What is an example of common cost?

Mar 26, 2022 · A common cost is a cost that is not attributable to a specific cost object, such as a product or process. When a common cost is associated with the manufacturing process, it is included in factory overhead and allocated to the units produced. When a common cost is associated with administrative functions, it is charged to expense as incurred.

What is the cost of common stock?

Definition: A common cost is an expense associated with operating a facility, product, or segment that is shared between two or more departments or users. In other words, it’s a shared expense of creating a product or providing a service that …

What is a common fixed cost?

Definition of common cost. : expense chargeable in accounting to the business as a whole : cost assigned to several departments or operations.

What is the relationship between multiple products and common costs?

Apr 10, 2022 · What Are The Common Costs? This is a financial cost associated with a business venture and is shared among departments or groups of people that deal with the enterprise’s core mission. For this reason, it refers to a shared expense not only for producing a product but for the ability to provide that product or service to many users.

What are examples of common costs?

Examples of Common Costing Typical universal costs in small businesses include electrical expenses, transportation and money costs such as depreciation and income taxes, reports Send Pulse. These shared costs include the basic production of multiple goods, and fuel costs.

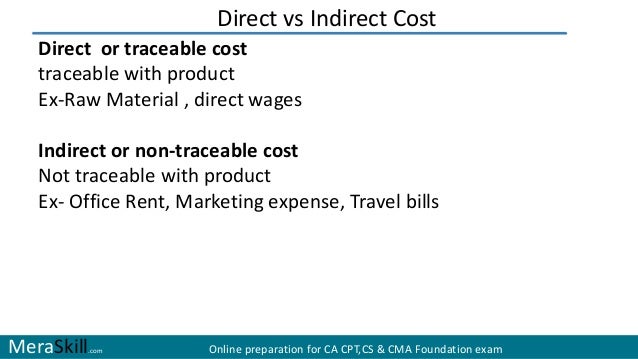

What are the 4 types of cost?

Direct, indirect, fixed, and variable are the 4 main kinds of cost.Oct 8, 2020

What are the three most common types of costs?

There are three major types of expenses we all pay: fixed, variable, and periodic.Jan 16, 2020

What are joint and common costs?

Joint costs occur when one process or element results in outputting several goods. For instance, you can derive kerosene, fuel oil, gasolene from crude oil. Common costs arise when a firm outputs several products. However, these expenses can't be attributed to any of these products directly.Feb 3, 2021

What are types of costs?

Direct Costs.Indirect Costs.Fixed Costs.Variable Costs.Operating Costs.Opportunity Costs.Sunk Costs.Controllable Costs.More items...

What is cost explain the types of cost?

The two basic types of costs incurred by businesses are fixed and variable. Fixed costs do not vary with output, while variable costs do. ... It takes more labor and material to produce more output, so the cost of labor and material varies in direct proportion to the volume of output.Feb 6, 2020

Is rent indirect cost?

Indirect costs include costs which are frequently referred to as overhead expenses (for example, rent and utilities) and general and administrative expenses (for example, officers' salaries, accounting department costs and personnel department costs).Dec 13, 2020

What are the 3 types of spending?

That spending can be divided into three categories: mandatory, discretionary, and interest.

Are taxes variable cost?

Variable costs can increase or decrease based on the output of the business. Examples of fixed costs include rent, taxes, and insurance. Examples of variable costs include credit card fees, direct labor, and commission.

What are allocated common costs?

Common costs are typically assigned or allocated to joint products, processes, and activities, so the company can accurately determine the cost of each activity and adjust prices accordingly. In this case the joint activities are trips to different suppliers related to different department.

Are common costs relevant costs?

They are incremental – relevant costs are incremental costs and it is the increase in costs and revenues that occurs as a direct result of a decision taken that is relevant. Common costs can be ignored for the purposes of decision making.Nov 7, 2012

What is imputed cost and common?

An imputed cost is a cost that is incurred by virtue of using an asset instead of investing it or the cost arising from undertaking an alternative course of action. An imputed cost is an invisible cost that is not incurred directly, as opposed to an explicit cost, which is incurred directly.

How to view invoice details in Azure?

To view your invoice details in the Azure portal, navigate to Cost analysis for the scope associated with the invoice that you're analyzing. Select the Invoice details view. Invoice details show you the charges as seen on the invoice.

What is reserved instance?

Reserved instances provide a way for you to save money with Azure. With reservations, you spend money up front for a given number of resources over time . Cost analysis shows the charges as they appear on your bill. The charges are shown as actual costs or amortized over the course of your reservation period.

What is spot VM?

Spot VMs can provide large cost savings for workloads that can handle interruptions. Workloads are run on unused Azure capacity. Since they can be evicted at any time, Spot VMs get a significant discount. Use the following steps to view your Spot VM charges.

What is usage details report?

Your usage details report file, in CSV format, provides a breakdown of all the charges that accrued towards an invoice. You can use the report to compare it to, and better understand, your invoice. Each billed charge on your invoice corresponds to broken-down charges in the usage report.

Why do Azure users use tags?

Many Azure users apply tags to their resources such as a cost center or development environment (production and test) to better categorize charges. Tags appear as a dimension in cost analysis. You can use the dimension to gain insights into your custom tagging categorizations.

What is standard costing?

Standard costing. Standard costing is a costing approach that denotes standard costs for inventory and the cost of goods sold (COGS.) The costs associated with standard costing are based on the production of a good under typical operating conditions.

What is cost accounting?

Costing, or cost accounting, is a system for determining a company's cost of production. This type of accounting looks at both variable and fixed costs incurred throughout the production process. Companies use costing information to make informed business decisions and ensure each area of production is financially effective and efficient.

What is internal management?

An organization's internal management performs costing activities, and, unlike other forms of accounting, isn't seen by outside clients or institutions. As a result, there are no set standards that cost accounting must meet, and it has more flexibility in comparison to other types of accounting.

What is absorbed costing?

Absorption costing, sometimes referred to as full costing, is used by a company to determine all costs that go into the manufacturing of a specific product . This costing method involves allotting all variable and fixed costs to cost units and the total overhead of the company is absorbed based on the organization's activity level. In this type of costing, manufacturing overheads are apportioned to specific products and included in the company's stock valuation regardless of whether the product was sold in the period being assessed.

What is marginal costing?

Marginal costing is a type of cost accounting used to assess the impact of variable costs on the total volume of output or production. This costing approach adds an additional unit to production to allow management to determine the impact of different levels of volume and costs on the company's overall operating profit. Marginal costing is frequently used to make short-term financial decisions and to assess the profitability potential of new products, marketing campaigns and current sales prices of existing products.

What is fixed cost?

Fixed costs: Fixed costs are expenses that don't change despite the level of production. For example, the monthly payment for the lease on a manufacturing building is considered a fixed cost. Direct costs: These costs are directly related to manufacturing a product.

Is variance unfavorable or favorable?

If a company performs a variable analysis and finds that the actual costs are more than what was anticipated, the variance is considered unfavorable . If the company finds that the actual costs match or are lower than the standard costs, the variance is considered favorable.