When will I receive my 1098 statement for my mortgage?

What information is on a 1098?

- Your name and address

- Your Social Security number

- The value of what you paid or donated

- Data on the other party involved in the transaction (for example, your mortgage or student loan lender)

Where do I enter my 1098 mortgage interest statement?

To enter the information from Form 1098 Mortgage Interest Statement into the TaxAct program:

- From within your TaxAct return ( Online or Desktop), click on the Federal tab. ...

- Click Itemized or Standard Deductions to expand the category and then click Interest Expenses

- On the screen Itemized Deductions - Form 1098 Mortgage Interest choose whether or not the mortgage interest was reported on Form 1098

How to get my 1098 mortgage interest statement?

How Do I Get a 1098 Mortgage Interest Statement for the IRS?

- Minimum Reporting Threshold. Your lender is only required to prepare a Form 1098 if your mortgage interest exceeds $600 for the calendar year.

- Deadline for Filing. If required to prepare a Form 1098, your lender should provide you a copy of the Form 1098 by January 31 of the following year.

- No Form 1098 Received. ...

- Claiming Your Deduction. ...

Will my mortgage company send me a 1098?

Your lender should send both you and the IRS a Form 1098 to document how much mortgage interest you paid during the year.

What is a 1098 statement used for?

Use Form 1098, Mortgage Interest Statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or business from an individual, including a sole proprietor. Report only interest on a mortgage, defined later.

Do I have to file a 1098 with my taxes?

No, you don't have to actually file Form 1098—that is, submit it with your tax return. You only have to indicate the amount of interest reported by the form. And you generally only report this interest if you are itemizing deductions on your tax return.

How do I get my 1098 mortgage interest statement?

To download a copy, log into your Freedom Mortgage account. Select “Statements” from the right-hand menu, look for your 2020 statement, and click on the icon to get your copy. If you have any questions about your Year End Statement, please call our customer care team at (855) 690-5900.

How does a 1098 affect your taxes?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

Does a 1098 increase refund?

Taxable scholarship income can be reported on 1098-T when the box 5 value exceeds the box 1 value. This could reduce your refund.

Do you get money back from mortgage interest?

Mortgage Interest Deduction All interest you pay on your home's mortgage is fully deductible on your tax return. (The exception is for loans above $1 million; the deduction on these is capped.) In other words, $4,000 in annual mortgage interest reduces your taxable income by that $4,000 amount.

What happens if I don't file my 1098 mortgage interest statement?

It is generally recommended to file as soon as possible if you have missed the deadline to file form 1098 as the penalty increase with time. The penalty is: If you file within 30 days of the deadline the penalty is $30 per 1098 form with a maximum of $250,000 per year or $75,000 for small businesses.

Why did I get a 1098 from my mortgage company?

Mortgage lenders issue a 1098 Mortgage Interest Statement to let you know exactly how much you paid in interest, points, or private mortgage insurance for the year. The form does not always look like a tax form, but will say Form 1098 somewhere on it. Your 1098 may be included in your January statement from the lender.

What happens if I don't get a 1098?

Student Loan Servicer Even if you didn't receive a 1098-E from your servicer, you can download your 1098-E from your loan servicer's website. If you are unsure who your loan servicer is, log in to StudentAid.gov or call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243; TTY 1-800-730-8913).

How much does a 1098 mortgage help with taxes?

If you pay at least $600 in interest on a qualified student loan per year, your lender is required to send this form out to you. You can potentially deduct up to $2,500 from your taxable income if you qualify for the student loan interest deduction.

Why does my 1098-T lower my refund?

Grants and /or scholarships are taxable income to the extent that they exceed qualified educational expenses to include tuition, fees, books, and course related materials. So, taxable income may reduce your refund.

What happens if I don't file my 1098 mortgage interest statement?

It is generally recommended to file as soon as possible if you have missed the deadline to file form 1098 as the penalty increase with time. The penalty is: If you file within 30 days of the deadline the penalty is $30 per 1098 form with a maximum of $250,000 per year or $75,000 for small businesses.

Why does my 1098-T make me owe money?

A: The Form 1098-T is a statement that colleges and universities are required to issue to certain students. It provides the total dollar amount paid by the student for what is referred to as qualified tuition and related expenses (or “QTRE”) in a single tax year.

Where do I enter Form 1098 on my tax return?

You might be able to deduct the Form 1098 amounts if they meet the guidelines for that amount. Put Box 1, deductible mortgage interest, and Box 6, points, into your Schedule A (Form 1040), Line 8a.

Do I need mortgage papers to file taxes?

1098 — For most homeowners, mortgage interest is tax-deductible, and this document will tell you how much you paid last year. Your lender is required to send you one of these forms if you paid at least $600 interest.

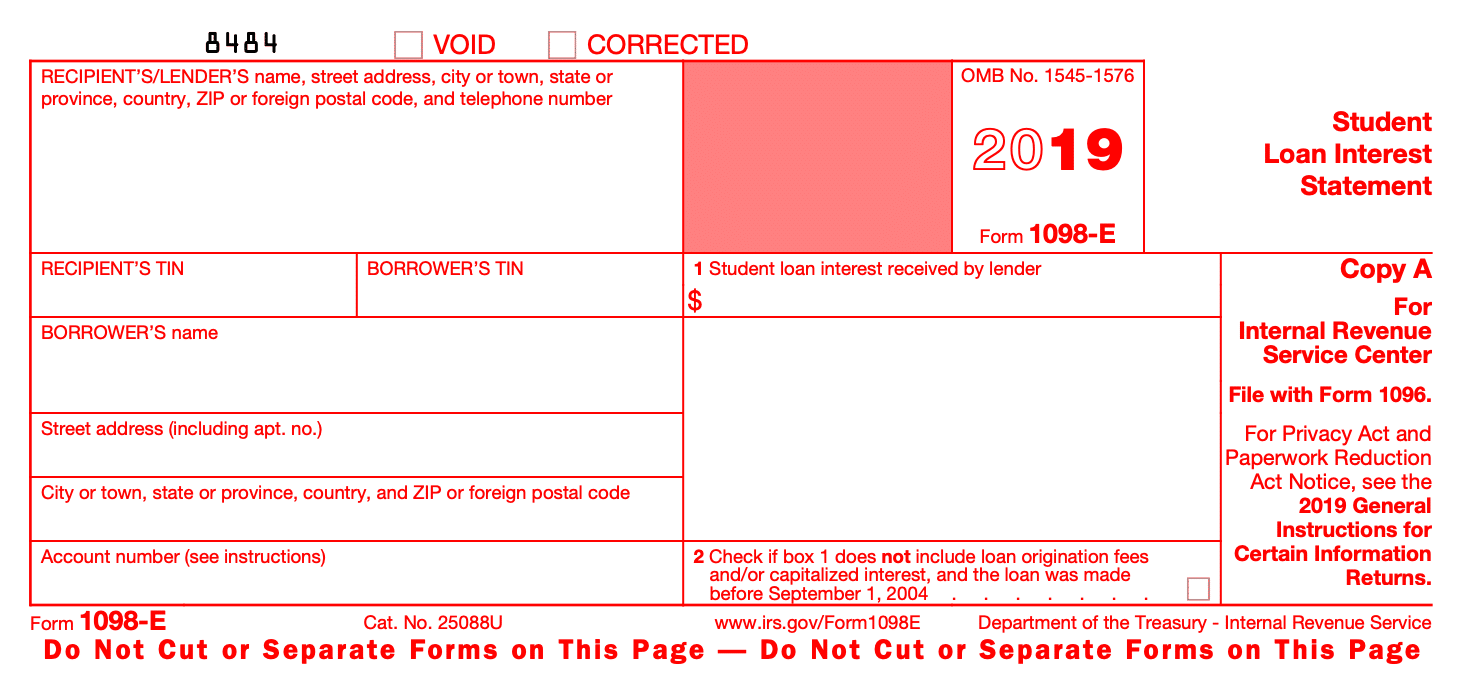

What is a 1098-E?

1098-E Form. Paying for college is expensive, but luckily you can get a tax break on the interest you’ll be paying for what may seem like the rest of your life. Each year, from each of your student loan servicers, you’ll receive a 1098-E detailing how much interest you paid that year.

When do you send a 1098-T to a dependent?

If you are or one of your dependents is currently in school, the school will send a 1098-T at the end of the year detailing all fees that were paid to it for tuition and other necessary educational expenses. Use this form to calculate education-related tax deductions and credits, such as the tuition and fees deduction, ...

Does 1098T show up on taxes?

The amounts on the form encompass all money you paid to the school, even if you paid in advance – the payment appears on the tax form for the year in which it was actually paid. For example, if you pay your spring semester tuition in the winter, it will show up on the prior year’s 1098-T. These amounts include any money used from loans to pay ...

Form 1098 Explained in Less Than 5 Minutes

Jacqueline DeMarco has 7+ years of experience researching and writing dozens of articles. She covers investing, taxes, credit cards and scores, loans, banking, budgeting, and more for The Balance.

Definition and Examples of Form 1098

Form 1098 reports to the IRS mortgage interest that a lender or business has received throughout the year. It's used when interest paid for the year totals $600 or more. 1 You may receive the interest from an individual or sole proprietor in the course of running your trade or business, or you may have paid the interest as the consumer.

Who Uses Form 1098?

Doug Jackson, a Certified Financial Planner (CFP) and Enrolled Agent with the IRS, explained to The Balance via email that the 1098 Form is used by lenders to report mortgage interest payments, as well as mortgage insurance premiums, points, and more to the IRS. The information is reported directly to the IRS and to taxpayers.

Types of Form 1098

There are a few types of Form 1098. It can be helpful to understand the differences between them when you prepare your tax return.

Where To Get Form 1098

You’ll likely get Form 1098 in the mail along with your other tax forms, Jackson said. These forms are sent out by mortgage lenders usually well in advance of the deadline for when taxes need to be filed.

Can Form 1098 Be E-Filed?

Yes, businesses and lenders can e-file Form 1098. The company must have access to software that generates a file according to the specifications in IRS Publication 1220. The IRS doesn’t provide a fill-in form option for businesses. 7

How To File Form 1098

You should submit any Forms 1098 you receive when you file your annual tax returns. Whether you file your taxes yourself with online software or work with a tax advisor or accountant, Form 1098 is easy to file. Just plug in some numbers and double-check it for accuracy, Jackson said.

What is a 1098 form?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

What is a 1098 mortgage statement?

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders must file a separate Form 1098 for each mortgage you hold.

What information is on a tax return?

The form reports: The lender's name, address, phone number, and taxpayer identification number. The borrower's name, address, account number, and taxpayer identification number.

When do you have to send 1098-C?

The IRS requires most of these forms (excluding 1098-C) to be completed and sent to taxpayers by February 1 of each year so that taxpayers can use the information to complete their tax returns.

Can you claim a donation as a standard deduction?

This deduction usually falls under itemized deductions, which you cannot claim if you take the standard deduction. You must include this form with your tax return if you claim more than $500 as a deduction for the donation.

What To Do With Form 1098: Mortgage Interest Statement

In addition to the money you paid in mortgage interest, the form is also used to report mortgage insurance premiums and points to the IRS and taxpayers. If you refinanced and had more than one mortgage during the course of the calendar year, you’ll receive a Form 1098 from each lender.

Mortgage Interest on Rental Properties

Investors with rental properties can deduct mortgage interest as part of the expenses associated with renting out the property. You’ll file this amount on Schedule E of your Form 1040, which is used to report any income and losses from your rental properties.

The Bottom Line

If you are a homeowner who is claiming itemized deductions, you don’t need to attach a Form 1098 to your tax return – the IRS already has this information. If you do your own taxes, input Box 1, deductible mortgage interest, into line 8a of your Form 1040.