Key Takeaways

- Home equity is the difference between a property’s current market value and the amount owed on the mortgage.

- Home equity loans, home equity lines of credit (HELOCs), and cash-out refinancing are the main ways to unlock home equity.

- Tapping your equity allows you to access needed funds without having to sell your home or take out a higher-interest personal loan.

What are some examples of home equity?

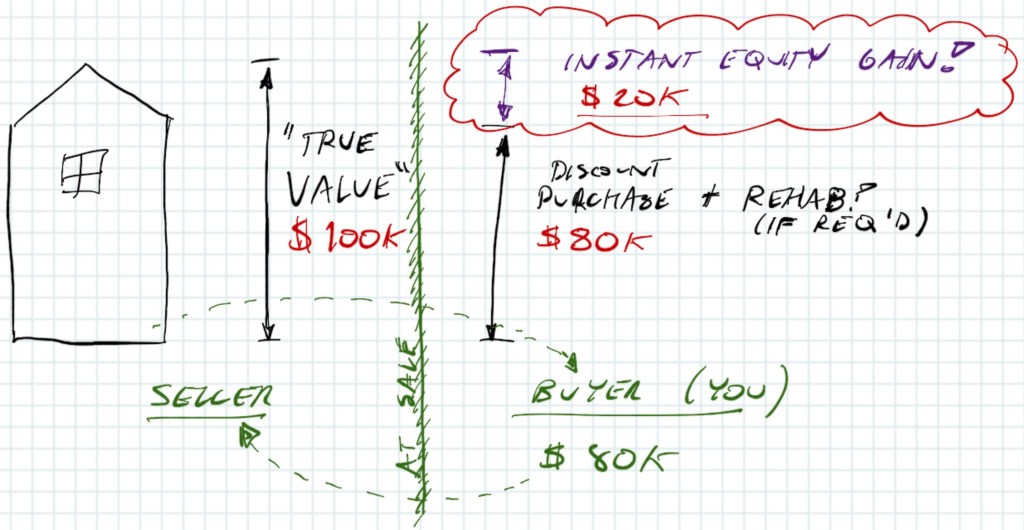

Example of Home Equity . If a homeowner purchases a home for $100,000 with a 20% down payment (covering the remaining $80,000 with a mortgage), the owner has equity of $20,000 in the house.

Is a home equity loan a good idea?

What are the pros of home equity loans?

- Lower interest rates. Compared to standard personal loans and credit card cash advances, interest rates on home equity loans are quite low.

- Predictable payments. Due to, again, the home acting as collateral, interest rates shouldn’t cause too much worry. ...

- Tax benefits. Yes, home equity loans are tax deductible. ...

- Starting a business. ...

How to use home equity?

Key Takeaways

- Home equity loans borrow against the equity in your home for a lump sum of cash.

- Funds from a home equity loan can be used for anything, including buying other real estate.

- Having cash can help make foreign property purchases easier.

What is the best home equity loan?

Our Top Picks for Home Equity Loans of 2021

- Discover - Best for Competitive Rates

- Regions Bank - Best for Flexible Repayment Terms

- Truist - Best Fixed-Rate HELOC

- SunTrust - Best for Quick Approval

- U.S. Bank - Best for Borrowers with Good Credit

- Citizens Bank - Best for Flexible Loan Amounts

- PenFed - Best for Non-owner-occupied Properties

What happens when you take equity out of your house?

Home equity debt is secured by your home, so if you fail to make payments, your lender can foreclose on your home. If housing values drop, you could also wind up owing more on your home than it's worth. That can make it more difficult to sell your home if you need to.

Why do people take equity out of their house?

Home improvements Home improvement is one of the most common reasons homeowners take out home equity loans or HELOCs. Besides making a home more comfortable for you, upgrades could raise the home's value and draw more interest from prospective buyers when you sell it later on.

How do you pull equity out of your house?

You can take equity out of your home in a few ways. They include home equity loans, home equity lines of credit (HELOCs) and cash-out refinances, each of which has benefits and drawbacks. Home equity loan: This is a second mortgage for a fixed amount, at a fixed interest rate, to be repaid over a set period.

Why you shouldn't pull equity out of your home?

Tapping your home's equity has its advantages and drawbacks. Used wisely, that tapped money can fund an important expense or payoff other high-interest debt. Used poorly, it can yield a poor return on your dollar. And, if you can't repay your higher home debt, you may even lose your house.

Is it better to use equity or cash?

Pay using borrowed equity The preferable solution for all scenarios where the borrower has property – funds are released from an existing property as an equity release or top-up. These funds are then used for the deposit to purchase a property, and then remaining purchase funds borrowed against the new property.

Do you pay back home equity loan?

A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is dispersed in one lump sum and paid back in monthly installments.

Can I use my equity to pay off my mortgage?

Can I use equity to pay off my mortgage? Yes. There are many ways to use equity to pay off your mortgage, but two of the most common approaches are second mortgages and home equity lines of credit (HELOCs).

When can I take equity out of my house?

Technically you can take out a home equity loan, HELOC, or cash-out refinance as soon as you purchase a home. However, you don't see very many people doing this because you won't have much equity to draw from that early on.

How do you benefit from home equity?

Here are the best ways to use your home equity to your advantage.Paying off credit card bills. ... Consolidating other debts. ... Home improvements. ... Home additions. ... Down payment for an investment property. ... Starting a business. ... Emergencies.

Is it worth pulling equity out of your home?

A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate. However, a home equity loan is a bad idea if it will overburden your finances or only serves to shift debt around.

What is a good amount of equity in a house?

What is a good amount of equity in a house? It's advisable to keep at least 20% of your equity in your home, as this is a requirement to access a range of refinancing options. 7 Borrowers generally must have at least 20% equity in their homes to be eligible for a cash-out refinance or loan, for example.

Can you sell your home after taking out equity?

You can sell a home even if you've taken out a home equity loan (or home equity line of credit). In such cases, you can use the money you receive for the sale to repay the home equity loan, and you won't have to make any further payments.

Is it worth pulling equity out of your home?

A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate. However, a home equity loan is a bad idea if it will overburden your finances or only serves to shift debt around.

In which scenario do most homeowners use the equity in the home?

Home Improvement The most often-cited way to use a home equity loan is to put that money toward home repair or improvements, whether they're necessary, like replacing a leaky roof, or big value-adding projects, like a kitchen remodel.

Can you sell your home after taking out equity?

You can sell a home even if you've taken out a home equity loan (or home equity line of credit). In such cases, you can use the money you receive for the sale to repay the home equity loan, and you won't have to make any further payments.

What are the advantages and disadvantages of a home equity loan?

Home equity loans: Advantages and disadvantagesPros.● Lower monthly payments.● Proceeds that can be used for any purpose.Cons.● Your home secures the loan, so your home is at risk.● You have to borrow a lump sum.● ... Pro #1: Home equity loans have low, fixed interest rates.More items...•

What Is Home Equity?

Equity is the difference between what you owe on your mortgage and what your home is currently worth. If you owe $150,000 on your mortgage loan and your home is worth $200,000, you have $50,000 of equity in your home.

How to build equity in a house?

The fastest way to build equity is to come up with a large down payment. The bigger your down payment, the more equity you’ll immediately have in your home. Say you buy your home for $180,000. If you put down $5,000, you’ll owe $175,000 on your mortgage. That leaves you with $5,000 in equity.

What is the portion of a mortgage payment?

A portion of each mortgage payment you make will go toward the principal balance of your home loan. The rest will usually go toward paying interest, property taxes and homeowners insurance.

What happens if you sell your home for what it's worth?

Whatever the reason, you're ready to sell your home and find a new place to live. Equity can be your friend as you make this move. Let's say the home you’re selling is worth $220,000, and you've built $70,000 worth of equity in it. If you sell your home for what it's worth, you'll leave the closing table with a profit.

How does equity increase when you pay down a mortgage?

As you pay down your mortgage, the amount of equity in your home will rise. Your equity will also increase if the value of your home jumps.

What are the benefits of buying a home?

You've probably heard that one of the benefits of buying a home is that you can build equity in it and tap into that equity to pay for a major kitchen remodel, eliminate your high-interest credit card debt or even help cover your children's college tuition.

How much equity do you have if your home is worth $200,000?

If your home is worth that $200,000 sales price, you now have $20,000 of equity, or $200,000 minus $180,000.

What is home equity loan?

A home equity loan is any new mortgage loan that you take out as an existing homeowner. If you own your home free and clear, you can borrow a home equity loan, which would have first lien position rather than being a second mortgage. But in general discussion, the terms are often used interchangeably.

What to do if you only owe $150,000?

1. Cash-Out Refinance. If you have a home worth $300,000, and you only owe $150,000, you can refinance your mortgage and pull out more cash. Of course, it comes at the cost of higher home payments and restarting your loan amortization from scratch (more on that shortly).

What happens if you default on a mortgage payment?

If you miss a payment or default entirely, expect it to impact your credit score. Similarly, if you default on debts secured against your home with a lien, the lender can foreclose on you. While you do have a few options at your disposal to stop a foreclosure, the risk of losing your home is real.

What is a HELOC?

A home equity line of credit (HELOC) through a companies like Axos Bank and Figure.com is a far more flexible option for tapping home equity without borrowing a one-time mortgage.

Is HELOC interest lower than credit card?

Also, HELOC interest rates are typically lower than credit cards’ since they’re secured by your home. In general, rates fall in a similar range as second mortgages’.

Do you have to pay off your mortgage if you already have a mortgage?

If you already have a mortgage and want to borrow more money against your home, no one says you have to pay off your existing mortgage. One option is taking out a second mortgage, also known as a home equity loan. Similar to refinancing your original mortgage, you can use LendingTree to get the best rates on a home equity loan.

Is borrowing against your home bad?

But if you must take out debt, borrowing against your home usually means lower interest rates than unsecured debts. Just beware high upfront closing costs, and be especially careful not to take on more debt than you can repay. Most debt is, in fact, bad debt, and the only exception is debt that helps you build wealth.

How much equity can I cash out?

Lenders impose limits on the amount that you can borrow—typically 80% to 85% of your available equity. For example, if you have $250,000 in equity, the lender may let you tap 80% of that, or $200,000.

How can I build equity in my home to maximize my cash-out?

Your home’s equity increases as you pay down your mortgage and when the property’s value increases . To pay down your mortgage faster, you can increase your down payment and pay down the principal by making larger and/or extra mortgage payments.

How do I calculate my home equity?

To calculate your home equity, subtract your mortgage balance (and any other liens) from the property’s current market value. For example, if your home is currently valued at $400,000 and you owe $150,000, then you have $250,000 in home equity.

What is a home equity line of credit?

A home equity line of credit (HELOC) is a good fit for homeowners who will need access to cash periodically over a span of time. These expenses are usually incurred on an ongoing basis.

What is a HELOC?

A HELOC is a good fit for homeowners who need access to cash periodically over a span of time. These expenses are usually incurred on an ongoing basis. A HELOC can be used for a series of home improvements, for example, or for launching a small business.

How long is a home equity loan amortized?

Home equity loans are amortized at the beginning. They also have a set term, such as 15 years. Each payment received is divided between interest and principal (in the same manner as a primary mortgage). The loan cannot be drawn upon further once it is issued.

What is a cash out refinance?

A cash-out refinance can be a good idea if your home has gone up in value. It is often the best option if you need cash right away and you also qualify to get a better interest rate than on your first mortgage. If your credit score is much higher than it was when you purchased your home, a lower rate can help offset the higher payment that will come with the larger balance that includes the cash-out amount. If you use the cash-out amount to pay off other debts, such as car loans or credit cards, then your overall cash flow may improve. Your credit score may rise enough to warrant another refinance in the future.

How to increase equity?

To increase your equity, you must either: Reduce the amounts you owe on your mortgage loan or. Increase the value of your home.

How long does a home equity loan last?

Home equity loans offer fixed interest rates for the life of the loan and repayment terms ranging from 5 to 30 years. A home equity loan is distributed as a single lump-sum payment that starts the loan’s term.

How does knowing your credit score affect your home equity loan?

Knowing the amount you want to borrow, coupled with your credit score, can allow lenders to generate your home equity loan interest rates. Lower loan amounts, larger amounts of equity, and higher credit scores are less risky for lenders, so they earn lower interest rates, where higher borrowing, lower levels of equity, ...

What is a HELOC loan?

HELOCs, unlike home equity loans, typically use a variable interest rate that can fluctuate over the life of the loan, based on national economic factors. HELOCs typically include a draw period, where the borrower can receive funds up to their HELOC borrowing limit and only pay interest on what they borrow.

Why do you pay extra on your mortgage?

Making extra payments on the principal of your mortgage can help you increase your equity and it may also help shorten the term on your original mortgage and reduce the interest you pay over the life of the loan.

Why is a home important?

The home you own provides shelter, security and comfort for you and your family. Your home is also an investment that may provide a financial return with appreciation in price when you decide to sell it. In fact, your home may also be the biggest asset that you have. After building enough equity, you can decide to leverage it by taking out ...

Can you use your home equity to get financing?

While home equity loans are a common way to use your home’s equity to receive financing, other ways to tap your home’s equity include home equity lines of credit and cash-out refinancing.

How Do You Build Home Equity?

You can take a few steps as a homeowner to increase your equity in your home.

How much equity do you have if your home is worth $400,000?

You'd have a 60% equity stake if the home is now worth $400,000, and you still owe only $160,000. Your loan balance remains the same, but the home's value has increased, so your home equity goes up, too. How to Calculate Equity. Calculate your equity stake by dividing the loan balance by the market value, then subtracting ...

What is the difference between a shared equity mortgage and a home equity loan?

The difference is your home equity. Your lender doesn’t own any portion of the property unless you've obtained a shared equity mortgage, which isn't common. You own the house, but it's being used as collateral for your loan. Your lender secures its interest by getting a lien against it. 2.

How much interest do you pay on a mortgage over 30 years?

Making monthly payments over the life of the loan would result in $93,256 in interest paid over 30 years if you have a $100,000, 30-year conventional mortgage at 5% interest.

What is the term for building home equity faster?

A popular method of building home equity faster is a concept often referred to as "accelerated mortgage payments."

What are the risks of borrowing against home equity?

Risks of Borrowing Against Home Equity. A risk of tapping into home equity is that your home secures the loan. Your lender can take your house in foreclosure if you're not able to repay the loan for some reason, and sell it to repay your debt. 1.

Why are home equity loans so attractive?

Home equity loans are tempting because you they can give you access to a large pool of money, often at fairly low interest rates. They’re also pretty easy to qualify for because the loans are secured by the real estate. Look closely at how these loans work so you fully understand the possible benefits and risks before you borrow money against your home's equity. 5

What is a Home Equity Loan?

A home equity loan — also known as a second mortgage, term loan or equity loan — is when a mortgage lender lets a homeowner borrow money against the equity in his or her home. If you haven’t already paid off your first mortgage, a home equity loan or second mortgage is paid every month on top of the mortgage you already pay, hence the name “second mortgage.”

Who Should Consider a Home Equity Loan?

If you need a lump sum of money for something important (such as a home repair, not a vacation or something fleeting) and are sure you can easily repay a home equity loan or second mortgage, it’s worth considering. The rates on a home equity loan tend to be significantly lower than rates on credit cards, so a second mortgage can be a more economical option than paying for what you need with plastic. And sometimes the interest paid on home equity loans or second mortgages is tax deductible, so this may be an added financial bonus (talk to your tax advisers, as this varies person to person).

How much equity do you have if you put down $30,000?

You put down $30,000 when you bought it and have paid down $30,000 in mortgage principal. You would have $60,000 in equity ($300,000 value of home – $240,000 still owed = $60,000 in equity) in the home. The lender would use this equity number — in addition to your credit score and income — to determine how much of a loan you will get.

How does a lender use equity?

The lender would use this equity number — in addition to your credit score and income — to determine how much of a loan you will get. Your lender will need to pull your credit report and verify your income to determine the interest rate you’ll pay for your second mortgage.

How long does it take to pay off a second mortgage?

Often, you have to pay off a home equity loan or second mortgage within about 15 years, though the terms vary. The interest rate on the loan is typically fixed. Similar to your first mortgage, second mortgages will require closing costs, which can cost about 3 -6 % of the amount of the loan.

What happens if you default on a second mortgage?

Just beware: with a second mortgage, you are putting up your home as collateral for the loan, so if you default on this second mortgage, the bank can take your home. And this type of loan will reduce the equity you have in your home. So when you sell your home, you’ll have to pay off both your first and second mortgages with your sale proceeds.

Do you get a home equity loan if you pay down a mortgage?

If you get a home equity loan, you will receive the entire amount of the loan all at once, as opposed to a home equi ty line of credit, which works similar to a credit card, ...

What is the point of pulling out equity?

This is the whole point of pulling out your equity: To put that capital to work earning for you by finding a stable, safe investment earning more than the interest rate on your loan.

How does easy money affect housing prices?

Easy money policies have been in place since 2008, and their main effect has been to produce asset price inflation. Almost every asset class has been buoyed, including housing prices. Since 2013, housing prices have grown by roughly 5% or more per year, with 9.2% growth from December 2019 to December 2020.

What happens if you get a 30 year mortgage?

If you get a 30-year, fixed-rate mortgage, your mortgage payments over the lifetime of the loan actually get cheaper in terms of real dollars. As inflation continues over those 30 years, you’re making payments with dollars that are worth a little bit less each year. Inflation is a smart debtor’s best friend.

Why is cash out refinancing so appealing?

One of the biggest factors that makes a cash-out refi so appealing is that it’s currently cheap to borrow money. With mortgage rates being this low, there are many other places you could put your withdrawn equity that could earn you much more than you’d be paying in mortgage interest.

What is the main factor to be looking for when deploying this capital?

The main factor you want to be looking for when deploying this capital is low volatility. This certainly removes things like bitcoin and other cryptocurrencies or your brother-in-law’s startup, but also the stock market and public real estate investment trusts (REITs) from the list, given the volatility.

Can pulling out equity increase your net worth?

The short version of this is that when done wisely, pulling out your equity can provide an opportunity to increase your net worth and cash flow, though I recommend you weigh the risks and make sure you have a safe , reliable investment vehicle to put your equity into .

Is borrowing equity taxed?

Borrowing the equity in your house also provides several tax advantages. First, the equity you borrow is not taxed because it is borrowed. Second, the additional interest you pay on your mortgage is tax-deductible, making your effective borrowing cost even lower. • Having liquidity creates opportunity.

Why do people get home equity loans?

Home equity loans can provide access to large amounts of money and be a little easier to qualify for than other types of loans because you're putting up your home as collateral.

What is a home equity loan?

A home equity loan is a type of second mortgage that allows you to borrow against your home’s value, using your home as collateral. A home equity line of credit (HELOC) typically allows you to draw against an approved limit and comes with variable interest rates. Beware of red flags, like lenders who change the terms of the loan at ...

How long do you have to pay off a HELOC loan?

Repayment terms depend on the type of loan you get. You'll typically make fixed monthly payments on a lump-sum home equity loan until the loan is paid off. With a HELOC, you might be able to make small, interest-only payments for several years during your “draw period" before the larger, amortizing payments kick in. Draw periods might last 10 years or so. You’ll start making regular amortizing payments to pay off the debt after the draw period ends.

Why is a HELOC loan more flexible?

A HELOC is a more flexible option, because you always have control over your loan balance—and, by extension, your interest costs. You'll only pay interest on the amount you actually use from your pool of available money.

What are some alternatives to home equity loans?

Alternatives to home equity loans include cash-out refinancing, which replaces the mortgage, and a reverse mortgage, which depletes equity over time.

How much equity do you need to buy a house?

Lenders commonly look for, and base approval decisions on, a few factors. You'll most likely have to have at least 15% to 20% equity in your property. You should have secure employment—at least as much as possible—and a solid income record even if you've changed jobs occasionally. You should have a debt-to-income (DTI) ratio, also referred to as "housing expense ratio," of no more than 36%, although some lenders will consider DTI ratios of up to 50%.

How to get a loan estimate?

Apply with several lenders and compare their costs, including interest rates. You can get loan estimates from several different sources, including a local loan originator, an online or national broker, or your preferred bank or credit union.