A contra account is a negative account that is netted from the balance of another account on the balance sheet. The two most common contra accounts are the allowance for doubtful accounts/bad debt reserve, which is subtracted from accounts receivable, and accumulated depreciation, which is subtracted from fixed assets.

What are the examples of contra account?

What is a Contra Asset Account?

- Examples of Contra Assets. Accumulated Depreciation Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use.

- Reasons to Show Contra Accounts on the Balance Sheet. ...

- Contra Asset – Accumulated Depreciation. ...

- Allowance for Doubtful Accounts. ...

- Related Readings. ...

Is a contra account a debit or a credit?

Normal asset accounts have a debit balance while contra asset accounts have a credit balance. In that sense, a contra asset is regarded as a negative one. Using the asset account account as a contra asset account reveals what its net balance is.

What is a contra account in accounting?

- It is used to offset another account, for instance, debtors have a debit balance of 50,000 however the associated contra account i.e. ...

- It is also used to correct errors made with an account.

- It helps to make financial records transparent. ...

What are contra accounts to accounts receivable?

What is a Contra Account?

- It is a general ledger account with a purpose to have its balance to be the opposite of the original balance for that account. ...

- The transactions made in this account are reported on a company’s financial statements directly under the related account.

- The usual pattern for a Contra Account is Gross Amount – (Amount in the Contra Ac) = Net Amount.

What are contra items in balance sheet?

A contra asset account is a type of asset account where the account balance may either be a negative or zero balance. This type of asset account is referred to as "contra" because normal asset accounts might include a debit, or positive, balance, and contra asset accounts can include a credit, or negative, balance.

Do contra accounts go on the balance sheet?

Contra assets and contra liabilities are listed on a company's balance sheet and carry balances opposite of their related accounts. Unlike regular assets and liabilities, contra assets typically keep a credit balance and contra liabilities typically keep a debit balance.

Is a contra asset an asset or liability?

A contra asset account is not classified as an asset, since it does not represent long-term value, nor is it classified as a liability, since it does not represent a future obligation.

What type of accounts are contra?

A contra account is an account used in a general ledger to reduce the value of a related account. They are useful to preserve the historical value in a main account while presenting a decrease or write-down in a separate contra account that nets to the current book value.

What is the purpose of a contra account?

A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification. The use of a contra account allows a company to report the original amount and also report a reduction so that the net amount will also be reported.

Is a contra account a debit or credit?

credit balanceNormal asset accounts have a debit balance, while contra asset accounts are in a credit balance. Therefore, a contra asset can be regarded as a negative asset account.

Which of the following is not a contra account?

Accumulated depreciation is a contra property, plant and equipment account and sales discount is a contra sales revenue account. Transportation in, also referred to as freight in, increases the purchases account and it is not a contra account.

Which of the following would not be classified as a contra account?

Sales Revenue. Explanation: Sales revenue is an account with a credit balance as it indicates the amount of revenue created on account of making sales. It is a revenue account and not a contra account.

Do contra revenue accounts go on income statement?

Contra revenue accounts appear near the top of the income statement, as a deduction from gross revenue.

What is contra entry in financial accounting?

A contra entry is recorded when the debit and credit affect the same parent account and resulting in a net zero effect to the account. These are transactions that are recorded between cash and bank accounts.

What type of balance does a contra asset account have?

A contra asset account is an asset account where the account balance is a credit balance. It is described as "contra" because having a credit balance in an asset account is contrary to the normal or expected debit balance. (A debit balance in a contra asset account will violate the cost principle.)

Is contra revenue an expense?

The difference is that expenses represent money that flows out of a company as it does business, while contra revenues represent money that never comes in, or that comes in but turns around and goes right back where it came from.

What is a contra account?

Definition of Contra Account. A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification. The use of a contra account allows a company to report the original amount and also report a reduction so that the net amount will also be reported. ...

What is income statement account sales returns and allowances?

The income statement account Sales Returns and Allowances is a contra revenue account that is associated with the revenue account Sales.

Does allowance for doubtful accounts have a credit balance?

Since it is a contra asset account, this allowance account must have a credit balance (which is contrary to the debit balances found in asset accounts). The Allowance for Doubtful Accounts is directly related to the asset account entitled Accounts Receivable.

What is a contra account?

Contra Account is an opposite entry passed to offset the balances of related original account in the ledger and helps the organization to retrieve the original amount and the amount of decrease in the value, thereby presenting the net balances of the account. It is a general ledger account with a purpose to have its balance to be the opposite ...

What is a contra balance?

The balance of a contra asset account#N#Contra Asset Account A contra asset account is an asset account with a credit balance related to one of the assets with a debit balance. When we add the balances of these two assets, we will get the net book value or carrying value of the assets having a debit balance. read more#N#is a credit balance. This account decreases the value of a hard asset. This account is not classified as an asset since it does not represent a long term value. It is not classified as a liability since it does not constitute a future obligation.

Why are Contra Accounts Important?

It facilitates easy retrieval of the original amount and the actual decrease , which helps in understanding the net balance. It allows a business to present the net value based on the reduction made on the original amount.

What are some examples of contra liability accounts?

The examples of contra liability account include: Discount on bonds payable – This is the difference between the amount of cash a company receives when issuing bonds. Bonds A bond is financial instrument that denotes the debt owed by the issuer to the bondholder.

What is a contra liability?

A liability that is recorded as a debit balance is used to decrease the balance of a liability. The balance of a contra liability account is a debit balance. This account decreases the value of the liability. Contra Liability a/c is not used as frequently as contra asset accounts. It is not classified as a liability since it does not represent a future obligation.

What is a general ledger account?

It is a general ledger account with a purpose to have its balance to be the opposite of the original balance for that account. It is linked to specific accounts and is reported as reductions from these accounts.

Do balance sheets have a debit balance?

As you know , from studying the basics of debit and credit, balance sheet accounts have a healthy balance. Assets accounts have a debit balance. Contra assets have a credit balance. Liabilities accounts. Liabilities Accounts Liability is a financial obligation as a result of any past event which is a legal binding.

What Is a Contra Account?from investopedia.com

A contra account is used in a general ledger to reduce the value of a related account when the two are netted together. A contra account's natural balance is the opposite of the associated account. If a debit is the natural balance recorded in the related account, the contra account records a credit. For example, the contra account for a fixed asset is accumulated depreciation .

What are the different types of contra accounts?from investopedia.com

There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue. Contra assets decrease the balance of a fixed or capital asset, carrying a credit balance. Contra liabilities reduce liability accounts and carry a debit balance.

What is the allowance for doubtful accounts?from investopedia.com

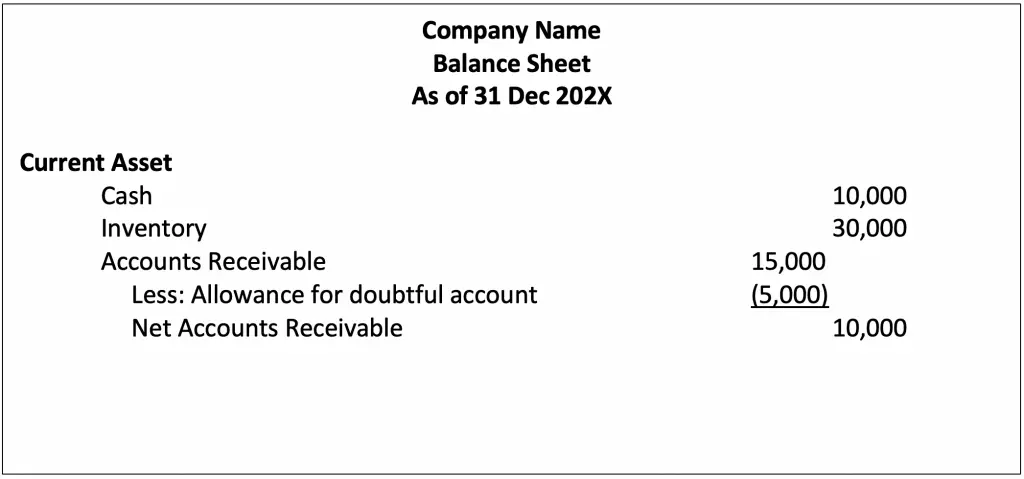

This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. The amount is reported on the balance sheet in the asset section immediately below accounts receivable. The net of these two figures is typically reported on a third line.

What are some examples of contra liabilities?from investopedia.com

A key example of contra liabilities include discount on notes or bonds payable. Contra liabilities hold a debit balance. Contra liability accounts are not as popular as contra asset accounts.

What is allowance method in accounting?from investopedia.com

The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account. The percentage of sales method assumes that the company cannot collect payment for a fixed percentage of goods or services that it has sold. Both methods result in an adjustment to book value.

What is the difference between the asset's account balance and the contra account balance?from investopedia.com

When accounting for assets, the difference between the asset's account balance and the contra account balance is referred to as the book value. There are two major methods of determining what should be booked into a contra account.

What is income statement account sales returns and allowances?from accountingcoach.com

The income statement account Sales Returns and Allowances is a contra revenue account that is associated with the revenue account Sales.

What is contra account?

What is a Contra Asset Account? In bookkeeping, a contra asset account is an asset account in which the natural balance of the account will either be a zero or a credit (negative) balance. The account offsets the balance in the respective asset account that it is paired with on the balance sheet. Balance Sheet The balance sheet is one ...

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are

How much does allowance for doubtful accounts reduce?

$100,000 – $5,000 (allowance for doubtful accounts) = $95,000 in net receivables.

What is allowance for doubtful accounts?

It is a contra-asset account – a negative asset account that offsets the balance in the asset account it is normally associated with. Allowance for Doubtful Accounts The allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the true value of accounts receivable.

What is straight line depreciation?

Straight Line Depreciation Straight line depreciation is the most commonly used and easiest method for allocating depreciation of an asset. With the straight line

What is PP&E in accounting?

PP&E (Property, Plant and Equipment) PP&E (Property, Plant, and Equipment) is one of the core non-current assets found on the balance sheet. PP&E is impacted by Capex,

Is a contra asset a negative asset?

Therefore, a contra asset can be regarded as a negative asset account. Offsetting the asset account with its respective contra asset account shows the net balance of that asset.

What is a contra account?

Definition. A contra account is an account with a balance opposite the normal accounts in its category. Contra accounts are usually linked to specific accounts on the balance sheet and are reported as subtractions from these accounts. In other words, contra accounts are used to reduce normal accounts on the balance sheet.

What is a contra liability account?

Contra Liability Account – A contra liability account is a liability that carries a debit balance and decreases other liabilities on the balance sheet. An example of this is a discount on bonds payable. Contra Equity Account – A contra equity account has a debit balance and decreases a standard equity account.

What is an asset account that has a debit balance?

Equipment is depreciated over its useful. This depreciation is saved in a contra asset account called accumulated depreciation. The accumulated depreciation account has a credit balance and is used to reduce the carrying value of the equipment. The balance sheet would report equipment at its historical cost and then subtract the accumulated depreciation.

Can you see the cost of an asset on a balance sheet?

Balance sheet readers cannot only see the actual cost of the item; they can also see how much of the asset was written off as well as estimate the remaining useful life and value of the asset. The same is true for other asset accounts like accounts receivable.

Is accounts receivable reported on the balance sheet?

Accounts receivable is rarely reported on the balance sheet at its net amount. Instead, it is reported at its full amount with an allowance for bad debts listed below it. This shows investors how much receivables are still good.

What is contra account?

Key Takeaways. A contra account is an account used in a general ledger to reduce the value of a related account. A contra liability account adjusts the value of liabilities held by a company on its balance sheet. A contra liability may be generated due to the issuance of bonds or other debt securities.

Why do accountants use contra accounts?

Note that accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean.

What does a debit to contra liability account of $100 mean?

In the above example, the debit to the contra liability account of $100 lets the company recognize that the bond was sold at a discount .

What is a contra liability account?

In finance, a contra liability account is one that is debited for the explicit purpose of offsetting a credit to another liability account. Contra liabilities reduce liability accounts and carry a debit balance. In other words, the contra liability account is used to adjust the book value of an asset or liability.

What happens if a bond is sold at a discount?

If the bond is sold at a discount, the company will record the cash received from the bond sale as "cash", and will offset the discount in the contra liability account. Note that accountants use contra accounts rather than reduce the value of the original account directly to keep financial accounting records clean.

What are the different types of contra accounts?

There are four key types of contra accounts—contra asset, contra liability, contra equity, and contra revenue. Contra asset accounts include allowance for doubtful accounts and the accumulated depreciation. Contra asset accounts are recorded with a credit balance that decreases the balance of an asset. A liability that is recorded as ...

Is a contra asset a liability?

Contra Liability a/c is not used as frequently as contra asset accounts. It is not classified as a liability since it does not represent a future obligation. Examples of contra liabilities include a discount on notes or bonds payable. Contra liabilities hold a debit balance.

Contra Asset Accounts Explained in Less Than 3 Minutes

A contra asset is a negative account used in double-entry accounting to reduce the balance of a paired asset account in the general ledger.

Definition and Examples of Contra Assets

Contra assets are accounts in the general ledger—where you enter your transactions—that carry a balance used to offset the account with which it is paired. Instead of debiting the asset account directly, the contra asset account balance will be credited (reduced) separately.

How Contra Asset Accounts Work

Contra asset accounts are useful tools in double-entry accounting. They are also helpful for keeping the books balanced and creating a clear trail of financial breadcrumbs for historical review and reporting.

Types of Contra Assets

While accumulated depreciation is the most common contra asset account, the following also may apply, depending on the company.

Accounts

From the bank’s point of view, when a debit card is used to pay a merchant, the payment causes a decrease in the amount of money the bank owes to the cardholder. From the bank’s point of view, your debit card account is the bank’s liability.

Contra Asset Definition

In other words, contra accounts are used to reduce normal accounts on the balance sheet. A less common example of a contra asset account is Discount on Notes Receivable. The credit balance in this account is amortized or allocated to Interest Income or Interest Revenue over the life of a note receivable.

Does Accumulated Depreciation Affect Net Income?

In either case, the net amount of the pair of accounts is referred to as the book value of the asset account in question. A contra asset is a negative asset account that offsets the asset account with which it is paired.

2 Accounting For Uncollectible Accounts

Similar to depreciation, this account plays a significant role in representing the book value of a company’s assets. Debit BalanceIn a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance.