Full Answer

How do you determine salvage value?

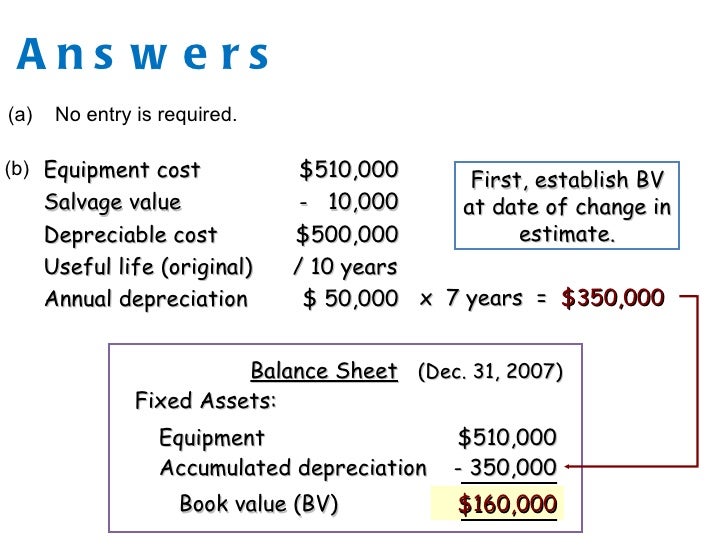

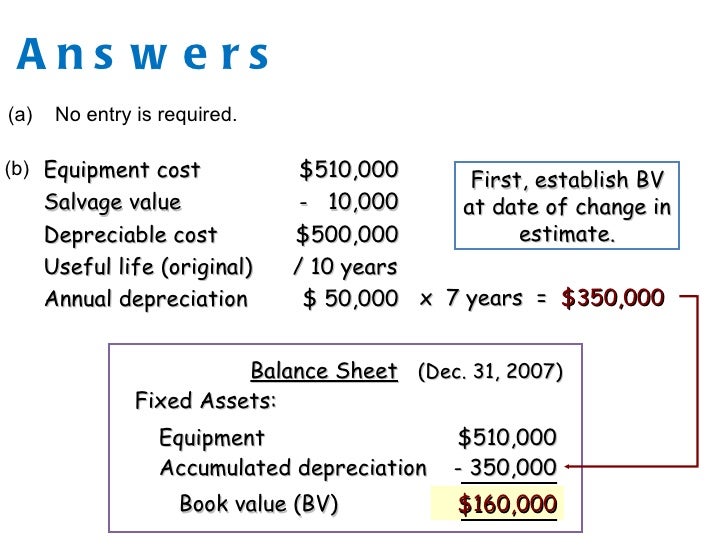

You can calculate salvage value by taking the original purchase cost of an asset and subtracting any accumulated depreciation over its lifetime. Use the following equation: Salvage Value = Basis Cost - Accumulated Depreciation, or S = P – (I x Y) wherein:

How to calculate salvage value?

- Salvage Value = $10,00,000 – ($80,000 * 10 )

- Salvage Value = $10,00,000 – $8,00,000

- Salvage Value = $2,00,000

What is the formula for salvage value?

after its effective life of usage is known as Salvage value. In other words, when depreciation during the effective life of the machine is deducted from Cost of machinery, we get the Salvage value. The formula for Salvage Value – S = P – (I * Y) Engineering machinery costing INR 100,000 has a useful life of 7 years.

How to calculate salvage value of an automobile?

What is Salvage Value?

- Determining the Salvage Value of an Asset. The Internal Revenue Service (IRS) requires companies to estimate a “reasonable” salvage value. ...

- Importance of Salvage Value. ...

- Using Salvage Value to Determine Depreciation. ...

- Download the Free Template. ...

- Real-World Example of Salvage Value Fraud. ...

- More Resources. ...

What does salvage value means?

Legal Definition of salvage value 1 : the value of damaged property. 2 : the actual or estimated value realized on the sale of a fixed asset at the end of its useful life. Note: Salvage value is used in calculating depreciation.

What does no salvage value mean?

Some assets are truly worthless when they're no longer of use to your business. If there's no resale market for your asset, it likely has a zero salvage value. You might have designed the asset to have no value at the end of its useful life.

How is salvage value calculated?

Salvage Value Formula Calculating the salvage value is a two-step process: The annual depreciation is multiplied by the number of years the asset was depreciated, resulting in total depreciation. The original purchase price is subtracted from the total depreciation expensed across the useful life.

Why is salvage value deducted?

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation.

Is salvage value good or bad?

Why it's Important? In the organization, salvage value is significant as it allows the companies to calculate the depreciation. For instance, Company A purchases machinery for $1 million, and its useful life is ten years. The company would expect some value for the machine after ten years, let's say $10,000.

What is an example of salvage value?

Salvage value is the amount for which the asset can be sold at the end of its useful life. 2 For example, if a construction company can sell an inoperable crane for parts at a price of $5,000, that is the crane's salvage value.

What is difference between salvage value and scrap value?

Salvage value is the amount that an asset is estimated to be worth at the end of its useful life. It is also known as scrap value or residual value, and is used when determining the annual depreciation expense of an asset.

Do you pay tax on salvage value?

Key Takeaways When a good is sold off, its selling price is the salvage value and this is called the before tax salvage value. The price at which a good is sold becomes an income on the statement and therefore, attracts tax.

Do you have to pay taxes on salvage value?

To allow a larger tax deduction for depreciation, you can use the 10 percent rule to calculate salvage value if the item has a useful life expectancy of three years or more. Subtract 10 percent of your cost basis from the salvage estimate.

Is salvage value the same as market value?

When valuing a company, there are several useful ways to estimate the worth of its actual assets. Book value refers to a company's net proceeds to shareholders if all of its assets were sold at market value. Salvage value is the value of assets sold after accounting for depreciation over its useful life.

What does salvage mean in insurance?

Salvage — (1) Property after it has been partially damaged by an insured peril such as a fire. (2) As a verb, to save endangered property and to protect damaged property from further loss.

How do you find depreciation without salvage value?

How do you calculate straight line depreciation? To calculate depreciation using a straight line basis, simply divide net price (purchase price less the salvage price) by the number of useful years of life the asset has.

What is difference between salvage value and scrap value?

Salvage value is the amount that an asset is estimated to be worth at the end of its useful life. It is also known as scrap value or residual value, and is used when determining the annual depreciation expense of an asset.

What is the difference between market value and salvage value?

Book value refers to a company's net proceeds to shareholders if all of its assets were sold at market value. Salvage value is the value of assets sold after accounting for depreciation over its useful life.

Determining the Salvage Value of an Asset

The Internal Revenue Service (IRS) requires companies to estimate a “reasonable” salvage value. The value depends on how long the company expects to use the asset and how hard the asset is used. For example, if a company sells an asset before the end of its useful life, a higher value can be justified.

Importance of Salvage Value

If the salvage value is set too high or too low, it can be harmful to a company.

Using Salvage Value to Determine Depreciation

The estimated salvage value is deducted from the cost of the asset to determine the total depreciable amount of an asset.

Download the Free Template

Enter your name and email in the form below and download the free salvage value and depreciation expense template now!

Salvage Value Template

Download the free Excel template now to advance your finance knowledge!

Real-World Example of Salvage Value Fraud

Waste Management, Inc. is a waste company founded in 1968 and was the largest waste management and environmental services company in 1980. Between 1992 and 1997, Waste Management, Inc. committed fraud several times. Among other fraudulent activities, the company:

More Resources

CFI is the official global provider of the Financial Modeling and Valuation Analyst (FMVA) Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career.

What is salvage value?

What is a Salvage Value (Scrap value)? Salvage value or Scrap Value is the estimated value of an asset after its useful life is over and therefore, cannot be used for its original purpose. For example, if the machinery of a company has a life of 5 years and at the end of 5 years, its value is only $5000, then $5000 is the salvage value.

Is salvage value the same as residual value?

There is confusion between salvage value, scrap value, and residual value. In accounting, they all are one and the same. To summarize, it is the value of an asset after its usefulness is over. Scrap value is an estimated figure. It can be calculated if we can determine the depreciation rate and the useful life.

What is salvage value?

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation.

How much does ABC depreciate?

This means that ABC will depreciate $90,000 of the asset cost over five years, leaving $10,000 of the cost remaining at the end of that time.

When will a loss be recorded?

When this happens, a loss will eventually be recorded when the assets are eventually dispositioned at the end of their useful lives. Auditors should examine salvage value levels as part of their year-end audit procedures relating to fixed assets, to see if they are reasonable.

Is salvage value discounted to present value?

Any proceeds from the eventual disposition of the asset would then be recorded as a gain. Salvage value is not discounted to its present value.

Is salvage value included in depreciation?

Thus, salvage value is used as a component of the depreciation calculation. If it is too difficult to determine a salvage value, or if the salvage value is expected to be minimal, then it is not necessary to include a salvage value in de preciation calculations. Instead, simply depreciate the entire cost of the fixed asset over its useful life.

Is salvage value fraud?

Fraudulent Use of Salvage Value. The salvage value concept can be used in a fraudulent manner to estimate a high salvage value for certain assets, which results in the under-reporting of depreciation and therefore of higher profits than would normally be the case.

What is salvage value?

Definition: Salvage value also called residual or scrap value is the estimated worth of an asset at the end of its useful life. In other words, salvage value is the price management believes it can sell an asset for after the asset is deemed unusable because of time, abuse, and obsolescence.

How long are company computers worthless?

Example. Some company assets are completely worthless after their useful life like computers. Company computers usually have a useful life of three to five years. After the useful life, these computers are obsolete and have no salvage value. They can’t be sold for anything.

How long does a car last?

Vehicles usually have a useful life of five to ten years. At the end of the vehicle’s useful life, the company can sell the car for a small amount of money or sell it to a junkyard for parts. Either way, the vehicle has value.

How to Calculate Salvage Value

There is no formula for calculating the salvage value of an asset. This is because resale values are always in flux, unique to every specific asset. It’s effectively what someone is willing to pay for the asset in its current condition—the variables behind this are too numerous to formulate.

Why is it Useful?

Salvage value serves two purposes. First, it’s used in estimating the depreciation schedule of an asset. Second, it’s part of enterprise asset management—specifically, end-of-life management.

The Problem With Salvage Value

Salvage value is, at best, an educated guess and, at worst, an unpredictability. Why? Because there’s no telling what something will be worth in the future based on the marketplace need.

Salvage Value as a Donation Metric

When donating (not selling) used assets such as electronics or automobiles, companies need to use salvage value to qualify the value of the asset for tax purposes. This amount is typically close to the fair market price someone might be willing to pay if the asset was for sale.

Salvage Value is an Assumption

Asset management—particularly depreciation—is a game of assumptions. Companies model the serviceable life and salvage value of an asset based on forward-looking predictions… which may or may not come to fruition.

Why is salvage value important?

As said above, the salvage value is important for businesses as they impact the size of a company’s depreciation expense. However, the companies just make their best estimates and not a definite number. We call it an estimate because one can only guess the real value of an asset after ten years.

What happens if you assume zero in depreciation?

If we assume the value to be zero, then there would be no chance of reduction in the depreciation amount. This, in turn, would mean no chances of inflating profit due to depreciation. The US Income Tax Regulations also ask taxpayers to assume the scrap value of the asset to be zero for calculating depreciation.

How did the company try to avoid depreciation?

The company tried to avoid depreciation by inflating the scrap value and increasing the useful life of assets. The company did this to meet earnings targets. In 1998, the company had to restate its earnings by $1.7 billion, the biggest restatement in history.

What is salvage value?

Salvage Value is the amount that a company expects to get at the end of the useful life of an asset. There are various terms for salvage value such as residual value, scrap value, and disposal value.

How long does a car last in a junkyard?

After its useful life or after fifteen years, the vehicle should end up in a junkyard. The salvage value of the vehicle would be the price that the junkyard or a recycler might pay for it. Table of Contents.

Can you take salvage value in the consideration?

On the other hand, accountants and income tax regulations usually do not to take salvage value in the consideration. Or, take the scrap value as zero.

Who is Sanjay Borad?

Sanjay Borad is the founder & CEO of eFinanceManagement. He is passionate about keeping and making things simple and easy. Running this blog since 2009 and trying to explain "Financial Management Concepts in Layman's Terms".

What happens if a car is vandalized?

Vandalism - If criminals damage a car to a significant degree, the insurance company will declare it a total loss, and it will be branded with a salvage title.

What is salvage title?

What is a Salvage Title? If, while shopping, you saw the term “salvage title”, you may wonder what does salvage title mean? A salvage title vehicle has suffered major damage, and an insurance company declared that the cost to fix it was more expensive than its current value. When they do this, they call the vehicle a “total loss.”.

What is a total loss car?

Theft - A car that is stolen and lost for a number of days may be re-branded as salvage. Hail - Cars damaged by hail (which could be only superficial) are often called a total loss and branded as salvage title cars. Vandalism - If criminals damage a car to a significant degree, the insurance company will declare it a total loss, ...

What to do if your car is totaled?

Have a good mechanic do a full inspection of the vehicle to know what you are getting into and how extensive the damage is. Ask about the type of damage the car suffered. If the vehicle was totaled due to hail, fire, or flood, mechanically and electrically, it could run fine and just requires some cosmetic fixes.

What percentage of damage is considered a total loss?

In some states, if the damage is 75% of the car’s value, then it must be declared a total loss. In other states, that percentage might be relaxed or higher. Some of the types of damage that deem a car worthy of a salvage title are: Flood - If the car has been in water for more than two days, an insurance company will mark it as a total loss/salvage ...

Can you replace a salvage title?

No. Once a car has been branded with a salvage title, that will follow it for the rest of the car’s useful life. However, there is one exception. If someone buys a salvage title car and fixes it up restoring it to perfect working condition, they can apply to have it rebranded a “rebuilt title.”. That will then replace the salvage title, ...

Is it cheaper to buy a used car with a salvage title?

If you are searching for a used car that will run great and has no cosmetic flaws, a salvage title car is probably not your best bet. However, if you are handy with tools and like to fix automobiles, it might be cheaper to purchase a car with a salvage title. It depends on your level of commitment and whether you are willing to deal with ...

Determining The Salvage Value of An Asset

Using Salvage Value to Determine Depreciation

- The estimated salvage value is deducted from the cost of the asset to determine the total depreciable amount of an asset. For example, Company A purchases a computer for $1,000. The company estimates that the computer’s useful life is 4 years. This means that the computer will be used by Company A for 4 years and then sold afterward. The company al...

Download The Free Template

- Enter your name and email in the form below and download the free salvage value and depreciation expense template now!

Real-World Example of Salvage Value Fraud

- Waste Management, Inc. is a waste company founded in 1968 and was the largest waste management and environmental services company in 1980. Between 1992 and 1997, Waste Management, Inc. committed fraud several times. Among other fraudulent activities, the company: 1. Avoided depreciation expenses by inflating salvage values and extending the usefu…

More Resources

- Thank you for reading CFI’s guide to Salvage Value. To keep learning and advancing your career as a financial analyst, these additional CFI resources will be a help in your journey: 1. Depreciation Schedule 2. Accumulated Depreciation 3. Projecting Income Statement Line Items 4. Income Statement Template