The cash receipts journal format is usually multi-column. The information in the journal is taken from source documents such as remittances, cash receipts vouchers and checks, and typically includes the following: Transaction date – the date the cash is received. Click to see full answer.

Full Answer

What information is recorded in the account debited column of CRJ?

Feb 07, 2020 · Information Listed in the Cash Receipts Journal The cash receipts journal format is usually multi-column. The information in the journal is taken from source documents such as remittances, cash receipts vouchers and checks, and typically includes the following: Transaction date – the date the cash is received.

What information is recorded in the cash receipts journal?

Jan 03, 2022 · Cost of goods sold/inventory: In cash receipt journal, this column is used to record the cost of merchandise sold for cash. This column is also found in sales journal where it is used to enter the cost of goods sold on credit. The total of this column is debited to cost of goods sold account and credited to inventory account in general ledger.

Which column is used to record the receipt of cash?

Nov 19, 2021 · The cash receipts journal is a specialized accounting journal and is an important part of the general journal. This journal is used particularly to record receipt of cash from all sources. A business can receive cash from many sources, and the most important include: Capital Investment. Cash Sales. Collection on Customer Accounts.

What is the other accounts column in the cash payments journal?

Jun 22, 2020 · A cash receipts journal is used to record all cash receipts of the business. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received. An additional posting must be made to balancing the transaction.

What is recorded in the cash receipts journal?

A cash receipts journal is used by companies to record all cash received from any source. This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets. Below you can see an example of a typical cash receipts journal.Nov 19, 2021

What is recorded in the receipts column?

Every time a cash sale is made, the amount received is entered in this sales column. Other accounts: This column is used to record the receipt of cash from sources other than cash sales or credit customers. Examples include the receipt of cash for interest, rent and the sale of old assets etc.Jan 3, 2022

What information should be included in a cash receipt?

A cash receipt contains the following information:The date of the transaction.A unique number that identifies the document.The name of the payer.The amount of cash received.The payment method (such as by cash or check)The signature of the receiving person.Mar 9, 2022

What information is recorded in the name of payee column of the cash payments journal?

If the payment is made by a check, this column is used to enter the check number belonging to the payment. Payee column: The payee name (the person or entity to whom the payment is being made) is entered in this column.Oct 21, 2021

How do you record cash receipts?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.Oct 10, 2019

What transaction is recorded first in the journal?

Journalizing in accounting is the system by which all business transactions are recorded for your financial records. A business transaction is first recorded in a journal, also called a Book of Original Entry.Dec 18, 2019

How do you record cash entry journal entries?

How To Account for Cash ReceiptsMake the sale: Make the sale of Product A for $50 paid in cash. ... Make the entry in the cash receipts journal: Make the cash receipt accounting entries if you have sold $50 of Product A for cash in the cash receipts journal:Make the equal and opposite entry in the sales journal:More items...

What is recorded in a purchase journal?

A purchases journal is a subsidiary-level journal in which is stored information about purchasing transactions. This journal is most commonly found in a manual accounting system, where it is necessary to keep high-volume purchasing transactions from overwhelming the general ledger.May 14, 2017

What is recorded in the general journal?

A general journal is the first place where data is recorded, and every page in the item features dividing columns for dates, serial numbers, as well as debit or credit records. Some organizations keep specialized journals, such as purchase journals or sales journals, that only record specific types of transactions.

What is recorded in the Debtors journal?

Debtors Journal (DJ) This journal records transactions that the business did not receive cash payment for goods sold i.e. goods are sold on credit. Although no cash is received a debtor has been created and this must be recorded immediately. The source document for debtor's journal is called a duplicate invoice.

Where do we record the transactions that we have identified in the accounting process?

Where do we record the transaction that we have identified in the accounting process Brainly? Answer: Journal entries. The most basic method used to record a transaction is the journal entry, where the accountant manually enters the account numbers and debits and credits for each individual transaction.Dec 4, 2021

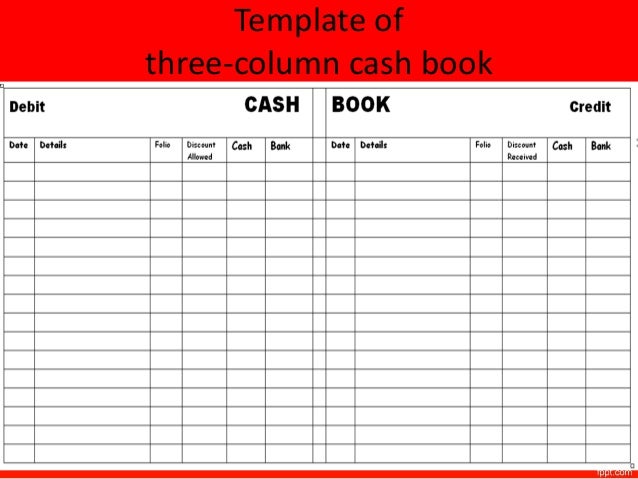

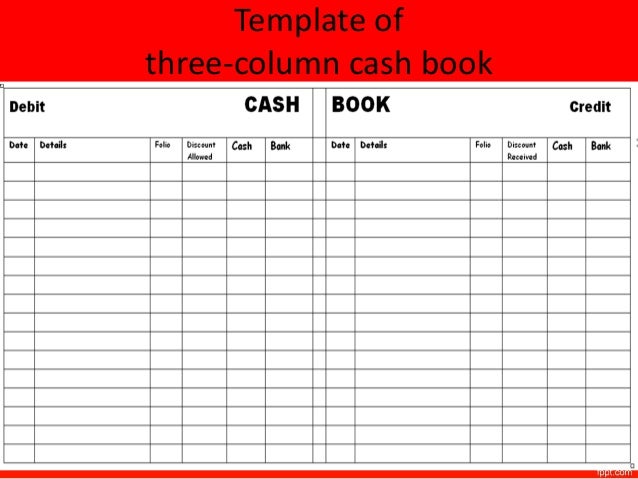

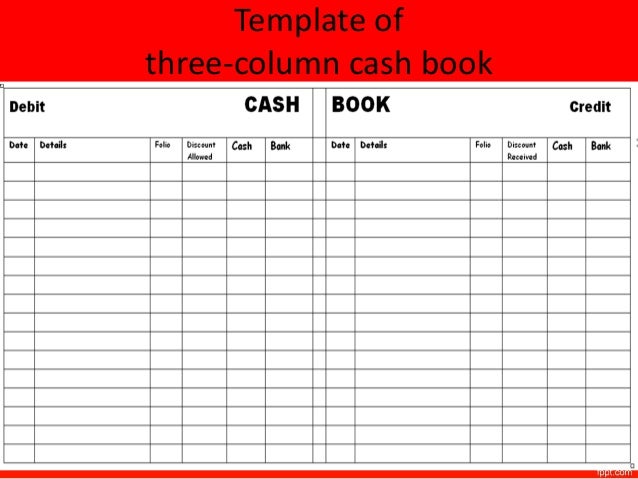

What is discount allowed column?

By using a discounts allowed column, the business can use the cash receipts journal to record the invoiced amount, the discount allowed, and the cash receipt. In this way, the line item postings to the accounts receivable ledger are for the full invoiced amount, and only the discounts allowed column total is posted to the general ledger.

Why should a cash receipt journal have an other column?

The cash receipts journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. It is important to understand that if any cash is received, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash receipts journal.

Is a cash receipt a line item?

Each cash receipt is recorded as a line item in the cash receipts journal as shown in the example below. In this example, it is assumed that receipts are cash collections from customers who have outstanding amounts for credit sales, and receipts from cash sales.

Is a cash receipt journal a double entry journal?

The cash receipt journal is a book of prime entry and the entries in the journal are not part of the double entry posting.

Who is Michael Brown?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping . He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

What is cash receipt journal column?

At the end of each accounting period (usually monthly), the cash receipts journal column totals are used to update the general ledger accounts. As the business is using subsidiary ledger control accounts in the general ledger, the postings are part of the double entry bookkeeping system. Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Cash, checks, debit cards, credit cards and wire transfers are treated as cash sales.

Where to record cash payment?

You record the cash payment in the cash receipts journal, then enter the cash transaction in the sales journal or in the customer’s accounts receivable ledger account. In a cash receipts journal, a debit is posted to cash in the amount of money received. Therefore, a credit is needed for one or more other accounts that are affected by collecting ...

How are the sundry accounts entered into the general ledger?

The Sundry Accounts are entered into the General Ledger using the date that the transaction took place. On a regular (usually daily) basis, the line items in the cash receipts journal are used to update the subsidiary ledgers.

What is discount allowed column?

By using a discounts allowed column, the business can use the cash receipts journal to record the invoiced amount, the discount allowed, and the cash receipt. In this way, the line item postings to the accounts receivable ledger are for the full invoiced amount, and only the discounts allowed column total is posted to the general ledger.

What is a journal in accounting?

In accounting, journals are used to record similar activities and to keep transactions organized. One of the journals is a cash receipts journal , a record of all of the cash that a business takes in. It is reserved specifically for activities that involve receiving cash.

Why do accounting transactions have to be in balance?

Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed.

Do cash receipts have an other column?

The cash receipts journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. The entries in the cash payments journal are recorded and posted in a similar manner to those in the cash receipts journal.