See more

How does a NetBank Saver work?

Open up a NetBank Saver Account today and you could be rewarded with a bonus introductory interest rate for your balance. Linked to a Commonwealth Bank transaction account, the NetBank Saver provides you with a convenient way to manage your savings without having to pay any fees for your transactions.

Is a NetBank Saver account free?

About our savings accounts: There's no monthly account fee for using a NetBank Saver (fees may apply to a linked transaction account though) There's no minimum balance to open a NetBank Saver or a GoalSaver.

Is a NetBank Saver good?

A decent introductory rate makes the NetBank Saver account a good option for anyone looking to give their savings a bit of a kickstart.

Can you withdraw money from NetBank Saver?

Scheduled withdrawals from your account using BPAY or NetBank are not allowed. 4. Withdrawals must be made by transferring funds to a linked Commonwealth Bank Smart Access, Complete Access, Streamline or Pensioner Security Account in your name using NetBank or Telephone Banking. ✔ Yes, you can use that option.

Can you withdraw from a savings account?

Cash withdrawals can be made by visiting a local branch and asking a teller to withdraw funds from your savings account. But they can also be made using an ATM card at virtually any ATM, though fees may apply if you use a machine that's not in your bank's network.

How do I delete my Commonwealth NetBank Saver account?

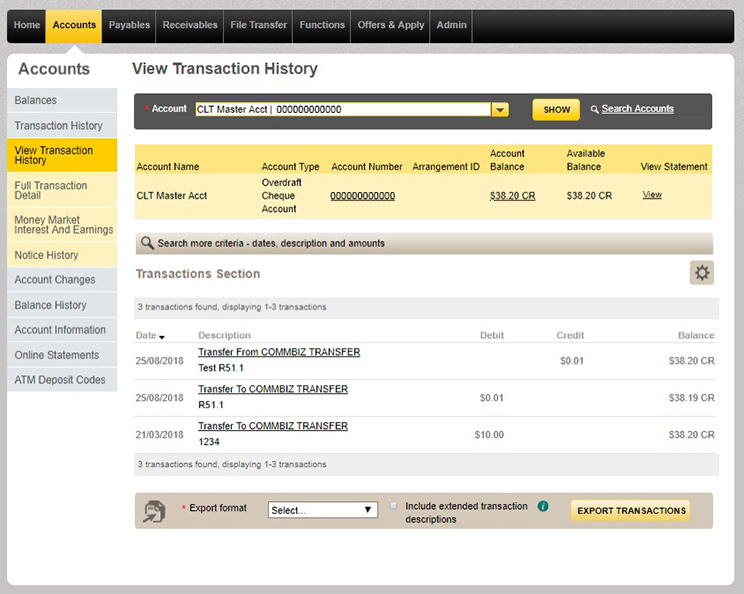

Removing an accountGo to Admin click Service.From View service accounts choose the Disabled accounts tab.Click the Edit button at the bottom of the page.You need to disable an account before removing it from the service.You can search for account names or numbers to pick the account you'd like to remove.

What is the interest rate on NetBank Saver?

Interest rates 0.35% p.a. Interest for the NetBank Saver account is: Calculated daily.

Can NetBank Saver direct debit?

Yes. You can direct debit from a Netbank Saver.

Does it cost to have a savings account?

The most common type of savings account is the standard, no-frills version offered by each major bank, and the most common fee on a standard savings account is the $5 monthly maintenance fee, which covers the cost of maintaining branch locations and in-person services.

How do I deposit money into Netbank?

0:072:08How to make payments and transfer between accounts in NetBankYouTubeStart of suggested clipEnd of suggested clipThe six-digit BSB and the account number you can also choose to save these details to your addressMoreThe six-digit BSB and the account number you can also choose to save these details to your address book for future payments enter the amount you want to transfer.

Should I have a savings account?

A savings account is a safe place to put your money when you can't afford to lose any or think you'll need it in an emergency. It's also a good place to put some of your investments as a hedge against losses – you can't lose everything if some of your money is in an ordinary savings account, after all.

How do I avoid Commonwealth Bank Fees?

The fee will be waived if:You're under 25 years of age, or.You deposit at least $2,000 per month (excludes Bank initiated transactions), or.You're on Student Options, or.You meet other criteria.

How do I create a NetBank Saver account Commonwealth Bank?

You'll need to link an eligible CommBank transaction account to your NetBank Saver, If you don't have an existing eligible transaction account to link to your NetBank Saver, then we'll automatically open a Smart Access account for you when you open a NetBank Saver3. Fees may apply to this account.

Is smart access a savings account?

The Smart Access account is designed to manage your everyday spending, pay bills and get paid....Product NameCommonwealth Bank Smart AccessInternational transaction fee3%Monthly deposit required to waive account fee$2,000Contactless PaymentsApple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay4 more rows•May 10, 2021

What is the current NetBank Saver interest rate?

CBA to pass on 0.25% hike to 2 million NetBank Saver customersOld rateNew rateMax intro rate (5 mths)0.25%0.50%Ongoing rate0.05%0.30%May 12, 2022

What is Netbank saver?

Linked to a Commonwealth Bank transaction account, the NetBank Saver provides you with a convenient way to manage your savings without having to pay any fees for your transactions. If you apply now, you will have the added benefit of bonus interest applied to your deposits, allowing you to grow your savings quicker than you had thought.

How much do you need to deposit to open NetBank saver?

In order to open the NetBank Saver you will need to make a minimum deposit of at least $0. Tax file number. Your tax file number (TFN) or TFN exemption code ensures that Commonwealth Bank is deducting the correct amount of tax on your earned interest.

What is a TFN tax file number?

Tax file number. Your tax file number (TFN) or TFN exemption code ensures that Commonwealth Bank is deducting the correct amount of tax on your earned interest. You can choose to not provide this information, but the bank will then be legally obligated to withhold taxes at the highest marginal rate. Identification.

Details

Rates and fees information correct as at 25 February 2022. Mozo has robust processes to ensure our site is updated to reflect the latest information from providers. There may be the odd occasion where updates are delayed, so please confirm information before purchasing.

About Commonwealth Bank

The Commonwealth Bank might be one of Australia's oldest and largest banks, but lately it's determined to do things differently. The Commonwealth Bank reckons it's focusing more on customer service and earning your business rather than counting on it.

bad customer service

i been on calls nearly 1 hour 35 min still no answer at all i been scammed and try to report the bank and this crap customer service not helping me still on hold even i didnt talk to any body yet it been more then an hour an half really bad service

Commonwealth bank is always doing upgrades

I was on the phone for over an hour and a half, can't access bank because there always doing upgrades on the weekend can't do my banking on line, can't talk to a operator or transfer funds to cover bills coming out.

THE WORST

Constantly crashing and updating key times no way to access your information no way to access net codes no where to transfer money bank does not give money to customers that have been affected.

Good service

Since coming to Australia I have been a customer of commbank. For the past two years I have experience good, fast and friendly service. The bank fees are low (compared to other) and the customer services at the branches are good and clerks are friendly. The netbank app is also easy to use.

Savings account is a SCAM

Do not bank with commbank. Do not set your kids up with COMMBANK. I had been with Commbank since my parents opened an account for me. When I turned 18, I had to change my Youth saver account to the Netbank saver. This is when I started noticing problems.

Vultures

Over a period of 9 months Commbank have Continually changed my Interest Rate without notifying me as per the terms set out in there product disclosure!

ATMs always down

It seems every time I go to use a commonwealth branch it’s always “out of service” so annoying meaning I have to then drive to the next towns atm. Seriously

What is a savings account?

A savings account that helps you teach your child the value of money and how to save. We reward bonus interest on balances up to $50,000 when your child grows their savings balance each calendar month (this excludes interest and bank-initiated transactions).

How to save for a goal?

This could be for you if you want: 1 To save for a goal e.g. holiday 2 To earn bonus interest when you grow your savings balance each calendar month 3 To save regularly