unique identifier for you while you work there. When you have a payroll query, you may need to quote this number. You won’t keep this number if you move company, and it’s worth noting that not all employers will issue one. - EMPLOYERS PAYE REFERENCE / ERN

An ERN is given to every business that registers with HM Revenue and Customs as an employer. You may need this number when applying for tax credits, applying for Student Loans, or a range of other tasks, so your employer will sometimes put it on your payslip.

Tax References

- TAX CODE

This tells your employer how they should apply tax on your earnings. Your tax code is given to your employer by HMRC and will usually change each financial year. Again, this should appear on every payslip. - TAX PERIOD

This is the period for which the tax was calculated. For monthly pay it refers to the month of the tax year, with April being period 1 and March being period 12. If you are on a weekly payroll it refers to the week of pay, starting with week 1 in April to week 52 at the end of March.

Deductions

- EMPLOYEE NI / EE NI

The amount being deducted for your National Insurance contribution. - EMPLOYERS NI / ERS NI

Employers also pay Employer’s National Insurance contributions on their employees’ earnings and benefits, which is summarised for reference on your payslip.

Summaries

- EARNINGS FOR TAX / EARNINGS FOR NI

This is the amount of your earnings that are subject to tax or national insurance deductions. Often, these will be displayed for the pay period and for the year to date. - TD OR YTD

This means “To Date” or “Year To Date”. As well as showing earnings and deductions for that specific pay period, your payslip should also show you a combined total for that tax year to date. Download PDF Click here for Payroll Service