What is an NOC letter?

What happens in the absence of an NOC letter?

About this website

What is a NOC payment?

An ACH Payment Notification of Change or NOC is provided by the ACH Network. The purpose of a NOC to notify you that something about your customer's bank account has changed. For example, if your customer's bank routing number has changed, you may receive a NOC.

What is a NOC report?

What is a Notification of Change (NOC)? Notifications of Change (NOCs)— are updates from the consumer's bank informing us that information on a bank account has changed.

Why would an ACH be returned?

What Causes ACH Returns? ACH returns (sometimes referred to as ACH rejects) are initiated when the transaction cannot process as intended. Because ACH transactions do not process in real-time like a credit or debit card authorization, they can be returned or rejected after the transaction is assumed complete.

What is an ACH notice?

An ACH is an electronic fund transfer made between banks and credit unions across what is called the Automated Clearing House network. ACH is used for all kinds of fund transfer transactions, including direct deposit of paychecks and monthly debits for routine payments.

What is the purpose of a NOC?

A network operations center (NOC) is a centralized place from which enterprise information technology (IT) administrators -- either internal or third party -- supervise, monitor and maintain a telecommunications network.

How do you set up NOC?

The 4 Key Components of a NOC Business AnalysisGather Your Support Requirements (and Those of Your Customers) ... Determine the Service Levels Necessary for Support (SLOs) ... Determine the Metrics the NOC Will Need to Measure. ... Determine the Total Cost of Ownership (TCO)

How long can a bank hold an ACH deposit?

Deposit holds typically range from 2-7 business days, depending on the reason for the hold.

Can a bank reverse an ACH payment?

ACH Reversal Requirements A reversal can only be processed if an entry or file was processed in error. The reversing entry must be transmitted to the bank within five banking days after the settlement date of the erroneous file. If it is past the five banking-day time frame, a reversal cannot be processed.

How long does it take for a ACH payment to clear?

ACH payments can take several days to process — typically between three to five business days.

Do all banks allow ACH transfers?

Which banks allow ACH transfers? All banks in the US can use ACH, as all that's needed to receive an ACH transfer is a valid bank account and routing number. Additionally, payment processors like Square, PayPal, and Stripe also use ACH.

What is an example of an ACH payment?

ACH Processing Examples: Direct deposit from an employer (your paycheck) Paying bills with a bank account. Transferring funds from one bank account to another (Venmo, PayPal, etc.) Sending a payment to the IRS online.

Is Zelle an ACH transfer?

Zelle uses the Automated Clearing House (ACH) payments system to speed payments between U.S. bank accounts. While you could initiate an ACH payment to a friend from your bank account, that transfer could take three days to process. With Zelle, your money arrives in minutes.

What is NOC from employer?

NO OBJECTION CERTIFICATE (NOC) FROM EMPLOYER NOC from the present employer of the applicant. (strike off whichever is not applicable): An application in r/o Mr./Miss/Mrs./Dr.

What is a restaurant NOC?

NOC stands for Not Otherwise Classified.

How do I get a college NOC?

To get No Objection Certificate from the college office, you have to write an application or request letter to issue NOC mentioning the reason for which you need that documents. Normally, NOC is required for admissions, events, jobs and travel purposes.

What is NOC in real estate?

A no objection certificate from society may be required by the bank during the purchase of a property. The government may ask for NOCs as part of legal documentation. To obtain a NOC from the society, you must write a letter requesting the society owner or secretary to issue the no objection letter.

How do I write a request letter to the bank for issuing the NOC for a loan?

In order to write a request letter to the bank for issuing the NOC for a loan, you will have to mention the reason for taking the loan. Mention the...

Within how many days can I get a NOC from the bank to close the loan?

Generally, it takes three to four days for the bank to revert back with the NOC and other clearance details of your loan account.

How long is a NOC valid for?

A NOC is valid for six months. After it is expired, you will not be able to proceed with the same NOC, you will have to request for another NOC.

sample No Objection Certificate(NOC) templates example - hrhelpboard

What is No Objection Certificate? Sample Format of No Objection Certificate (NOC) No Objection letter Commonly known as NOC letter , it is an legal type of document which is issued by any type of agency , institute , organisation.. In certain cases it is issued by individual persons also , which was written statement say that they no objection to the details present in documents.

idfc first bank ka noc kaise dekhe | How to download noc - YouTube

Today in this video idfc first bank ka noc kaise dekhe | How to download noc | download noc of idfc loan | noc download |Topic Covered in This Video-how to ...

Importance of NOC when you pay off the home loan - IDFC FIRST Bank

The IDFC FIRST Bank Fixed Deposit offers 7.50% interest rate. We offer different features like no penalty on early withdrawal, competitive interest rates, high returns and more. Open Tax Saving FD account online now!

NOC Full Form, NOC Letter Format, No Objection Certificate - Money View

Loan NOC. If you are wondering what a loan NOC letter or what an NOC for loan closure is, you’ve come to the right place. NOC full form is No Objection Certificate issued to lift any restriction.

Application of No Objection Certificate (NOC) from Bank

Application for Issuance of Library Card Application for Fee Concession by Disabled Students Application for providing Sound System for large classrooms

What is a NOC in ACH?

A notification of change (NOC) occurs when the bank sending funds notifies the bank receiving funds that some portion of the once-valid information has changed. This could result from a bank buying another bank, which would cause routing numbers to change. With NOCs, ACH transactions will run successfully, but your business will incur a fee. These notifications of change are inevitable, but they could eat away at your profits if you’re not with the right provider.

Do merchant accounts charge a fee for NOC?

Notifications of change can have a significant financial impact on your business. Most Merchant Account Providers charge a fee for every NOC, so they have an incentive to not notify you of changes.

Is it unfair to get charged for every NOC?

Work with a provider with the best technology. Getting charged for every NOC you encounter is unfair, especially when your provider fails to assist you in resolving the change. With a top-notch Virtual Terminal, information is auto corrected when a NOC comes through, so the next time around it runs correctly and you don’t incur further fees. For example, if an account number has changed, but the routing number remains the same, the system corrects the account number.

Do NOCs run with ACH?

With NOCs, ACH transactions will run successfully, but your business will incur a fee. These notifications of change are inevitable, but they could eat away at your profits if you’re not with the right provider.

What is NOC in banking?

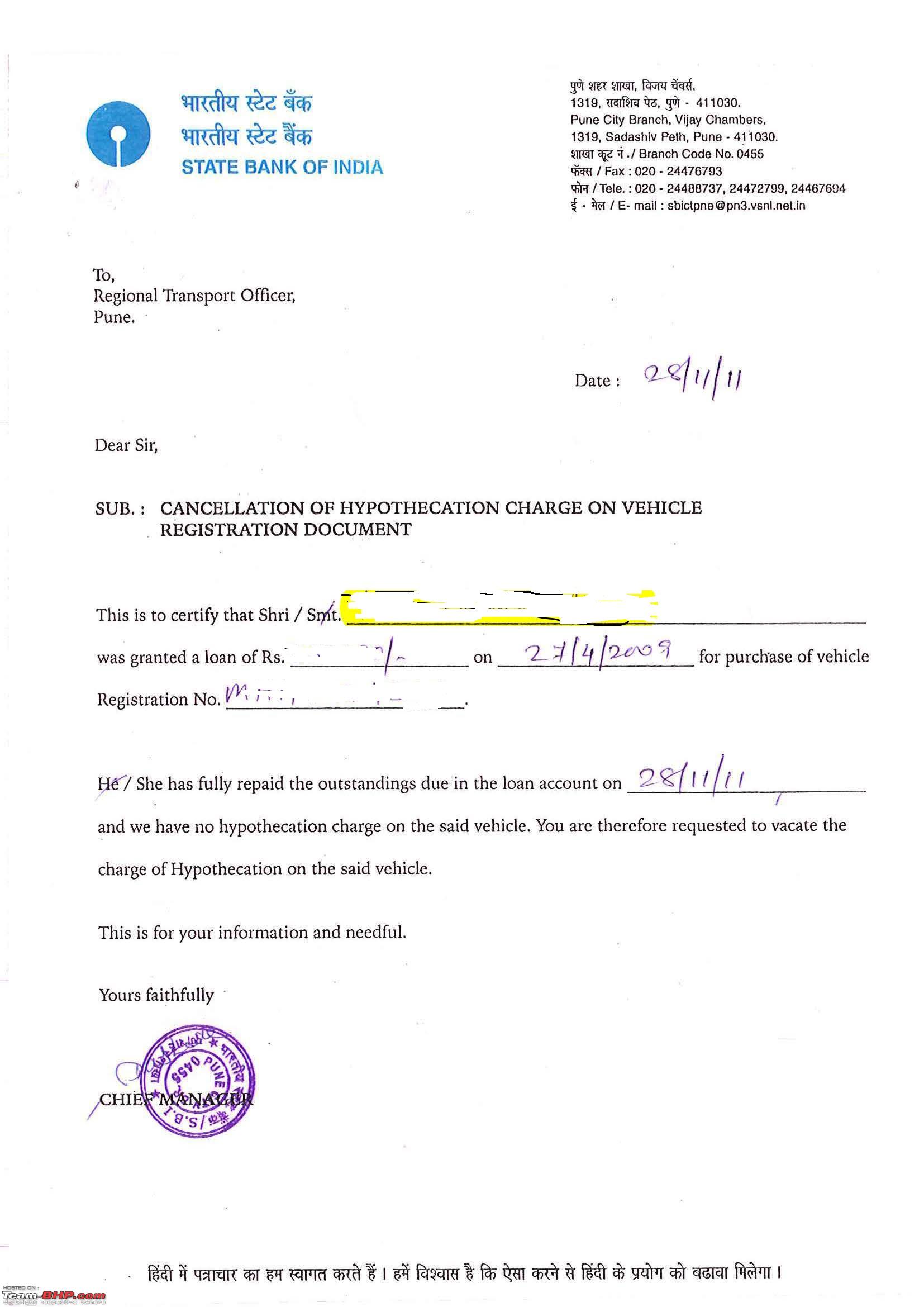

Format of No Objection Certificate, NOC from Bank to Customers and clients after clearance of payment of the loan anyone had taken. Bank issue NOC for further assistance and transactions. Find sample below.

What is the CNIC number for Ahsan Khan?

It is certify that Mr. Ahsan Khan bearing CNIC# 35201-146789-6 was maintaining his personal finance account no 01-915-3571-1 with Askari Bank ltd ,G-8 branch Islamabad and there is no outstanding liability and the said loan has been fully adjusted with up to date mark up.

Why does VeriCheck have NOCs?

Many times a NOC occurs because the customer’s bank has merged or been bought by another bank and they have changed the customer’s account or routing number. As of January 1, 2015 – All NOCs that are received by VeriCheck will be updated automatically to reflect the changed information received by the customer’s bank.

Does VeriCheck notify merchants of changes?

VeriCheck will still notify merchants of any Notifications of Change that occur for a merchant’s transactions, but information will automatically update on VeriCheck’s servers before the transaction is again submitted to the bank.

What is an NOC letter?

An NOC letter is a 'No Objection Certificate' from a bank on the closing of your loan. The lender issues an NOC letter that will state that all outstanding debts have been paid in full and that no other payments are due on a specific date. The formal conclusion of your loan repayment cycle is marked by a personal loan NOC letter from your lender. It eliminates any future legal ramifications from your debt.

What happens in the absence of an NOC letter?

It is difficult to prove that you have paid your debts in the absence of evidence, so do not put off collecting the necessary documents.