A current ratio of less than 1 means the company may run out of money within the year unless it can increase its cash flow or obtain more capital from investors.

Is current ratio good or bad?

The current ratio is a very good indicator of the liquidity position of the company amid certain limitations which one needs to keep in mind before using and interpreting the ratio. One can look to use an acid test ratio that does away with some limitations of the current ratio; however, any of these ratios should be used in comparison/conjunction with other measures to interpret the short-term solvency of the company.

What is current ratio and how to calculate it?

Key Takeaways

- The current ratio is used to evaluate a company's ability to pay its short-term obligations—those that come due within a year.

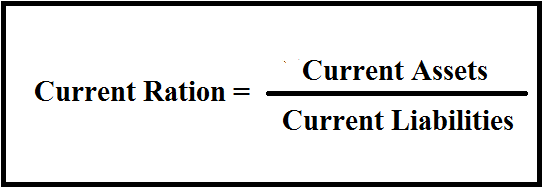

- The current ratio is calculated by dividing a company's current assets by its current liabilities.

- The higher the resulting figure, the more short-term liquidity the company has.

Should current ratio be high or low?

If the current ratio is too high (much more than 2), then the company may not be using its current assets or its short-term financing facilities efficiently. This may also indicate problems in working capital management. All other things being equal, creditors consider a high current ratio to be better than a low current ratio, because a high current ratio means that the company is more likely to meet its liabilities which are due over the next 12 months.

What does a low current ratio mean?

What is current ratio?

- Formula to calculate current ratio. The following formula is used to calculate current ratio. ...

- Significance of Current Ratio. We can determine the short term liquidity of a business concern using the Current ratio. ...

- Reasons of High Current Ratio. There may be slow moving of stocks. ...

- Reasons of Low Current Ratio. ...

Is a current ratio of less than 1 bad?

A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations. Some types of businesses can operate with a current ratio of less than one, however.

Is a current ratio of 0.5 good?

What Is a “Good” Current Ratio? Current ratio is typically expected to be between 0.5:1 and 2:1, depending on the industry and business type, for an entity to have sufficient current assets to satisfy its short-term liabilities as they fall due, without overinvesting in working capital.

What does a low current ratio mean?

If your current ratio is low, it means you will have a difficult time paying your immediate debts and liabilities. In general, a current ratio of 1 or higher is considered good, and anything lower than 1 is a cause for concern. However, good current ratios will be different from industry to industry.

What does a current ratio of 0.5 mean?

This number indicates that a company has just enough in current assets to cover all its current liabilities, but has no extra buffer. Any ratio below 1, such as 0.5:1, indicates the company doesn't have enough in current assets to cover all of its current liabilities.

What does a current ratio of 0.6 mean?

Current Ratio Calculation Current liabilities refers to the sum of all liabilities that are due in the next year. This list includes wages, accounts payable and mortgage payments and loans. For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6.

What does a current ratio of 0.8 mean?

If the ratio is 1 or higher, that means that the company can use current assets to cover liabilities due in the next year. For example, if a company has a quick ratio of 0.8, it has $0.80 of current assets for every $1 of current liabilities.

Why is a low current ratio bad?

A current ratio that is lower than the industry average may indicate a higher risk of distress or default. Similarly, if a company has a very high current ratio compared with its peer group, it indicates that management may not be using its assets efficiently.

What does a 1 current ratio mean?

A current ratio of one means that book value of current assets is exactly the same as book value of current liabilities. In general, investors look for a company with a current ratio of 2:1, meaning current assets twice as large as current liabilities.

What causes low current ratio?

Generally, your current ratio shows the ability of your business to generate cash to meet its short-term obligations. A decline in this ratio can be attributable to an increase in short-term debt, a decrease in current assets, or a combination of both.

What is a healthy current ratio?

While the range of acceptable current ratios varies depending on the specific industry type, a ratio between 1.5 and 3 is generally considered healthy.

What is a good current ratio?

A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. A current ratio below 1 means that the company doesn't have enough liquid assets to cover its short-term liabilities.

How do you know if a current ratio is good or bad?

Current ratio measures the extent to which current assets if sold would pay off current liabilities.A ratio greater than 1.60 is considered good.A ratio less than 1.10 is considered poor.

What is a healthy current ratio?

While the range of acceptable current ratios varies depending on the specific industry type, a ratio between 1.5 and 3 is generally considered healthy.

What is a good current ratio?

A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. A current ratio below 1 means that the company doesn't have enough liquid assets to cover its short-term liabilities.

What is a bad acid-test ratio?

For most industries, the acid-test ratio should exceed 1. If it's less than 1, then companies do not have enough liquid assets to pay their current liabilities and should be treated with caution.

What is a healthy quick ratio?

A good quick ratio is any number greater than 1.0. If your business has a quick ratio of 1.0 or greater, that typically means your business is healthy and can pay its liabilities.

Why is current ratio called current?

The current ratio is called “current” because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities.

What does a high ratio of 3 mean?

However, while a high ratio, say over 3, could indicate the company can cover its current liabilities three times, it may also indicate that it's not using its current assets efficiently, is not securing financing very well, or is not managing its working capital .

What is current ratio?

The current ratio is a liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year. It tells investors and analysts how a company can maximize the current assets on its balance sheet to satisfy its current debt and other payables.

How to calculate current ratio?

Calculating the current ratio is very straightforward. To do so, simply divide the company’s current assets by its current liabilities. Current assets are those which can be converted into cash within one year, whereas current liabilities are obligations expected to be paid within one year. Examples of current assets include cash, inventory, ...

What happens if the current ratio is less than one?

If the inventory is unable to be sold, the current ratio may still look acceptable at one point in time, even though the company may be headed for default. A current ratio of less than one may seem alarming, although different situations can affect the current ratio in a solid company.

What is Walmart's current ratio in 2021?

Walmart's current ratio in Jan. 2021 was 0.97. 1.

What does a current ratio of 1.0 mean?

A company with a current ratio less than 1.0 does not, in many cases, have the capital on hand to meet its short-term obligations if they were all due at once, while a current ratio greater than one indicates the company has the financial resources to remain solvent in the short term.

What is current ratio?

The current ratio, which is also called the working capital ratio, compares the assets a company can convert into cash within a year with the liabilities it must pay off within a year. It is one of a few liquidity ratios —including the quick ratio, or acid test, and the cash ratio —that measure a company's capacity to use cash to meet its ...

Why is the current ratio not the best measure of short-term liquidity?

2 . The cash ratio replaces current assets with only cash and cash equivalents—the most-liquid assets a company can own—so it eliminates the potential liquidity problem associated with inventory and accounts receivable.

What does a high current ratio mean?

A company with a high current ratio has no short-term liquidity concerns, but its investors may complain that it is hoarding cash rather than paying dividends or reinvesting the money in the business. 6 1 .

How is the current ratio calculated?

It's calculated by dividing current assets by current liabilities. The higher the result, the stronger the financial position of the company.

What are current liabilities?

Current liabilities include accounts payable, income taxes payable, wages payable, and dividends declared, which are, respectively, amounts owed to suppliers, income taxes owed to the federal government, employee wages earned but not yet paid, and dividends approved and declared by the board of directors but not yet paid. 5 .

What are the items that are often used when calculating current assets?

Two items that are often used when calculating current assets are not easily converted into cash: accounts receivable (money other companies owe the company in question) and inventory (completed products and the materials used to create them). For that reason, the current ratio may not be the best measure of a company's short-term liquidity. 2 .

Who is Rosemary Carlson?

Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area. Read The Balance's editorial policies. Rosemary Carlson. Updated July 24, 2020.

What is the odds ratio for the predictor variable smoking?

Here are the results: The odds ratio for the predictor variable smoking is less than 1. This means that increasing from 0 to 1 for smoking (i.e. going from a non-smoker to a smoker) is associated with a decrease in the odds of a mother having a healthy baby.

What does it mean when the odds ratio is less than 1?

If a predictor variable in a logistic regression model has an odds ratio less than 1, it means that a one unit increase in that variable is associated with a decrease in the odds of the response variable occurring.

What Is The Current Ratio?

Formula and Calculation For The Current Ratio

- To calculate the ratio, analysts compare a company’s current assets to its current liabilities.1 Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory, and other current assets(OCA) that are expected to be liquidated or turned into cash in less than one year. Current liabilities include accounts payable, wages, taxes payable, short-term debts, an…

Understanding The Current Ratio

- The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. In many cases, a company with a current ratio of less than 1.00 does not have the capital on hand to meet its short-term obligations if they were all due at once, while a current ratio greater than 1.00 indi…

Interpreting The Current Ratio

- A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its assets—cash or other short-term assets expected to be converted to cash within a year or less. A current ratio of less than 1.00 may seem alarming, although different situations can negatively affect the current ratio in a solid company. For example, a ...

How The Current Ratio Changes Over Time

- What makes the current ratio good or bad often depends on how it is changing. A company that seems to have an acceptable current ratio could be trending toward a situation in which it will struggle to pay its bills. Conversely, a company that may appear to be struggling now could be making good progress toward a healthier current ratio. In the first case, the trend of the current r…

Example Using The Current Ratio

- The current ratios of three companies—Apple, Walt Disney, and Costco Wholesale—are calculated as follows for the fiscal yearended 2017: For every $1 of current debt, Costco Wholesale had 99 cents available to pay for debt when this snapshot was taken.4 Likewise, Walt Disney had 81 cents in current assets for each dollar of current debt.5 Apple, meanwhile, had more than enoug…

Current Ratio vs. Other Liquidity Ratios

- Other similar liquidity ratios can supplementa current ratio analysis. In each case, the differences in these measures can help an investor understand the current status of the company’s assets and liabilities from different angles, as well as how those accounts are changing over time. The commonly used acid-test ratio, or quick ratio, compares a company’s easily liquidated assets (in…

Limitations of Using The Current Ratio

- One limitation of the current ratio emerges when using it to compare different companies with one another. Businesses differ substantially among industries; comparing the current ratios of companies across different industries may not lead to productive insight. For example, in one industry, it may be more typical to extend creditto clients for 90 days or longer, while in another i…