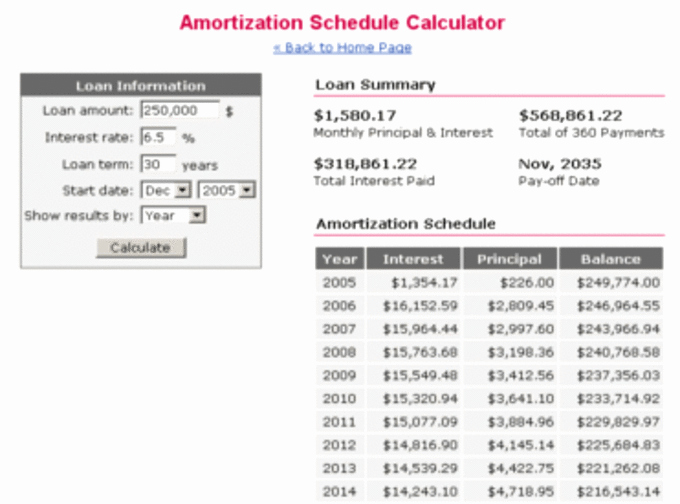

30 Year Amortization Schedule is a loan calculator to calculate monthly payment for your fixed interest rate 30-year loan.

What is an amortization schedule and how does it work?

Here are three ways to ensure that you have enough cash flowing through your business:

- Develop a budgeting system. It doesn’t matter whether you use Excel spreadsheets or paper accounting systems; both methods work well. ...

- Keep tabs on your monthly expenditures. Make a note of every expense — everything from utilities to advertising costs. ...

- Set aside extra cash for emergencies. ...

How to create an amortization schedule?

Use the concept of amortization to make smart choices about your finances.

- Whenever possible, make extra payments to reduce the principal amount of your loan faster. ...

- Consider the interest rate on the debts you have outstanding. ...

- You can find loan amortization calculators on the Internet. ...

- Use the $10,000 figure and calculate your amortization over the remaining term of the loan. ...

What is the current interest rate for a 30 year mortgage?

The average rate for a 30-year fixed-rate mortgage is 2.90 percent , climbing 1 basis point over the previous week. A month ago, the average interest rate on a 30-year loan was more favorable, at 2.86 percent. Today's is less than the average rate of 2019 by 123 basis points, meaning that now is an excellent time to get a 30-year mortgage.

What are the average current 30 year fixed mortgage rates?

The average interest rate for a standard 30-year fixed mortgage is 4.20%, which is a growth of 27 basis points as seven days ago. (A basis point is equivalent to 0.01%.) The most common loan term is a 30-year fixed mortgage.

How do you calculate a 30-year amortization schedule?

The monthly mortgage payment formula number of payments over the loan's lifetime Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30x12=360).

How does 30-year amortization work?

Anyone who has a 30-year mortgage will have a home loan amortization schedule that includes a breakdown of all 360 payments (12 payments a year for 30 years) needed to pay off their mortgage. If you have a 15-year mortgage, you'll see 180 payments.

How do you calculate an amortization schedule?

It's relatively easy to produce a loan amortization schedule if you know what the monthly payment on the loan is. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan. Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest.

What does 10 year term 30-year amortization mean?

It provides you the security of an interest rate and a monthly payment that is fixed for the first 10 years; then, makes available the option of paying the outstanding balance in full or elect to amortize the remaining balance over the final 20 years at our current 30-year fixed rate, but no more than 3% above your ...

What is the difference between 25 and 30-year amortization?

Improves purchasing power: A 30-year amortization improves purchasing power by approximately 16.6% versus a 25 year amortization. If it means getting into the right house, it could very well be worth it.

What does an amortization schedule tell you?

An amortization table can show you how your payment breaks down to principal paid and interest paid, and will also keep track of how much principal you have left to pay. Amortization tables do not typically show additional charges you pay on your loan, other than interest.

How can I pay off my mortgage early with amortization schedule?

One of the simplest ways to pay a mortgage off early is to use your amortization schedule as a guide and send you regular monthly payment, along with a check for the principal portion of the next month's payment. Using this method cuts the term of a 30-year mortgage in half.

What is the difference between mortgage and amortization?

The mortgage term is the length of time that the mortgage agreement at your agreed interest rate is in effect. The amortization period is the length of time it will take to fully pay off the amount of the mortgage loan.

What happens if I pay 2 extra mortgage payments a year?

Making additional principal payments will shorten the length of your mortgage term and allow you to build equity faster. Because your balance is being paid down faster, you'll have fewer total payments to make, in-turn leading to more savings.

Can you pay a 30-year mortgage in 15 years?

There are a few ways to pay off a mortgage sooner than the 30-year term. Options to pay off your mortgage faster include: Pay extra each month. Bi-weekly payments instead of monthly payments.

What is an example of amortization?

First, amortization is used in the process of paying off debt through regular principal and interest payments over time. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments.

What is the best amortization period?

The most common amortization is 25 years. If you have at least a 20% down payment, however, you can go higher—up to 30 years, and sometimes longer. Shorter amortizations are also available. Their benefit is helping you accumulate home equity faster.

Can you pay off an amortized loan early?

Paying off an amortizing loan early can save you from having to pay future interest. However, some lenders include an early payoff penalty in the loan contract since an early payoff will cause the lender to lose out on interest.

How can I pay off my 10 year mortgage in 5 years?

Five ways to pay off your mortgage earlyRefinance to a shorter term. ... Make extra principal payments. ... Make one extra mortgage payment per year (consider bi-weekly payments) ... Recast your mortgage instead of refinancing. ... Reduce your balance with a lump-sum payment.

Is it better to have a 25 or 30-year mortgage?

A 25-year amortization makes the most sense when you want to save on interest and get the most competitive interest rate. You'll save on interest with a 25-year amortization because you're paying off your mortgage in 25 years instead of 30 years.

Why is it better to get a 30-year mortgage?

Because a 30-year mortgage has a longer term, your monthly payments will be lower and your interest rate on the loan will be higher. So, over a 30-year term you'll pay less money each month, but you'll also make payments for twice as long and give the bank thousands more in interest.

What are the advantages of a 30-year mortgage?

Advantages of a 30-Year Mortgage Enjoy lower, more affordable monthly payments. Free-up cash for savings, retirement, and other needs and expenses. Still qualify for higher loan amounts. Pay extra each month (when possible) towards the principle balance thus reducing the effective term of the loan.

What are the benefits of amortized loan?

One of the main good points about amortized loan setups is that they offer a clear, set monthly payment to the borrower. The amortized loans are also often easier to track, since the payment amount for each month is a given, where irregular payments could cause a lot of confusion.

How could you pay off your 30 year mortgage quicker?

Here are some ways you can pay off your mortgage faster:Refinance your mortgage. ... Make extra mortgage payments. ... Make one extra mortgage payment each year. ... Round up your mortgage payments. ... Try the dollar-a-month plan. ... Use unexpected income. ... Benefits of paying mortgage off early.

Which type of amortization plan is most commonly used?

1. Straight line. The straight-line amortization, also known as linear amortization, is where the total interest amount is distributed equally over the life of a loan. It is a commonly used method in accounting due to its simplicity.

What is amortization schedule?

What Is an Amortization Schedule? An amortization schedule is a complete table of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the loan is paid off at the end of its term. Each periodic payment is the same amount in total for each period.

How Do You Calculate a Loan Amortization Schedule?

Calculating a loan amortization schedule is as simple as entering the principal, interest rate, and loan term into a loan amortization calculator. But you can also calculate it by hand if you know the rate on the loan, the principal amount borrowed, and the loan term.

How to calculate the next month's interest and principal payments?

To calculate the next month’s interest and principal payments, subtract the principal payment made in month one ($329.21) from the loan balance ($250,000) to get the new loan balance ($249,670.79), and then repeat the steps above to calculate which portion of the second payment is allocated to interest and which to principal. You can repeat these steps until you have created an amortization schedule for the full life of the loan.

How to calculate monthly payment?

How to calculate the total monthly payment 1 i = monthly interest rate. You'll need to divide your annual interest rate by 12. For example, if your annual interest rate is 6%, your monthly interest rate will be .005 (.06 annual interest rate / 12 months). 2 n = number of payments over the loan’s lifetime. Multiply the number of years in your loan term by 12. For example, a 30-year mortgage loan would have 360 payments (30 years x 12 months).

What is the majority of each payment in a mortgage schedule?

However, early in the schedule, the majority of each payment is what is owed in interest; later in the schedule, the majority of each payment covers the loan's principal . The last line of the schedule shows the borrower’s total interest and principal payments for the entire loan term.

How to calculate the number of payments over a loan?

n = number of payments over the loan’s lifetime. Multiply the number of years in your loan term by 12. For example, a 30-year mortgage loan would have 360 payments (30 years x 12 months).

What happens if you have a shorter amortization period?

If a borrower chooses a shorter amortization period for their mortgage —for example, 15 years—they will save considerably on interest over the life of the loan, and they will own the house sooner. Also, interest rates on shorter-term loans are often at a discount compared to longer-term loans.

What is a 30 year mortgage?

A 30-year mortgage comes with a locked interest rate for the entire life of the loan. Because the rate stays the same, expect your monthly payments to be fixed for 30 years. You can obtain 30-year fixed-rate loans from government-sponsored lenders, private mortgage companies, banks, and credit unions.

How much of the mortgage market is 30 year fixed rate?

In a comprehensive report conducted by the Urban Institute, 30-year fixed rate loans accounted for 77 percent of new mortgage originations in April 2020. The chart below illustrates how 30-year mortgages take up most of the market share from 2000 to April 2020. The data is based on the Urban Institute’s Housing Finance at a Glance: A Monthly Chartbook June 2020.

What is a conventional loan?

A mortgage is a called a conventional loan when it is not federally sponsored by the government. These are offered by private lenders such as mortgage companies, banks, and credit unions. To be eligible for a conventional loan, you must have a credit score of 650 and above. That said, this option is usually obtained by borrowers with high credit rating, stable funds, and a large income.

How to manage mortgage payments?

Managing Your Mortgage Payments 1 Principal – This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments. 2 Interest – This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

What is front end ratio?

Front-end ratio – The percentage of your income that goes toward housing expenses such as mortgage payments, property taxes, insurance, and homeowner’s association fees

Why is it better to take a shorter mortgage?

If you can afford higher payments, it’s beneficial to take a shorter term. Shorter loans come with lower rates sans the extra years of interest charges. Paying your mortgage faster also means you gain ownership of your home sooner.

How much is a 20 year mortgage?

The 20-year fixed mortgage has a monthly payment of $1,586.78, which is $328.70 more expensive. Likewise, the 15-year fixed mortgage has a higher payment of $1,916.95, which is $658.87 more costly than the 30-year fixed term. Depending on your finances, it’s good to take a shorter loan with payments you can afford.

What is amortization schedule?

What exactly is an amortization schedule? It’s a document that covers the life of the loan and lists every single payment, breaking down principal and interest. The principal is the money that you originally agreed to pay back, and interest is the cost of borrowing the principal.

How many monthly payments are there for a 30 year loan?

Payment number: For a 30-year loan, there are 360 monthly payments. The first column lists the order of payments chronologically.

What is the loan to value ratio?

Loan-to-value ratio: The loan-to-value ratio (LTV ratio) on the amortization schedule reflects the outstanding loan balance divided by the purchase price. It decreases with every payment.

What is the percentage of interest on a 30 year loan?

People need to know it's not 4.125% interest as the example shows. The actual percentage on that for a 30 year loan is more than 74%. For a 15 year loan, it would be over 34%.

When can I cancel my mortgage insurance?

You can cancel it when your principal balance reaches 80% of your home’s original value.

Can an adjustable rate mortgage go up?

With an adjustable-rate mortgage (ARM), your interest rate can go up or down periodically. Payment amount: With a fixed-rate mortgage, the payment amount also remains the same. Principal: This is where things get interesting!

Can you adjust the interest rate when shopping for a loan?

You can use that tool and adjust the Interest Rate when you're shopping for loans.