What is the antonym of guarantee?

guarantee | definition: give surety or assume responsibility | synonyms: vouch, assure, stipulate, ensure, insure| antonyms: uncover, artifact, undress, exclude, arise, show, fall short of

What is the plural of guarantee?

guarantee. Answer. The plural form of guarantee is guarantees . Find more words! Another word for Opposite of Meaning of Rhymes with Sentences with Find word forms Translate from English Translate to English Words With Friends Scrabble Crossword / Codeword Words starting with Words ending with Words containing exactly Words containing letters Pronounce Find conjugations Find names.

What is the meaning of guarantee?

A guarantee pledges that something will be performed in a specified manner. It is an assurance that could be given in writing or verbally. A guarantee is defined as an agreement providing for the quality of an item or service, while also offering security for that agreement.

What is a guarantor and guarantee?

The word “guarantee” is only used as a noun. Guaranty means a promise to do something if something happens. The word guarantee is an obsolete form of the word guarantee (guarantor and guarantee). In most cases, a guaranty may be linked to a promise to pay a sum of money in case another does not pay. For example:

What are the different types of guarantees?

Who provides a guarantee?

Why do lenders give guarantees?

What is a guarantor in financial modeling?

What is a bank guarantee?

Who can be a personal guarantor?

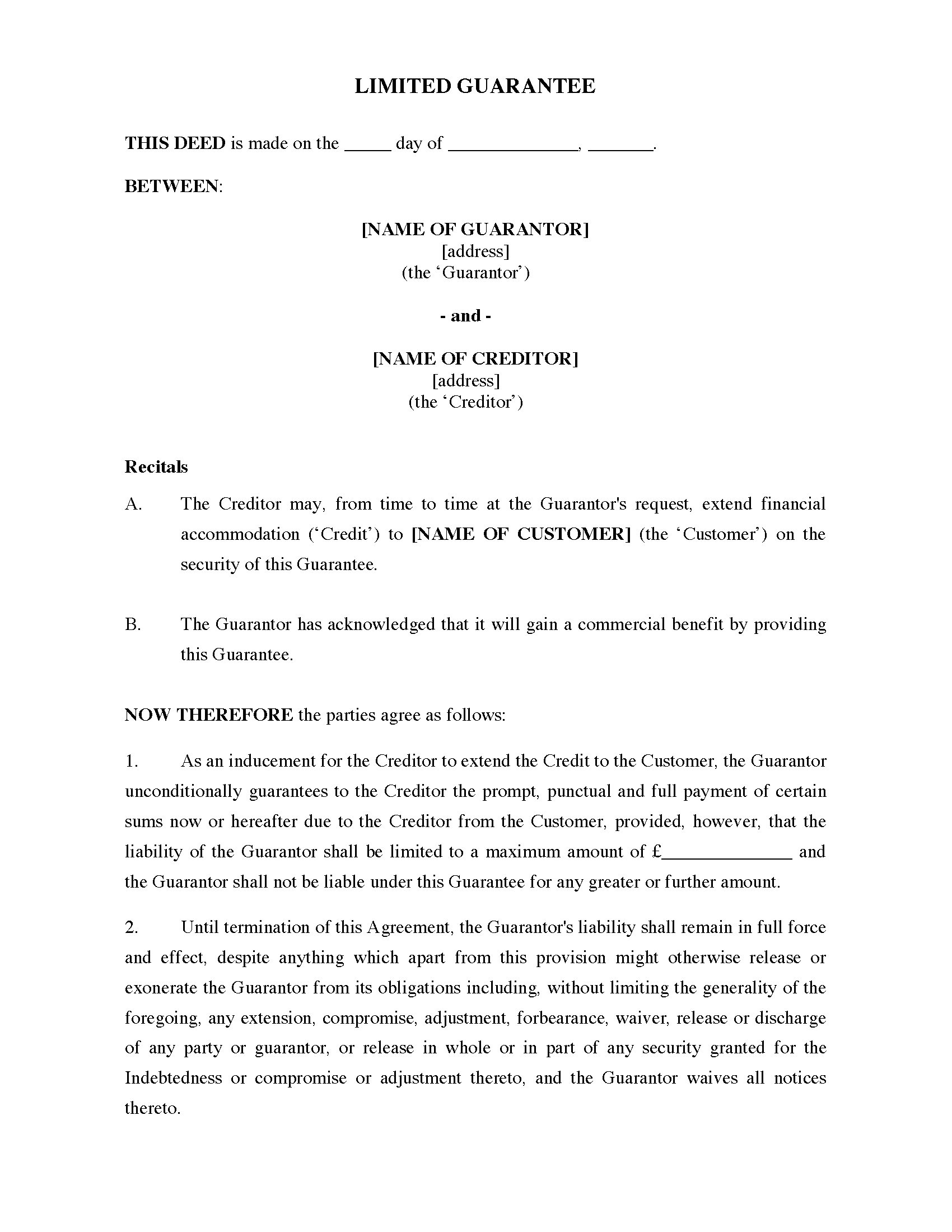

What is the difference between unlimited and limited guarantee?

See 4 more

About this website

What is the purpose of a letter of guarantee?

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

What is guaranteed document?

Guaranteed Documents means the Credit Agreement, the Notes, any Letter of Credit and all other Loan Documents to which any Credit Party or any of its Subsidiaries is now or may hereafter become a party, but only to the extent that the Parent Foreign Borrower is a party.

What is an example of guarantee?

I guarantee that you'll be satisfied. He guaranteed us that everything would go according to plan. Money doesn't guarantee a happy life. He guaranteed a victory in the championship game.

What is the purpose of a guarantee agreement?

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

What are the types of guarantees?

Types of GuaranteesBid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed.Performance Guarantee. ... Advance Payment Guarantee. ... Warranty Guarantee. ... Retention Guarantee.

How do you issue a guarantee?

To request a guarantee, the account holder contacts the bank and fills out an application that identifies the amount of and reasons for the guarantee. Typical applications stipulate a specific period of time for which the guarantee should be valid, any special conditions for payment and details about the beneficiary.

What happens when a guarantee is called?

In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another (usually to pay) by promising to themselves pay if default occurs. At law, the giver of a guarantee is called the surety or the "guarantor".

What does guarantee mean in business?

Guarantee is a security in form of a right of action against a third party called the surety or the guarantor. In simple terms, a Guarantee means the promise to pay another's debt or fulfill another person's contractual obligation, if that other person fails to pay his debt or perform his obligation.

What is a guarantee policy?

Guarantee insurance is used as security for the performance of a piece of work, which has been agreed upon in a contract. It is also used as security for advance payments or payments on account for services agreed upon in a contract.

Who is mainly responsible in the contract of guarantee?

3) Liability In a contract of guarantee, the liability of a surety is secondary. This means that since the primary contract was between the creditor and principal debtor, the liability to fulfill the terms of the contract lies primarily with the principal debtor.

Who can enforce a guarantee?

The Court of Appeal has held that a beneficiary can enforce a guarantee against the guarantor even if it holds security over assets of the principal debtor. Neither the court, nor the debtor, can dictate to the lender how or in what order it should recover its money.

Is a guarantee a security document?

A guarantee is a simple security document. It states the conditions where the guarantor must take over the borrower's repayment obligations upon default. As a lender, you want to be sure that the guarantor will be able to satisfy its obligations under the guarantee.

What does it mean to guarantee someone?

to promise someone that they will have something or will get something. guarantee someone something: We can guarantee you the very finest standards of service.

What is the best synonym for guarantee?

synonyms for guaranteeagreement.assurance.certificate.collateral.contract.deposit.insurance.security.More items...

Is guarantied a word?

1. a warrant, pledge, or formal assurance given as security that another's obligation will be fulfilled. 2. something that is taken or given as security.

What is a antonym for guarantee?

What is the opposite of guarantee?breachcontraventionbreakdisagreementdenialuncertaintyrefusalprohibitionvetomisunderstanding10 more rows

Are SBA loans guaranteed?

The government guarantees any Small Business Administration (SBA) loan. Mostly, banks issues this guarantee to small businesses in the United State...

What is a government-guaranteed debt?

A government-guaranteed debt or federally guaranteed obligations are debt securities in the United States. They issue this guarantee to be risk-fre...

How do you value a loan guarantee?

To obtain the value of the guaranteed obligation/loan, discount the expected cashflow (principal and coupon payments under the risky rate) to the g...

Letter of Guarantee - How and When to Use a Letter of Guarantee

A Letter of Guarantee refers to a written commitment issued by a bank on the request of a customer who has entered into a sale agreement to buy goods from a supplier, providing assurance that the customer will fulfill the obligations of the contract entered into with the supplier. Apart from the purchase of goods, a

What Is a Bank Guarantee? How They Work, Types, and Example - Investopedia

Bank Guarantee: A bank guarantee is a guarantee from a lending institution ensuring the liabilities of a debtor will be met. In other words, if the debtor fails to settle a debt, the bank covers ...

Types of Guarantee in Business Law - UpCounsel

There are several types of guarantee in business law. A guarantee is basically the promise made by a third party that they will cover a person or a company's debt should that person or company be unable to continue to do so themselves.

Financial Guarantee - Overview, Types, Importance

Different Types of Financial Guarantees. There are numerous situations in which a financial guarantee may be required or utilized. Also, there are several different sources of financial guarantees – individuals, companies, banks, insurance companies, and other entities.

Where do you use a guarantee form?

Another area where guarantee forms are generally used is in leases, like the owner and the landlord of leased properties. With this form, the owner or the landlord has the assurance and documented proof that the renter or tenant has a guarantor who will pay any dues in case of a default.

What should a personal guarantee template include?

Every personal guarantee template should include details about the total balance of the loan and the state in which it got granted. Since the standards of lending vary by state, specifying a loan’s place of origin makes things much clearer for everyone involved.

What does a personal guarantee look like?

A personal guarantee form defines the entire loan balance, as well as, the specific condition in which the lender grants the loan. Since the lending standards can vary from state to state, specifying the state where you created the loan can easily help you determine the legal context and explicit provisions to include in the loaning contract.

What to include in the document?

In general, you’re subject to the same terms and conditions as the borrower and this includes a punitive situation should the debtor default.

Who needs this form?

The use of a personal guarantee form is very common with certain organizations, groups or individuals:

What is a guarantor loan?

As a guarantor, you’re responsible for paying back a personal loan in case the borrower cannot. For the borrowers, it’s much easier to secure a loan with a guarantor. If you agree to become a guarantor, you may need a personal guarantee form. Contents. 1 Personal Guarantee Forms.

Why do hiring managers use a guarantor form?

Hiring Managers. The main reason why hiring managers of a company will use this form is to clarify and verify the latter’s employment claims and background. The hiring manager will use the form to collect the information regarding the guarantor, the applicant , and the previous company where the applicant worked for.

What Is a Loan Guarantee Form?

A loan guarantee form is a document used in loan arrangements. Generally, it allows a guarantor to pay back money owed to a lender if the borrower has insufficient resources to repay. Even though it would be difficult for some to loan because of low earnings and other liabilities, looping a guarantor can change a lender’s perspective. It means a higher chance of loan approval, lower interest rate, and favorable borrowing terms. Because loan has tricky nature and money is contentious, a loan guarantee form gives both debtor and creditor security for better financing options.

Why is a loan guarantee form important?

That is why a loan guarantee form is important if a debtor is compromised in paying their loan.

What is a government-guaranteed debt?

A government-guaranteed debt or federally guaranteed obligations are debt securities in the United States. They issue this guarantee to be risk-free and receive full faith and credit of the federal government. Selling these securities will finance the federal debt.

How to get the value of a guaranteed loan?

To obtain the value of the guaranteed obligation/loan, discount the expected cashflow (principal and coupon payments under the risky rate) to the guaranteed rate. The value of the non-guaranteed loan can be obtained by discounting at the risky rate.

How to make a loan guarantee?

1. Identify the Parties Involved . Ideally, a loan guarantee form starts with the introduction of the parties. Whether the document is for personal or company use, all parties should be careful with the names they will use—and this should be factual. The parties can use the name of the company or name of an individual.

Do loan guarantees end after terms and conditions?

Notarize the Document and Sign. The loan guarantee form does not end after the terms and conditions because it needs to be notarized in the presence of a witness or two. Check on your place’s notary requirements first because it depends on the state laws.

What is a guarantee agreement?

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

What are the different types of guarantees?

Several forms of guarantee exist and provide varying levels and responsibilities of the guarantor and avenues for remedy for the creditor. These include: 1 Absolute Guarantee. An absolute guarantee has no conditions that restrict a creditor from immediately moving to assume relief if the party that agreed to the initial deal defaults on the contract. Without the conditions, a guarantee is automatically assumed to be absolute. 2 Conditional Guarantee. In the event the parties enter into an agreement that contains a conditional guarantee, it takes more than just the default on the debt to trigger the guarantor’s responsibility to repay the debt. It requires action on the part of the creditor in some aspects. 3 Payment Guarantee. This guarantee creates an obligation of the guarantor to pay the creditor when the debt comes due if the borrower defaults at that time. It occurs automatically at a fixed date upon the default. 4 Collection Guarantee. A collection guarantee assures the creditor that after all other reasonable efforts

What is a guarantor's obligation to pay a debt?

It requires action on the part of the creditor in some aspects. Payment Guarantee. This guarantee creates an obligation of the guarantor to pay the creditor when the debt comes due if the borrower defaults at that time. It occurs automatically at a fixed date upon the default. Collection Guarantee.

What is an absolute guarantee?

Absolute Guarantee. An absolute guarantee has no conditions that restrict a creditor from immediately moving to assume relief if the party that agreed to the initial deal defaults on the contract. Without the conditions, a guarantee is automatically assumed to be absolute. Conditional Guarantee.

What are the provisions of a guarantee agreement?

Important provisions found in a guarantee agreement form include: Agreement with the third party providing a financial guarantee, including signatures. Agreement on the part of the guarantor to fulfill the promises of the borrower. Payment terms and amount of loan or debt guaranteed.

Why does the guarantor assume all the risk?

The guarantor always assumes a risk, in fact, all the risk, because if the child fails to make the agreed payments, responsibility for paying off the loan falls onto the parent. The risk is exacerbated because parents are unlikely to set stringent conditions for providing the guarantee of payment, such as a collateral agreement that they might enter into if they were involved in a financial transaction with anyone else.

What is conditional guarantee?

Conditional Guarantee. In the event the parties enter into an agreement that contains a conditional guarantee, it takes more than just the default on the debt to trigger the guarantor’s responsibility to repay the debt. It requires action on the part of the creditor in some aspects. Payment Guarantee.

What does "I'll guarantee his loan" mean?

2 : to promise to be responsible for the debt or duty of another person I'll guarantee his loan.

What does "garanty" mean in a washer?

b : an assurance of the quality of or of the length of use to be expected from a product offered for sale often with a promise of reimbursement The washer comes with a guarantee against major defects.

What does "garanty of job security" mean?

3 : a promise that something will happen or be done They want the new contract to include a guarantee of job security. The U.S. Constitution includes guarantees against unreasonable searches. He cited the First Amendment guarantee of free speech.

What does "promise" mean?

1 : a promise that the quality of something (such as a product that is being sold) will be as good as expected The washer comes with a guarantee against major defects. The software comes with a money-back guarantee. [=a promise that the money you spend on a product will be returned if the product is not good enough]

What Is a Signature Guarantee?

A signature guarantee is a form of authentication, issued by a bank or other financial institution, which verifies the legitimacy of a signature and the signatory's overall request. This type of guarantee is often used in situations where financial instruments, such as securities, are being transferred.

When is a signature guarantee required?

A signature guarantee is required when an individual investor wants to sell or transfer securities, such as stocks or bonds, held in physical certificate form. If an owner holds securities through a broker, they will not need to obtain a signature guarantee to sell or transfer the securities.

Who accepts all consequences in the event that the signature is fraudulent?

In most cases, the guarantor, generally a bank or other financial institution, accepts all consequences in the event that the signature is fraudulent.

What are the different types of guarantees?

Types of Guarantees. Guarantees take several forms. The most common types include the following: 1. Personal guarantee. A personal guarantee is a promise to repay liabilities that is made by an individual on behalf of another individual or organization. Types of Organizations This article on the different types of organizations explores ...

Who provides a guarantee?

The guarantee may be provided by an individual, company, or financial institution. Financial Intermediary A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction.

Why do lenders give guarantees?

The lenders are more willing to provide guaranteed loans even to candidates with a poor credit profile ,#N#FICO Score A FICO score, more commonly known as a credit score, is a three-digit number that is used to assess how likely a person is to repay the credit if the individual is given a credit card or if a lender loans them money. FICO scores are also used to help determine the interest rate on any credit extended#N#as the presence of a guarantor diminishes the probability of a lender of not being repaid.

What is a guarantor in financial modeling?

In financial modeling, interest expense flows. Guarantor. Guarantor A guarantor is a third party that pays for a debt if the borrower misses their payments. They are usually a form of insurance for the lender.

What is a bank guarantee?

A bank guarantee is a promise from a bank to cover the liabilities of a debtor in case of the debtor’s failure to fulfill contractual obligations with another party. It is usually provided by commercial banks to companies involved in transactions with unfamiliar parties or foreigners. 3.

Who can be a personal guarantor?

A company’s executive or founder may become a personal guarantor to his or her company to be eligible to obtain a loan. In making a personal guarantee, an individual promises to repay the outstanding loan amount in case of the borrower’s default or pledges his or her own assets, which can be used to repay the loan to the lender. 2. Bank guarantee.

What is the difference between unlimited and limited guarantee?

An unlimited guarantee implies that the guarantor will cover the full amount of liability, while in a limited guarantee, the guarantor will cover only a portion of the liability.