Cash Cow Meaning

- Cash cows are well-established products that generate constant profits in the long run.

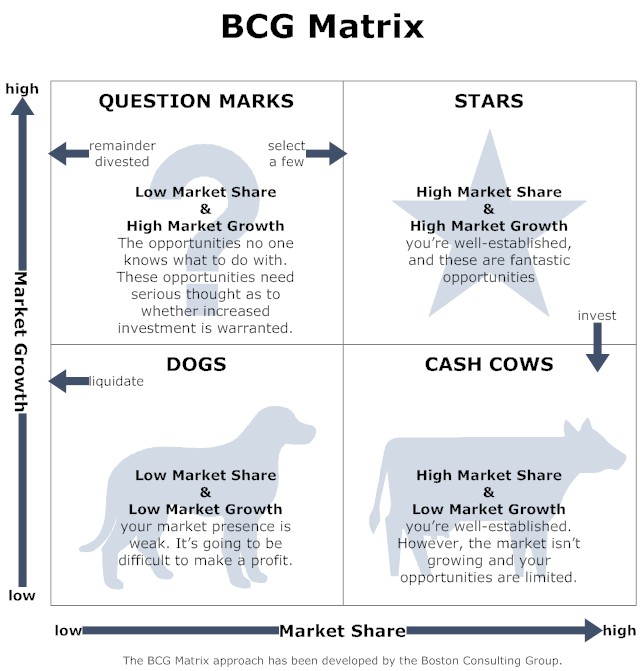

- It is one of the four grids in the Boston Consulting Group (BCG) matrix and resembles an enormous market share with a nominal growth rate.

- Also termed a money maker, it yields regular returns, just like a cow that provides milk regularly.

What is a cash cow in a matrix?

A cash cow is a product, asset, or business that ensures a consistent cash flow. In the Boston Consulting Group (BCG) matrix, cash cows are placed in the bottom right position—high market share but low growth rate.

What is the meaning of cash cow in Boston Consulting Group?

Cash cow refers to a part of the growth matrix of the Boston Consulting Group (BCG) wherein the cash cow group is an asset representing a larger market share but with a low-growth rate which would lead to a consistent stream of cash flows through the entire lifespan of the Company brand, business unit, product, or the entire firm.

What is the cash cows quadrant?

Products in the cash cows quadrant are “milked” and firms invest as little cash as possible while reaping the profits generated from the products. Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career.

What is a cash cow category?

The cash cow category generates a lot of cash flow to the company. The company enjoys a higher sales volume (relative to competitors) and, at the same time, incurs relatively little investment. Companies incur costs such as marketing and promotion are relatively small. I mean, it’s just to maintain market share. It contrasts with competitors.

What does the expression cash cow mean?

Definition of cash cow 1 : a consistently profitable business, property, or product whose profits are used to finance a company's investments in other areas. 2 : one regarded or exploited as a reliable source of money a singer deemed a cash cow for the record label.

What is cash cow position?

A cash cow is a product, asset, or business that ensures a consistent cash flow. In the Boston Consulting Group (BCG) matrix, cash cows are placed in the bottom right position—high market share but low growth rate.

Why is it called a cash cow?

The term cash cow is a metaphor for a dairy cow used on farms to produce milk, offering a steady stream of income with little maintenance.

What are cash cows and why are they important?

Cash cows are known to be a company's most valuable and competitive product or business divisions as they contribute to a significant chunk of a firm's operating profits. These profits are a result of low investment and high revenue gains from such products.

What is the best strategy for a strong cash cow in BCG matrix?

Reduce your investment and take out the maximum cash flow from a product, which increases its overall profitability. This strategy is best used for Cash Cows. Divest the amount of money invested in a product and apply it elsewhere. This strategy is best for Dogs.

Is a cash cow good?

Cash Cows – Cash cows are leaders in a more mature market. These are successful products that enjoy a large market share in a well-established market. Since a cash cow demonstrates a return on assets greater than the market growth rate, it generates more cash than it consumes.

What's the opposite of a cash cow?

What is the opposite of cash cow?drain on resourcesfinancial drainfinancial liabilitymoney down the drainmoney down the toilet

What is another word for cash cow?

In this page you can discover 9 synonyms, antonyms, idiomatic expressions, and related words for cash-cow, like: moneymaker, grubstaker, meal-ticket, golden-goose, patron, angel, backer, staker and money-spinner.

What is a dog in the Boston Matrix?

What Is a Dog? In business, a dog (also known as a "pet") is one of the four categories or quadrants of the BCG Growth-Share matrix developed by Boston Consulting Group in the 1970s to manage different business units within a company. A dog is a business unit that has a small market share in a mature industry.

What is the best strategy for a strong cash cow?

What is the best strategy for a strong cash cow? Hold. A strong Cash Cow must be held to ensure they keep yielding a large positive cash flow.

What do cash cows stand for in the BCG Boston Consulting Group matrix?

Definition: Cash Cow is one of the four categories under the Boston Consulting Group's growth matrix that represents a division which has a big market share in a low-growth industry or a sector.

What is the BCG matrix?

The BCG matrix, also known as the Boston Box or Grid, places an organization's businesses or products into one of four categories: star, question mark, dog, and cash cow. The matrix helps firms understand where their business stands in terms of market share and industry growth rate. It serves as a comparative analysis of a business's potential ...

What is a star in BCG?

In contrast to a cash cow, a star, in the BCG matrix, is a company or business unit that realizes a high market share in high-growth markets. Stars require large capital outlays but can generate significant cash. If a successful strategy is adopted, stars can morph into cash cows.

Is the iPhone a cash cow?

For example, the iPhone is Apple's ( AAPL) cash cow. Its return on assets is far greater than its market growth rate; as a result, Apple can invest the excess cash generated by the iPhone into other projects or products.

Example of Cash Cow

As explained above, it is relevant only in the case of mature industries which are steadily growing. Hence, we can consider the example of Marks & Spencer for the BCG matrix. The Company is into the retail segment and offers a wide range of products with different lines of supply.

Cash Cow Matrix

Please observe the timeline graph presented under the heading “what is cash cow” together with this heading. The cash cow matrix is divided into four parts, namely Question marks, Stars, Dogs, and Cash cows.

How to Calculate BCG Matrix?

Step 2: Identify the applicable market to the said product or single business unit, or entire firm

Advantages

The Company or business unit under the cash cow category grows steadily, providing consistent cash flows to the Company.

Disadvantages

The profits will grow at a slower rate as compared to companies in the star category.

Key Takeaway

A Cash cow is an asset representing a larger market share. It has a low-growth rate with a consistent stream of cashflows.

Conclusion

Cash cows are essential to ensure consistent cash flows in a business. Downfall in one business segment can be accommodated by using the cash generated from cash cows. However, Company should create enter into different ventures, which would be under the question mark category by using the cash from cash cows.

What is a cash cow?

Sharper Insight. What’s it: A cash cow is a product or business unit with a high market share in a low-growth market. In other words, a product is in a mature market and has a dominant position, perhaps as a market leader. It is one of four quadrants in the BCG matrix in addition to Star, Question mark, and Dog.

How can cash flow be used to build question marks?

Companies can use cash flow to build question marks into market leaders by increasing market share. Meanwhile, the star has a dominant position in the market. Hence, the company must at least sustain the current market position until the market reaches a mature stage. What companies need to pay attention to.

Why is investing in the star and question mark category important?

On the other hand, investment in the star and question mark categories is vital because their positions are unstable. Both are in high growth markets. Competitors can take over and dominate the market.

Do cash cows generate dividends?

Please remember, the cash cow category does not only apply to products, but also business units. Investors usually favor cash cows. These categories are more likely to generate continuous dividends thanks to their ability to generate a stable and significant amount of free cash flow.

What is a cash cow?

Products in the cash cows quadrant are in a market that is growing slowly and where the product (s) have a high market share. Products in the cash cows quadrant are thought of as products that are leaders in the marketplace. The products already have a significant amount of investments in them and do not require significant further investments to maintain their position.

What is the BCG matrix for dogs?

The BCG Matrix: Dogs. Products in the dogs quadrant are in a market that is growing slowly and where the product (s) have a low market share. Products in the dogs quadrant are typically able to sustain themselves and provide cash flows, but the products will never reach the stars quadrant. Firms typically phase out products in ...

What are the quadrants of the BCG matrix?

In addition, there are four quadrants in the BCG Matrix: 1 Question marks: Products with high market growth but a low market share. 2 Stars: Products with high market growth and a high market share. 3 Dogs: Products with low market growth and a low market share. 4 Cash cows: Products with low market growth but a high market share.

What is the horizontal axis of the BCG matrix?

The horizontal axis of the BCG Matrix represents the amount of market share of a product and its strength in the particular market. By using relative market share, it helps measure a company’s competitiveness. The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in a particular market.

What is the assumption in the matrix?

The assumption in the matrix is that an increase in relative market share will result in increased cash flow. A firm benefits from utilizing economies of scale. Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to the.

How are question marks funded?

Investments in question marks are typically funded by cash flows from the cash cow quadrant. In the best-case scenario, a firm would ideally want to turn question marks into stars (as indicated by A). If question marks do not succeed in becoming a market leader, they end up becoming dogs when market growth declines.

What is a product in the star quadrant?

Products in the stars quadrant are market-leading products and require significant investment to retain their market position, boost growth, and maintain a competitive advantage.

What is the Boston matrix?

Boston Matrix (Product Portfolio Model) The Boston Matrix is a model which helps businesses analyse their portfolio of businesses and brands. The Boston Matrix is a popular tool used in marketing and business strategy. A business with a range of products has a portfolio of products.

How does the Boston matrix work?

The Boston Matrix makes a series of key assumptions: Market share can be gained by investment in marketing. Market share gains will always generate cash surpluses. Cash surpluses will be generated when the product is in the maturity stage of the life cycle. The best opportunity to build a dominant market position is during the growth phase.